sanjeri

A man cannot be comfortable without his own approval.” ~ Mark Twain.

Today, we take a deeper look at Longboard Pharmaceuticals, Inc. (NASDAQ:LBPH), whose shares have rocketed up early in 2024 on mid-stage trial data. The company took advantage of the huge rally in its stock to do a large capital raise via a secondary offering. Can the rally continue, or is it time to take some profits? An analysis follows below.

Company Overview:

Longboard Pharmaceuticals is located right outside of San Diego in La Jolla, CA. This clinical stage biotech concern is focused on developing novel and transformative medicines for neurological diseases. The stock currently trades right at $25.00 a share and sports an approximate market capitalization of $910 million.

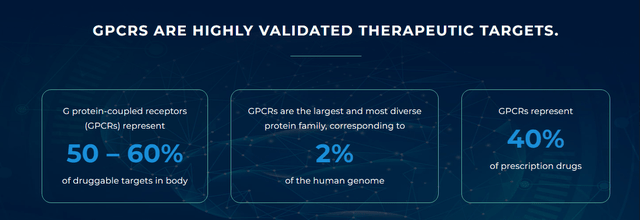

Longboard was launched early in 2020 by Arena Pharmaceuticals, Inc., which was purchased by Pfizer (PFE) in 2022. The new entity’s goal was to advance a portfolio of centrally-acting product candidates designed to be highly selective for specific G protein-coupled receptors (GPCRs).

The company is developing its drug candidate via a GPCR research platform that was created by Arena Pharmaceuticals.

Recent Developments:

