Kena Betancur

Overview

My recommendation for Best Buy Co., Inc. (NYSE:BBY) is a buy rating. My reason for the buy recommendation is because of the attractive capital return story and the demand recovery in PCs and smartphones in the latter part of this year. I need to highlight that any investment position should be small because near-term growth is likely to remain weak, at least through 1H24. If there are signs of further macro weakness, I would recommend further scaling down the position. For risk-averse readers, maybe it is better to wait until 2Q24 before considering investing because there will be more information disclosed at that time.

Business

BBY is a multi-channel retailer that sells a variety of technology and electronics products, including computers, phones, printers, cameras, stereos, appliances, and much more. As of FY23, BBY has more than 1,000 stores (the majority in the US) and a revenue size of $46 billion. BBY is a business with a long history, going all the way back to the 1980s. The stock went public in FY1987 and saw its revenue grow at a staggering pace of 731% CAGR until FY11, where revenue reached $49.7 billion before experiencing its first annual decline in FY12. Post-FY12, the business growth essentially plateaued, with growth coming in at low single digits or negative at times. Comparing FY23 revenue to FY11, the business was effectively flat for 12 years. The BBY balance sheet has also deteriorated in the past decade, going from a net cash position in FY14 ($1.3 billion in net cash) to a net debt position of $400 million in the last 12 months.

Near-term growth expected to remain weak

In the near term, I believe BBY is going to continue suffering from the weak macro environment. While consumer spending has largely been resilient, discretionary spending is still weak. While the products that BBY sells can be argued as necessities (i.e., having a phone is a necessity today), I argue that most of the demand is discretionary in nature. For instance, most people already have a phone or personal computer, and incremental demand is likely to come from upgrades, which is discretionary spending in my view. On top of these, the increase in debt levels and the prior demand pull forward are also factors that are weighing on demand recovery. We can see this macro impact in BBY’s recent 3Q23 performance, where domestic comp sales continue to see negative performance across almost all product types:

- Consumer electronics [CE] was down 2.9%, a deterioration of 120 bps vs. 2Q23, marking the 7th straight quarter of decline.

- Computing and Mobile Phones [CMP] was down 3.7%, a deterioration of 100 bps vs. 2Q23, marking the 8th straight quarter of decline.

- Appliances was down 2.3%, marking the 6th straight quarter of decline.

- Entertainment was the only product type that was up by 1%, but it is not big enough to move the needle.

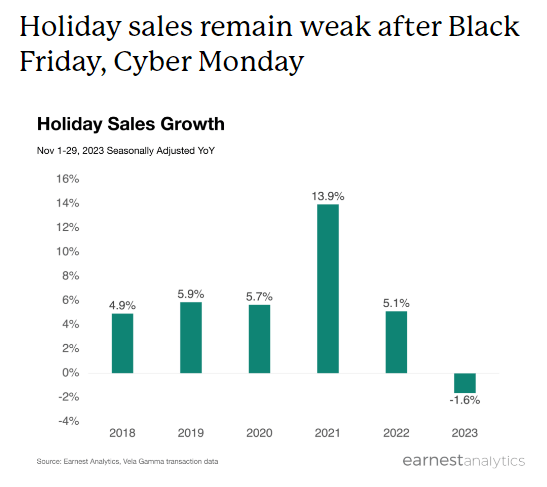

What’s more, the weak comp sales were driven by softening demand as the quarter progressed, with monthly comps of -6% for August, -7% for September, and -8% for October. This is clearly not a sign of any near-term turnaround. With that, management now expects 4Q comparable sales to decline 3% to 7%, with the range highly dependent on the upcoming holiday selling season as quarter-to-date (November) comps are trending toward the lower end of their guidance range. Based on how the major events—Black Friday and Cyber Monday—have performed weakly, I think it is very likely that BBY is going to hit the low end of its guided range or possibly miss the guidance altogether.

earnestanalytics

Possible turnaround?

