The Bank of England has opted once again to hold the base rate at 5.25 per cent, a move which will reinforce the view we’ve reached the peak for interest rates.

The decision marks its second pause after the Monetary Policy Committee voted to hold the base rate in September. Prior to that, there had been 14 consecutive base rate hikes since December 2021.

The announcement will be met with a degree of relief among borrowers and disappointment among savers.

The MPC voted by a majority of 6–3 to hold base rate compared to September’s narrow 5-4 vote.

Pause: The Bank of England has opted once again to hold the base rate at 5.25 per cent, which will reinforce belief that we have reached the peak for interest rates

In recent months, forecasts for where the base rate would eventually peak have fallen from a high of 6.5 per cent to 5.25 per cent.

Today, a 5.25 per cent peak seems ever more likely. While the Bank of England is not ruling out further rises, many will see this as a sign of its caution when it comes to pushing up rates any further, unless inflation persists for longer than expected.

Swap rates, which banks and building societies use to price their fixed rate mortgages and savings products, have also been falling suggesting that financial markets are expecting interest rates to gradually fall from here on.

We explain why the Bank of England has raised interest rates and what it means for your mortgage, savings and the wider economy.

Why has the bank paused rate rises?

Today’s base rate decision was widely expected given the central bank’s decision to hold base rate last time around.

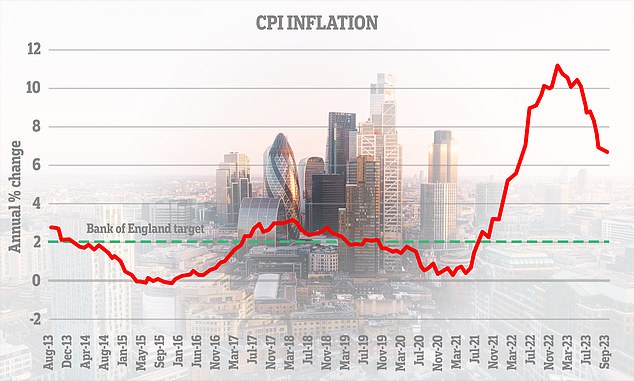

The official consumer prices index measure of inflation (CPI) remained at 6.7 per cent in September rather than dropping slightly as economists were expecting.

It means inflation remains at over three times above the Bank of England inflation target of 2 per cent.

Between December 2021 and August 2023, higher inflation led the bank to use the only real tool in its arsenal to try and bring it down – raising interest rates.

By raising the cost of borrowing for individuals and businesses it hoped to reduce demand, slowing the flow of new money into the economy.

In theory, more expensive mortgages and better savings rates should also encourage people to save more and spend less, further pushing down inflation.

Going down: Inflation is currently up 6.7% in the 12 months to September – down from a peak of 11.1% recorded last October

However, with the rate of inflation steadily easing back from its double digit highs recorded earlier this year, the Bank of England appears to have enough confidence to continue to halt for the time being as it watches the impact of its earlier rate hikes filter through to the wider economy.

Paul Dales, chief UK economist at Capital Economics, believes that the base rate will now remain at its 5.25 per cent peak until the second half of next year.

He says: ‘The Bank decided to keep interest rates at 5.25 per cent for the second month in a row as there have been some more signs that the 14 previous rises in interest rates are weakening the economy and helping to reduce inflation.

‘Our view that the economy will soon be in a mild recession suggests that interest rates are at their peak, although we don’t expect them to be reduced until late in 2024.’

Victor Trokoudes, founder and chief executive of saving and investing app Plum, is also expecting base rate to remain where it is for a while longer.

He says: ‘As expected, the Bank of England has decided to not change interest rates for the second month in a row. And it follows on from similarly cautious decisions by the Fed and European Central Bank.

