champpixs

Introduction

US packaging products maker Berry Global Group (NYSE:BERY) is the second largest position in my stock portfolio at the moment and February 7 was an eventful day for investors. Besides releasing its Q1 FY24 financial results, the company revealed that the spin-off and merger of the majority of its Health, Hygiene and Specialties segment in a transaction that values this business at $2.6 billion. Under the deal, Berry Global will receive $1 billion in cash and its global nonwovens and films operations will be merged with engineered materials manufacturer Glatfelter (NYSE:GLT). In my view, this deal is a win-win for both companies and I’m surprised the market seems disappointed considering the market capitalization of Berry Global slumped by 13.02% on February 7 and 8. Let’s review.

Background and details about the deal

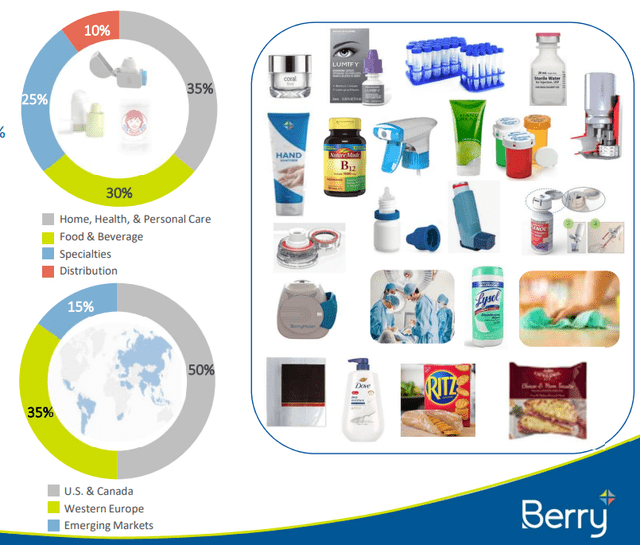

Berry Global was established in 1967 and is an Evansville-based packaging company focused on North America and Western Europe. More than 70% of its sales are concentrated in consumer packaging solutions for food, beverage, personal care, and healthcare products. Berry Global produces over 100,000 types of items and some of the brands with its packaging that I have at home include Pampers, and Listerine. The group has over 250 locations across some 40 countries and employs more than 40,000 people. The Health, Hygiene and Specialties segment is involved in the production of plastic fabrics which are used in diapers, wipes, health care protection, and construction materials among others.

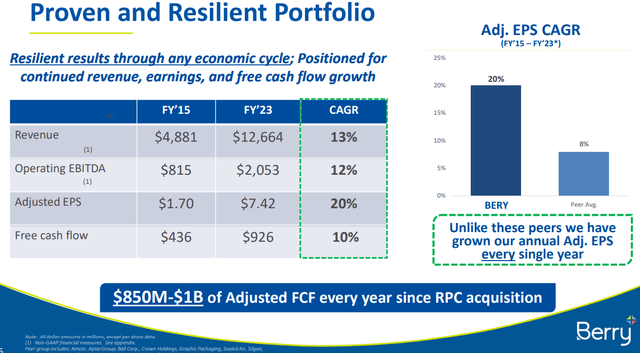

Overall, the global packaging space is highly fragmented, and Berry Global has been growing its business mainly through acquisitions over the past decade. Its biggest purchase was plastic packaging supplier RPC Group for $6.5bn in 2019. Berry paid about $4.3 billion in cash and assumed about $2.2 billion in debt. Yet, synergies and economies of scale allowed it to significantly boost FCF as well EPS and the group has been growing much faster compared to its peers over the past several years.

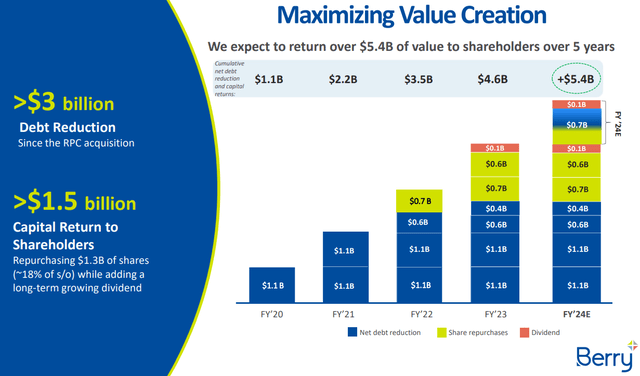

Yet, it’s worth noting that demand for Berry Global’s products received a boost during the COVID-19 pandemic, particularly its Health, Hygiene and Specialties segment. In FY20 and FY21, Berry focused on reducing its debt load but its share price was stagnant during that period which led to an activist investor named Ancora suggesting in November 2021 a shift in the capital allocation strategy – share buybacks, real estate asset sales, or a sale of the whole company. Ancora argued that Berry Global could be worth $100 per share if sold. In November 2022, Berry Global entered into a mutual cooperation agreement with Ancora and another activist investor and most of its $800-$900 million annual free cash flow has been going into share repurchases since then.

