GaudiLab/iStock via Getty Images

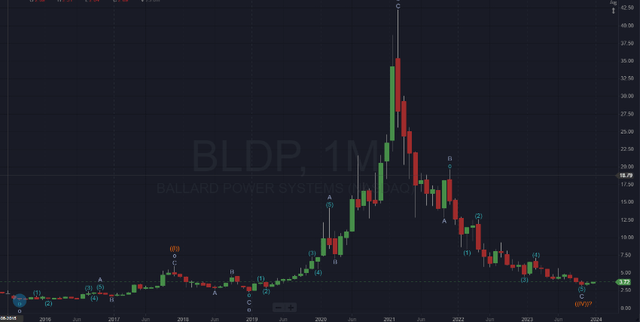

It is over two years since I have been able to cover a Hydrogen company and three years since I last bought shares in Ballard Power. 2020/2021 were my most profitable trading years so far, and that success was driven by the near-exponential growth in all the Hydrogen stocks. I bought Ballard Power Systems (NASDAQ:BLDP), Plug Power (PLUG), ITM Power (OTCPK:ITMPF), and others, repeatedly making significant gains each time. The hype hit reality in the first quarter of 2021 when the market seemed to achieve the industry was years away from actual revenue and that the commercial case for using hydrogen was yet to be made. In Ballard’s case, the catastrophic share price collapse from $42 per share to $3 was a massive hit for many retail investors. With Ballard 56% owned by the general public, many of them are likely still sitting on painful paper losses.

A slew of recent positive news and a potential technical bottom on the price chart caused me to look at the industry again. After analyzing the situation, I have taken a new position in Ballard.

The Case for the Hydrogen Industry

The hydrogen industry is a complete ecosystem based on using hydrogen as a carbon-free energy carrier. Hydrogen needs to be produced, stored, transported to the point of use, and finally converted into electricity by Fuel cells producing only water as an exhaust gas. Every part of the ecosystem is a potential revenue generator, but the whole value chain needs to be in place for the technology to take off. In 2021, this seemed too much of a long shot; in some areas, it still is, but not all.

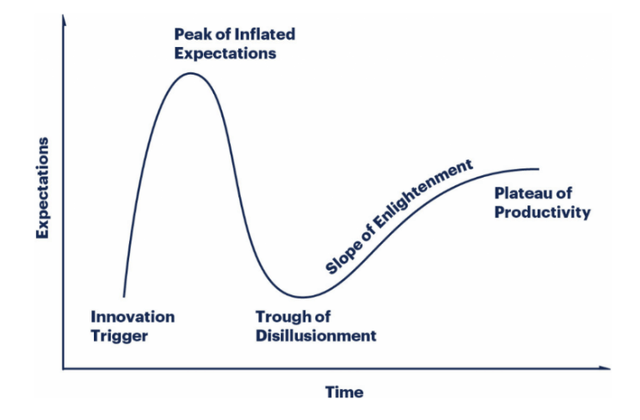

Gartner Model (Gartner.com)

The Hydrogen ecosystem is a disruptive technology, and modeling such industries is difficult. I often use the Gartner Hype Cycle to give a roadmap for these disruptive technologies. You may not be aware of the Hype Cycle, but you will likely recognize the shape of its price graph if you invest in these areas.

Monthly Chart BLDP (Author)

I have put the Gartner Hype Cycle alongside my long-term (Monthly) Elliot Wave chart for Ballard Power. My investment thesis is that the Hydrogen Industry has reached the bottom of the trough of disillusionment at the same time as Elliot Wave theory suggests that BLDP may have reached the bottom of its wave (IV) correction from its hype-induced peak in 2021. If so, then the technology may be about to rise again in the slope of enlightenment.

2021 and 2024, then and now

The big difference is data; we now have real-world data about the performance of fuel cells in the field, allowing us to appraise the competitive case for their adoption more accurately. The environmental story around this technology was the initial innovation trigger that caused all the hydrogen stocks to fly, but it was just a story back then. I will not go over the environmental reasoning here. It is well known and understood; instead, I will concentrate on the possibilities of commercial adoption of this technology and how parts of the world are moving towards large-scale adoption.

