picture alliance/picture alliance via Getty Images

Dark Skies

We are equivocal about Babcock & Wilcox Enterprises, Inc. (NYSE:BW) but are leaning toward our Hold rating from when we last wrote about the company in June 2023. Despite the dark skies enveloping this company, some curious actions niggle.

Downsides and substantial financial risks prevail. The Q3 ’23 financials reported on Seeking Alpha include:

- Negative cash flow from operations,

- Negative EPS revisions, burdensome debt,

- Shrinking cash on hand,

- A burgeoning net income loss,

- Sputtering momentum,

- Net loss increased to $126.6M from -$21.5M Y/Y,

- Revenue was up Y/Y but less than we expected.

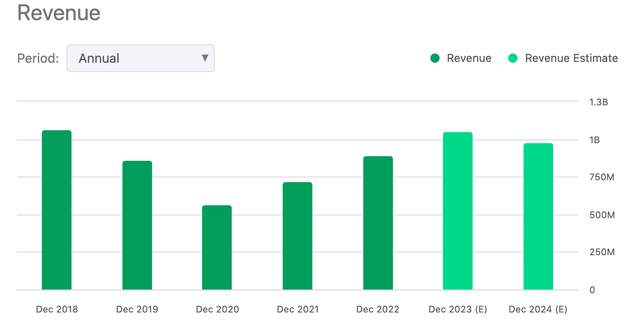

The consensus among analysts is that revenue will grow about 1.68% in FY ’24 over FY ’23. S A also forecasts a drop in FY ’24 revenue.

Annual Revenue (Seeking Alpha)

Despite regular revenue growth since 2020 and a +13% revenue pop in Q3 ’23, management warned shareholders that 2024 revenue is flagging. First, the board reclassified “our solar business out of continuing operations,” according to the Seeking Alpha transcript of the last shareholder meeting, because of high risks and poor margins. They are not selling the solar business and continue pursuing contracts.

A second risk to revenue growth is “attributable to timing of new bookings, as negotiations on a few larger opportunities are taking slightly longer than anticipated,” the CEO told shareholders. Project delays in 2023 and rising costs hurt company forecasts.

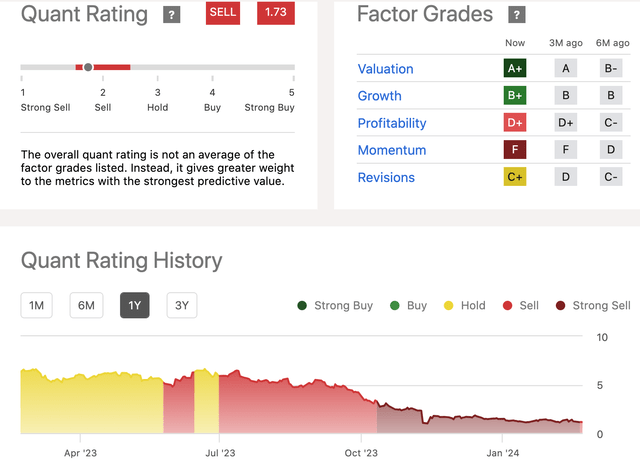

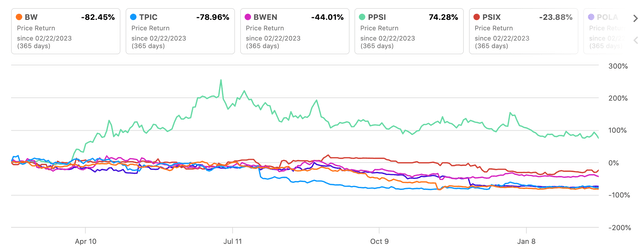

Fixating on revenue growth drove the share price to around $7 between 2020 and 2022. Babcock & Wilcox’s total revenue will have grown about 76% (FY’23 est.) since 2019. But lasting earnings are ephemeral and losses mounted. Then insiders sold substantial shares last summer giving impetus to the share price plummeting from +$6 each in June to now ~$1.10. The share price dived -82% over the last 12 months; it fell another -23% YTD. Momentum has hit bottom garnering an F for its SA Factor Grade.