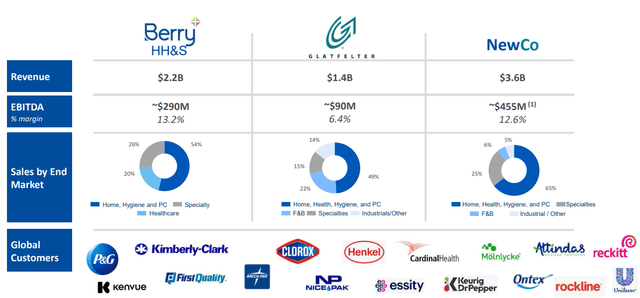

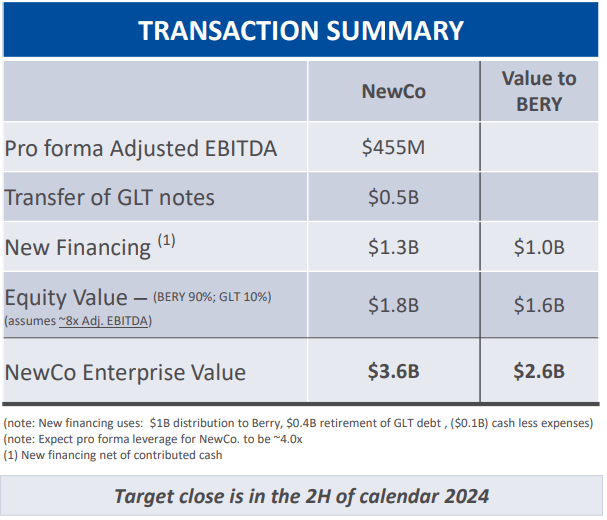

The sale of the Health, Hygiene and Specialties segment is in line with this new direction of the company and media reports that the operation was in the works started coming out in August 2023. Back then, analysts estimated that the price tag for the business could be as much as $2 billion. On September 8, Berry Global confirmed that it was evaluating strategic alternatives for the business which could include a sale, a strategic partnership, a joint venture or a spin-off among others. This is how we got to the agreement with Glatfelter that was announced on February 7. Under the deal, Berry Global will spin off the majority of its Health, Hygiene and Specialties business, merge it with Glatfelter and get 90% of the new company, refinance the latter’s debts, and receive a net cash distribution of about $1 billion at closing. This transaction will create a major specialty materials firm with TTM sales of around $3.6 billion and adjusted EBITDA of $455 million (this figure includes cost synergies of $50 million and combined pro forma adjustments of $25 million by year three). The yet unnamed company will have 45 locations, over 1,000 customers, and some 8,650 employees.

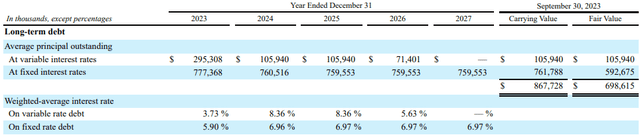

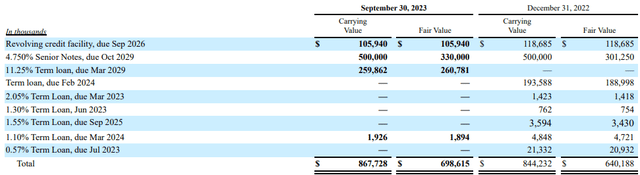

In my view, the deal is a godsend for Glatfelter as the company has been struggling financially since the start of the Ukraine war as explained in detail by The Insiders Forum on SA here. Basically, the company had key customers for its high-margin wallcover products in both Russia and Ukraine and high energy costs in Europe didn’t help either. Before the deal with Berry Global was announced, Glatfelter was struggling to restructure its business and return to the black which was made even more challenging by the high cost of its debt. As of September 2023, the weighted-average interest rate paid was 8.36% (page 47 of the Q3 2023 financial report) and the market capitalization of Glatfelter was less than $60 million before the transaction with Berry Global was announced.

