- IHT for the period was £400m higher than by the same point a year earlier

- Chancellor Jeremy Hunt under pressure ahead of next month’s Budget

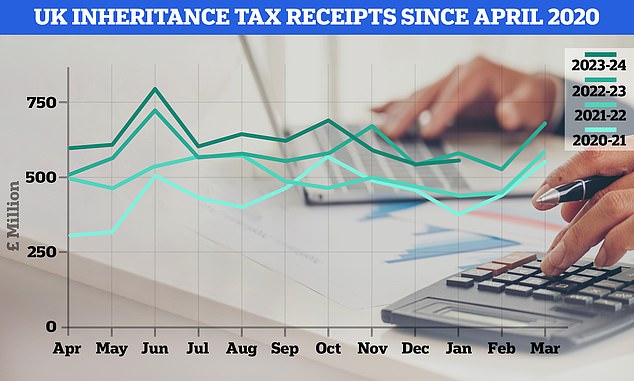

The Treasury raked in £6.3billion from inheritance tax receipts in the period from April 2023 to January 2024, new data from HM Revenue & Customs shows.

The inheritance tax take for the period was £400million higher than by the same point a year earlier.

According to an analysis by Evelyn Partners, the Treasury is on course to take record inheritance tax receipts of around £7.6billion in the current tax year, up from an all-time high of £7.1billion the previous year.

Chancellor Jeremy Hunt is under pressure to boost the economy at next month’s Budget, with some calling for inheritance tax to be scrapped.

Rumours swirled in the run up to last year’s Autumn Statement that Hunt would reform or scrap inheritance tax, but no changes materialised.

Raking it in: The Treasury made £6.3bn from inheritance tax receipts in the period from April 2023 to January 2024

On Wednesday, the Treasury said higher inheritance tax receipts in June 2022, November 2022, June 2023 and October 2023 could be attributed to ‘a small number of higher-value payments than usual.’

In June 2023, HMRC data showed bereaved families paid £1.2billion worth of inheritance tax in just eight weeks.

A freeze on exemption levels and, in many cases, higher property prices, is helping increase the number of households falling in the scope of inheritance tax.

The nil-rate band, which is the rate at which an estate pays no IHT, has stayed put at £325,000, pulling an ever-growing number of people into its web.

This nil-rate band has been in place since 2010 and Hunt has extended a freeze on it until 2028.

It is, however, possible for people to make use of the ‘residence nil-rate band’ in order to pass on a main residence to their children.

Under this rule, the allowance is raised by £175,000, meaning parents or grandparents can pass on £500,000 each to direct descendants before inheritance tax kicks in.

What’s next? Chancellor Jeremy Hunt is announcing the new Budget on 6 March

Despised by many, inheritance tax is often viewed as a broader strategy of ‘fiscal drag’, whereby tax thresholds and allowances do not keep up with inflation or wage growth, resulting in more tax being paid.

Laura Hayward, a tax partner at Evelyn Partners, said: ‘Although a relatively small number of large estates are typically behind the lion’s share of annual inheritance tax revenues, this is being supplemented by thousands of more modest inheritances.’

She added: ‘Minor property downturns such as we’ve seen in the last year or so will do little to dent this trend. And even though the Covid effect on mortality, which was at one point increasing the overall inheritance tax take, must now have all-but played out, inheritance tax receipts continue to rise.’

On whether Hunt could alter inheritance tax rules in next month’s Budget, Hayward said: ‘Whether it’s due to a plugging of leaks at the Treasury, or to a change of heart at No.10 and No.11, the Budget rumour mill has gone quiet on the subject of inheritance tax.

‘Despite being paid by a small proportion of estates, IHT is unpopular and has attracted attention as one of the taxes the Chancellor could look to cut at the spring Budget, in a last roll of the fiscal dice before the election battle proper commences.’

She added: ‘As an inheritance tax cut would have little immediate impact on households’ financial situation, it’s perhaps more likely that a pledge on inheritance tax will feature in the Conservative manifesto rather than in the Budget – particularly as it might appeal to and motivate some of the party’s core voting demographic.’

Nicholas Hyett, investment manager at Wealth Club, said: ‘The Government seems to be rowing back on potential tax cuts at the March Budget.

‘And with inheritance tax an ever growing source of revenue, you can see why the Chancellor might find it difficult to cut this most unpopular of taxes. Any shortfall would mean higher tax or lower spending elsewhere.’