BrianAJackson

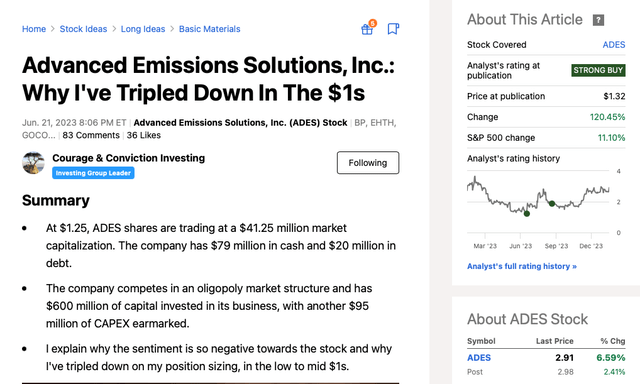

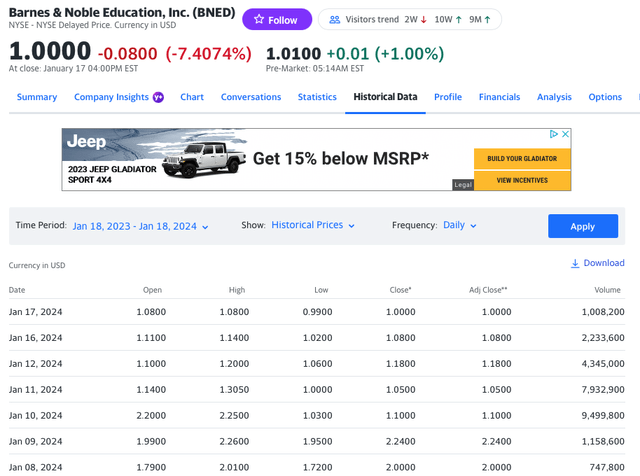

Today’s article is a defense of my Barnes & Noble Education (NYSE:BNED) buy thesis. My original article was published on December 13, 2023 and it is very comprehensive and provides an extensive background of the company and the compelling setup. On January 8th and 9th 2024, my $2 price target was not only met, it was exceeded, as BNED shares closed at $2.24 (on January 9, 2024). On January 10, 2024, however, there was a USA Today article that highlighted some proposed changes, by the Department of Education (DOE) relating to unused college meal plan balances as well as how Equitable Access Plans are billed. This article and the proposed changes sent BNED shares down 50%, and on massive volumes (with 9.5 million shares or nearly 20% of the entire share count changing hands). To be crystal clear, these are not actual changes and won’t be enacted, if they even get enacted, until Fall 2025, at the earliest. Secondly, there is an extensive public comments period where all stakeholders (BNED, Follett, other smaller competitors, Publishers, Colleges, and Students) get to present empirical evidence of the merits of the Equitable Access Plans. Thirdly, and worst case, if fact, logical, and compelling evidence are somehow overlooked, during the extensive comment period, and these DOE changes were enacted, BNED’s First Day Complete and Equitable Access Plans would simply move to ‘Opt In’ from the current ‘Opt Out’ format. Lastly, for additional perspective, on January 18, 2024, BNED published this short policy paper (DISPELLING MYTHS ABOUT EQUITABLE ACCESS FOR PARENTS, FACULTY, ADMINISTRATORS, AND STUDENTS), which explains FDC, what it does and it provides ample quoted statements by actual colleges, professors, and students, of the merits of FDC.

