gorodenkoff/iStock via Getty Images

Investment Thesis

Inflation is expected to remain elevated in the near term which makes value stocks attractive. The market is shifting towards small and mid-cap stocks, which can offer appealing returns because of their relatively low valuation. One of the stocks that fits these criteria is Benchmark Electronics (NYSE:BHE), a global provider of electronic manufacturing services (EMS) for various industries.

With a market cap of $900 million and a projected revenue of $2.85 billion for 2023, Benchmark stock trades at a P/S ratio of only 0.4, much lower than the S&P 500 average of 2.5. This reflects the low-margin nature of its industry, which limits its profitability. However, Benchmark has shown signs of margin improvement in recent quarters and expects to deliver strong EPS growth in the next several quarters.

In this article, we will explain how the company’s valuation will better over time and why we believe Benchmark is a great buy for investors who are looking for small-cap value stocks with a high return potential.

Company Strategy: Focus on Complex Products

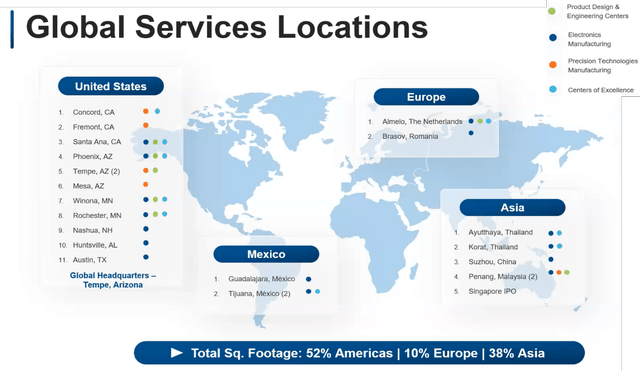

Benchmark Electronics is a global design, engineering and manufacturing company that operates in 8 countries, has 21 manufacturing locations, 7 global design centers and 13,500 employees worldwide (see below).

Benchmark Electronics Global Footprint (Benchmark Electronics)

The company is part of a highly competitive EMS industry, where it faces many rivals such as Jabil, Foxconn, Flex, Plexus, and Celestica. The typical characteristics of these EMS companies are that they function on very low margins, high volumes, and fast turnaround times. They also have to deal with complex supply chains, dynamic customer requirements, and strict quality standards. To remain competitive, they have to constantly invest in new technologies, equipment, and facilities. These are all cost drivers that reduce the profitability of the EMS companies.

Benchmark’s strategy to win in such a competitive and dynamic industry is to go after high-complexity opportunities within targeted sectors, leveraging its advanced technology and design services. It focuses on complex solutions that necessitate higher levels of engineering, technology, and manufacturing expertise, as well as higher quality standards and regulatory compliance. These products typically have higher margins, longer life cycles, and lower cyclicality than less complex products.

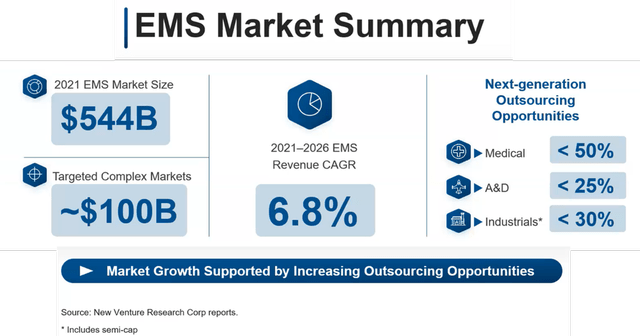

According to the company, the complex EMS market is worth about $100 billion in total (see below).

EMS Market Size (Benchmark Electronics)

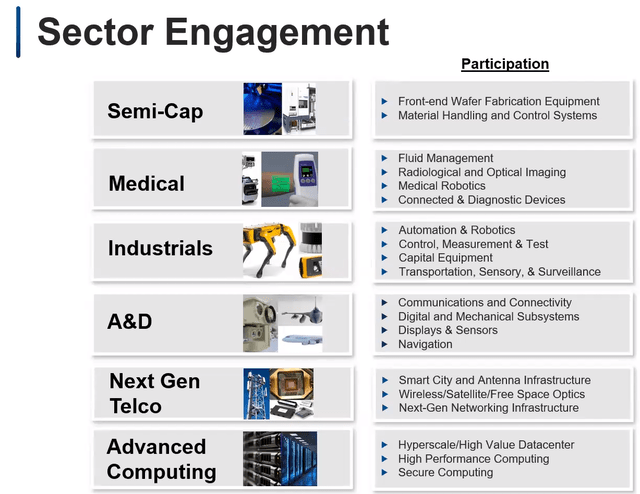

Benchmark Electronics has diversified its portfolio with a multi-sector approach and focuses on the complex solutions within each sector. The company aims to utilize its global engineering and manufacturing capabilities in the most efficient way towards these targeted sub-sectors and deliver high-quality products to its customers. Benchmark thinks that this strategy is a differentiator in the market, which we find compelling. Being highly targeted is always a good strategy as it drives expertise, reduced competition and longer-term customer relationships. Below you can see the list of market sectors and the sub-sectors that Benchmark is engaged in.