‘Even though the base rate hasn’t gone up further today, that doesn’t mean the pain is over. The base rate remains high at 5.25 per cent and there is no sign of it dropping anytime soon, save for a sudden plunge into recession which would lead to the Bank of England likely cutting rates quicker than they’d like.‘

Future base rate falls: Capital Economics is forecasting the the bank rate will be cut to 3% by the end of 2025

What does this mean for mortgage borrowers?

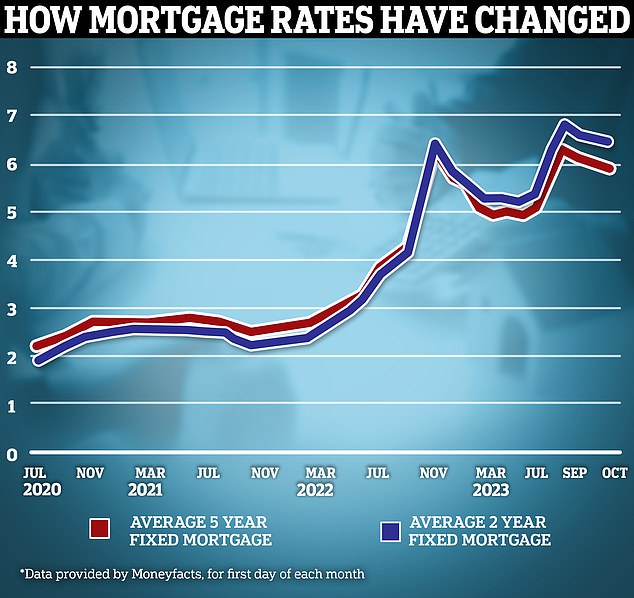

The higher base rate has created a mortgage crisis for some – especially those who are due to remortgage in the near future.

Many borrowers are protected by the fact that their interest rate is fixed for either two or five years.

However, there are some 1.6 million mortgage borrowers expected to roll off their fixed rate mortgages next year, many of whom will currently be enjoying a mortgage rate of less than 2 per cent.

The average two-year fixed mortgage rate is now 6.31 per cent, according to Moneyfacts, and the average five-year fix is 5.87 per cent – meaning these borrowers are set to see a big jump in their monthly payments.

U-turn: Mortgage rates have been on a downward trajectory in recent weeks, with markets having lowered their expectations of where the Bank of England’s base rate will peak

You can check the latest mortgage rates you could apply for, and get expert advice, using the This is Money mortgage service.

The average borrower coming off a two-year fix would see their rate increase from 2.29 per cent to 6.31 per cent, if they fixed for two years again today.

On a £200,000 mortgage over a term of 25 years, this would mean monthly mortgage payments rising from £876 to £1,327 – an increase of £451 a month or £5,412 a year.

Of course, it’s important to also remember these are the average rates across the entire market. The cheapest deals available paint a slightly more positive picture, particularly for those with big deposits or lots of equity built up within their home.

It’s possible to get a rate of 5.1 per cent on a two-year fix, and as low as 4.64 per cent when fixing for five years. It is worth speaking to a mortgage broker to find the cheapest deal that you may be eligible for.

However, those that can bag a below-average rate are still likely to face a serious hit to their finances.

Mortgage borrowers on tracker and variable rates will likely be breathing another sigh of relief today.

Variable rate mortgages include tracker rates, ‘discount’ rates and also standard variable rates. Monthly payments on all these types of loan can go up or down.

Trackers follow the Bank of England’s base rate plus or minus a set percentage, for example base rate plus 0.5 per cent.

Standard variable rates are lenders’ default rates that people tend to move on to if their fixed or other deal period ends and they do not remortgage on to a new deal.

These can be changed by lenders at any time and will usually rise when the base rate does, but they can go up by more or less than the Bank of England’s move.

Mortgage shock: For those approaching the end of their fixed deal, they will be preparing for their monthly mortgage costs to jump

Chris Sykes, associate director at mortgage broker, Private Finance, believes today’s decision will provide some much-needed respite for mortgage borrowers.

