artplus

Investment Thesis

I wanted to take a look at how Axcelis Technologies (NASDAQ:ACLS) has performed over the last year since I first covered the company back in May of ’23 when I assigned the company a hold rating. The company managed to improve its margins and top-line growth remained robust, despite a tough industry environment. The full-year results were great, but analysts didn’t like stagnant guidance, which I think makes for a great entry point to start a position now, given the stock price declined quite a bit from its 52-week high. Furthermore, an updated DCF model suggests the company is trading below its conservatively fair value, therefore, I am upgrading my rating to a buy.

Briefly on Financials

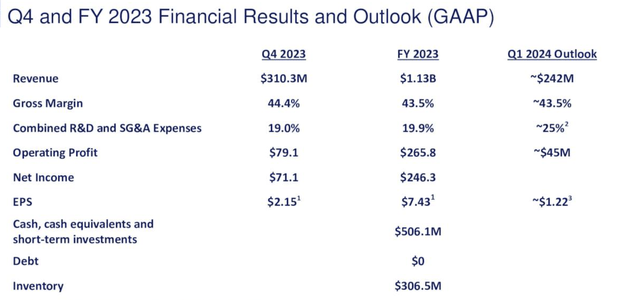

As of FY23, it had around $506m in cash and short-term investments, against still zero debt, which is a great position to be in no matter what kind of economic environment we’re in – especially if there is a downturn and high interest rates all around. The company’s current ratio is also very strong at over 3.5, so it looks like the balance sheet hasn’t changed much in the last year, which is a good thing because it already boasted a strong balance sheet to begin with.

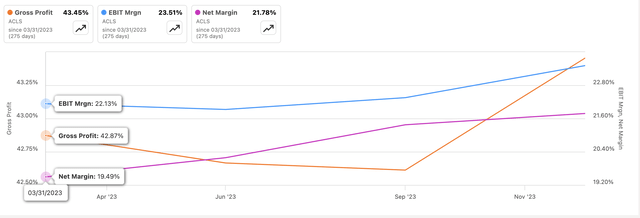

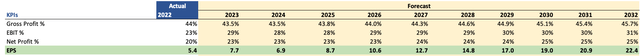

Now, let’s look at how the company’s margins progressed over the last year. It seems that these have been mixed throughout the year, with noticeable improvements in net margins and EBIT, while gross margins saw a slight decline in Q3, followed by a nice improvement in Q4. All three have seen improvements at the end of the year, which is what I like to see happening.

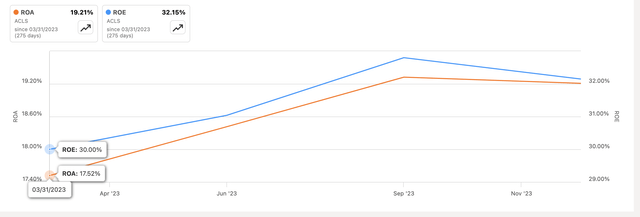

The company’s efficiency and profitability also saw a lift over the year, with a slight dip in Q4, which may continue to come down further or stabilize around these levels. Nevertheless, these are very impressive numbers still, especially when looking at where they were at the beginning of the year.

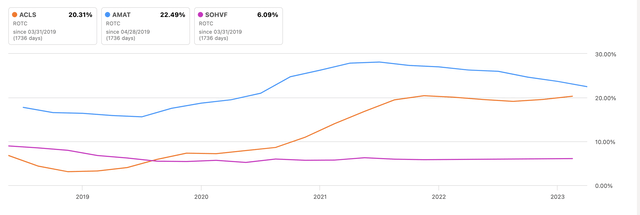

In terms of competitive advantage and competition in general, it seems that the company is positioned very well as it is serving quite a niche that only a few handfuls of companies can compete, with the biggest one being Applied Materials (AMAT), which has the full range of implantation products and services to support operations globally just like ACLS. Other lesser-known companies include Sumitomo Heavy Industries Ion Technology (OTCPK:SOHVF), and companies like Nissin Ion Equipment and Advanced Ion Beam Technology, which are not publicly traded unfortunately so my competitive comparison is rather limited. However, as you can see ACLS ranks 2nd only to AMAT in terms of ROTC and by a small margin nonetheless, which is very good given the size comparisons of the two companies.