Benchmark Electronics Sectors (Benchmark Electronics)

Financial Overview –Weakness in Most Sectors to Continue

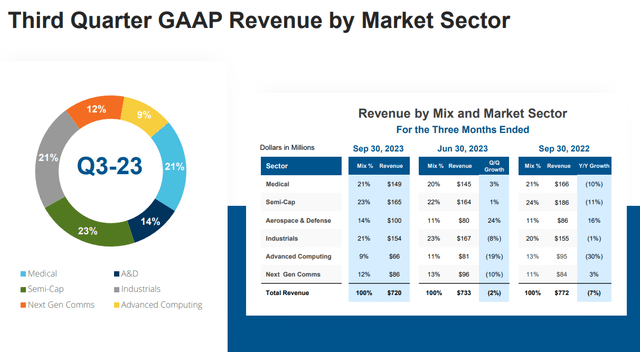

Benchmark segments its business in 6 different market sectors. The following table shows the Q3 FY2023 revenue breakdown by sector:

Benchmark Electronics Q3 Earnings Presentation (Benchmark Electronics)

Similar to other EMS companies, Benchmark faces a drop in sales in most of its segments, except for A&D and Next Gen Comms, which are trying to offset the negative effect.

The company’s outlook for the fourth quarter of 2023 is also negative, as most sectors are facing inventory challenges. As per the company earnings call, the medical sector revenue is expected to refuse advance due to lower demand. The semi-cap sector is likely to remain soft until the second half of 2024. The A&D sector, on the other hand, is very positive about its future growth, especially in defense, and anticipates a faster year-over-year growth in Q4. The industrials sector is experiencing strong domestic demand, but it is offset by weaker international markets, expecting in a sequential refuse in revenue. The advanced computing sector, which saw a drop in revenue due to the completion of several projects in the first half of the year, is now delivering a new HPC program that is expected to drive sequential growth in Q4. And finally, the next-generation communications sector is projected to be down due to project delays and macro issues.

In conclusion, the company guides for a declining revenue in Q4. We expect this downtrend to continue in FY2024 H1, in parallel with the continued macro weakness.

Priority is Operating Margins and Cash Flow

The company realizes that its sales growth is constrained by macroeconomic factors, so it focuses on increasing its operating margin instead. Benchmark aims to improve its profitability and create more cash flow by streamlining its operations. The company believes that free cash flow is a key indicator of its financial health and performance, as well as its ability to invest in growth opportunities, return capital to shareholders, and reduce debt.

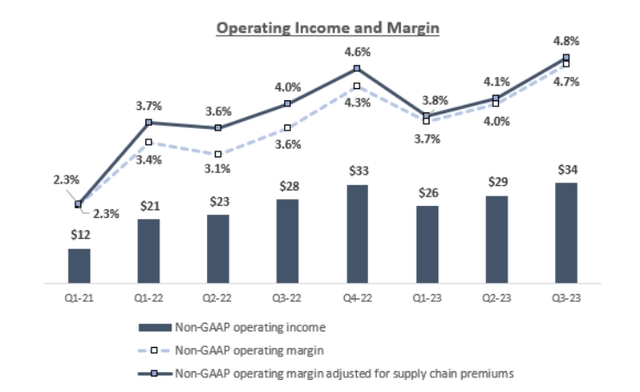

When we look at the operating margin trajectory, we can see it is on an uptrend. Company management expects Q4 margins to be between 4.8% and 5.0%, which is a 7% boost year-over-year on its midpoint. And with its continued operational efficiencies, it expects its operating margin to keep rising in the future.

