peshkov

Welcome back to the third edition of Bank Buzz, where we cover the community bank sector, with a specific focus on mutual conversions, our favorite niche within a niche.

Historically, investments in banks trading below tangible book value with overcapitalized balance sheets, solid asset quality, and shareholder-friendly management teams have generated attractive returns.

In today’s issue, we share a few brief insights from the thrift conversion universe and then spotlight NB Bancorp (NASDAQ:NBBK), which converted from a mutual stock holding company in late December.

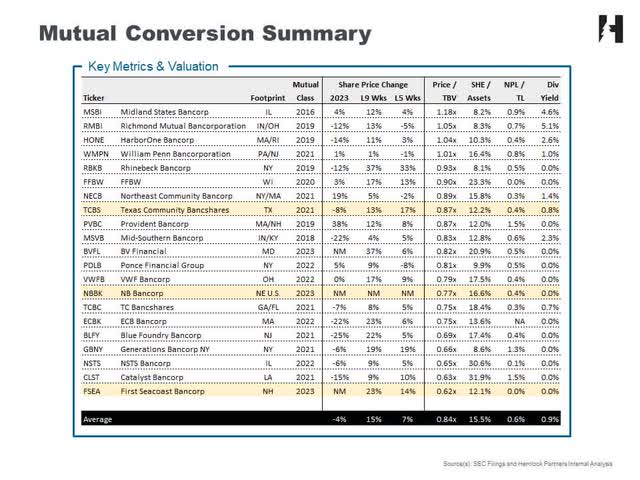

Comp Table & Quick Takes

- Our mutual conversion universe performed well recently, outpacing most benchmarks. For example, since early December, the group has appreciated 7.3% versus 3.9% for the S&P 500 (SP500).

SEC filings & internal analysis

- In recent weeks, shares of Texas Community Bancshares (TCBS) increased 17% as multiple insiders were buying shares in late December. Despite the move, TCBS trades at only 87% of tangible book value. To an acquirer, we believe the bank is worth $20 per share or ~40% higher than the current valuation. The three-year sale restriction period ends in July.

- As we accurately predicted in early December, First Seacoast Bancorp (FSEA) has enjoyed a nice run, up 14%, as investors anticipate a share repurchase announcement. January 19th will mark the one-year anniversary of FSEA’s mutual to stock transition and the stock trades at only 62% of tangible book value.

Profile: NB Bancorp – Inexpensive With Multiple Catalysts To Deliver Returns

Introduction

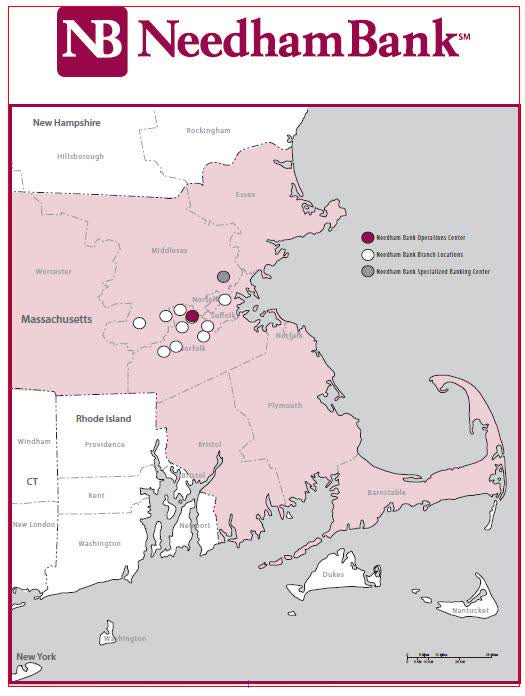

NBBK is the holding company for Needham Bank. Founded in 1892, the bank is headquartered in Needham, MA, and primarily serves the Greater Boston metropolitan area and surrounding communities, including eastern Connecticut, southern New Hampshire, and Rhode Island.

The bank’s footprint is illustrated below.

SEC Filings

NBBK operates the traditional community bank business model – attracting retail deposits from the general public (with a focus on the local area) and using those funds to originate loans secured by residential and nonresidential real estate. However, in recent years, NBBK has accepted more non-retail funding.

With approximately $4.6 billion in assets, NBBK is one of the largest converted thrifts on our watchlist. The firm maintains an overcapitalized balance sheet (equity to assets of ~16%) and attractive credit metrics.

At $13.97 per share, the stock trades at only 77% of tangible book value, a proxy for liquidation value. As is typical in these cases, the inexpensive valuation is likely a temporary phenomenon due to the recent mutual to stock transition (end of December) and relatively small market cap (~$600 million). We believe NBBK will be better received once fourth quarter (post-transaction) earnings are released and shares will screen accurately.

Catalysts, Valuation & Risks

Releasing fourth quarter results with the updated balance sheet will assist in getting NBBK on the radar of value investors. More importantly, as mentioned above, the firm is overcapitalized. And the substantial liquidity is key to driving shareholder value as it provides the wherewithal to ramp loan growth, pay dividends, and repurchase shares.

Over the next 12-18 months, we expect the company to begin repurchasing shares. Trading below tangible book value, every share repurchased will be immediately accretive.

Subsequently, as the gap between the stock price and tangible book value closes, the bank may elect to issue a modest, recurring, quarterly dividend, attracting a whole new group of income-hungry investors.

The combination of dividends, buybacks, and moderate loan growth has the potential to provide a total return of 20-30% over the next 24 months.

Considering a three-to-five-year investment horizon enhances the potential return outlook. Although by no means a guarantee, we expect NBBK to follow the game plan of so many other shareholder-friendly, demutualized banks. After flexing the balance sheet (conservatively growing organically while distributing a modest dividend and consistently repurchasing shares below tangible book value), the bank will likely become a takeover candidate. As a reminder, demutualized banks must wait three years after the conversion date to sell the business.

At that point, post-December 2026, NBBK will be eligible to be acquired, a typical outcome for demutualized banks. As we wrote previously, within five years of conversion, roughly 70% of these banks have been sold, usually at a nice premium to tangible book value.

Historically, the average thrift is acquired at 120%-140% of tangible book value.

To be conservative, we typically model an exit multiple of 120% of tangible book value. In this case, we have targeted a tangible book value of ~$20 per share in December 2026, indicating an acquisition price of ~$25 per share or a ~80% return over the next ~4-5 years.

Although we like the setup, there are no sure things. Potential risks to the thesis include, but are not limited to:

- Quality of the loan portfolio deteriorates. As a small bank, NBBK is significantly exposed to the economic conditions within its regional footprint.

- Leadership elects to hold excess capital versus returning to shareholders via dividends and buybacks. Or even worse, pursues a roll-up acquisition strategy.

- Material change in the local competitive environment could slow growth or reduce profitability.

Conclusion

Despite a strong capital position and attractive credit metrics, NBBK trades at just 77% of tangible book value. Over the next 3-5 years, we believe management will follow the proven, shareholder-friendly “thrift game plan” which includes conservative organic growth, dividends, prudent buybacks, and ultimately a sale.

Although there are no guarantees, we view NBBK as a low risk holding, which conservatively offers total return potential of ~80% (plus or minus 10%) for patient, long-term investors.

Previous Editions of Bank Buzz

Missed an issue? Our previous commentary can be found here.

- 2 Value Plays With Near-Term Catalysts

- Buyback Bonanza At Small Cap Banks William Penn And Northeast Community

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.