shapecharge

4Q23 Market Overview

Global financial markets rallied in 4Q, with small cap stocks leading the way. Dovish FOMC commentary driven by lessening inflation concerns drove the stock market higher. Interest rates declined and expectations for a soft landing increased as recession fears faded.

The FOMC stayed the course with no changes to interest rates following their 3Q pause. The benchmark 10-year Treasury yield fell from 4.67% to 3.87% marking the lowest levels since earlier in the summer. Oil prices declined despite support from OPEC on fears of declining demand and seasonality.

Small caps (+14.0%) led large caps (+11.9%) and the NASDAQ rallied in the face of lower interest rates. Despite the rally in small cap stocks, large caps outperformed for the full year by almost 10%.

Value beat growth for the quarter but trailed growth for the year. The R2000V (+15.3%) beat both the R2000G (+12.7%) and R2000 (+14.0%). In the R2000V, cyclicals paced the advance, led by Financials, Consumer Discretionary, Real Estate and Materials, each posting double digit returns. All sectors were positive except for Energy, which declined by 3.4%.

Despite the overall rally in small caps, valuations relative to large caps remain very attractive with small caps trading at over a 3-turn discount compared to large caps. We believe this gap should narrow over time as inflation continues to moderate, interest rates normalize, and the economy continues to grow, albeit at a more moderate pace. The broadening out of the market should also bode well for small caps, with a majority of investor returns over the last couple of years concentrated within mega cap, specifically the so-called “Magnificent 7”. Historically, when large cap returns broaden, small caps tend to outperform. Since 1984, when the R1000 equal weighted index outperformed the R1000 capitalization weighted index, small caps outperformed over the majority of 1-, 3-, and 5-year rolling periods. We believe this sets up a very constructive backdrop to owning small cap stocks.

We remain keenly focused on our philosophy and process in which we seek high quality companies we believe can compound returns over long periods while proving resilient in downturns. Our investment philosophy is time-tested and based in deep analysis of the business fundamentals of each holding. Derived from years of experience, our “edge” is employing an investment process that identifies what we consider to be high quality businesses with shareholder friendly management teams trading at a significant discount to our assessment of fair market value. We believe these attributes should outperform the market over full market cycles.

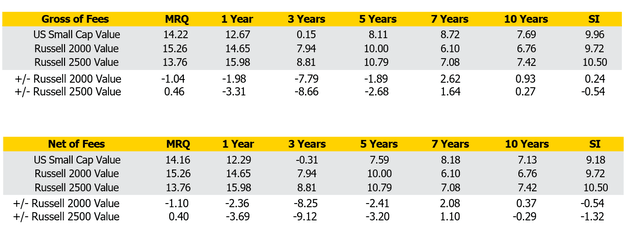

* The Bernzott US Small Cap Value strategy inception date is January 1, 1995.

4Q23 Performance

The portfolio gained +14.1% on a net basis, below the R2000V’s advance of +15.2% and above the R2500V’s rise of +13.7%.

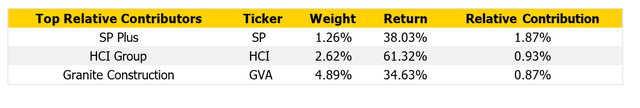

Industrials were the leading contributor to the portfolio’s returns. Stock selection was the main driver within Industrials with both SP Plus and Granite Construction advancing more than 30%. SP Plus benefited from a take private transaction by Metropolis Technologies for

$54 per share. We exited the position shortly after the announcement locking in a sizable gain. Granite Construction benefited from strong quarterly results as infrastructure spending for roads and bridges continues to be robust. Granite remains a top position in the portfolio. Within Financials, HCI Group was also a top contributor, rising more than 60% during the quarter on the heels of positive quarterly results coupled with their ability to assume additional in-force premiums from Citizens Property Insurance Corporation. We continue to hold the position. Real Estate performed well during the quarter and our holding in Spirit Realty benefited from an acquisition announcement by Realty Income. The stock advanced 26% on the news and we exited the position.

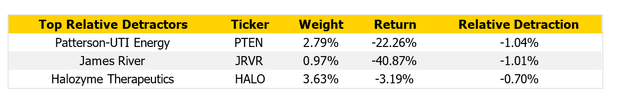

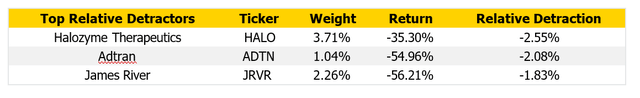

Financials were the leading detractors to relative performance. Our lack of exposure to banks negatively impacted results as the group got a bid following the FOMC announcement in December causing a precipitous fall in interest rates. We continue to be underweight banks based on fundamentals. Our position in James River also hurt performance as the stock declined by over 40% following their earnings release, which highlighted adverse reserve developments. They also announced a dilutive sale of their casualty reinsurance segment. We exited the position. Despite Energy being a contributor, our position in Patterson-UTI weighed on results. The combination of weaker oil and natural gas prices coupled with depressed rig counts negatively impacted the stock. We see those conditions as transitory and added to our position during the quarter.