BHE Operating Margins (Benchmark Electronics)

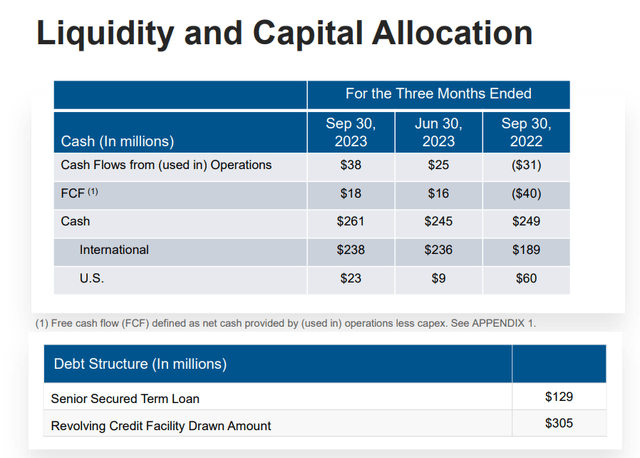

Benchmark also improved its free cash flow from -$40 million in Q3 2022 to $18 million in Q3 2023, by lowering its inventory levels (see below). It has been generating positive FCF for the past two quarters, totaling $34 million and expects to produce more than $70 million FCF in FY 2023. We expect this FCF trend to continue and consider it as a very favorable factor for company’s valuation.

Liquidity and Capital Allocation (Benchmark Electronics)

Balance Sheet Overview

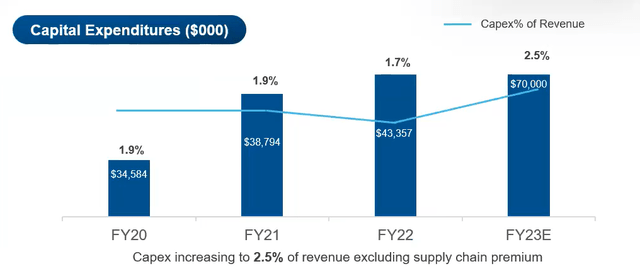

As per its balance sheet, Benchmark has increased its debt level to fund capex projects in engineering and supply chain areas. Capex represents currently 2.5% of its projected revenue for FY2023, reflecting its growth ambitions (see below).

BHE Capital Expenditures (Benchmark Electronics)

As of September 30, 2023, the company had cash and cash equivalents of $261 million and total debt of $561 million, resulting in a net debt position of $300 million. The company’s current ratio is 2.4 and its debt-to-equity ratio is 0.4, indicating it has enough liquidity and can confront its short-term and long-term obligations.

The company’s capital structure may seem highly leveraged, but we believe that the debt is manageable. The leverage ratio of 1.6 is not too high, considering the sustained EBITDA growth. We do not have any major concern for Benchmark to supervise its debt. See below the Net Debt\EBITDA leverage ratio which is on the rise.

Net Debt\EBITDA leverage (Benchmark Electronics)

Valuation

Our investment thesis is that the company is improving its operating margin and cash flow generation, thereby lowering its earnings multiples and making it an attractive investment opportunity.

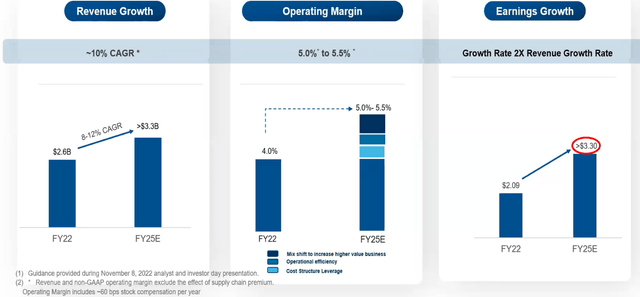

The company anticipates its FY 2025 EPS to be at least $3.3(see below), resulting in a forward P/E ratio of 7.6x. This ratio stands significantly below its historical averages. Consequently, we believe that Benchmark Electronics is at least 50% undervalued at its current price level of $25.

Future Revenue and Earnings Growth (Benchmark Electronics)

Risks

Risks to our valuation are as follows:

Potential Financial Distress: Benchmark Electronics is taking on more debt to fund its capex spending. This could worsen its financial position and constrain its ability to service its debt if the macroeconomic environment deteriorates.

Macro Uncertainties: Benchmark Electronics is a global company and exposed to macroeconomic uncertainties, geopolitical conflicts and supply chain disruptions that may affect its customer demand and operational efficiency.

Competition: The company faces strong competition in a cyclical industry. It has to contend with leading global contract manufacturers that may impact its market share.

Conclusion

Benchmark Electronics faces growth challenges in its business, due to macro slowdown in some of its target sectors. The company’s leverage has also increased significantly due to increased capex investments. However, Benchmark also has some positive aspects that are not factored in by its current price.

Its focus on operational efficiencies and productivity is resulting in operating margin expansion and increased cash flow. We think this margin expansion trend will drive its valuation higher even if its revenues stay flat in the near term. Our forward P/E valuation implies significant upside.

In conclusion, there are positive factors in Benchmark Electronics business, and we see it as a good value investment. We rate Benchmark as a Buy.