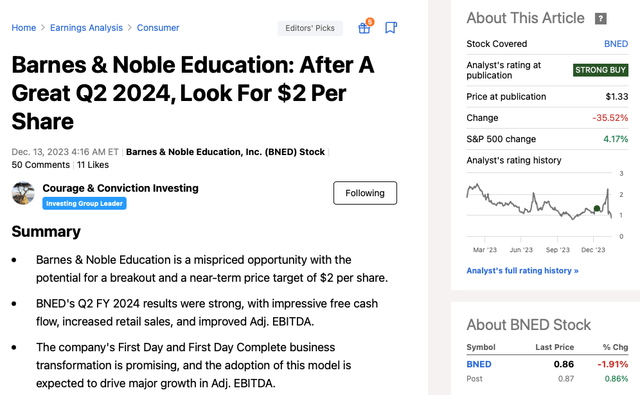

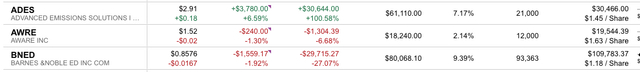

Moving along, to explain the title of today’s article, I haven’t written a doubling down or tripling down article in a while, so I’m overdue. Today’s article is expressly designed to remedy that dry spell and add a new piece to the genre. In fact, the last time I wrote a ‘doubling down’ or ‘tripling down’ piece was back on June 21, 2023, was when I wrote on Advanced Emissions Solutions, Inc. (ADES). Since that article was published, and measured through yesterday, January 19, 2024, ADES shares have climbed by 120%.

See below:

In others words, I don’t regularly and cavalierly double or triple down on my investments. The idea is to selectively and artfully do so, and only when I believe the setup and the risk/reward profile is compelling. More importantly, and for context, I still own a very healthy amount of ADES and I’m invested in seeing my long-term investment thesis through.

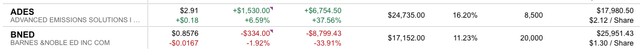

See below:

SWC Flagship Account (As of January 19, 2024):

SWC Smaller Managed Account (As of January 19, 2024):

The reason I’m providing this very important context is because it is really easy to write an article with an aggressive title such as ‘Buying Hand Over Fist’, ‘I’ve Bet Big’, or a ‘Generational Buy’, to name a few popular phrases tossed around perhaps too loosely. Candidly, unless a person shows an actual screenshot of their position size, to verify that they have in fact aggressively bet their thesis, and actually doubled or tripled down, I tend to ignore the pieces. The reason is simple, I make my living by investing and betting my ideas, not writing articles. My investment returns and record are my only North Star, so again, I really try not to write articles unless I have something to say.

And to clarify the tripling down, in early December 2023, at average cost of $1.20, I bought 36,000 shares of BNED, across both accounts.

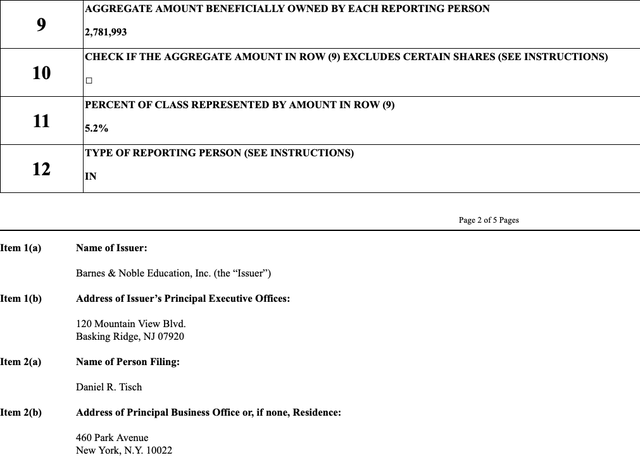

Lo and behold, and perhaps driven by a combination of a technical breakout, on increasing volume, as Barnes & Noble Education (BNED) pierced through its then 200 DMA, as well as the news that Daniel Tisch filed a new SC 13G and acquired a 5.2% equity stake in BNED, shares of BNED leapt as high as $2.26, on January 9, 2024.

See here:

See here:

Just to be crystal clear, when I wrote the December 13, 2023 piece, I noted that my short term/ intermediate term price target was $2. As this price target was reached, on both January 8th and 9th of 2024, as I alluded to in the title, I sold 70% of my position, around $2, on average. To be clear, at $2.25, I retained 30% of my original position size, which was then a 90% unrealized gain, as of the January 9, 2024 closing bell.