SP Plus (SP): Exited the position following the acquisition announcement by Metropolis Technologies.

HCI Group (HCI): Strong quarterly results and the assumption of in-force premiums from Citizens Property Insurance Corporation drove stock performance during the quarter. The company is also seeking to unlock value of TypTap, a proprietary technology that identifies profitable insurance customers, via an IPO.

Granite Construction (GVA): Reported better than expected top and bottom-line results which led to outperformance during the quarter. As legacy contracts roll off the books and backlog of new, more profitable business continues to grow, margins should expand. The pace of new contract awards continues to accelerate as overall funding focused on the improvement in the nation’s infrastructure begins to materialize.

Patterson-UTI Energy (PTEN): Lower energy prices and depressed rig counts caused the underperformance during the quarter. Recently completed merger with NextTier Oilfield Solutions and the acquisition of Ulterra should drive improved cash flow and cost synergy opportunities.

James River (JRVR): Exited the position following poor results and the dilutive sale of their casualty reinsurance segment.

Halozyme Therapeutics (HALO): Despite an inline quarter and solid outlook, the stock underperformed. We believe there are several potential licensing agreement catalysts heading into 2024 that should add to their highly predictable and cash flow generating royalty revenue streams.

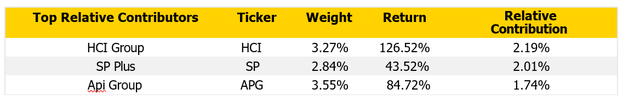

2023 Performance

The portfolio rose 12.3% on a net basis, below the advances of the R2000V’s of 14.6% and R2500V’s of 15.9%.

APi Group (APG): Following several quarters of the company beating expectations as result of their acquisition of Chubb, we exited the position as the stock hit our fair value target. For the year, the stock appreciated over 84%.

Adtran (ADTN): We exited the position as its earnings results and outlook were marred by supply chain disruptions, excess inventory, and execution challenges with their earlier acquisition of ADVA.

Portfolio Activity:

- Bought: NNN Reit (NNN).

- Sold: APi Group (APG), Encore Capital (ECPG), James River (JRVR), Spirit Realty (SRC), SP Plus (SP).

New Positions:

NNN REIT (NNN): NNN is a triple-net lease REIT that maintains a high-quality portfolio, producing consistent results and high occupancy rates throughout all economic cycles. Strong lease renewal rates with very little capex combined with long-term net leases adds stability to operating results. The balance sheet is conservative, with ample capital to make accretive acquisitions. Their strong track record of dividend increases is a testament to the strategy and ability of the long tenured management team.

Sold Investments:

Encore Capital (ECPG): Following several quarters of mixed results, we exited the position as the stock hit our fair value target.

Bernzott Capital Advisors Update:

We ended 4Q managing $311 million, with $84.5 million in our US Small Cap Value strategy. As a bottom-up, fundamental value investor, we seek high quality companies we believe can compound returns over long periods while proving resilient in downturns. We believe characteristics of a high-quality company include: market leadership; recurring revenue or companies that maintain high revenue visibility; high margins and operating leverage; high returns on capital; financial flexibility; and a strong management team with skin in the game and a long term view.

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end please visit Home or call (800) 856-2646. See last page for full GIPS compliant disclosure.

Explanation of Equity Performance

Bernzott Capital Advisors claims compliance with the Global Investment Performance Standards (GIPS®) and has prepared and presented this report in compliance with the GIPS standards. Bernzott Capital Advisors has been independently verified for the periods of Jan. 1, 1995 through December 31, 2019. Verification assesses whether the firm has complied with all the composite construction requirements of the GIPS standards on a firm-wide basis and the firm’s policies and procedures are designed to calculate and present performance in compliance with the GIPS standards. The US Small Cap Value composite has been examined for the periods of Jan. 1, 1995 through December 31, 2019.

