Oselote

A “Hold” rating for Aya Gold & Silver Inc.

This analysis re-affirms the “Hold” rating on Aya Gold & Silver Inc. (OTCQX:AYASF) (TSX:AYA:CA) stock.

The previous article based the “Hold” rating on Aya Gold & Silver Inc. on the fact that this stock represents a strong candidate to benefit from silver’s ability to appreciate over time as a key metal in energy transition programs and from the bullish sentiment for silver as a hedge against the recession expected in the coming months. While this represents an attractive investment opportunity, retail investors have also been informed of the possibility of waiting for a more attractive entry point as the stock price moves through cycles, similar to the price of silver, with which it has a positive correlation.

The Outlook for Silver

At the time of writing, silver was at $23.23 an ounce, having risen more than 30% in recent years. In the coming period, the ounce is expected to continue to grow very well due to the strong demand for silver which is expected to play an important role in the Go-Green project and electrification. This is the view of this analysis, based on currently available information about what countries want to do to transform their economy into a sustainable and green economy. With the endorsement of Cop28 Global Stocktake at the UN Climate Change Conference in Dubai, which aims to triple renewable energy and double energy efficiency by 2030, the use of silver is part of a new era in which dependence on fossil fuels will be reduced until energy we need in our daily lives will be produced entirely from clean sources, such as renewable sources. Silver is widely used in the construction of solar panels, which will help countries replace much of the energy produced by burning fossil fuels with energy using photovoltaic technology. China is poised to provide a major boost to the global energy transition as its economy – the second largest in the world – increasingly uses silver solar panels to meet energy needs. The Asian country appears to be leading the way as the International Energy Agency (IEA) says China has tripled the capacity of its solar panel infrastructure in just two years.

This trend will accelerate as the country manages to overcome the current challenges of the real estate developer crisis and get its economy back to the pre-COVID-19 growth levels. The restoration of good trade relations with the US, as signaled by representatives of both economies at the Asia Pacific Economic Cooperation (APEC) summit in San Francisco in mid-November 2023, will make China’s task easier.

This is the view of this analysis, which also recognizes silver for its role in hedging strategies against the impact of an increasingly uncertain macroeconomic environment on the value of an investor’s portfolio. Compared to gold, which is considered the “safe-haven par excellence”, silver or “poor man’s gold” serves less as a hedge but is still used for this purpose. For industrial purposes, silver is more in demand than gold, paving the way for a bright future for silver as a metal in several clean technologies such as solar panels.

Aya Gold & Silver’s Growth Prospects In the Strong Silver Outlook

Given this positive outlook for silver prices, retail investors have the opportunity to benefit from Aya Gold & Silver’s amazing growth prospects. Aya Gold & Silver is a Canadian producer and explorer of precious metals in Morocco.

The company’s continued operational improvements are reflected in its share price. Retail investors may want to take advantage of the growth opportunities that exist in this stock market surrounding Aya Gold & Silver Inc. shares.

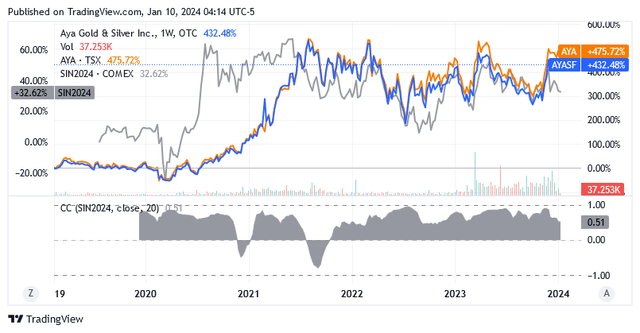

Shares are up a whopping more than 430% and more than 470% on the US over-the-counter market and the Toronto Stock Exchange, respectively, and this massive rally appears to still have fuel in the tank to burn off additional upside potential.

Of course, retail investors can benefit directly from rising silver prices by investing in physical metals. However, because this would require allocating funds that they do not normally have or do not have at the same level as large investors or banks, they can also quickly link the returns of their portfolios to the growth-oriented silver companies like Aya Gold & Silver Inc.

This Canadian company is engaged in expanding profitable silver operations on mineral properties in Morocco — 98 km South of Marrakesh (the Zgounder Mine, 100% ownership) and in eastern central Morocco in the region of Dra-Tafilalt, 75 km SW from Errachidia (the Boumadine Project in joint venture: 15%-Aya and 85%-ONHYM 15% joint venture).