On January 10, 2024, all hell broke loose! As I still believe in my thesis, that day and today, so I slowly started buying back BNED shares between $1.63 and $1.85. Around 3pm, on January 10, 2024, BNED shares cascaded lower, and I steadily continued to buy. In the after-hours session, also on January 10, 2024, I aggressively added more shares between $0.97 and $1.10. As a result, and as I showed above, I’ve tripled down, and am long 113,363 BNED shares with a cost basis in the low $1.20s. With this context out of the way, let me walk readers through why I’ve bet so aggressively here and explain why this sell-off seems highly irrational and could represent a great buying opportunity for any readers that missed the big leg up, from December 13, 2023 – January 9, 2024.

Why I’ve Tripled Down

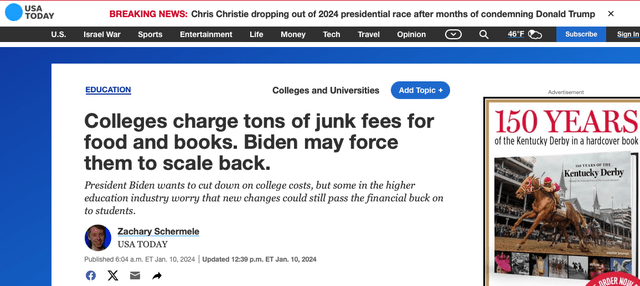

The trigger of the sell-off or the straw that broke the proverbial camel’s back was this USA Today article.

If you actually read the article and can synthesize, you quickly work out that some unnamed gov’t official thinks that the best way to arrest the rapid rise in the cost of a college education (and by the way, rapidly rising cost of a college education is a thirty year plus phenomenon) is to go after unused school meal plan dollars and make sure students can spend the first days and weeks of their new semesters trying to shop online for books, while risking falling behind on their coursework, and risking bombing their first series of quizzes or exams, if they happen to encounter issues sourcing all of their course work materials.

Seriously?

Is that the pinnacle of the gov’t creative thinking?

Let’s devise a plan so that college students can try and save upwards of $50 to $100, per semester, scavenging like a person that relishes spending their Saturday’s frequenting fleas markets, in search of deals. Never mind that college textbooks are merely a small fraction of the overall ticket or cost of the all in cost of a college.

Perhaps lost in all of the noise and all of this smoke, is a complete lack of understanding of First Day Complete or what Equitable Access Programs actually and empirically are designed to do. In fact, within the USA Today article, there is absolutely zero empirical evidence offered to support this sudden policy shift proposal or framework and no contextual compelling data presented.

Lastly, at the end of the USA Today piece, it notes that: The policies will be discussed and a final version wouldn’t be set, if at all (my emphasis), until November 2024!

Understanding The Market’s Reaction

As for BNED shares, well, when you have a microcap stock, that had run up sharply, on the back of spectacular Q2 FY 2024 results, a quarter where BNED generated $61.1 million of free cash flow and materially took down its turns of leverage, and where the conference call pointed towards strong fall 2024 (calendar year) adoption/ pipeline / funnel trends, invariably, there is always ‘hot money’ involved. And hot money tends to ‘rent’ stocks, as opposed invest in businesses based on a fundamental thesis and a compelling valuation setup. As a result, these ‘hot money’ traders tend to just be looking to run between raindrops, ride the wave or next leg up and then gracefully hop off the ride, in search of greener pastures and their next thrilling trading adventure. ‘Hot money’ tends to be looking for a sexy story and/or sexy stock charts and are happy to be at the party, when the stock is moving up. Arguably, in many cases, the ‘hot money’ crowd tends to have a limited/ superficial understanding of the actual business, and tends lack the understanding of some of the important nuances or the business’s future trajectory.