The verification and performance examination reports are available upon request.

|

# of Portfolios in Composite at period end |

Total Composite Assets ($ millions) at period end |

Composite Equity Only Assets ($ millions) at period end4 |

Composite Dispersion(%) |

Composite 3 Yr Standard Deviation |

Russell 2000 Value3 Yr Standard Deviation |

Russell 2500 Value 3 Yr Standard Deviation |

Total US Small Cap Value Assets 1 ($ millions) |

Total Firm-wide Assets Under Management($ millions) |

Composite Assets as a % of US Small Cap Assets at period end |

Composite Assets as a % of Firm- wide Assets at period end |

Bernzott Gross of Fees(%) |

Bernzott Net of Fees(%) |

Russell 2000 Value(%) |

Russell 2500 Value(%) |

|

|

2014 |

35 |

269.1 |

260.0 |

0.4 |

10.25 |

12.77 |

11.25 |

274.7 |

528.7 |

97.96 |

50.90 |

6.73 |

6.06 |

4.22 |

7.11 |

|

2015 |

37 |

257.9 |

246.5 |

0.5 |

12.62 |

13.11 |

12.03 |

339.9 |

577.2 |

75.88 |

44.68 |

-6.91 |

-7.46 |

-7.47 |

-5.49 |

|

2016 |

34 |

385.3 |

365.7 |

0.3 |

13.16 |

15.38 |

13.17 |

405.9 |

655.3 |

94.92 |

58.80 |

17.62 |

16.99 |

31.74 |

25.20 |

|

2017 |

37 |

404.5 |

385.3 |

0.2 |

12.47 |

13.97 |

11.81 |

512.7 |

854.4 |

78.90 |

47.34 |

28.18 |

27.54 |

7.84 |

10.36 |

|

2018 |

42 |

444.1 |

421.3 |

0.3 |

13.41 |

15.76 |

13.58 |

470.0 |

793.8 |

94.49 |

55.95 |

-5.18 |

-5.71 |

-12.86 |

-12.35 |

|

2019 |

41 |

585.8 |

558.8 |

1.3 |

15.14 |

15.90 |

14.43 |

618.2 |

1,046.4 |

92.07 |

54.39 |

26.97 |

26.28 |

22.39 |

23.56 |

|

2020 |

30 |

685.8 |

670.9 |

0.5 |

25.31 |

26.49 |

25.40 |

792.7 |

1225.4 |

86.51 |

55.96 |

15.83 |

15.22 |

4.63 |

4.88 |

|

2021 |

35 |

823.3 |

795.2 |

0.3 |

23.83 |

25.35 |

24.49 |

831.0 |

1244.6 |

98.90 |

66.14 |

13.34 |

12.76 |

28.27 |

27.78 |

|

2022 |

31 |

525.7 |

496.5 |

0.2 |

26.61 |

27.66 |

26.84 |

526.6 |

848.8 |

99.83 |

61.93 |

-21.35 |

-21.75 |

-14.48 |

-13.08 |

|

2023 |

5 |

84.5 |

81.1 |

0.5 |

21.23 |

21.75 |

20.70 |

85.2 |

311.1 |

99.18 |

27.1 |

12.67 |

12.29 |

14.65 |

15.98 |

Equity product inception: January 1, 1995. 1The difference between this column and the “total composite assets at period end” is the accounts that do not meet the size parameter for the composite and any new account under management that has not met the waiting period to join the composite.2 Presented composite performance prior to October 1, 2006 is based upon equity only returns including allocated cash. Composite performance following October 1, 2006 is based on total account returns. * – To accommodate the needs of our high net worth non- institutional clients, Bernzott Capital Advisors has and will purchase equities across the capitalization spectrum, and not limit those purchases to the small cap universe. Effective October 1, 2010, the composite was redefined to only include those clients with a specific small cap mandate. This redefinition and client accommodation has resulted in a decline of AUM in the US Small Cap Value composite without impacting firm wide AUM.

GIPS Compliance Requirements:

Bernzott Capital Advisors is an equity portfolio investment manager that invests in U.S.-based securities. Bernzott Capital Advisors is defined as an independent investment management firm that is not affiliated with any organization.

The US Small Cap Value Composite includes all fully discretionary portfolios that invest in small capitalization U.S. stocks that are considered to have risk-adjusted returns purchased, at reasonable prices. The composite includes concentrated portfolios of market leading companies with consistent operating performance, significant recurring revenue, solid operating margin, moderate leverage and strong returns on capital. A size parameter of $250,000 is applied for composite membership. As of October 1, 2006, composite asset performance is derived from total account performance and eligible accounts are added to the composite after accounts are under management for two complete quarters. Prior to October 1, 2006, the composite was constructed from fully discretionary small cap equity only portfolios and fully discretionary small cap equity segment carve outs of accounts included in the firm composite. Prior to October 1, 2006, accounts were included in the composite their first full quarter under management. The benchmark is the Russell 2000 Value Index (taken from published sources). The Russell 2500 Value Index is provided as a secondary benchmark.