BLDP News. Sales up costs down

We have had a run of exciting press releases from Ballard in recent months. The table below is output from my database, where I store important information on the companies I follow. It is a summary of press releases from the Ballard Investors website with the date of publication.

| Date | Summary |

| Nov 6th | Ballard Power Systems has received an order for 12 fcels totaling 2.4 MW of additional fuel cell engines from Canadian Pacific Kansas City (CPKC) to maintain the development of hydrogen-powered locomotives planned for regular switching and local freight service applications in Alberta. This is an expansion of the 38 fuel cell engines already supplied by Ballard to CPKC over the past two years. |

| Nov 6th | Ballard has received multiple purchase orders for 62 hydrogen fuel cell engines from Solaris Bus & Coach, a leading European bus manufacturer. Ballard’s Chief Commercial Officer is confident that the current momentum in the bus vertical will continue into 2024. |

| Oct 10th | Ballard Power Systems announced multiple purchase orders from Solaris Bus & Coach for 177 hydrogen fuel cell engines to be delivered from 2023 to 2026. The orders include fuel cell engines to maintain the largest announced deployment of a fleet of fuel cell city buses in Europe, with 127 Solaris fuel cell buses to be deployed in Bologna, Italy. This brings Solaris’ total number of fuel cell engines ordered from Ballard year-to-date to over 270. |

| Aug 8th | Ballard Power Systems has received multiple purchase orders for a total of 96 hydrogen fuel cell engines from Solaris Bus & Coach The largest single order to date is from Rebus Regionalbus Rostock, a public transport operator in Germany, who ordered 52 fuel cell engines to power Solaris Urbino hydrogen buses. Most will be delivered in 2024. |

| Aug 3rd | Ballard Power Systems has signed a letter of intent with Ford Trucks to supply a fuel cell system for the development of a hydrogen fuel cell vehicle prototype. Ford Trucks plans to evolve a Fuel Cell Electric Vehicle (FCEV) F-MAX, which will blend the 120 kW FCmove-XDTM fuel cell engines into the F-MAX 44-ton long-haul tractor truck. As part of the European Union’s Horizon Europe ZEFES project goals, Ford Trucks aims to commence European Ten-T corridor demonstrations in 2025. |

| Jul 27th | Ballard Power Systems has received an order for 18 additional 200 kW fuel cell engines from Canadian Pacific Kansas City (CPKC) to maintain the expansion of its Hydrogen Locomotive Program. Ballard has already supplied CPKC with 20 fuel cell engines over the past two years for use in three different types of locomotives. |

| Jun 12th | Ballard has announced a strategize to reduce the costs and enhance the production capacity of their next-generation graphite bipolar plates. This project follows the development of thin flexible graphite bipolar plates and an expansion of membrane electrode assembly manufacturing capacity. The project will present disruptive manufacturing technology and new lower-cost material suppliers, resulting in cost savings of up to 70%. |

| Jun 1st | Ballard Power Systems and First Mode have announced a purchase order for Ballard to supply First Mode with 60 hydrogen fuel cell modules for delivery in 2024. This order represents an expansion of the relationship, following the order of 35 modules year-to-date in 2023, to power hybrid hydrogen and battery ultra-class mining haul trucks. |

The press releases from Nov 6th, Oct 10th, and Oct 8th refer to orders from the Polish Bus company Solaris Bus and Coach. I intend to use the Solaris Bus as a case research to explore the competitive case for hydrogen for large-scale Bus transit operations. If it works for buses, I assume it will work for several inner city medium to heavy-duty usage and set up a clear business rationale for adopting this tech.

Hydrogen Buses

Many cities and regions worldwide are trying to reduce the pollution caused by diesel internal combustion engines. As well as adding to global warming, they are thought to contribute enormously to particulate matter emissions responsible for reduced air quality. Incentives are offered to buy zero-emission vehicles, and large numbers of cities across Europe are bringing in low-emission zones that impose charges each time a bus or truck (or car, for that matter) is driven inside a predetermined area. (London is leading the way with its ULEZ scheme that imposes charges on almost all of Greater London ranging from 12.5 to 300 GBP per day.)

The commercial case for Ballard Powered Solaris Buses.

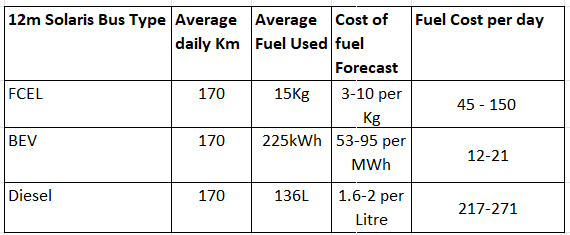

In November this year, the Journal of Energy Storage published a paper that gives data collected from the city of Bolzano in northern Italy. Bolzano runs a fleet of 12-metre buses supplied by Solaris Bus and Truck. They are a mix of Fuel Cell, Battery Electric, and Diesel buses. It is an excellent chance to contrast the running costs of all three. The buses have been used interchangeably, trying to cover all the different routes, and as a result (rounded to the nearest 10), they have averaged the same number of miles each day. (Fuel cost is in Euros and is covered later in the article)

Data from Bolzano (Author from the linked paper)

The first takeaway is that in terms of fuel costs, diesel-powered trucks are costly compared to the other two and that the BEV vehicle is far cheaper than the fuel cell one.