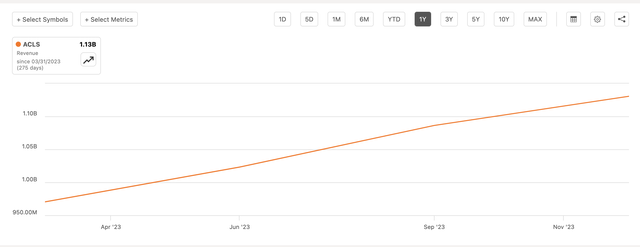

In terms of revenue progression, the company continued to grow at a very solid pace over the year, with Q4 being a little slower than the other quarters but still a very good pace, certainly like a growth company. Furthermore, it finally crossed the $1B mark and is breaking records in many metrics.

Overall, the company has been heading in the right direction all year, in what I would consider not a very easy environment for the semiconductor industry, but as I mentioned in my first article, the company seems to be very resilient and hardly gets affected by such macro headwinds. The company is still in a very good financial position, with no debt to worry about and plenty of resources to expand its market share and further the growth of the company. There is very little to dislike, if anything, when it comes to the company’s operational performance.

Comments on Q4 Results

The company saw full-year revenue growth of 23%, with systems revenue leading the charge with 28% y/y growth. Operating profits were up 25%, while net income was up 35%. It’s worth noting that these results are achieving company records all across the board, which is a sign of strong growth and demand for the company’s products and services. On the margins side of things, gross margins were only up 20bps y/y, but an increase, nonetheless. In my opinion, this was a stellar report, with great growth y/y. The company has improved tremendously over the year, considering such headwinds of the industry throughout the year. So, why did the stock drop and continue ever since the report? In my opinion, the guidance is very unexciting. The forward year guidance is flat compared to ’23, which is not as bad as a decline but also not as good as a continual improvement in performance going forward. Many analysts expected growth for 2024, and when the management announced their 2024 outlook, investors didn’t like that. The management also mentioned that they expect a recovery in the 2nd half of ’24 in the mature process technology and memory segments, which will enable strong growth in 2025. I think this overreaction is a blessing for those people who are looking to enter for the long term, as the short-term obstacles are just that, short-term in my opinion.

Comments on the Outlook

In terms of the overall semiconductor environment, we already heard about 2023 being the bottom of the cycle and it’s just up from now on. Deloitte is looking at around 13% growth for 2024, which is also higher than 2022’s record industry revenues by around 2.5%.

Another big development the company may see is within the AI industry, which is also not news anymore. The boom in AI chips will certainly play a role in the company’s continual growth. It may not be the main driver of growth, but coupled with the automotive industry, it should be quite significant.

Speaking of automotive, this is still the largest catalyst for the company particularly the adoption of EVs. The company’s Purion Power Series has been doing very well over recently and is leading the charge forward, particularly H200 and XE SiC systems. EVs, like it or not, are here to stay. Governments will continue to push incentives to transform vehicles away from ICEs. This will take time and a lot of experimenting to find the right tools and techniques that make EVs more reliable, efficient, and cost-effective than traditional ICE vehicles, or at least as cost-effective as ICEs. This is proving to be quite difficult right now as it is still in the early experimenting stages, with so many different companies trying their luck at building an efficient EV, so I don’t expect wide adoption in this first generation of vehicles, but we will certainly see much more adoption in the later years when companies manage to find the right mix of production that makes it worthwhile.

China is of course going to continue to lead the way here, which brings me to the next point on the company’s outlook. In my first article, I mentioned that the company had around 45% of its revenues come from China. Has this changed much over the last year? Unfortunately, it has not. That number stood at around 46% as of FY23. I was hoping the company would do better at diversifying away from China, given the geopolitical risks and the negative sentiment towards the region, however, the management is very positive about the potential the Chinese economy has for the company’s revenue growth and expects the region to “represent 40% to 60% of its quarterly systems revenue”. So, the dependency on China is still quite big, which is a good thing and a bad thing. A good thing because the company doesn’t see any major obstacle right now that would take away their revenue potential in the region. The bad may be the Chinese dependency on companies like ACLS and other international semiconductor companies declines as the country becomes more and more dependent on domestic chip production. I mentioned in my first article, that China is very dependent on international chip imports as it is nowhere near self-sufficient but is trying to get there. These efforts are formidable and the Chinese share of global chip sales has accelerated at 30% CAGR. If this continues, the country will be less reliant on outside companies and become much more self-sufficient, which could be bad for ACLS, however, I don’t think there is much risk there for now.