Russell 2000 Value Index measures the performance of those Russell 2000 companies with lower price-to-book ratios and lower forecasted growth values. .The Russell 2000 index is an index measuring the performance of approximately 2,000 smallest-cap American companies in the Russell 3000 Index, which is made up of 3,000 of the largest U.S. stocks. It is a market-cap weighted index. The Russell 2500 Value Index measures the performance of the small to mid-cap value segment of the US equity universe. It includes those Russell 2500™ companies that are considered more value oriented relative to the overall market as defined by Russell’s leading style methodology.

Gross-of-Fees returns reflect only the deduction of trading costs. Net performance returns reflect the deduction from gross performance of all trading costs, actual management fees and embedded fees. Since January 1, 2005 non-fee-paying accounts represent <1% of the composite assets. For the period Jan. 1, 2004 through Dec. 31, 2004 non-fee-paying accounts represent 1% of the composite assets. For the period Jan. 1, 1998 through Dec. 31, 2003 non-fee-paying accounts represent 2% of the composite assets. Bernzott performance is stated in US dollars. Prior to 10/1/06 the annual composite dispersion was an asset-weighted standard deviation calculation for the equity only portion of the account in the composite for the entire year and calculations did not take into account the effect of cash. Following that date, the annual composite dispersion is an asset-weighted standard deviation calculation using total account returns. 1995 and 1996 dispersion values are presented as n/a since five or fewer accounts are in the composite for the entire annual periods presented. Returns are presented gross and net of management fees and include the reinvestment of all income.

For institutional client accounts in the US Small Cap Value strategy, the management fee schedule is as follows: 0.90% on the first $10 Million; 0.80% on the next $15 Million; 0.75% on the next $25 Million and 0.65% on the balance. For private client accounts, the management fee schedule is as follows: 1% on the first $2 Million; 0.75% on the next $3 Million; 0.50% on the balance.

Special circumstances unique to a specific client may result in the negotiation of fees different than those set forth herein. We generally aggregate separate accounts of a single relationship for billing purposes. We may serve certain non-profits qualified under Section 501(c)3 IRC at a discount and we waive fees for employees and related parties.

Bernzott’s composite was created July 1,1999 and composite membership parameters were revised December 1, 2006 effective October 1, 2006. A complete list of Bernzott’s composites is available upon request. The policies of valuing portfolios, calculating performance and preparing compliant presentations are available upon request. Bernzott does not utilize leverage, derivatives or short positions. Bernzott does not have any significant company events to disclose. A size parameter of $250,000 is applied for composite membership. The minimum account size was implemented January 1, 2001. As of October 1, 2006, composite asset performance is derived from total account performance. Prior to October 1, 2006, the composite was constructed from fully discretionary small cap equity only portfolios and fully discretionary small cap equity segment carve outs of accounts included in the firm composite. Prior to January 1, 2004, the composite was known as the Small/Mid Cap Domestic Equity Composite. There was no change in the investment process as a result of the composite name change. Prior to October 1, 2006, carve-out portfolio segments were included in this composite and cash was allocated to the composite on a set percentage of 5%. As of October 1, 2006, portfolio segments are not included in this composite and all cash and cash equivalents are included in performance. An account will be removed from the composite membership if a cash outflow reduces the account value below the minimum size parameter. Additional information regarding the treatment of significant cash flows is available upon request.

Past performance is not indicative of future results. The statements contained herein are solely based upon the opinions of Bernzott Capital Advisors and the data available at the time of publication of this report, and there is no assurance that any predicted results will actually occur. This material is not investment advice. Not every client’s account will have these exact characteristics. The actual characteristics with respect to any particular client account will vary based on a number of factors including but not limited to: (i) the size of the account; (ii) investment restrictions applicable to the account, if any; and (iii) market exigencies at the time of the investment. Bernzott reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. The information provided in this report should not be considered a recommendation to purchase or sell any particular security. It should not be assumed that any of the composite characteristics discussed were or will prove to be profitable, or that the investment recommendations or decisions we make in the future will be profitable.

Prior to April 2013, Schmetter & Associates, LLC. (S&A) served as an independent institutional sales and marketing representative for Bernzott Capital Advisors. S&A continues to receive 20-25%

of collected revenue from specified institutional clients. S&A is not a broker/dealer. All fees paid by Bernzott Capital are in hard dollars. No additional amount is ever billed to any client as a result of such payments.

Bernzott Capital Advisors is a registered investment adviser, registered with the SEC. Registration does not imply a certain level of skill or training. More information about the adviser, including the investment strategies, fees and objectives are more fully described in the firm’s Form ADV Part 2, which is available upon request by calling (800) 856-2646, or can be found by visiting www.bernzott.com.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.