sanjeri

I admire looking for laggards to potentially direct in a new cycle, which is why the Biotech space looks interesting now. The sector hasn’t done well for some time now, but think there’s real potential for outperformance in the next year. The VanEck Biotech ETF (NASDAQ:BBH) is a good product worth considering if you believe the same.

BBH is a targeted exchange-traded fund offering exposure to a curated selection of prominent biotechnology stocks, primarily listed in the U.S. Since its inception in December 2011, BBH has accumulated assets worth approximately $444 million.

BBH aims to replicate, before fees and expenses, the performance of the MVIS US Listed Biotech 25 Index (MVBBHTR). This index tracks the overall performance of companies involved in the development, production, marketing, and sales of drugs based on genetic analysis and diagnostic equipment.

With an expense ratio of 0.35%, BBH ranks among the most cost-effective ETFs in the biotech space. Despite its relatively smaller size compared to some industry-specific ETFs, BBH’s unique profile and cap-weighting methodology focusing on large-cap stocks give it a competitive edge in a traditionally volatile and high-risk sector.

Top Holdings of BBH

BBH’s portfolio is comprised of 24 positions, primarily invested in large-cap biotechnology and life sciences stocks. The top five positions are:

-

Amgen Inc. (AMGN): A biopharmaceutical firm known for its innovation in human therapeutics. AMGN accounts for over 14.63% of BBH’s net assets.

-

Gilead Sciences Inc. (GILD): A research-based biopharmaceutical company that discovers, develops, and commercializes innovative medicines. GILD makes up 9.16% of the portfolio.

-

Vertex Pharmaceuticals Inc. (VRTX): A global biotechnology company that invests in scientific innovation to create transformative medicines for people with serious diseases. VRTX represents 8.38% of BBH’s holdings.

-

Regeneron Pharmaceuticals Inc. (REGN): A leading biotechnology company that uses the power of science to bring new medicines to patients in need. REGN constitutes 6.99% of the fund.

-

IQVIA holdings Inc. (IQV): A leading global provider of advanced analytics, technology solutions, and contract research services to the life sciences industry. IQV makes up 5.20% of BBH’s portfolio.

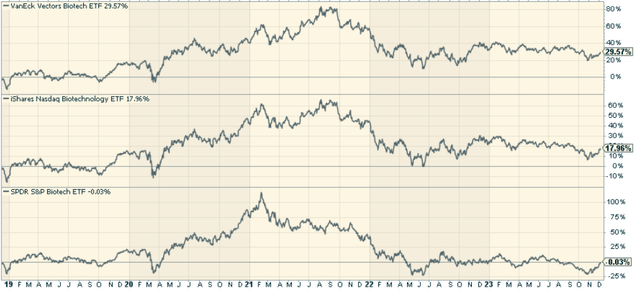

Peer Comparison

When juxtaposed with similar biotech ETFs, BBH demonstrates compelling relative returns. For instance, the iShares Biotechnology ETF (IBB) holds a broader range of biotech stocks, including micro-caps. While having an overlap with BBH among top holdings, IBB has historically been more volatile due to its exposure to speculative stocks.

On the other hand, the SPDR S&P Biotech ETF (XBI) employs a modified equal-weighting methodology, giving more significance to small-caps. While this can direct to wider volatility swings, it also presents the potential for higher returns during bullish markets.

However, BBH’s focus on established, large-cap names in the industry provides a layer of quality, making it a more balanced choice with better risk-adjusted returns.

Pros and Cons of Investing in BBH

Pros:

- Diversification: BBH offers exposure to a diversified portfolio of biotech stocks, reducing the risk associated with investing in individual stocks.

- Access to Innovation: Investors can benefit from the sector’s potential for high growth and innovation without requiring deep industry knowledge.

- Low Costs: With a low expense ratio, BBH is a cost-effective option for gaining exposure to the biotech sector.

Cons:

- Sector Risk: Being a sector-specific ETF, BBH is vulnerable to any unfavorable developments or regulatory changes in the biotech industry.

- Volatility: The biotech industry is known for its high volatility, which can direct to significant price fluctuations.

Final Analysis: Should You Invest in BBH?

Given the ongoing advancements in biotechnology and the sector’s potential for disruptive innovation, BBH could be a valuable addition to a diversified investment portfolio. It’s been a laggard against broad market averages, and I admire the less speculative nature of the fund given its focus on larger-cap stocks in the Biotech space. I think there’s a mean reversion play here, and BBH could be a really good way to play it.

Markets aren’t as efficient as conventional wisdom would have you believe. Gaps often appear between market signals and investor reactions that help give an indication of whether we are in a “risk-on” or “risk-off” environment.

The direct-Lag Report can give you an edge in reading the market so you can make asset allocation decisions based on award winning research. I’ll give you the signals–it’s up to you to deduce whether to go on offense (i.e., add exposure to risky assets such as stocks when risk is “on”) or play defense (i.e., lean toward more conservative assets such as bonds/cash when risk is “off”).