e-crow

At this point, I am skeptical that Fury Resources’ acquisition of Battalion Oil (NYSE:BATL) will end up going through. Fury made a $10 million deposit in December 2023 and was required to make a second $10 million deposit by January 23, 2024. It was unable to make this second deposit in time and has now received an extension until February 5, 2024 to make an increased deposit of $15 million.

I believe there is a significant chance that the $15 million deposit isn’t made by February 5 and thus now have a small short position in Battalion. That being said, Battalion’s recent wells have started off with production above expectations and Battalion will be up at least $10 million (from the initial deposit) if the deal falls through.

I mentioned before that I believed $6 per share was a reasonable price for Battalion’s shares. That belief hasn’t really changed, but my small short position reflects the possibility that Battalion’s shares may fall noticeably below $6 for at least a little while if the deal falls through.

Notes On Offer From Fury Resources

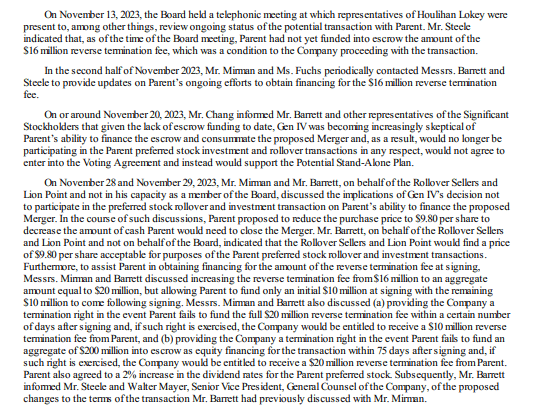

Fury Resources offered $9.80 per share in cash for Battalion. It is required to raise $200+ million in common equity to complete the deal and is also currently required to make a $15 million deposit by February 5, 2024, in addition to the $10 million deposit it has already made.

The initial plan was for Fury to make a $16 million deposit, but this plan was changed to an initial $10 million deposit followed by another $10 million deposit by January 23, 2024 to give Fury more time to come up with additional funds.

Details About Deposits (battalionoil.com (PREM14A filing from Jan 12, 2024))

(Above: Source)

Fury appeared to have challenges coming up with a $16 million deposit initially, and then had challenges coming up with the second $10 million deposit by January 23.

As a result, I am quite skeptical that it will be able to come up with $15 million for the second deposit with only a couple extra weeks. As well, Fury hadn’t previously secured commitments for the full $200 million in common equity funding that it is required.

Recent Wells

Battalion’s two most recent wells have been performing well. Battalion noted that the average initial production for its two Glacier pad wells was around 1,838 BOEPD (71% oil) and that production was still increasing. It is uncertain how these wells will perform over a longer period of time, but the initial results are good and above type curve, while the $11.5 million cost per well was also solid.

Battalion also mentioned that its acid gas injection well is expected to be online with the end of Q1 2024, which will help with Battalion’s gathering, treatment and other costs.

Financial Situation

Battalion also provided a financial update where it mentioned that it had $61 million in cash on hand and $200 million in outstanding term loan credit facility debt. This should include the impact of Fury’s $10 million deposit being transferred over to Battalion’s bank accounts a few days before that financial update.

Battalion also noted that it had a bit over $20 million in preferred equity commitments that it could still draw upon.

Thus Battalion has a reasonable amount of liquidity, although it is also required to make $50 million in credit facility repayments during 2024.

I had previously projected that Battalion could generate around $28 million in free cash flow in 2024 if it only put two wells online during the year. I believe that $25 million to $30 million in 2024 free cash flow is still reasonable to expect at current strip. Commodity prices have gone down since November, but Battalion is mostly hedged and its Glacier wells have been performing above type curve.

Battalion has approximately $106 million in outstanding preferred shares currently and could end up with around $121 million in outstanding preferred shares at the end of 2024 if it doesn’t draw on its preferred equity commitments anymore.

In this scenario, without additional development, Battalion would be projected to end 2024 with around $35 million in cash on hand and $150 million in outstanding term loan credit facility debt.

Valuation

I believe that $6 per share is a reasonable valuation for Battalion if the deal doesn’t go through. That would give Battalion an enterprise value of approximately $335 million based on the debt and preferred share projections for the end of 2024 mentioned above.

Houlihan Lokey was hired to provide its opinion on Battalion’s estimated value (among other items) as part of the due diligence around the sale process. Houlihan Lokey mentioned that Battalion’s estimated value was $2.66 to $6.30 per share based on a 2.75x to 3.25x multiple to estimated 2024 Adjusted EBITDA, at mid-October strip prices.

Taking into account the results of the selected companies analysis, Houlihan Lokey applied selected multiple ranges of 3.00x to 3.50x estimated 2023 Adjusted EBITDA, 2.75x to 3.25x estimated 2024 Adjusted EBITDA to corresponding financial data for the Company. The selected companies analysis indicated implied per share value reference ranges of $1.71 to $4.97 per share of Company common stock based on the selected range of multiples of estimated 2023 Adjusted EBITDA and $2.66 to $6.30 per share of Company common stock based on the selected range of multiples of estimated 2024 Adjusted EBITDA, as compared to the proposed Merger Consideration of $9.80 per share of Company common stock.

(Valuation Estimates – PREM14A, Jan 12th, 2024)

Houlihan Lokey also estimated Battalion’s value using a number of other methods, which typically resulted in a low-end valuation around $2 to $3 and a high-end valuation around $7 to $8 per share.

Although Battalion is currently around $6 per share, I do still have a small short position in the belief that there is a high chance that the deal doesn’t go through, and that Battalion’s shares will go well below $6 per share at least temporarily if the deal doesn’t go through.

Conclusion

Fury Resources was unable to make the $10 million deposit that was due by January 23. It is now looking at a February 5 deadline to come up with a $15 million deposit. I am skeptical that it will be able to make that deposit, so the most likely outcomes involve either another extension or a deal termination.

I have a neutral rating on Battalion at $6 per share since I believe that is reasonable value for its shares in the longer-term as a standalone company. Houlihan Lokey’s valuation estimates were fairly similar, although $6 would tend to be towards the higher end of its valuation estimates via various methodologies.

I do believe that is some shorter-term downside potential for Battalion’s shares if the deal falls through, so I have a small short position in it right now.