Golden_Brown

By James Knightley & Francesco Pesole

April cut not likely, June still possible

The Bank of Canada has left its policy rate unchanged at 5% as expected. The accompanying statement acknowledges that fourth quarter GDP grew more than expected, but recognises that there is more labour market slack emerging, due to rapid population increases, and this should help to dampen wage pressures. Nonetheless, they remain concerned about inflation with BoC Governor Tiff Macklem stating that “future progress on inflation is expected to be gradual and uneven, and upside risks to inflation remain. [The] Governing Council needs to see further and sustained easing in core inflation”. Given this backdrop “It’s still too early to consider lowering the policy interest rate”.

It is unlikely that the BoC will be comfortable enough to loosen policy at the next meeting on 10 April, but we do see a decent chance of interest rate cuts starting to come through from the 5 June meeting onwards.

The effects of previous rate hikes are still feeding through since Canadian mortgage rates continue to ratchet higher for an increasing number of borrowers as their mortgage rates reset after their fixed period ends. This will intensify the financial pressure on households, dampening both consumer spending and inflation. Unemployment is also expected to rise given the slowdown in job creation (and rising job lay-off announcements) with high immigration and population growth rates adding to the slack in the labour market.

Consequently, we expect inflation to drop back to 2% in the second half of this year rather than in 2025 as the BoC expects, which will give the central bank the opportunity to move policy to a more neutral level before anything painfully breaks in the Canadian economy. We look for 100bp of rate cuts in 2024 with a further 75bp in 2025.

CAD slightly stronger, but no changes to our FX call

The Canadian dollar reacted positively to the BoC announcement, as the unchanged policy statement defied some expectations that hints on rate cuts would be provided. Still, post-meeting action was largely confined to the FX space: the CAD sovereign and swap curve is slightly changed, and largely following global dynamics today.

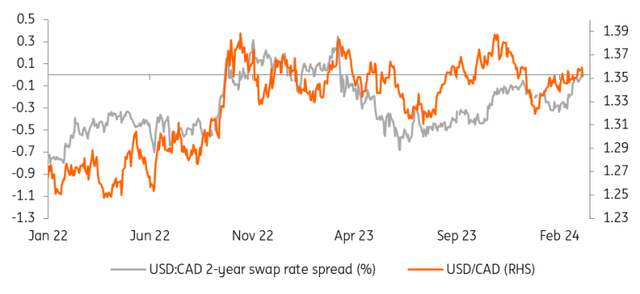

The two-year USD:CAD swap rate differential has moved back into positive territory of late, but does not point to marked mis-valuation in the short term. The persistence of CAD’s correlation to US data and the strict link between Fed and BoC policy expectations means the room for a major break in either direction in USD/CAD does not seem very likely. We expect it to keep trading in a 1.34/1.36 range in the coming weeks before a clearer USD downtrend starts to emerge from the second quarter onwards and takes the pair towards the 1.30 mark in the second half of 2024.

USD/CAD and short-term rate swap spread

Content Disclaimer This publication has been prepared by ING solely for information purposes irrespective of a particular user’s means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more