Per profitability, ROE was last reported at -1,035.7% compared to the sector median of 13.8%. All other profitability metrics rate a D+. Seeking Alpha’s Quant Rating meanders between Sell and Strong Sell assessments. S A warns shareholders that Babcock & Wilcox “is at high risk of performing badly.” Babcock’s next earnings announcement is scheduled for March 20, 2024.

Quant Rating & Factor Grades (Seeking Alpha)

A Legacy Company

Babcock & Wilcox is a 155-year-old company building a $102.8M market cap. Its vision and mission are to ensure clean energy is available from facilities worldwide. It operates in a wide range of industries through subsidiaries and brands offering Renewable technologies to clean or replace fossil fuels, Environmental solutions for lowering emissions from energy and other industries, and the company builds thermal clean power generation equipment and plants.

Babcock assists refineries and industrial plants in meeting environmental standards. According to the website, it continues to work in the field of photovoltaic solar panel installations and operations and:

A Vibrant Industry and Positive Developments

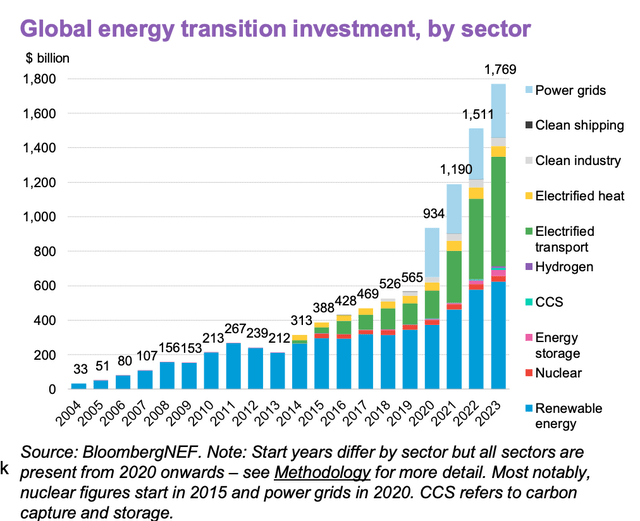

In a positive move for companies like Babcock & Willcox, the project delays in carbon emission control projects sparked the Biden White House to push harder for plant upgrades and new facilities, Reuters reported in May ’23. That bodes well for revenue growth. Moreover, Bloomberg mapped out the transition to clean energy growth which we believe Babcock will benefit from with its strategies for clean energy and power and growing commitment to hydrogen.

Global Energy Transition (Bloomberg)

48% of the emissions control sector of the economy targets industrial and power facilities. That gives Babcock & Wilcox tremendous growth opportunities. Government regulations and corporate self-imposed targets since the Clean Air Act of 1970 inspire and reward companies incentivizing them to use services that Babcock & Wilcox can provide. In Q3 ’23, the company reported a 13% increase in revenue Y/Y and expects revenue growth for the full year to top 30%.

A second positive note is that the lending markets expressed confidence in the company in January ’24 by offering a new revolving credit facility. The company estimates it will save ~$4M. “Company and its Senior Unsecured Notes received a reaffirmed credit rating of BB+ from Egan-Jones Ratings Company,” according to Business Wire.