Therefore, as one of the few publicly traded college textbook / course material providers, the algos or high frequency traders (must have) caught wind of the USA Today article and all of a sudden, aggressive buyers flipped to aggressive sellers. ‘Hot money’ traders usually set protective stops, and rightly so in their world, to minimize their downside exposure, as trading on margin or leverage is commonplace, and the next thing you know, stops are getting tripped left and right. As the stops get triggered, the volume intensifies and people start to get really, really nervous as the proximate cause or catalyst for the sudden, abrupt, and then violent (starting just before 3pm, on January 10, 2024) reversal is unknown. High emotions kick up a notch, morphing to pure fear, and then, the last stage is outright panic. And in BNED’s case, by 4pm, on January 10, 2024, an all-out panic engulfed shares of BNED. When the dust settled, the fire marshals were called onto the scene, with their caravans of fire truck outfitted with the world’s best water hose and state of the art equipment. The only thing is, though, there was no actual fire. Instead, only reports of someone that yelled ‘fire’ in the proverbial crowded theatre. And in the end, on January 10, 2024, when the stampede was long gone, in the aftermath, BNED shares closed down 50%, with 9.5 million shares that changed hands (including after-hours volume)! For perspective, there are only about 53 million shares, in existence, when it comes to BNED’s entire share count.

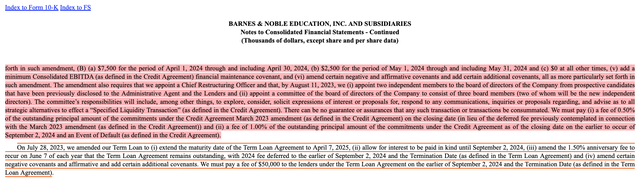

The other easy way to explain the sell-off is that BNED is in midst of trying to refinance its debt, short sellers (perhaps of the short term variety) might have seen the news and looked at BNED’s balance sheet. As of October 28, 2028 (Q2 FY 2024 quarter end), its debt which totaled $230 million gross and about $215 million net, and is admittedly high. And if you take a step back, although the company has until December 28, 2024 to resolve its debt situation, which can be resolved via an outright sale of the business, some other form of an M&A transaction, a strategic partner, or a refinancing of the debt, people simply react and concoct a simply narrative in their minds to explain a one day and 50% sell-off. And by the way, there are no covenants or triggers that can spring forward the debt. Yes, there are two members on the board of directors and a chief debt resolution officer, so to speak, that was appointed by BNED’s ABL creditors, who have a vested interest in protecting the principal of their first lien debt investment.

Perception Becomes Reality And The Sell Side Gives Up

Given this new and unexpected challenge, seemingly out of left field, any threat or fear, however unlikely or empirically baseless, creates uncertainty. And when you’re in the midst of trying to smartly get a refinancing transaction over the finish line, and the company is about 5.5X turns leveraged (October 28, 2023 net debt / FY 2024 Adj. EBITDA guidance of $40 million), investors and especially hot money traders sell first and ask questions later. Fear takes over and the equity, as a percentage of the overall enterprise value, trades like a stub. Lost in the chaos are the strong merits of the actual turnaround, led by $30 million to $35 million of actual cost savings, as well as a really exciting ramp up of First Day Complete (FDC) adoption, as well as a strong pipeline of fall 2024 prospects, as I covered in my December 13, 2023 article.

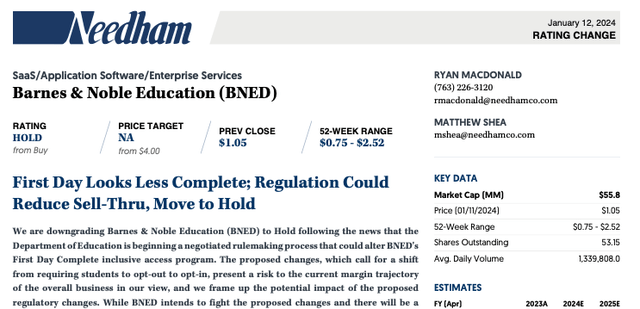

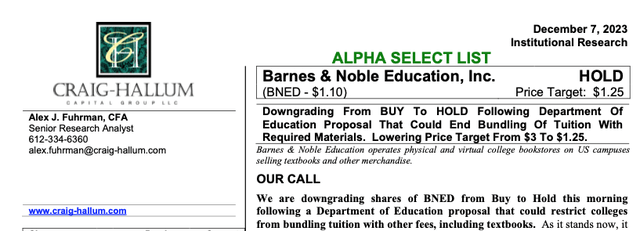

Lo and behold, in the wake of the DOE news/ uncertainty, the only two covering sell side firms, Craig-Hallum (reducing its price target from $3 to $1.25) and Needham (pulled its $4 price target entirely) threw up their hands. Ironically, no one seems to pay any attention to these $3 or $4 price targets, respectively, before the move from $1.20 to $2.25. Now, suddenly, when the fear is heightened and uncertainty enhanced, new bears or newly bitter longs, that got whipsawed by bad timing, point to these downgrades as compelling evidence and some sort smoking gun. Go figure!