The BEV has the same passenger capacity but a smaller range. The fuel cell versions typically used less than half of their tank capacity in a single day; the electric buses used 107% of their battery capacity, meaning the bus company had to install a fast charging system so that the buses could be given a 10 min re charge after the completion of each run. The BEVs were plugged in overnight and consequently could not run the night routes and did not have the range to complete the longer distance suburban lines. Very little change in performance was noted with the seasons, but the weather in that part of Italy was not extreme.

The city of Bolzano is committed to zero-emission buses and would need some Hydrogen buses to reach these goals. If they were price competitive, it would make sense to buy only FCEL buses as they can replicate all the routes of the diesel vehicles, whereas the BEVs cannot.

Infrastructure Costs

Both BEV and fuel cell buses need additional infrastructure, and that infrastructure has held up the deployment of vehicles worldwide. Bolzano installed a Hydrogen refueling station in its bus depot despite one already existing less than 5 km from the depot. They installed overnight charging for the BEV and needed a Pantograph system to recharge buses between routes quickly.

(A Pantograph system is an overhead charging system that lowers an arm onto the top of the bus to connect to a rooftop charger.)

It isn’t easy to get actual prices for all of these things; however, a case research was published regarding a Canadian fleet of 300 BE buses. It suggests that the overnight charging infrastructure would come in at a little over $300k per bus and that the fast charging system would be $500k per unit. Total spending for the 21 Buses in Bolzano would be $6.8 million using these figures. The price would decrease if Bolzano could charge its buses in two shifts, as suggested in the Canadian research.

The cost of installing a Hydrogen fuelling point appears much lower. Linde (LIN) has established large numbers of these refueling stations and quotes 1 euro per Kg of hydrogen as the cost at 80% capacity. The Bolzano fleet works out at just over $110k per year or $1.1 million on an estimated 10-year life span. That is a substantial saving on infrastructure, but at the moment, it is wiped out by the cost of the buses.

The Cost of Buses

Currently, the cost of a fuel cell bus might be nearly a million dollars, perhaps twice the price of a BE bus and three times the price of a diesel-powered one. (Again, it is almost impossible to get exact figures, and these are internet explore results)

The main cost of a fuel cell Bus is the fuel cell itself; similarly, the main cost of a BEV is the battery. When analyzing the production costs of the two, they are very different. The battery for a BEV is already produced at scale; its cost of manufacture is a relatively small part of the total cost because of the heavy use of rare earth metals and lithium. The cost of its constituent components will limit the downward trajectory of its price.

A fuel cell is almost the exact opposite; apart from a tiny amount of platinum, the components are relatively low value, but the precision manufacturing of these small components is complicated and expensive.

The complete cell described below is less than 1 mm thick.

A single fuel cell comprises a membrane electrode assembly, with gaskets providing a seal. A fuel cell stack is formed by stacking multiple fuel cells separated by bipolar plates. The plates keep the cells apart and supply channels for fuel and air to enter and leave the cell.

The membrane electrode assembly has a polymer electrolyte membrane (PEM) at its heart that looks admire plastic shrink wrap. The PEM is sandwiched between the anode and cathode layers constructed from high surface area carbon with nanometer-sized particles of platinum acting as a catalyst with ion-conducting polymers. The gas diffusion layers, usually PTFE-coated carbon sheets, come after the catalyst layers. It is a feat to make these things, nanoscale manufacturing with the durability of heavy-duty engineering.

In the press release on July 12th, Ballard guided to reduce the cost of constructing the bipolar plates by as much as 70%. As fuel cells begin to reach scaled production, I think we will see the price of these devices fall dramatically, approaching the sum of their parts, perhaps even approaching the price of diesel engines (see page 25 PEM stack component summary, the Manufacturing cost of fuel cells produced for the DoE).

The website Sustainable Bus predicts a slight drop in the price of batteries for buses (perhaps 10% by 2030) but a massive 77% drop in the price of a fuel cell. They also forecast significant drops in the overall drive train from $100,000 to $50,000 for both vehicle types. If these predictions are even nearly correct, Fuel cell buses will have the lowest TCO of the three bus types by the end of the decade.