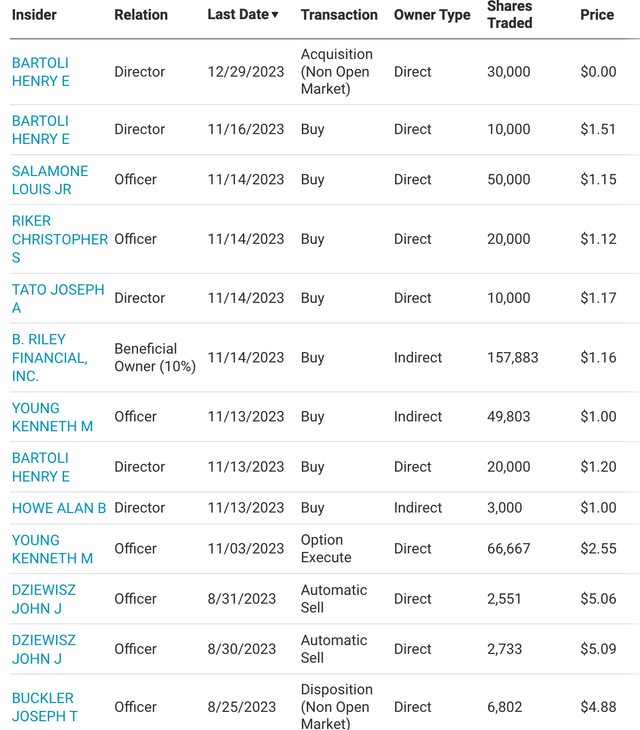

Shortly following the Q3 ’23 announcement, the company CFO announced his purchase of 50K common shares at $1.14 each. NASDAQ.com reports this was followed by directors and officers purchasing substantial amounts of stock.

Insider Purchases/Sales (NASDAQ.com)

Among the few analysts following the stock, the consensus seems to be shifting positively. One at Craig-Hallum reiterates a Hold-to-Buy position. Others upgrade their analysis of the stock with stronger recommendations. Two analysts set a 12-month price target at $11 per share including Robert Brown from Lake Street Markets. Simply Wall Street sets the stock’s fair value at $23.24 per share.

We are not quite so enthusiastic. We anticipate increasing revenue at Babcock as America drills more oil and gas and generates more clean power. However, momentum ticking up the share price will stumble along, in our opinion, after the company next reports Q4 ’23 EPS of a negative 5 to 6 cents compared to +$0.02 Y/Y. Moreover, the company has consistently reported lower EPS than analysts’ expectations every quarter since May 2022.

What seems to be grabbing the attention of investors is the positive valuation of price-to-sales TTM and FWD per SA metrics. Babcock is at 0.10 compared to the sector median of about 1.45.

Risks

Cash was last reported to be $48.37M while debt tops $434M. We do not believe upside revenue growth is enough to drive the share price. While its revenue prospects look good to us, looks alone are deceiving. The industry average is expected to grow bigger and faster than revenue at Babcock. We expect Babcock’s peers to outpace in revenue and earnings and offer better price returns.

We cannot pick an average high target price considering the financial health of the company but at this low stock price, the positive events suggest the stock has potential. The stock’s 24-month Beta is a high 1.64 suggesting excessive volatility that we see as a red flag to retail value investors.

Peer Comparison (Seeking Alpha)

Another disincentive for retail value investors is while waiting for the share price to tick up the company pays no dividend. Concomitantly, we expect the company’s free cash burn to continue apace; we suggest further reading of another SA analyst on this matter. Another cautionary note for us is the company was bankrupt before; only a few percent survive let alone prosper in our experience after emerging from bankruptcy.

On the upside, Babcock has more than a year’s cash runway with the moves and intends to secure stronger cash flow by refinancing all forms of its debt, refocusing priorities on more assured revenue streams with better margins from the aftermarket businesses, and instituting overhead budget cuts totaling $30M annually. The CEO emphasized to shareholders the company will be “utilizing federal, state and project level financing to accelerate the deployment of our (BrightLoop™ Low-Carbon Hydrogen Production) and (ClimateBright™ Decarbonization Technologies).”

Takeaway

The lack of confidence in Babcock & Wilcox in the investment community is going to be difficult to turn around. Insider stock purchases, up 14% in the last 6 months, are a bright signal to outside investors. Stock purchases by institutions over the last 6 months outstripped sales by about $21M.

In addition, we like the moves management intends to make to increase margins and cash flow. The low share price at present and its price-to-sales ratio are enticing and this American legacy company seems to have enough cash runway to meet its earnings goals. Over the years the company has maximized available debt in part for M&A purposes to spur revenue growth. Insiders and analysts appear more positive the share price will be moving up this year, so we are rating the stock a Hold for the interim.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.