PhonlamaiPhoto

Investment Introduction

For the past 10 years, the performance on investment in Avnet, Inc. (NASDAQ:AVT) has been lackluster based on stock price appreciation, up 11.1% but a little higher when accounting for the dividend as well. However, AVT has underperformed the broader markets for quite a long time now and the question comes up whether or not it will continue to do so.

Stock Price Return (Seeking Alpha)

The valuation of the company might indicate a significant upside if AVT would receive a similar multiple as the rest of the information technology sector. The recent quarterly report didn’t do anything to help any buy thesis here as the top and bottom lines fell drastically. Value can still be found in the company dividend, but it is not a worthwhile investment opportunity right now, but just a hold instead.

Company Introduction

AVT is included in the information technology sector and more specifically in the technology distributors industry. Beginning back in 1921 the company has grown to a valuation of $4.1 billion right now. AVT has divided the operations into two different segments, those being Electronic Components and Farnell. The biggest segment is by far the Electronic Components segment which had $5.812 billion in revenues last quarter, compared to $393 million for the Farnell segment. The products that AVT makes in this segment produce electromechanical components used in industrial monitoring for example. The segment also covers design chain support and logistical services as well as display solutions. In the smallest segment, the company focuses on distributing kits and tools along with industrial automation components.

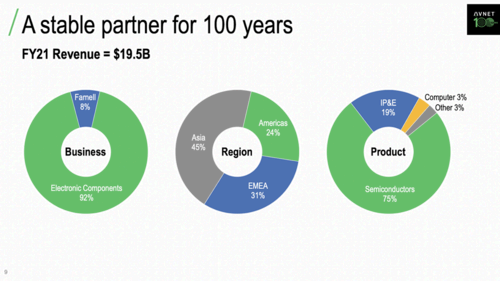

AVT Overview (Investor Material)

Diving a little bit deeper into the revenue sources and what markets that AVT focuses on. 92% of revenues came from electronic components in FY2021, and this trend has continued as we saw in the last earnings report. The primary market for the company is semiconductors at around 75% and also the one that I can see growing fast for the next decade. Analysts estimate that the global market for semiconductors is going to reach $1.38 trillion in 2029. The main driver behind this growth comes from how semiconductors in all the shapes and ways they are made are being integrated into technology and manufacturing these days. It’s difficult to find a product that doesn’t have one or has been in contact with one.

Now that we know a little about what the company does, let’s look a little at what the management sees in their current situation. The Q2 FY2024 results were released on 31 January and the earnings call had the CEO Phil Gallagher say the following:

As I mentioned previously, we are in the midst of an inventory correction. And our team has done a really nice job navigating it with a focus on optimizing our inventory investments today and reducing inventory levels in the coming quarters”.

I think this is what needs to be viewed the most in the next few quarters, the inventory levels of AVT. The poor sentiment might come from the lack of price hikes in the industry, which occurred when demand skyrocketed following significant supply chain issues after the COVID-19 pandemic. Now companies like AVT have to navigate a completely different market environment where they need efficient inventory turnover. Inventory is at $6.116 billion and has rapidly risen since FY2021, nearly increasing 100% from $3.226 billion. The CEO followed up by saying:

But with the near-term sales outlook, we are focused on reducing inventory, were elevated and improving our cash conversion cycle”.

This is the strategy I want to see now, and it should help AVT keep revenues steady for the next few years, and potentially grow once the next market cycle begins for semiconductors.

Valuation

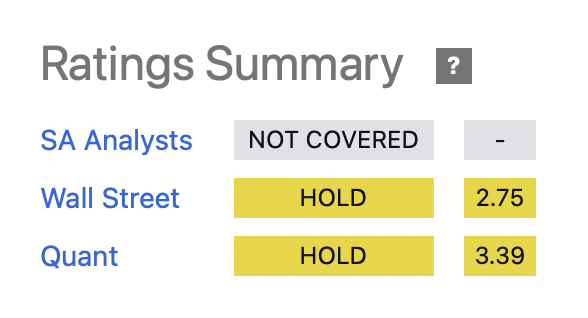

Ratings Summary (Seeking Alpha)

Ratings for AVT are not very mixed, with it being as a hold right now. I fall in this same category as AVT is navigating to manage its inventory levels. The management is also quite focused on distributing a dividend, which might not necessarily be bad for inventors, but for a semiconductor company, it does leave with the feeling they will not grow as fast and strong as other peers.

