AndrewJohnson/E+ via Getty Images

The municipal bond market needs more attention from investors in a world where everyone is seemingly YOLOing into equities. If you agree, the Invesco Taxable Municipal Bond ETF (NYSEARCA:BAB) may be worth considering, as it’s a part of the muni market most wouldn’t necessarily consider.

BAB is an exchange-traded fund, or ETF, with the core aim of mirroring the performance of the ICE BofAML US Taxable Municipal Securities Plus Index. This particular index serves as a benchmark for the performance of taxable municipal bonds issued in U.S. dollars by various governmental entities within the United States and its territories. To adhere to its investment strategy, BAB commits a minimum of 80% of its assets to the bonds that are part of the Index.

However, it’s crucial to highlight that BAB doesn’t replicate the index in its entirety. Instead, it opts for a strategic “sampling” approach to meet its investment goals. Both the fund and the index are subject to monthly rebalancing and reconstitution procedures.

Unveiling the ETF’s Holdings

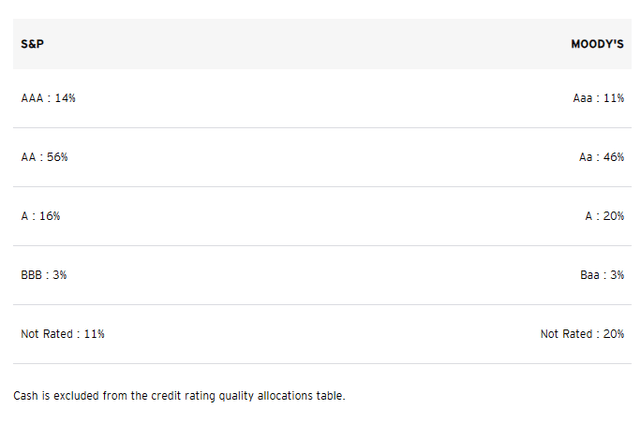

In the case of BAB, the fund is invested in a wide array of securities. The fund included 663 holdings, with a majority being high-grade bonds. Around 70% of BAB’s assets are invested in securities with a credit rating of AA and above, indicating a relatively safe investment profile.

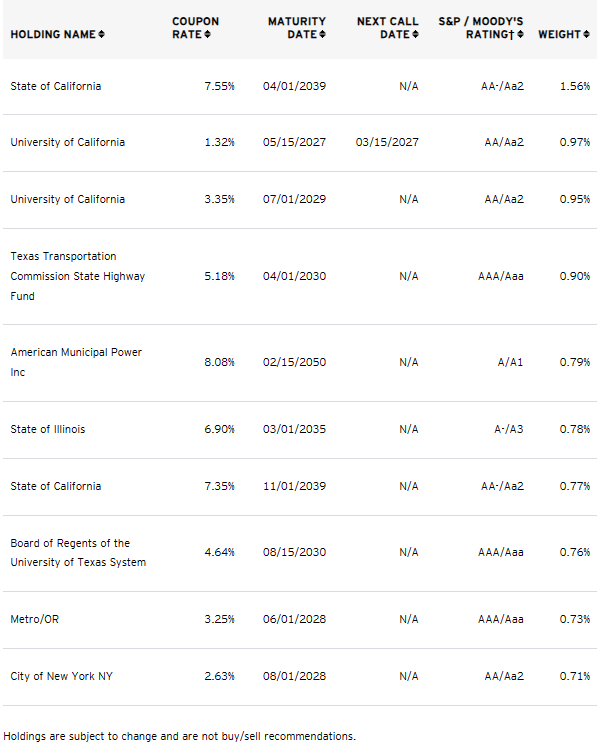

The top ten holdings of BAB, representing 8.9% of the total asset value, include bonds issued by various entities such as the State of California, the University of California, the State of Texas, and American Municipal Power Inc.

invesco.com

Sector Allocation: A Closer Look

For BAB, the fund’s assets are primarily invested in the Local Authorities sector, constituting nearly 100% of the fund’s asset allocation. This heavy concentration in one sector can be viewed as both a strength and a potential risk. On one hand, it highlights the fund’s clear focus on a specific sector. On the other hand, it also exposes the fund to potential sector-specific risks.

Peer Comparison: BAB in the ETF Landscape

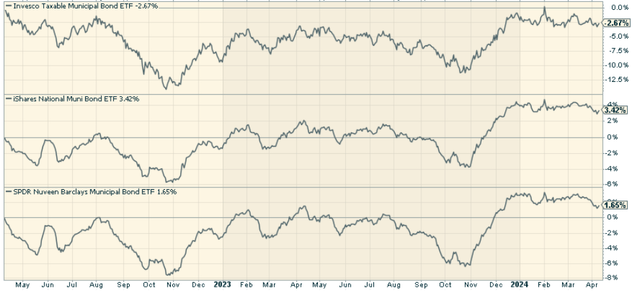

The iShares National Muni Bond ETF (MUB), and SPDR Nuveen Bloomberg Municipal Bond ETF (TFI) are decent proxies to compare BAB against. Total return-wise, BAB has underperformed. Much of this likely has to do more with duration than anything else. BAB’s duration is 7.9 versus MUB at 6.11 and TFI at 7.11. At the margin, this makes a difference given the way rates have acted over the last several years. Combined with the broader diversification helping MUB and TFI has resulted in BAB’s performance being comparatively weaker.

The Pros and Cons of Investing in the Theme BAB Tracks

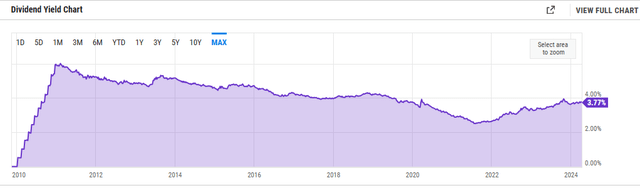

On the positive side, the fund offers exposure to a unique asset class of taxable municipal bonds, which can provide diversification benefits. It also allows investors to potentially earn higher yields compared to their tax-exempt counterparts. Furthermore, BAB’s investment in high-grade bonds adds a layer of safety to the investment. With a current yield of 3.77%, it’s not a bad option among income bond funds.

However, on the downside, the interest income from BAB is subject to federal taxes, unlike tax-exempt municipal bonds. Additionally, the fund’s concentration in a single sector exposes it to sector-specific risks. Lastly, the fund’s sampling strategy might not accurately replicate the performance of the underlying index.

To Invest or Not to Invest: The Final Verdict

I think Invesco Taxable Municipal Bond ETF is just an “okay” fund overall. It’s a part of the muni bond market that I don’t see often referenced, and the credit quality is good. The issue is: It just hasn’t performed compared to other muni bond funds, which makes me leery given it’s passive and may just be constructed suboptimally. It’s not one I’d avoid, it’s just a fund I’m not too excited about overall.