Under the terms of the deal with Berry Global, about $400 million of Glatfelter’s debt will be retired and only the 4.75% senior notes due 2029 will remain. In addition, the new company has obtained committed financing from two banks. After all is said and done, the new firm will have a leverage of about 4x. This number isn’t far off Berry Global’s own leverage level of 3.7x and the transaction is expected to be leverage neutral for it. At 8x EV/EBITDA, the new company would have an equity value of about $1.8 billion and be 90% owned by the shareholders of Berry Global.

Berry Global

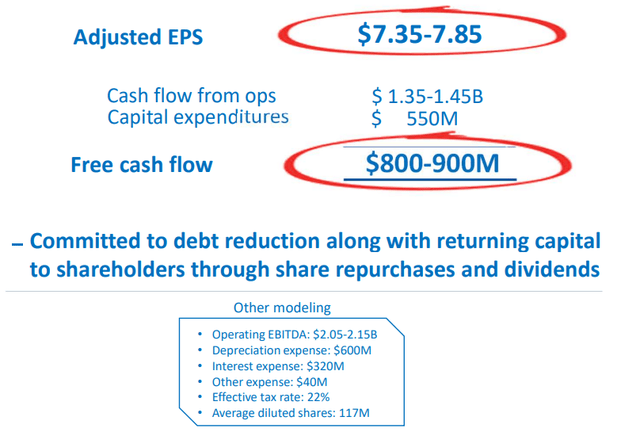

The benefits for Berry Global from the deal are that it can focus on its Consumer Packaging, and Flexibles segments which are less cyclical and require less sustaining CAPEX. In addition, the value for shareholders was estimated $2.6 billion, which is around $600 million higher than what analysts were expecting. Then why did the share price slump? Well, I think there are two main reasons. First, 8x EV/EBITDA might be too optimistic for a packaging business that is experiencing falling demand as well as headwinds in Europe. Glatfelter has a market capitalization of $100 million as of the time of writing, which suggests that the market is valuing the new company at just $1 billion. This would drop the value for Berry Global’s shareholders to $1.9 billion. The figure isn’t too far off from the $2 billion estimates by analysts August, but the latter were expecting part of the sum to be used for share buybacks back then. With Berry Global sticking with its plan to reduce leverage to 3.5x by the end of FY24, this means that the $1 billion in cash that it will get will probably be used for debt repayment, limiting share buybacks. The second reason for the share price slump seems to be the soft Q1 FY24 financial results of Berry Global. The company booked non-GAAP EPS of $1.22, missing by $0.09. Revenue, in turn, went down by 6.9% year on year and missed by $90 million. On a positive note, Berry Global kept its guidance for FY24 unchanged as it expects the second part of its fiscal year to be stronger. It still expects to book EPS of $7.35-7.85 and free cash flow of $800-900 million.

Overall, I think that Berry Global is getting a good price for its Health, Hygiene and Specialties business for shareholders even if Glatfelter continues trading at around $2.20 per share. While the Q1 FY24 results were somewhat underwhelming, the guidance for the fiscal year still looks strong and the share price should receive support from buybacks in the coming months as share repurchases for the quarter were just $7 million. The company thus has $435 million remaining under its share buyback plan. Looking at historical data, Berry Global has rarely been valued below 8x EV/EBITDA over the past three years. In view of this, I’m optimistic that the valuation of the company will improve to around 8.5x EV/EBITDA over the coming months.

Looking at the downside risks, I think the major one is that Berry Global could be overoptimistic about its financial performance over the second half of FY24. The packaging industry is vulnerable to recessions and Europe has been struggling with growth over the past two years. While unlikely, it’s also possible that the deal with Glatfelter could fall through if the latter receives a better offer for its business over the next few months. The transaction needs a green light from Glatfelter’s shareholders.

Investor takeaway

I think that Berry Global is getting a good price for its Health, Hygiene and Specialties business and its stock is starting to look oversold. While some of fall in the market capitalization could be attributed to the weak Q1 FY24 financial results, I doubt that it’s a major part considering the guidance for the fiscal year was kept unchanged. In my view, the valuation of the company is likely to improve to around 8.5x EV/EBITDA over the coming months.