See here:

Craig-Hallum snapshot (1/7/24)

See here:

To be clear, I have a copy of both reports and there isn’t much to really talk about in these research notes. Sadly, after the horse bolted from the barn and after the stock is down 50%, the sell-off side downgrades. And as a quick aside, and this isn’t a comment directed at Craig-Hallum or Needham per se, it is a general comment about the sell side at large, over the past twenty years, upwards of 90% of the time, I’ve learned to completely ignore the sell-side. Generally speaking, I honestly don’t care what the sell side thinks as I do my own synthesizing of facts and make my own assumptions / projections of what could be in the future and try and figure out what businesses are worth.

What First Day Complete (FDC) Actually Does

If people have actually gone to college and/ or have any idea of how the real world works then they might have worked out that some college students can be very short sighted. And for first generation students or students coming from disadvantaged economic backgrounds, college is a major risk and a leap of faith. It is very expensive and often students need to take out loans to make a far sighted investment in themselves and in their futures. If you haven’t been coached, mentored, and encouraged about the benefits of college and about how it can change the trajectory of your life, it is truly a leap of faith. I’m not talking about ritzy upper echelon private school schools where the majority of the student body is coming very wealth backgrounds or where really talented and top students are on scholarship.

What actually happens is let’s say you are taking a full load of classes, say five classes, per semester, as a full time student. Depending on the subjects, perhaps, the overall cost of books is $500 to $1,000, per semester. Students coming from economically disadvantaged background are already scraping by or taking on a lot of debt, so it is very common for student to be have a penny wise and pound foolish mindset because they’ve been resource constrained, perhaps most of their lives. Therefore, it is very common for some people to try and game the system and try and wait to buy some books or try and share books with a roommate or a friend. Therefore, on day one, they don’t have all of their materials and books, and aren’t ready to learn. Some might put off getting the materials or waste a bunch of time trying to save small dollars buying the textbooks that need to be shipped and in an a la carte fashion. What can easily happen is students fall behind. And when a student falls behind, they risk bombing their first test and this can creates a wave of anxiety and a negative feedback loop.

What First Day Complete has done is team up with the publishers and the schools and give everyone equal access to all of their materials, which are ready on the first day of school semester. Therefore, the poorer and economically disadvantaged students are on a level playing field with the students from wealthy backgrounds, where their parents say your only job is to excel in school. The reason the program works so well is because it is designed to be win-win-win-win.

The publishers are now getting 80% to 85% sell through rates vs. a fragmented 30% to 35% and therefore and as the linchpin to the program, they pass through real savings, via scale, which ultimately benefits the students.

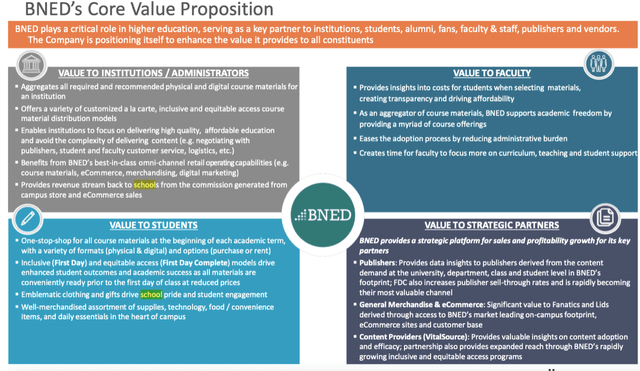

This recent BNED investor slide highlights this win-win of FDC, from four perspectives.