Manufacturing Hydrogen

For the Hydrogen economy to work, you must produce, store, and transport Hydrogen in vast quantities. Hydrogen could be produced at the point of need or transported by pipes and tankers to where it is needed; both methods represent a huge undertaking.

Producing Hydrogen

Hydrogen does not occur naturally but is the universe’s most abundant element. Hydrogen is derived from Methane for Grey Hydrogen or Water for Green Hydrogen. The oil industry likes grey hydrogen and the environmentalists admire green hydrogen.

The 2023 average price for Hydrogen in Europe is around 10 euros per Kg. However, this must be seen as the low volume early adopter price. The production cost of green Hydrogen in August 2023 was 6.48 euros on average (Platts Hydrogen Price wall); the CEO of Power2X said in an interview that his company was targeting 3-5 Euros at the two large-scale sites under construction. We can expect the hydrogen price to fall significantly over the next 12 months, reaching the prices I used in the table for Bolzano.

Transporting and Storing Hydrogen

The argument favoring hydrogen as the preferred energy carrier for heavy-duty transport appears to be accepted in Europe. The strategize for the European Hydrogen Backbone is well supported and progressing on multiple fronts. The Hydrogen Backbone uses many existing and some new pipes. It connects areas suitable for producing green hydrogen (using renewable energy to split water) with large cities and storage facilities. In some regions, the Backbone is already in use; work is going on in others; for some, it is just a strategize with no forward movement.

The EU has awarded funds to more than 200 Hydrogen projects and formally adopted the renewable Hydrogen strategize in June 2023; the strategize called Repower is committing the block to a significant movement towards hydrogen as the source of power for heavy-duty transport. Repower is a 400 billion Euro scheme to enable the production of 10 megatons of hydrogen by 2030. This will surprise many US readers, but the decision is grounded in security concerns.

Europe has depended on imports of natural gas and oil from Russia for many years. The IMF covered the potential fallout from this long-running saga. Geopolitical concerns stemming from the Russian action in Ukraine (Ukraine is not in the EU yet) and the NordStream2 pipeline controversy have concentrated the minds of the lawmakers in Europe, and they are working hard to wean themselves away from Russian energy at the same time as reducing emissions.

Russia supplies much of the natural gas and oil that Europe needs, giving it a heavy bargaining tool that it keeps threatening to use, and the Europeans don’t admire it. Hydrogen is a way out of this trap.

Market Research Forecasts

A explore of the internet provided the following forecasts for the growth in the market for fuel cell buses.

A clear split exists between those focusing on Europe as the driver for growth and those looking at Asia. The two Asian-focused reports see a much larger final market and a larger CAGR to get there; however, they have a more extended forecast period and a higher initial market calculate to work from.

All the market research companies see a large market for fuel cell buses within 5 years and a significant CAGR leading to a considerable market in the 2030s.

Is it just another story

So far, this article has presented a positive case for the hydrogen industry, but it could be the same story we heard in 2020. If things are changing, it should show up in Ballard’s financials and comments from management.

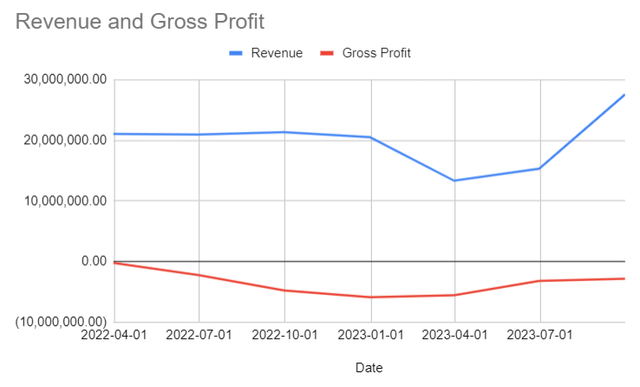

The recent Q3 earnings call and financials confirm that the uptick has begun and supply evidence that the hydrogen industry is starting its journey on Gartner’s slope of enlightenment. Revenue is showing an uptick, and guidance was positive going forward.

Quarterly Revenue and Profit (Author Database)

The CEO confirmed the improvement in business performance on the two criteria I have based this article on: sales to the heavy-duty transport market and cost improvements due to scalability. He said in his prepared remarks.

“Our Q3 revenues are up 30% compared to the prior year period and up 80% compared to the previous quarter.