How Silver Production in Morocco Is Developing

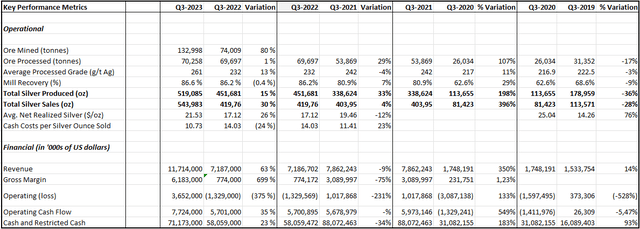

The following table summarizes the significant progress at the Zgounder mine, with the volume of ore processed, precious metal recovery rates, and silver ore grades supporting a positive trend in the company’s silver production, and total marketed ounces, and total cash costs per ounce.

Source of data: Company Quarterly Earnings Reports

The potential for further improvements to the production profile is significant as Zgounder’s open pit mine ramps up while underground production continues to develop. The potential for further improvements to the production profile (519,085 ounces in Q3-2023) is significant as the further ramp-up of the Zgounder opencast mine is welcomed by the expanded asset capacity from the current 700 to 2,700 tonnes of throughput per day (more than 60% has been completed and it is expected to reach 100% completion this year). While underground production can continue apace, with 1,950 meters underground fully operational, despite significant mine development activities commencing in January 2022 and now more than 70% complete.

With annualized silver production of between 2.05 and 2.10 million ounces per year, the Zgounder mine is on track to exceed the full-year 2023 target of 1.7 to 1.9 million ounces significantly in subsequent years, thanks to successful expansion activities on 96 million ounces of silver in measured and indicated resources grading 306 g/t. Of these, approximately 70,876,000 ounces of silver reserves at the end of 2022 were grading 257 g/t, equivalent to over 2.5 decades of production at current annual levels, or supported by a high-grade reserve estimate, equivalent to the project enabling annual production of 6.8 million ounces of silver (4x current levels) for 8-9 years at an AISC of $9.58/oz.

These operational trends are consistent with the very positive outlook for silver, which is increasingly needed for industrial purposes, and the effective implementation of strategies to combat the extreme phenomena of climate change.

Aya’s Exploration Activities in Morocco

To determine Zgounder’s further production potential through a drilling program, activities are currently aimed at extending known mineralization and expanding mineral resources. This is facilitated by the issuance of drilling permits allowing a recent expansion of the program from 3,000 to 29,000 meters. From a mineral permitting perspective, a cooperative local regulator is of course essential. However, it is important to note that Sprott Inc.’s Mining Risk Heat Map 2023 assigns high risk to business activities and investments in Morocco. But it must also be said that the factors defining such a high risk for Morocco are likely to include geophysical factors, in addition to geopolitical and economic factors. As for the geophysical factor, the reader will remember the terrible, shallow earthquake of magnitude 6.8 in early September 2023, which shook the western part of the North African country and caused serious damage to local communities and infrastructure. The impact of the event led to a major mobilization across Europe and North America in support of the populations and the economy of the communities affected by the earthquake and its aftershocks.

The company was also recently granted additional drilling permits at its other Moroccan mineral site, Boumadine. In July 2023, the 2023 drill exploration program was more than doubled to 76,000 meters, and infill and exploration activities to date have shown additional mineralization in the southern portion of the property and at depth and along strike in the northern portion of the property. The latest resource estimates are very outdated as they date back to 1998 and are not compliant from a technical perspective. A new mineral resource estimate is expected in the first quarter of 2024, which will include 6 years of drilling data from 2018 to 2023.

Based on past performance and growth prospects, retail investors should hold a position in Aya Gold & Silver. The retail investor may also want to take advantage of the cycles and see price weakness as an opportunity to add equity to the position and thus reap greater benefits from growing silver.

Stock Valuation: Shares Near the Top Half of the Cycle. They May Offer a More Favorable Entry Point Going Forward

Right now, the stock price in both markets appears high compared to recent trends, but there may still be short-term headwinds, such as uncertainty surrounding the upcoming Federal Reserve rate cut and the looming US recession. Therefore, retail investors should stay on the sidelines for the time being and let the share price drop somewhat, then it makes all the sense to strengthen the position.