The country is still a long way from having the advanced capabilities of the more established player countries like Taiwan, Korea, Japan, and the US. Continuing with China, it seems that the company is not seeing any restrictions affecting imports of their product to China due to the restrictions introduced by the US, so that is good, however, it is worth keeping an eye out for further development on this issue, and I’m sure the management is doing the same.

I alluded to the company coming into growth by around 2025. The reason is the slow ramp-up in demand for DRAM and NAND which are slated to recover by 2025 and have decent growth after that. The timeline of the recovery is good to know, which should ease some volatility in the share price and shouldn’t impact the company’s share price performance too much going forward, as it should be all priced in.

Furthermore, the company boasts a robust backlog, so if the company manages to retain such levels going forward, this should give a lot of visibility into how the company will perform over the next couple of years if the backlog remains stable.

Valuation

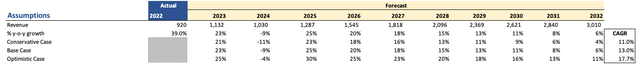

It’s been quite a while since I calculated the company’s intrinsic value, I went ahead and updated a lot of information concerning the company’s current share price and macroeconomic inputs, and the company’s growth potential. I will still go with a more conservative model for that extra room for error in estimates.

For revenue growth analysts estimate a 9% decrease in revenue for FY24, so I will take that number at face value, however, I will ignore the next estimate because it is very hard to predict what the company will be able to do more than a year out. These companies usually don’t supply that number for a reason, since we cannot know how the economy will do and how it will affect operations. For the whole model period of 10 years, I went with 13% CAGR, which I think is on the more conservative end. To cover my bases, I modeled an even more conservative outcome and a more optimistic one. Below are those estimates.

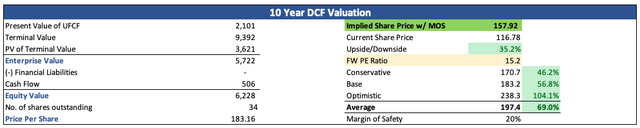

For margins and EPS, I modeled lower EPS than FY23 for conservatism and a gradual improvement of operations over the next decade, which I think is not too quick and very achievable. Margins will only improve by around 300bps over the next decade across the board. Below are those estimates.

Margins and EPS assumptions (Author)

For the DCF model, I am using 10% as my discount rate and 2.5% as my terminal growth rate. Furthermore, I went ahead and discounted the intrinsic value by 20% just to be on the safer side and to give myself more room for error. With that said, ACLS’s intrinsic value is $158 a share, which means the company is trading at a decent discount to its fair value.

Risks and Closing Comments

The slowdown in EV adoption poses a great risk to the company’s revenue potential. We don’t know how long it will last but the company expects a weaker first half of the year, which could be because of this slowdown. However, I believe that this is a risk that is going to be very short-lived and the demand for EVs will ramp up once again, and the more companies out there start to produce these vehicles, the more demand for ACLS’s products there will be. As I mentioned earlier in the article, these vehicles are not very cost-efficient yet, but with new iterations coming out every year, we will see much better outcomes for customers in terms of prices and reliability.

Since China still looks to be the largest contributor to the company’s top line, if China succeeds in becoming self-reliant much more quickly, and if ACLS cannot diversify quickly enough from the region, we will see a huge impact on the company’s performance, which will weigh on its share price significantly. This is more of a long-term risk, and I don’t think over the next couple of years or so will be a significant factor in the company’s overall performance.

Speaking of China, further restrictions on bans of chips to the region by the US may affect customers of ACLS, like SMIC, which so far managed to obtain renewals of licenses, but if more restrictions come out of the US, that may change.

Despite these risks, I believe the company’s share price presents an opportunity to start a position as risk/reward has changed for me. The company has proven to be able to grow at a fantastic rate even during an economic down cycle of the industry, which gives me hope that during the more prospering years, the company will see even more upside, therefore, I am upgrading my rating to a buy.

The company’s stellar balance sheet and the recovering industry should boost its share price as long as the company’s products and services remain in high demand, which I think they will, given their niche nature.