He says: ‘This will be another really positive message to lenders and borrowers that unless anything drastic changes, this is likely the peak of the base rate. It always inspires confidence into the market when the only way is down.

‘There are variable rate products that can take advantage of decreasing rates over time. The real question is when we will see decreases, and I don’t think anyone expects these until later next year.’

David Hollingworth, associate director at broker, L&C Mortgages, agrees.

He adds: ‘Whilst we can’t rule out base rate increasing again, it does now feel that the peak may have been reached and borrowers can look forward with a little more confidence.

‘The mortgage market has been a lot less volatile, after unsettled buyers retreated into a holding position in recent months.

‘Fixed rate mortgages have been coming down and this news should only lead to that trend continuing.

‘That’s not going to see a return to the historic lows of only a couple of years ago, but at least borrowers will feel that there’s a better choice of rate on offer.’

> How to remortgage your home: A guide to finding the best deal

What next for fixed rate mortgages?

Mortgage borrowers on fixed term deals should focus less on the base rate decision today, and more about where markets are forecasting the base rate to go in the future.

This is because banks tend to pre-empt the base rate hike. They change their fixed mortgage rates on the back of predictions about where the base rate will ultimately be in the future.

In recent weeks, mortgage lenders have been slashing rates. Earlier this week both HSBC and Halifax cut rates, following Nationwide, Santander, Virgin Money and Yorkshire Building Society earlier this month.

More rate cuts: Major mortgage lenders including HSBC, Nationwide and Santander have slashed their rates this month, offering further respite for mortgage borrowers

These rate cuts have been encouraged by revised market expectations over where interest rates are heading.

Market expectations are reflected in swap rates. These are agreements in which two counterparties, for example banks, agree to exchange a stream of future fixed interest payments for a stream of future variable payments, based on a set amount.

Mortgage lenders enter into these agreements to shield themselves against the interest rate risk involved with lending fixed rate mortgages.

Put more simply, swap rates show what financial institutions think the future holds concerning interest rates.

Mortgage expert: Chris Sykes, associate director at Private Finance, expects mortgage rates may gradually fall from here

Five-year swaps are currently at around 4.33 per cent and two-year swaps are at 4.8 per cent – both trending below the current base rate.

Only as recently as July, five-year swaps were above 5 per cent. Similarly, the two-year swaps were coming in around 6 per cent.

Nicholas Mendes, mortgage technical manager at broker John Charcol says: ‘NatWest, Halifax and HSBC have all cut mortgage rates this week.

‘With markets settled, another hold in the MPC meeting today, and swaps across two, three, and five-years falling further, lenders clearly feel there is still further ground to make.

‘Expect to see a 4.6 per cent rate deal imminently, and potentially 4.5 per cent on a five-year fixed rate deal sooner than expected.’

Chris Sykes of Private Finance is also expecting further rate cuts. However, he expects the pace of change will be very gradual.

He adds: ‘Fixed rates-wise, today’s decision may inspire greater lender confidence so this could lead to some rate decreases, but it is likely to keep things the same as we are seeing most lenders expect rates to stay flat.

‘From there, we will see very gradual decreases to fixed rates generally as we get closer to the time when base rate will start to fall, but don’t expect to see large changes at any point soon.’

What does the base rate pause mean for savers?

The Bank of England’s successive interest rate rises since December 2021 have been good news for savers.

The best savings accounts now offer some of the highest interest rates seen since 2008.

Now, with the base rate hike cycle appearing to peak at 5.25 per cent, savers will be wondering whether it is the end of the savings rate heyday for their nest eggs.

Savings experts have been calling the top of the market for some time now. Previous headline-grabbing deals including Santander’s 5.2 per cent special edition easy-access rate and NS&I one-year bond paying 6.2 per cent have all but vanished.

