When China’s e-commerce outfit Alibaba (BABA -2.21%) went public back in 2014, investors were understandably stoked. The market was looking for the next Amazon (AMZN 0.46%), which had performed very well since its initial public offering back in 1997. What better way to repeat the performance than with a company that could be considered China’s carbon copy of Amazon itself? And for the better part of the past 10 years, Alibaba stock dished out Amazon-like gains.

The past three years, however, have been different. While Amazon shares continued to perform well — overcoming 2022’s bear market — Alibaba’s stock is back within sight of a record low.

What gives? And more than that, is this weakness a chance to step into a stake in Alibaba? Or does Amazon remain a go-to pick?

The answer is complicated, and even a little bit philosophical.

Amazon and Alibaba are different in one big way

On the surface, the two companies look similar enough. Amazon is an e-commerce behemoth. So is Alibaba. Amazon is in the cloud computing business. So is Alibaba. Both organizations are also dabbling in computer hardware, manage logistics services, and offer digital entertainment. So what’s different? The two companies were built in different market environments and largely continue operating in those environments.

See, the bulk of Amazon’s revenue is generated within the western half of the world, with most of that coming from North America — a market with relatively soft regulatory oversight; you may have noticed efforts levied by U.S. watchdogs to break up “big tech” outfits have all failed. Well, these failures are also taking shape against a sociocultural backdrop that tends to favor function over form regardless of greater impacts like environmental damage or job displacement. Consumers are surprisingly tolerant of data-collecting companies, too, as they ultimately offer much-desired convenience even if at the expense of privacy.

That’s not quite the case overseas, and particularly in China where the bulk of Alibaba’s business is still done. While its home market initially cheered the advent of its online shopping platforms Taobao and Tmall, their dominance didn’t go unchecked … in a couple of different ways.

One of these ways is a regulatory-based one. In late 2020, for instance, Beijing initiated a broad, nondescript crackdown on most of China’s technology titans. The prompt and goal of the effort was never made clear, or official. But there’s no denying that doing business in China hasn’t been the same since.

Oh, investors have witnessed a variety of efforts from Alibaba to adapt. The company made several leadership changes just within the past few months, for example, following a restructuring of Alibaba into six distinct operating units in early 2023. It’s also been toying with the idea of spinning off its struggling cloud computing arm. While that didn’t happen — at least not yet — Alibaba has abandoned its quantum computing development efforts even though the tech is finally showing some practical promise.

None of this is to suggest the shakeup only stems from China’s recent regulatory crackdowns. It would be naïve, however, to believe Alibaba’s business environment doesn’t put (and keep) it at a significant disadvantage.

Said more directly, China’s regulatory environment can be restrictive, even if inconsistently so.

And the second way Alibaba’s dominance has been stifled? In the meantime, the world watched rival PDD Holdings, formerly Pinduoduo, penetrate China’s e-commerce market, seemingly coming out of nowhere.

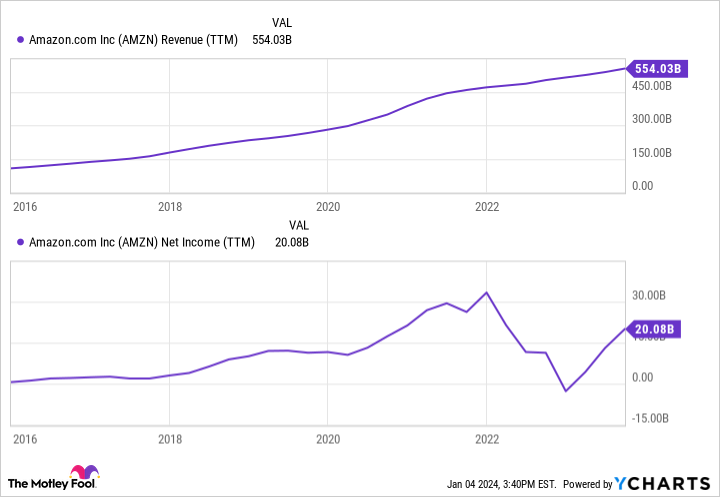

Meanwhile, Amazon’s business has never been bigger, and its future profitability has never been more promising. As it turns out, cloud computing and digital advertising are incredibly high-margin businesses.

AMZN Revenue (TTM) data by YCharts

The company isn’t bumping into any real legal or social challenges to the integration of all of its different operations, either. Indeed, Amazon’s in-house delivery service, first-party and third-party e-commerce business, budding advertising operation, and Amazon Prime all seem to be operating seamlessly with one another.

Not permanent, but persistent

Never say never. There may well come a time when consumers and regulators alike start pushing back against Amazon’s modus operandi, just as there may come a time when China’s regulators exert less strict oversight of Alibaba’s business. Such shifts could work against and for (respectively) the two companies in question.

There’s also no denying that at least some of Alibaba stock’s recent weakness is the result of heavy-handed lockdowns meant to curb the continued spread of COVID-19 within China (lockdown measures remained in place through the latter part of 2022). Although lifted since then, fear of long-term damage to the economy lingered, weighing on Alibaba’s shares. With retail spending growing firmly in recent months, though, the stock’s poor performance could be a chance to tap into the country’s rekindled consumerism.

On balance, however, the underpinnings of these two stocks’ disparate performances are as difficult to overcome as they are to identify. Both companies were built on very different foundations reflecting two very different operating and business environments. Investors just didn’t see it about Alibaba until 2020, and they have continued seeing it since then. Now that they have, it’s difficult to unsee.

This isn’t to say Alibaba is un-investable, to be clear. Even a troubled Alibaba is a stronger company than plenty of others. This year’s top line is projected to grow by more than 10%, with growth of almost as much in the cards for the coming year. Profits are expected to improve accordingly. The analyst community’s current consensus price target of $118.51 is also 58% above Alibaba shares’ present price. That’s not a bad risk-versus-reward scenario. You could certainly do worse.

If you only have room for one of these two tickers in your portfolio though, Amazon stock remains the better choice … for reasons that are obvious, and some that are a bit fuzzier and philosophical.

There’s of course a bigger takeaway here for interested investors. That is, while it’s not often part of a stock-picking regimen, more of us should consider a company’s operating environment and regulatory risks before taking the plunge. Often it’s the less obvious, unseen factors that can end up haunting you.