The global retail market generated $27 trillion in 2022 and is projected to hit $30 trillion this year, according to data from Statista. The industry is vast, including everything from grocery to consumer electronics, e-commerce, and more. As a result, it’s not a bad idea to make a long-term investment in the space and benefit from its gradual development.

While it might be tempting to invest in the industry through a market leader like Walmart, it’s worth looking at companies with more international reach to potentially profit from the market’s global footprint.

Costco (COST -0.05%) and Amazon (AMZN -0.68%) are attractive options. Both have operations in more than a dozen countries and are continuing to expand. Costco’s unique wholesale business model has successfully traversed dozens of cultures and regions, winning over consumers with its low prices and subscription-based model.

Meanwhile, Amazon has become a household name with the popularity of its online site and the many services included in its annual Prime membership.

So, let’s take a closer look at these businesses and determine whether Costco or Amazon is a better stock to buy this February.

Costco

Costco has come a long way since its founding 40 years ago. The retail giant has grown to 874 locations across 14 countries. The bulk of its stores are in the U.S., where the company ranks third among the nation’s top 100 retailers (behind only Walmart and Amazon).

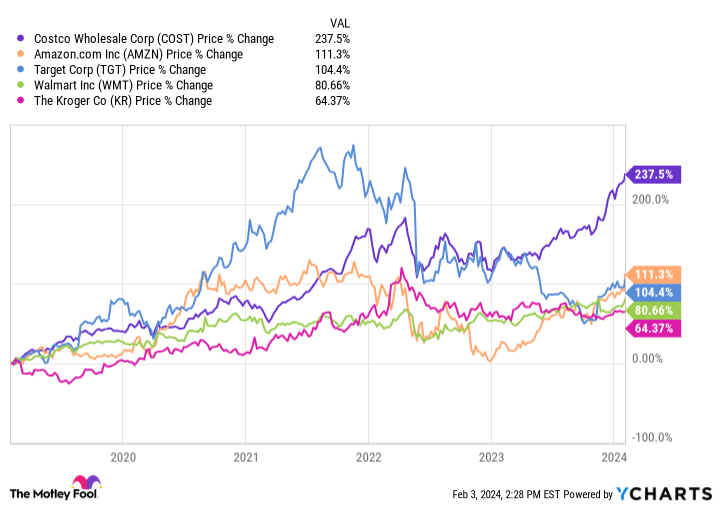

Yet, Costco’s stock has massively outperformed its American rivals.

Data by YCharts

This table showcases the long-term value of Costco’s shares, which have delivered more than double the growth of the most prominent U.S. retailers since 2019. Costco’s annual revenue and operating income have soared 59% and 71%, respectively, in that same period, while free cash flow has climbed 162%.

The company is on a promising growth trajectory that looks unlikely to slow any time soon, with plans to open 31 new locations in 2024 after opening 23 last year.

Moreover, Costco’s annual membership has been instrumental in its success. In general, product sales don’t amount to much in profits for many retailers. However, the company seemed to solve this issue with its annual subscription.

In fiscal 2023, Costco hit more than $6 billion in profits, with membership fees making up 73%. Alongside a 90% subscription renewal rate, the company will likely continue enjoying consistent gains for years.

Amazon

While Costco dominates wholesale grocery, Amazon is the biggest name in e-commerce. The retail giant’s success in the industry has seen it become the world’s fourth most valuable company, a spot it recently attained after its market cap surpassed Alphabet‘s last week.

Amazon’s shares have soared 11% since Feb. 1, when it posted earnings for its fourth quarter of 2023. During the quarter, revenue climbed 14% year over year to $170 billion, beating Wall Street estimates by nearly $4 billion.

Over the last year, the company has delivered impressive growth in its e-commerce segments. Macroeconomic headwinds hit Amazon’s retail business hard in 2022, prompting it to introduce a string of cost-cutting measures. And the company has more than made up for its temporary downturn.

Improvements are most apparent in its North American segment, which achieved more than $6 billion in operating income in the fourth quarter of 2023, a massive increase from the $240 million in losses it posted in the year-ago quarter.

Meanwhile, Amazon’s free cash flow has risen 904% year over year to $32 billion. Alongside heavy investment in artificial intelligence through its cloud platform, Amazon Web Services, the company has an exciting outlook.

Is Costco or Amazon the better stock to buy right now?

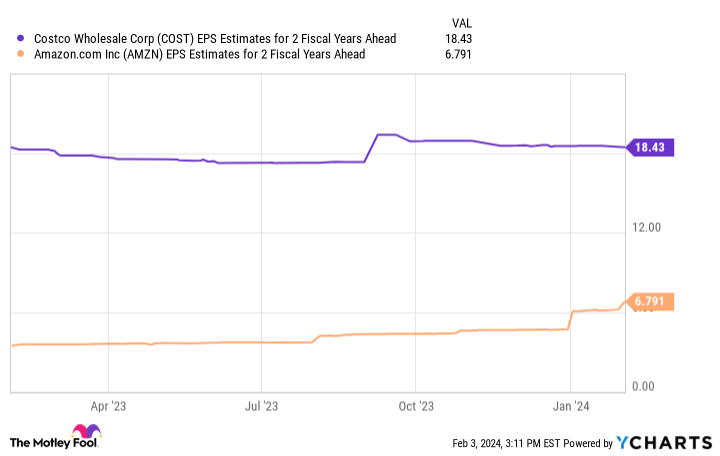

Costco and Amazon hold powerful positions in retail, with both likely to prove to be assets to any portfolio over the long term. However, the chart below indicates Amazon might have more room for growth over the next two years.

Data by YCharts

This chart shows Costco’s earnings could reach $18 per share over the next two fiscal years, while Amazon’s are expected to hit just under $7 per share. Multiplying those figures by the companies’ forward price-to-earnings ratios (Costco’s 45 and Amazon’s 40) gives a stock price of $810 for Costco and $272 for Amazon.

Based on their current positions, these projections would see Costco’s stock rise 14% by fiscal 2026, while Amazon’s would increase by 58%.

As a result, Amazon is a no-brainer if the choice is between these two stocks. The company is crushing it in e-commerce and is home to a highly lucrative cloud business that could make it one of the best growth stocks right now.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Dani Cook has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon and Costco Wholesale. The Motley Fool has a disclosure policy.