What next? With the base rate hike cycle appearing to peak at 5.25 per cent, savers will be wondering whether it is the end of the savings rate heyday for their nest eggs

However, there are still top rates available, including three one-year fixes paying 6 per cent or more as well as 20 easy-access deals paying 5 per cent or more.

If you haven’t reviewed your savings recently, now is a good time to check your rate and move to a table topping rate while you still can.

You can find the best rates using This is Money’s independent best buy savings tables.

Laura Suter, head of personal finance at AJ Bell says: ‘Rising interest rates mean that many savers have shed their previous apathy around chasing better rates.

‘The fierce competition in the savings market means that many savers voted with their feet and jumped to the best-paying account.

‘Lots of savers are still doing this, with the latest stats showing that in September £13 billion was put into fixed-rate accounts as savers tried to snap up a good deal.

‘But with some of the top rates having already been withdrawn, the end is nigh for savers waiting for the peak savings rate to hit.

‘The news for anyone who has been waiting on the sidelines for even higher rates is: act now while stocks last.’

Is it downhill from here for savings rates?

This year has seen rates continue to climb, with banks battling it out with each other in order to take the top spot and attract new customers.

With many now seeing 5.25 per cent as the peak for base rate, experts agree that rates are likely to move downwards.

Andrew Hagger, personal finance expert and founder of MoneyComms says he expects savings rates will slowly start to slip back

However, rather than savings rates crashing back down, most commentators are expecting a gradual decline over the coming years.

Andrew Hagger, personal finance expert and founder of MoneyComms says: ‘I can’t envisage any dramatic changes over the next few years’.

‘I think we will see a very gradual decline in base rate from a high of 5.25 per cent this year to somewhere around the 4 per cent mark in the next three years.

‘As for 2024, perhaps a couple of 0.25 per cent cuts towards the end of the year would be my prediction.

‘I therefore expect easy access savings rates to hover around the 5 per cent mark for the coming 12 months.

‘Meanwhile, I think one-year fixed rate savings deals could fall back to around 5.3 or 5.4 per cent over the coming year.’

Which banks offer the best savings rates?

When it comes to choosing an account, it’s always worth keeping some money in an easy-access account to fall back on as and when required.

Most personal finance experts believe that this should cover between three to six months worth of basic living expenses.

The best easy-access deals, without any restrictions, pay north of 5 per cent. If you’re getting a lot less than this at the moment, then consider switching to a provider that pays more.

Won’t last long: With only a few 6% fixed rate savings deals remaining, savers may not have long before there are none left

In terms of the best of the best, Paragon is now offering a market-leading easy-access deal paying 5.25 per cent.

Someone putting £10,000 in Paragon’s account could expect to earn £505 in interest over the course of a year, if the variable interest rate remained the same, albeit the rate on this account drops to 1.50 per cent if three or more withdrawals are made within a 12 month period.

Ulster Bank, which is part of the NatWest Group, is offering a 5.2 per cent rate with unlimited access.

> Find the best easy-access savings rates here

Those with extra cash which they won’t immediately need over the next year or two should consider fixed rate savings.

Fixed rates offer the best returns at present. The best one-year deal is offered by Union Bank of India (UK) paying 6.05 per cent.

Someone putting £10,000 in this deal will earn a guaranteed £605 interest over one year. It comes with full protection under the Financial Services Compensation Scheme (FSCS) up to £85,000 per person.

Hakib Bank Zurich is paying 6.03 per cent, FirstSave is paying 6 per cent, Vanquis Bank is paying 5.95 per cent and Gatehouse Bank is paying 5.9 per cent. All offer FSCS protection.

> Check out the best fixed rate savings deals here

Savers should also consider using a cash Isa to protect the interest they earn from being taxed.

The top one-year fixed term cash Isa is paying 5.7 per cent interest, while the top two-year fix is paying 5.61 per cent.

Those wishing to keep their money in an easy-access cash Isa can also get 5.08 per cent with Zopa Bank.

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.