At the same time, our gross margin loss is more than half, due primarily to execution and our product cost reduction initiatives and scale benefits from higher revenues.”

The CEO also discussed the improvement in sentiment from Ballards OEM customers, saying.

“Many bus and truck OEMs have increased their conviction on the adoption of fuel cells and as a result have scaled their in-house investments in fuel cell powertrain integration.“

Two years ago, Ballard invested in Ballard Motive Systems. The rationale was to supply powertrain and vehicle integration of fuel cells as the OEMs were not doing this work in-house, unconvinced that fuel cells would be a core part of their businesses. Ballard is now restructuring this area, taking a $ 2 million impairment charge as they discontinue this work and focus on the production of fuel cells.

The CEO mentioned growing demand from US bus customers and the 350 orders from Solaris already discussed. He described significant growth in the truck market and the rail industry business (increasing by a factor of 9). Only stationary applications showed a fall in revenue.

Management guided to a doubling of revenue in the second half of 2023 from the first half.

In the Q and A section of the earnings call, the CFO said they expect to hit gross margin profitability in 2024 (in some quarters, not the full year) and hit break-even operations in 2025.

This guidance suggests profitability in 2026, and with Ballard’s near-flawless balance sheet, I believe it is significantly undervalued.

(Ballard has zero debt and equity of just over $1 billion; short-term assets are over $900 million, with short-term liabilities of only $72 million and long-term liabilities of $17 million)

Conclusions

I think the case for fuel cell buses is now proven in Europe. They have zero emissions low running costs, and their cost of production is falling.

Fuel Cell Buses have proven that they can perform all of the tasks currently performed by diesel buses and act as a direct replacement.

Linde has a low-cost refueling infrastructure solution for hydrogen that appears much cheaper than the equivalent battery electric charging infrastructure cost, although still higher than that of the Diesel trucks.

The hydrogen production cost is forecast to fall to 3 Euros per Kg in the next couple of years.

Europe appears committed to hydrogen, having the added incentive of being hydrocarbon-poor and needing to import its oil and natural gas from Russia. Europe does not admire being dependent on others for its energy needs and sees hydrogen as one of the ways it can proceed towards energy independence.

Having analyzed the prospect for Hydrogen Buses in Europe, which I think extends easily to all forms of heavy-duty transport, looking at the investment being made in hydrogen by the European Union and its development of the European Hydrogen Backbone, I think that the hydrogen industry is about to enter the Gartners slope of enlightenment as people begin to see the potential of the technology become realized.

I also believe that the thesis expands to other high-population-density regions admire Asia.

I suggest that people buy Ballard; it already has a significant share of the European bus market and has shown multiple orders arriving. Ballard has proven operational data to show to existing and new customers, and with five years of cash on its balance sheet, enough time to ride this new slope of enlightenment into the plateau of productivity where it will make substantial and sustained profits.

A Risk To the Buy Ballard Idea

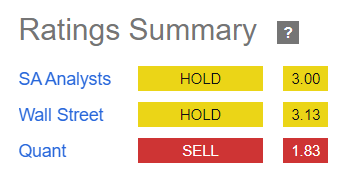

I will end with a risk warning: my opinion contradicts the general view. As can be seen from this graphic

Ratings Summary (Seeking Alpha)

SA gives Ballard a Quant score of 1.83 and a high risk of performing badly warning.

It is one of the few companies with the full range of recommendations from Wall Street; price targets range from a fall of 50% to a rise of 300%

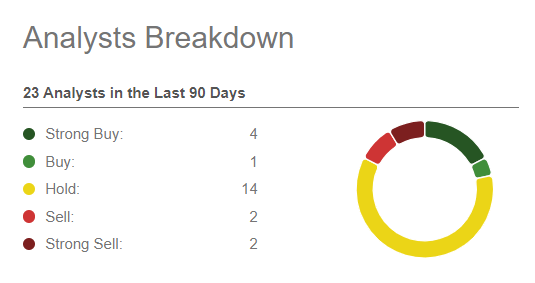

Wall Street forecast (Seeking Alpha)

Seeking Alpha analysts have published 19 hold or sell articles since the last positive one in April 2021; many hold articles are quite negative when you read them.

The hydrogen industry is beaten down, and some players are teetering on the edge of oblivion. As a famous saying goes, blood is on the streets, which is often the time to be brave. I bought Ballard @ $3.85 and will supply a technical update on this trade in the article’s comments section.

I will cover two more hydrogen stocks in the coming weeks and look into Ballard’s train engine market when I review their progress next quarter.