The artificial intelligence (AI) market has captivated Wall Street, with increased interest in the technology being a major driver in the Nasdaq-100 Technology Sector index’s 53% year-over-year rise. Investors have become particularly bullish about chip stocks, homing in on the companies developing the hardware necessary for training and running AI models.

As a result, shares in Nvidia (NVDA 0.49%) and Intel (INTC -2.10%) have soared about 204% and 53% since last January. These companies are poised to see significant gains over the long term as demand for graphics processing units (GPUs) continues to rise alongside AI market growth.

Nvidia is an attractive option as one of the most established companies in AI, with its estimated 80% to 95% market share in AI GPUs. However, Intel is at an earlier stage in its AI expansion, which could indicate it has more room to run.

So, let’s examine these chipmakers more closely and determine whether Nvidia or Intel is the better AI stock this month.

Nvidia

Nvidia’s years of dominance in GPUs gave it a head start in AI. As rivals Intel and Advanced Micro Devices scrambled to catch up last year, Nvidia was well equipped to immediately begin supplying its chips to the entire AI market. Consequently, the company’s earnings and stock skyrocketed, with Nvidia becoming the first chipmaker to exceed a market cap of $1 trillion.

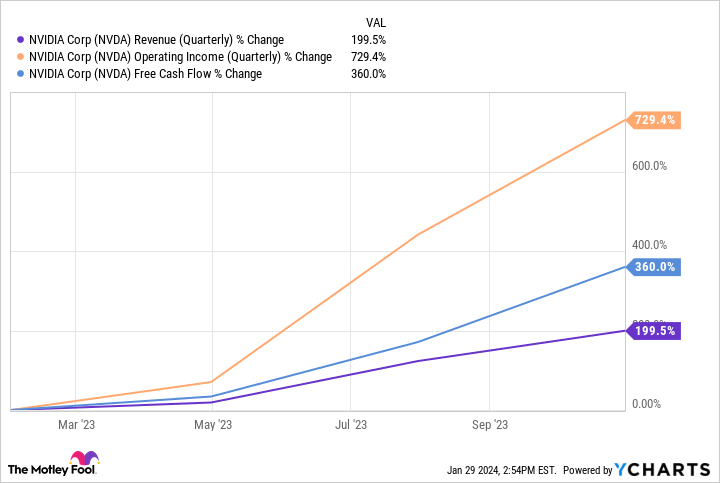

Data by YCharts

This chart reflects Nvidia’s meteoric rise over the last year. As chip sales have skyrocketed, so has the company’s quarterly revenue, operating income, and free cash flow. Competition in the AI GPU market is expected to heat up this year as Intel and AMD begin shipping their own offerings.

However, Nvidia’s $17 billion in free cash flow indicates it has the funds to continue expanding in AI and defend its dominance. For reference, Intel’s free cash flow is negative $14 billion, while AMD’s is just over $1 billion.

Despite Nvidia’s significant gains last year, the company likely still has much to offer new investors. The AI market is projected to expand at a compound annual growth rate (CAGR) of 37% through 2030, with demand for GPUs likely to continue rising for the foreseeable future.

Intel

Intel’s stock has fallen 12% since Jan. 25, when it released its fourth-quarter 2023 earnings results. The company posted revenue growth of 10% year over year, beating Wall Street estimates by $230 million as it benefited from an improving PC market.

However, that wasn’t enough to overshadow weak guidance that sent Intel’s stock tumbling. The company expects its first-quarter 2024 earnings to come in at $0.13 per share; analysts had forecast $0.42 per share.

Intel has hit some roadblocks, but poor guidance illustrates why keeping a long-term perspective is crucial when investing in budding industries like AI.

Last December, Intel unveiled a range of AI chips, including Gaudi3, a GPU designed to challenge Nvidia’s and AMD’s offerings. The tech giant also showcased new Core Ultra processors and Xeon server chips, both of which include neural processing units for running AI programs more efficiently.

The good news about the AI market’s CAGR of 37% is that it suggests Intel won’t need to dethrone Nvidia to still carve out a lucrative role in the space. That trajectory would see the industry surpass $1 trillion well before 2030, indicating there will be plenty of room for Intel to still see significant boosts to revenue.

Is Nvidia or Intel the better AI stock to buy?

Nvidia’s forward price-to-earnings (P/E) ratio of about 50 compared to Intel’s 32 makes it the far more expensive stock. Forward P/E is a helpful valuation metric calculated by dividing a company’s current share price by its estimated future earnings per share. And the lower the figure, the better the value.

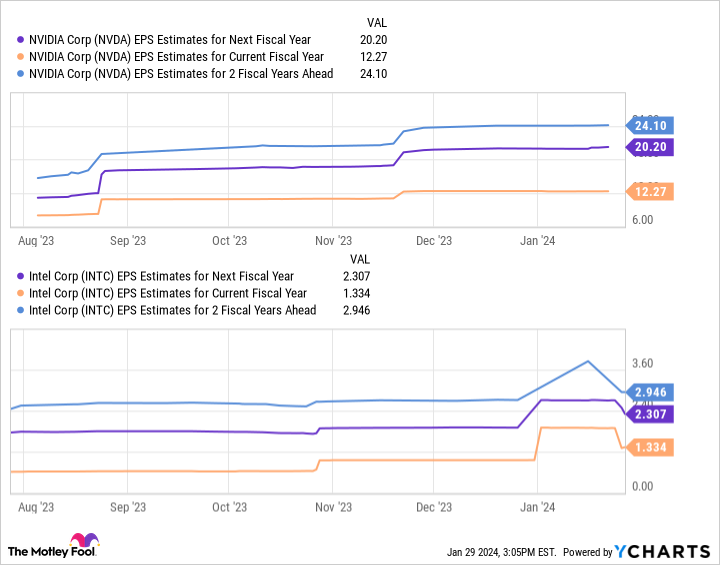

Data by YCharts

Moreover, this chart shows Nvidia’s earnings could hit $24 per share over the next two fiscal years, while Intel’s may reach nearly $3 per share. Multiplying these figures by each company’s forward P/E yields a stock price of $1,200 for Nvidia and $93 for Intel.

Considering their current positions, these projections would see Nvidia’s stock rise 93% by its fiscal 2026 and Intel’s increase by 116%. On this basis alone, Intel looks like the better AI stock. Intel offers more value and potentially has more room for growth in the coming years.

However, Nvidia’s growth potential is still significant, with a far more established role in AI and a financially healthier business. Its stock could be the more reliable play if you’re willing to pay its premium price tag.

Dani Cook has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices and Nvidia. The Motley Fool recommends Intel and recommends the following options: long January 2023 $57.50 calls on Intel, long January 2025 $45 calls on Intel, and short February 2024 $47 calls on Intel. The Motley Fool has a disclosure policy.