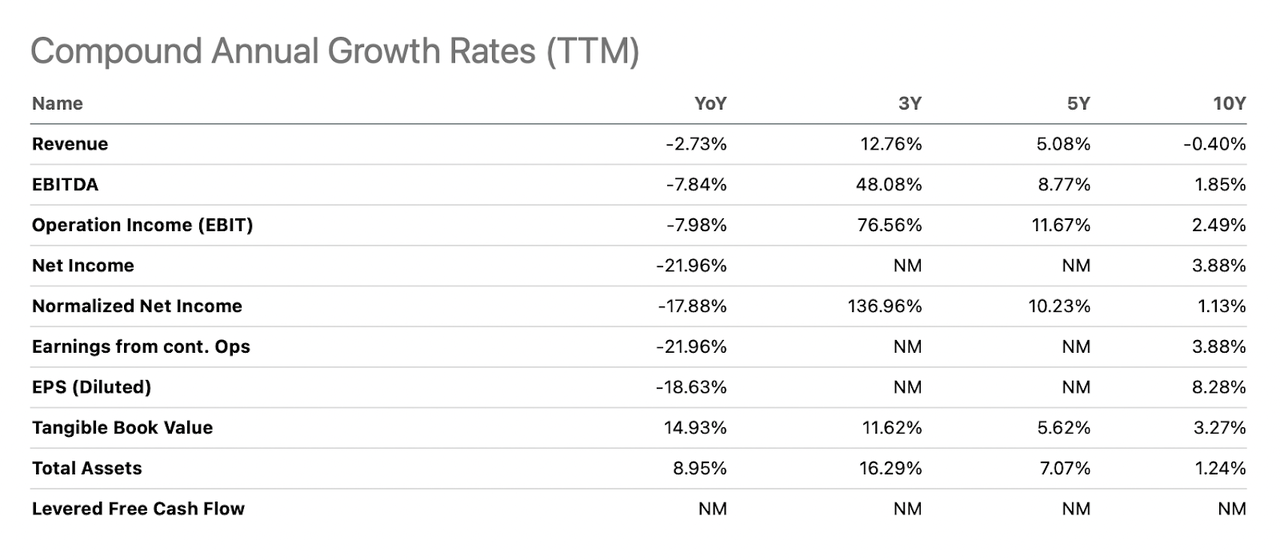

Growth Rates AVT (Seeking Alpha)

Even though historical numbers are never something that you should completely rely on when making investments, they do reveal often how a company has managed to position itself previously to growth opportunities. As I think most investors know, the semiconductor industry has seen rapid demand in the past years, and AVT has captured some of it, with revenues growing 12.78% annually over the past 3 years. However, in the past 10 years, revenues have fallen. I think this comes down to increased competition in the industry and AVTs lacking the ability to counter this and compete themselves. Revenues may be stable, but that stability should come with the low valuation that AVT trades at right now.

The Value You Get

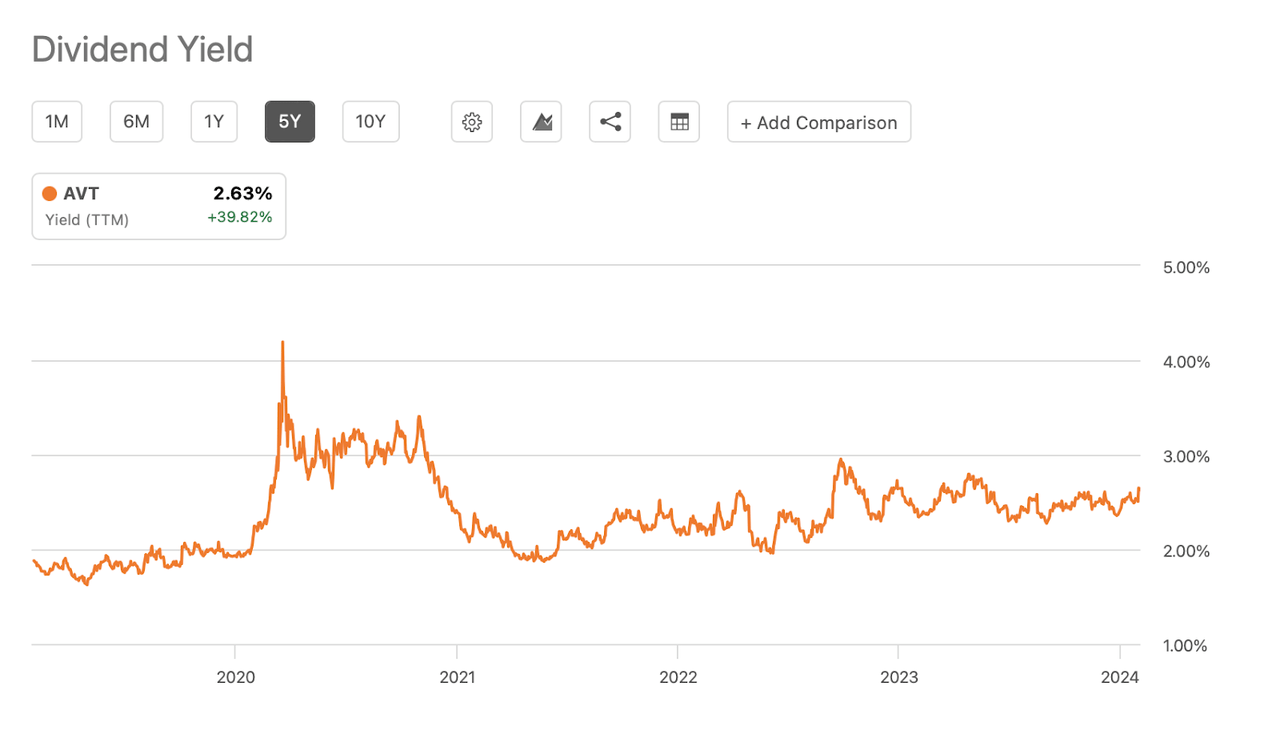

Dividend Yield (Seeking Alpha)