See below:

Barnes & Noble Education IR Deck

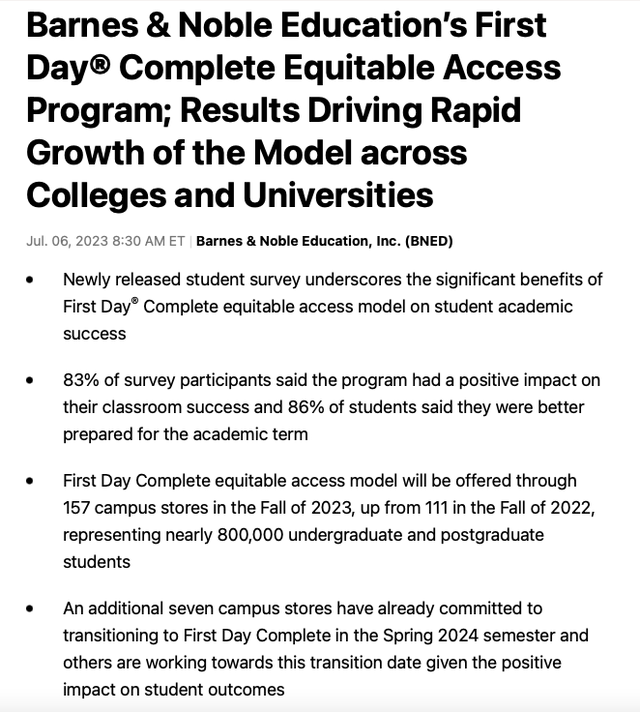

Moreover, back on July 6, 2023, BNED shared actual empirical data that highlights the efficacy and popularity of FDC.

July 6, 2023 BNED press release

Also, as another nuance, the way FDC works, in its current form, is student can ‘opt out’, as books and materials are billed and the default option is FDC. However, for the system to work well, you need 80% to 85% participation rates. Conceptually, the law of large numbers is no different than Obama Care and other large programs, designed to operate at scale. If you get everyone involved and under the big tent, you’re spreading out the costs. And when it comes to books and course work, the incremental cost of physical printing and binding new books isn’t a big part of the overall cost of the textbooks.

To make a long story short, colleges and universities primary job is education the next generation of students. Colleges and Universities want to empower and enable their student bodies to work hard, learn a lot, and to graduate. Once they graduate, the hope is that they go out and become productive members of society. FDC helps colleges meet this mission, as it saves students money, time, and more importantly it equals the playing field whether you’re coming from an economically disadvantaged background or whether you’re coming from a wealthy background.

Without getting into politics, logically and from a facts based perspective, I don’t see any empirical evidence to support the framework for this DOE proposed rule change would make any sense. In fact, it would only negative impact economically disadvantaged students, as unfortunately, money and resources are tight and many resort to sharing books or not buying all of the course material in hopes of savings a few hundred dollars (penny wise and pound foolish) when they are spending a lot more in tuition, room and board.

BNED’s Relationship With Fanatics

As I’ve been very closely following BNED and waiting for an opportunity to invest aggressively, after seeing clear and tangible evidence of an inflection point, I want to share a very underappreciated and very under reported aspect of the BNED story.

In April 2023, Fanatics hired Meta’s Head of IR. In May 2022, they raised $1.5 billion at a $27 billion valuation. In December 2022, they raised an additional $700 million, at a $31 billion valuation.

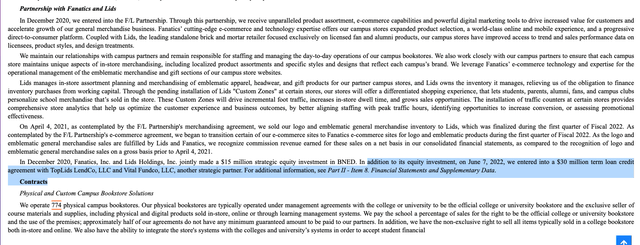

Fanatics and Barnes and Noble Education have been working together since December 2020. As part of that agreement, Fanatics and Lids (the F/L Partnership) made a $15 million equity investment.