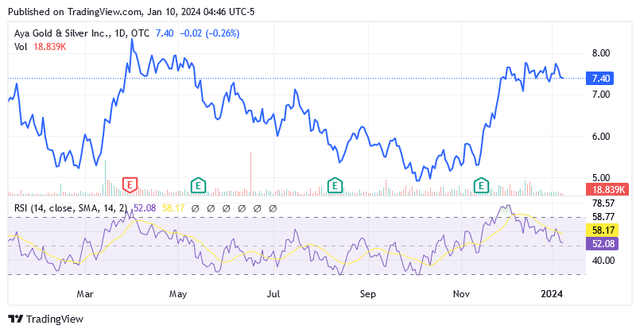

Under the AYASF symbol, Aya Gold & Silver shares were trading at $7.40 per unit on the US over-the-counter market at the time of this writing, representing a market capitalization of $909.69 million. Shares are trading well above the 200-day simple moving average of $6.55 and well above the 50-day SMA of $6.82. Shares were also 54.2% above the floor and 14.1% below the ceiling of the 52-week range of $4.80 to $8.44/share.

The 14-day RSI of 52.08 indicates the stock is not yet overbought, despite the sharp rally fueled by the US dollar’s cooling over the past three months and the S&P 500 Index’s nine-week winning streak. The prospect of further upside in the stock price from here would still be strong, but to get that, the situation with the Fed’s next rate cut policy needs to be clear, and that is not the case at the moment.

There is indeed a possibility of a delay in the rate cut, although traders point to a more than 60% chance of a 25-basis point cut at the March 20 Fed meeting: Richmond Fed President and CEO Tom Barkin, a voting member of the FOMC, sees the need for another increase if inflation heats back up in 2024. The possibility of such a scenario is far from unlikely after the Christmas holidays, as households are known to be out of sync and spend beyond their means at this time of year. If prices for goods and services heat back up, further interest rate hikes or an extension of the term of the restrictive interest rate policy “higher and longer” may be necessary. These measures would not bode well for silver prices as they would dampen the demand outlook for silver: Expensive borrowing will weigh on industrial demand by discouraging investment, while further hawkishness will see the metal weaken its position in competition with fixed-income securities such as US Treasuries.

In addition, the recession looms on the 2024 horizon, which, despite the metal’s properties as a hedge against risk and uncertainty, will initially weigh on the silver producer’s shares as on the entire stock market. Following the shock to US-listed stocks caused by the outbreak of the COVID-19 pandemic in mid-March 2020, Aya Gold & Silver shares lost up to 50% of their previous market value at the peak of the cycle. As the stock has a 24-month market beta of 1.07x, shares of Aya Gold & Silver will experience another sharp correction should the market receive a shock from the economic recession as well. The longer the recession persists as a less likely scenario vs. a soft-landing scenario among the expectations of US-listed equity analysts, the bigger the shock the recession will unleash on US-listed stocks. The extent of the damage that the recession-induced shock could cause will depend on how “out of the blue” the unfortunate event for the economy will appear to the market and at what valuation level stocks will be caught off guard. If the dominant narrative in the markets continues to assume that the economy’s soft-landing scenario is “increasingly conceivable” while the core component of the US economy, consumption, is instead affected by “softening consumer trends” (in line with the views of Lakos-Bujas Dubravko, JPMorgan Chase & Co. (JPM) strategist, and Torsten Slok Apollo Global Management, Inc. (APO), chief economist), then this already is one strong assumption because the recession comes like a bolt from the blue. The next scenario for the US economic cycle will either be a soft landing, which the narrative says is very likely, or a recession, as the soft landing is “not inevitable”. The higher the level of investor negligence, the greater the damage the adverse economic event will do to U.S.-listed stocks should a recession ultimately occur. Instead of acting proactively when “rich valued” equities seemed disproportionate to the economic context, investors prefer to rely on the prevailing narrative of a soft landing.

The economic recession is predicted by the following strong indicator: The inverted yield curve of the spread between 10-year and 3-month U.S. Treasury notes (the 10-year U.S. Treasury note yield is 4.036% while the 3-month U.S. Treasury note yield is 5.388% at the time of writing) is a strong indicator of an economic recession, having correctly predicted each of the eight economic recessions of the last six decades.

Pending the formation of an attractive entry point for this stock, retail investors may want to continue with the “Hold” rating, just a little longer before the market begins to fear the negative consequences of the economic recession.