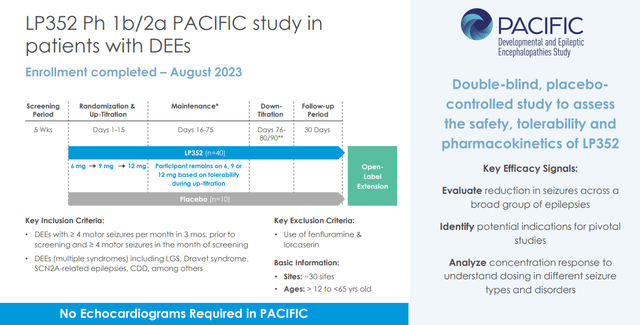

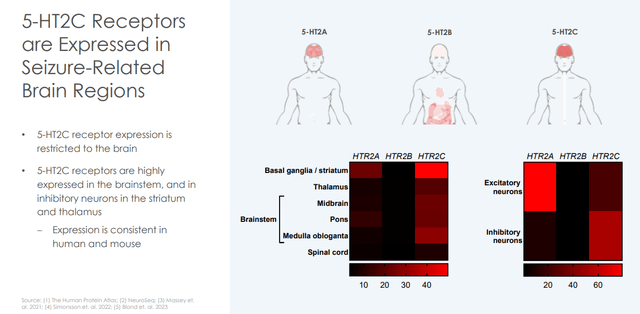

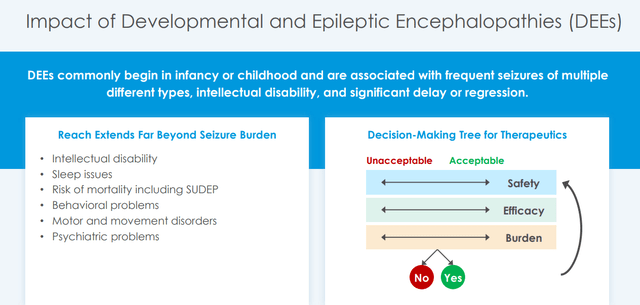

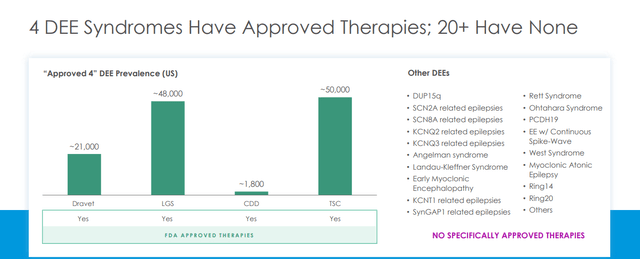

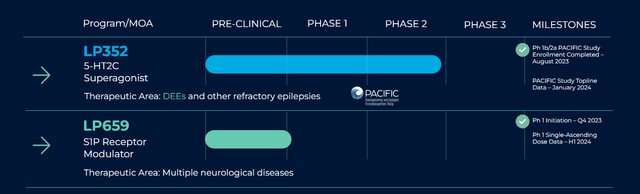

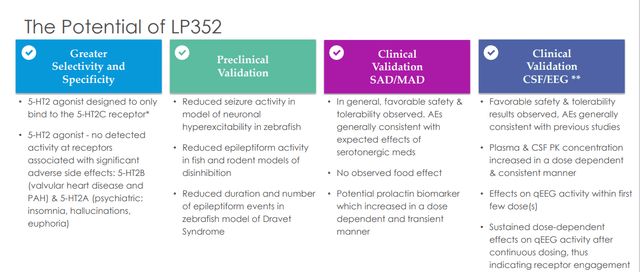

On the first trading day of 2024, the company released very positive data from a phase 1b/2a study around its lead drug candidate LP352, also known as bexicaserin. This trial “PACIFIC” was evaluating bexicarserin in the treatment of patients with developmental and epileptic encephalopathies or DEEs. LP352 is a 5-HT2C Superagonist. Preclinical and clinical data have shown 5-HT2 receptor agonists being effective potential treatments for a variety of motor seizures and seizure disorders.

The data showed a median seizure reduction of 53.3% in countable motor seizures. This compared with just 20.8% for the placebo group. In addition, the drug produced a “median seizure reduction of 72.1% for Dravet Syndrome, 48.1% for Lennox-Gastaut Syndrome and 61.2% for other DEE conditions” according to management. The data also showed a strong safety and tolerability profile for the compound.

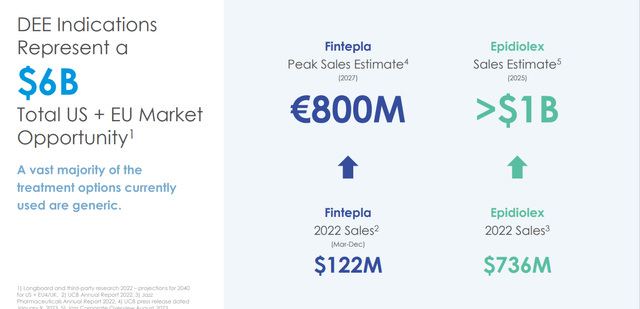

The news triggered a massive rally in the stock, understandable given bexicarserin potentially could evolve into a best of bread treatment for a market population of just over 100,000 individuals in the United States. LP352 is designed to be more selective and specific than other molecules. Leadership’s focused now is to efficiently put together a global registrational Phase 3 study that should lead to FDA approval, provided it can produce similar data.

To provide the funding for these efforts, management executed a secondary offering late last week that raised approximately $210 million for the company while being dilutive to current shareholders.

The company also has a compound called LP659 that is just entering early Phase 1 development.

Analyst Commentary & Balance Sheet:

Since those trial results came out last week, Cantor Fitzgerald ($55 price target, up from $35 previously), JonesTrading ($35 price target) and Evercore SI ($46 price target, up from $25 previously) have all reiterated Buy ratings on the stock. Of note, Cantor and Citigroup were the lead bookrunners on the company’s recent secondary offering.

Approximately four percent of the outstanding float in the shares is held short. The company ended the third quarter with $56 million in cash and marketable securities, and then executed the just over $200 million secondary offering this month. Total operating and R&D expenses ran just under $14 million during the third quarter.

Verdict:

LP352 is targeting a large potential market opportunity, so it is understandable why encouraging mid-stage trial data is igniting a large rise in the stock. That said, Longboard Pharmaceuticals, Inc. still has to put together and execute a large and global Phase 3 study to produce results on a larger scale to garner FDA approval. This means Longboard is a couple of years away from any potential commercialization.

Therefore, while this an intriguing story, I would not be chasing the huge rally in the shares. If the stock succumbed to some profit taking that brought the shares back down to the $20 level, I would probably take a small “watch item” holding in LBPH at that time. Of note, there are no options yet against this equity. This makes my preferred entry strategy of covered call orders non-viable at the moment on Longboard. Investors should get more details of the potential Phase 3 study guideline when management hosts a conference call following its fourth quarter earnings release. This should take place in early March.

Mostly it is loss which teaches us about the worth of things.”― Arthur Schopenhauer.