Fanatics’ cutting-edge e-commerce and technology expertise will offer BNED campus stores expanded product selection, a world-class online and mobile experience, and a progressive direct-to-consumer platform. Coupled with Lids, the leading standalone brick and mortar retailer focused exclusively on licensed fan and alumni products, BNC and its campus stores will have improved access to trend and sales performance data on licensees, product styles, and design treatments from more than 1,200 Lids stores.

Under the terms of the agreement, Fanatics and Lids will jointly make a $15 million strategic equity investment in BNED and receive 2,307,692 common shares of BNED in exchange, representing a share price of $6.50 per share. BNED expects to use these proceeds to further bolster its strategic growth initiatives.

BNC will maintain its relationships with campus partners and remain responsible for staffing and managing the day-to-day operations of its campus bookstores. It will also work closely with its campus partners to ensure that each BNC campus store will maintain unique aspects of in-store merchandising, including localized product assortments and specific styles and designs that reflect each campus’s brand. BNED will leverage Fanatics’ operational management of the emblematic merchandise and gift sections of BNC campus store web sites. Lids will manage in-store assortment planning and merchandising of emblematic apparel, headwear, and gift products for BNC partner campus stores.

And if you read BNED’s FY 2023 10-K, page 7, more details are revealed. Specifically, Fanatics has invested $15 million of equity (at a much higher level) and in June 2022, they entered into a $30 million term loan.

For added context, see this June 28, 2023, 10 year partnership with Notre Dame and F/L.

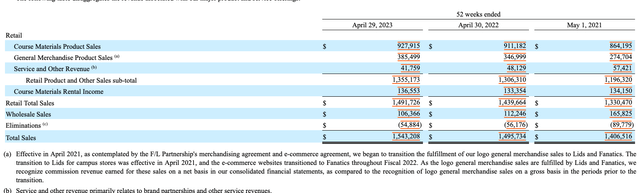

For perspective, BNED’s general merchandise product sales were $385.5 million out of $1.543 billion. Under the current structure, BNED gets a revenue sharing piece of general merchandise sales fulfilled by Lids and Fanatics. These revenues are recognized as commissions.

Because of BNED’s slower and longer than expected transformation (over the past two fiscal years, not to mention getting dinged by Covid) to First Day Complete, the company’s Adj. EBITDA performance has been disappointing (until this recent quarter, Q2 FY 2024, where they generated $61 million of FCF), and the company’s leveraged balance sheet has meant the company has had to play defense. When you’re playing defense and not offense, BNED hasn’t been able to really invest in the business, like a better and well capitalized merchandizing company could.

The reason the company’s equity currently trades for such a low valuation is because the company’s leveraged balance sheet and uncertainty of how successful FDC will be during calendar Fall 2024 college semester enrollment period.

Lo and behold, check out this nuggets from BNED’s December 6, 2023 conference call:

“During the quarter, the benefits from our Fanatics and Lids relationship were on full display at our schools. For example, at the Ohio State University book store, lines began forming around the block at 4:30 a.m. to participate in an exclusive in-store launch of Ohio State branded lululemon merchandise.”

See this video link of the Ohio State/ BNED/ Lululemon exclusive event.

Next, last summer, on August 11, 2023 (page 106 of BNED’s 10-K) as part of its credit line extension / covenant relief, BNED had to bring on a Chief Restructuring Officer as well as bring on two independent directors.

Therefore, I would argue Fanatics would greatly benefit if they, very opportunistically, I might add, acquired a $1.6 billion revenue business on the cusp of a big and successful turnaround with FDC, a situation where Adj. EBITDA (FY 2025 and FY 2026) could ramp up materially. Moreover, with Fanatics’ balance sheet, they could just pay off the ABL creditors, and they already own $30 million of the term loan, as their cost of capital is so much lower. This could work great for Fanatics as they get the benefits of FDC and inherent BNED’s well underfoot turnaround, in FY 2025 and FY 2026. In addition, they can invest in the merchandise side, and the Ohio State/ Lululemon exclusive merchandise is only sneak preview / scratching the surface on what a well-capitalized Fanatics can do on the College Campus Merchandizing side. If you think about it, BNED has key and long lasting strategic relationships on some of the most marquee campus in the United States (such as Harvard, Penn State, University of Michigan, and Ohio State). My vision would be for Fanatics to rebrand the college stores to Fanatics stores, at Flagship campuses. If you think about the type of places where BNED has these key footholds, think of the marketing value of having Fanatics branded stores, as places like the University of Michigan or Ohio State.