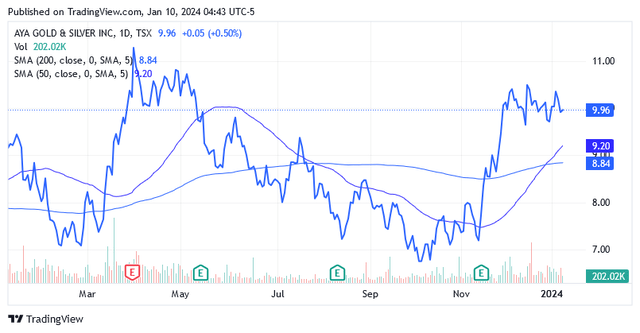

The same construction carries a “Hold” rating for shares of Aya Gold & Silver traded on the Toronto Stock Exchange under the symbol AYA:CA.

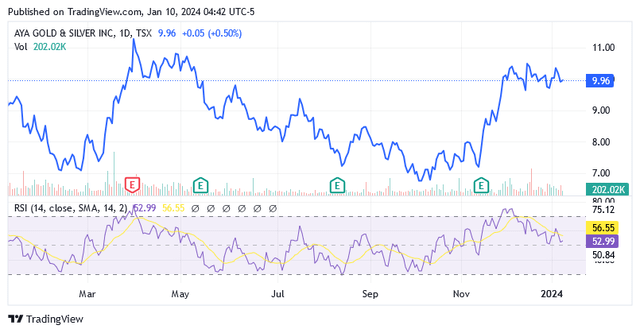

These were trading at CA$9.96 per unit at the time of this writing, representing a market capitalization of CA$1.22 billion. Shares are trading well above the 200-day simple moving average of $8.84 and well above the 50-day SMA of $9.20. Shares were also 51.4% above the floor and 14.4% below the ceiling of the 52-week range of CA$6.58 to CA$11.39/share.

The 14-day RSI of 52.99 indicates the stock is not yet overbought, despite the sharp rally fueled by the combination of two factors essentially: past 3 months of weaker US dollar versus other currencies coupled with S&P 500 Index’s nine-week winning streak.

Holding shares of Aya Gold & Silver does not imply a high risk at this time, as a lower share price resulting from the recession is seen as an opportunity to strengthen the position ahead of the expected silver price bull market.

Because of its hedging properties, silver is also sought as an antidote to recession headwinds, increasing the chances of a recovery in Aya Gold & Silver Inc.’s stock price. Additionally, the strong demand for silver as a critical metal for electrification and environmental projects will support Aya Gold & Silver Inc.’s goal of improving the company’s production profile to one of the most sustainable in the industry. The operational improvement will generate strong cash flow that the company can use to reinvest in further expansion, and the market will translate this momentum into a long-term positive effect on the share price.

A solid financial position that finances further production and development of metallic assets, as well as exploration activities, helps reduce investment risk in this stock.

Aya Gold & Silver Inc.’s balance sheet had $50.61 million in cash (excluding restricted cash) as of September 30, 2023, and total debt was $34.23 million.

The Altman Z-Score of 5.96x (on this Seeking Alpha page, scroll down to the “Risk” section) indicates that the balance sheet is in the safe zone, meaning the probability of bankruptcy in the next few years is zero.

Conclusion

Aya Gold & Silver Inc. is a Canadian silver producer and explorer in Morocco who is laying the foundation to firmly capitalize on silver’s very bright prospects as a key metal for energy transition projects. The positive correlation with the long-term growth prospects of the silver price is supported by gradual improvements in production and production costs, thanks to asset development activities that are very much in line with the company’s plan.

The country of Morocco represents a significant investment risk for foreign operators, but the regulatory authority does not appear to cause problems in issuing the necessary permits for the exploitation of the deposits and further exploration of potential mineral properties. Drilling continues to progress rapidly and by 2024 there should be significant news of mineral resource updates thanks to exploration activities undertaken in recent years.

The stock has characteristics that can be held in the portfolio for a long time, as they are suitable to benefit from the steady growth of the silver price. In imitating the precious metal, Aya’s share price is also characterized by ups and downs and therefore the retail investor must be vigilant to take advantage of any significant decline that occurs to strengthen his position in this promising operator. If the US central bank sends recessionary signals to solve the problem of high core inflation, the economy must slow down. The stock market narrative will determine when it is time for investors to worry that a slowing economy could pose a problem for portfolio profitability. The pessimistic sentiment will not surprise investors if they are sufficiently forward-looking. Although there are such investors in the market, they are always in a fierce minority.

Initially, the bearish sentiment will also impact Aya Gold & Silver Inc. shares, but investors should not view this as a catastrophe, but as an opportunity to buy shares at a lower price than the current one. It will take some time for the recession to make itself felt in the stock market, and for the time being, retail investors may want to stick to the “Hold” rating.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.