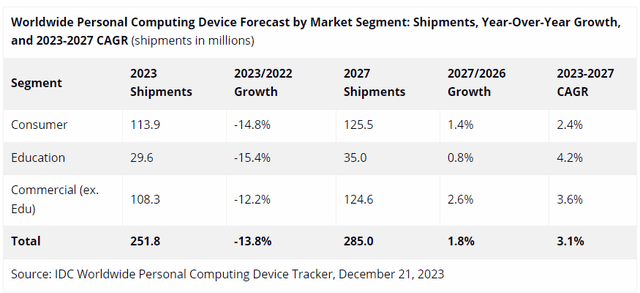

The good news for BBY is that there is an upcoming catalyst that could drive growth over the medium term. After two years of falling demand across the industry, management anticipates a return to stability next year and even expects growth in the second half of the year. My view is that there is a large installed base of personal computers that need to be upgraded as they are reaching a 3 to 4 year replacement cycle, Windows 10 support ends, and they need to be upgraded to AI PCs. This is in line with what IDC is expecting as well, where global PC shipments are expected to recover in 2024.

A similar trend appears to be happening in the smartphone category as well. With the pandemic pushing out the timeline for smartphone upgrades, 2024 could see a strong recovery as smartphone demand comes back online with higher ASPs.

Smartphone ASP is expected to rise 5.5% in 2023 to $438, marking a fourth consecutive year of growth as the premium market continues to grow across all regions. IDC

A capital return machine

While BBY growth plateaued over the past decade, BBY is still a very profitable business that generates billions of dollars in EBITDA and is FCF-positive. This gave BBY the capacity to raise dividends by a big margin through the years (FY12 DPS was 0.62 vs. FY23 DPS of 3.52). Furthermore, the company has also picked up its pace of share buyback over the past few years, reducing its share count from 350 million in FY15 to 215 million over the LTM (-6% a year). Using the LTM DPS, it implies a dividend yield of ~5%, and if BBY continues with its share buyback pace, the capital return could easily reach high single-digits. I also note that BBY has shown its willingness to turn its balance sheet into a net debt position. Suppose they lever the balance sheet further to just 1x EBITDA. The additional capital raised based on FY24e EBITDA is around $1.7 billion (1x * FY24e $2.7 billion EBITDA – ~$1 billion in gross debt). $1.7 billion is around 11% of BBY’s current market cap.

Valuation and risk

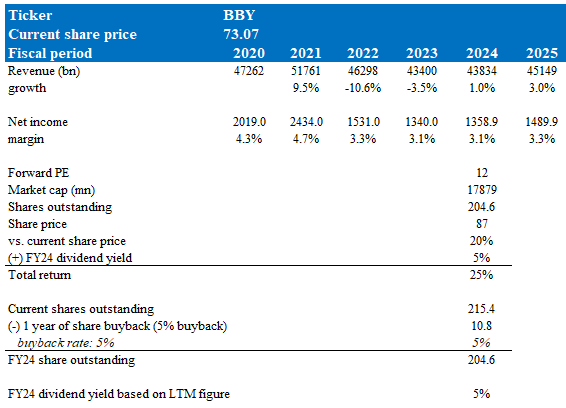

Author’s valuation model

According to my model, there is a potential for a 25% total return based on a target price of $87 and a dividend yield of 5%. This target price is based on my growth forecast of 1% in FY24 (1H24 to be weak and possibly negative, followed by a recovery in 2H24 as PC and smartphone demand helped drive positive growth) and 3% in FY25 as the demand momentum rollover from FY24. I expect margins to be flat in FY24, followed by a modest recovery as revenue grows. Another assumption I made was that BBY would continue to buyback shares at a mid-single-digit pace. Lastly, the revenue acceleration to a high range of low single-digits should be able to continue, supporting BBY’s current valuation of 12x forward PE.

The risk here is that the macro weakness in the near term could be a lot worse than I expected. This could push the demand recovery to 2025. This could put pressure on the stock as the market will be unlikely to price it in 2025 until there is clearer evidence of growth recovery.

Summary

I give BBY a buy rating because of its attractive capital return story and potential growth recovery in 2H24. However, I must note that the business has faced challenges in comp sales, particularly in consumer electronics, computing, mobile phones, and appliances, and this headwind is likely to persist through 1H24. However, there is potential for a medium-term turnaround driven by a likely demand recovery in PCs and smartphones, which is an upcoming catalyst for growth. On the capital return narrative, BBY’s profitability and free cash flow generation support further capital return efforts (dividends and share buybacks). The risk lies in the possibility of prolonged macro weakness delaying the expected turnaround until 2025, affecting the stock’s performance.