Besides, since last August 2023, there is already a strategic review in place, there is already a Fanatics / BNED business relationship established and Fanatics has already made both an equity and debt investments in BNED. If Fanatics were to buy BNED, BNED could ramp up the pace of the its FDC adoption, as its balance sheet uncertainty / overhang would get resolved. Additionally, I would argue that BNED/ Fanatics could very aggressively take market share and win more flagship campuses, like they did at Notre Dame, away from Follett.

That said, I do appreciate and understand that a lot of BNED’s footprint consists of Community Colleges and less known, non-flagship State schools. The mission wouldn’t change and FDC would be protected and ensure that students save money, have convenience, and are ready, on day one, to learn and to be on equal footing with all students throughout the economic ladder.

The Risks

The risks are very simple. The company needs to successfully refinance its debt. They have until December 28, 2024 to do so. That said, it would be better for all its stakeholders to get this refinancing resolved well in advanced of the fall 2024 semester (calendar 2024, not BNED’s fiscal year). The company has to positively make this happen and it has to be at somewhat reasonable terms.

The other big risk and overhang is the uncertainty surrounding this DOE policy proposal, which is in the comments period. Now, I’m of the opinion that facts and logical win the day, as the current party in the White House wants kids from disadvantaged economic backgrounds as well as all kids (as should any future administration) to do as well as possible in college and go out and do some great things out there in society and in the world. FDC is win-win, is much more convenient, and when adopted in its current form, empirically saves students money. That said, the DOE overhang creates uncertainty and could slow the adoption of FDC, for the Fall 2024 term.

The third possible risk is that BNED is forced to do an equity raise at unfavorable prices. That said, I would hope/ think management would be smart enough to post a good Q3 FY 2024 (early March 2024) and then do a rights offering, as no one get diluted in a rights offering, if they chose to participate. Again, though, this makes more sense when the stock is $1.25+. The reason a Rights Offering could make sense is that it should get net turns of leverage down to sub 4X (So $160 million / $40 million of FY 2024 Adj. EBITDA, if they raised $50 million in a rights offering, after posting a solid Q3 FY 2024). Although just shy of 4X turn of leverage isn’t great, it is much more attractive to a new ABL lender than the current 5.5X.

Putting It All Together

Given the extreme volatility in BNED shares, the first version being the good kind, on the leg up from $1.30 to $2.25, and the second version, being the roller coast down leg, from $2.25 to sub $1, this piece is an important update to share with the readership. As you might have worked out, I’ve done a fair amount of work on the business and am really excited about FDC. Yes, the cost of capital is very high now, yes equity capital is very expensive, and yes BNED doesn’t have the luxury of a ton of time. That said, the business is clearly turning, we saw that in the fantastic Q2 FY 2024 results, and the outlook for FDC looks very favorable notwithstanding this current DOE news. Lastly, although not my base case and perhaps a low probability event, I think Mr. Market is under appreciating how valuable BNED’s relationship is with Fanatics. Fanatics already owns equity in the business as well as $30 million of the term loan, which is junior to the ABL. A very well capitalized Fanatics, with its $31 billion, most recent private market valuation, might be able to do wonders, on the merchandising side, and its big balance sheet should give schools and universities ample reassurance of FDC and BNED’s staying power. Moreover, Fanatics would love to have Fanatics branded stores at some of the most prestige colleges in the United States. This would be a brilliant marketing move by the company.

Either way, despite all of the fear and uncertainty, at least at $0.85 or a $1 per share, I think Mr. Market is playing me to take this kind of risk. As always, we shall see in three to six months’ time.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.