The value that investors can get right now with AVT is very much around the dividend, sitting at a FWD yield of 2.63%. It has been trending higher the past few years both because AVT has been raising it but also because the share price has been decreasing. I am worried that AVT will reach a point where they can’t afford to raise it at the CAGR 9% it has maintained the past 5 years. I say this because the revenues show a lack of growth. TTM dividend distributions amounted to $109 million and with a 9% CAGR kept up it won’t be long until the payout ratio is above 50% and the risk profile significantly higher as well.

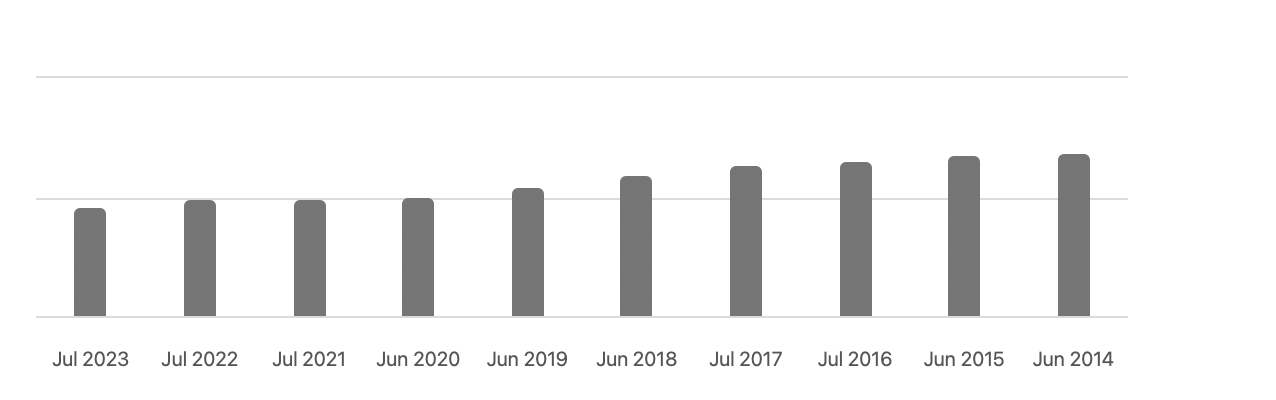

Share Buybacks (Seeking Alpha)

Apart from an increased focus on raising the dividend, AVT is also steadily buying back shares. In the past 10 years, it has decreased at an annual rate of 5.2%. Together with a dividend yield of 2.63% investors are getting a near 8% immediate return here from the earnings of AVT. However, as the price chart reveals this hasn’t meant an appreciation, but instead just a steady declining valuation as shares are being bought back, but organic growth in the top and bottom line is not necessarily reflecting that.

Price Target

The consensus rating for AVT is a hold right now and that is what I will be rating as well. But I do want to set a price target to get to a point where the price is just too good not to buy into. I won’t expect a significant amount of EPS growth for AVT these next few years, so I will instead look at the immediate value that you would get at a certain price point. I mentioned that AVT has a near 8% immediate value right now with the share buyback and dividend yield. I do think AVT can afford to buy back between 2 – 3% of stock annually if operations stay where they are right now. On the midpoint that would equate to around $100 million with the current market cap of $4.1 billion. Now, I want to get at least a 9% return with an investment to beat out most index funds. This means the yield would have to be 6.5% for AVT to get me there. At that yield, the annual payout would stay at $1.24 for example, and the price at $19.07. This is a near 50% drop from current levels. I say that I don’t estimate any significant EPS growth in the next few years as the semiconductor market is in a slump, and historically AVT has not had any impressive NI growth numbers to show off either, and nothing major has changed in the business for to think otherwise about the near future. I might end up wrong, but I am confident taking a more cautious approach here will be rewarded.

The Bear Thesis

The bear thesis for AVT revolves a lot around the cyclicality of the industry they are in, but perhaps more so now with the inventory levels as well. Inventory levels have ballooned up to $6.116 billion, a massive increase in the past few years. As the CEO of AVT mentioned, they need to focus on getting rid of some of this inventory to build up more once again and not find themselves in a bottleneck. If they can’t get inventory out fast enough it might mean lower net earnings but still the same operational expenses as before. Estimates are a little up and down for the next few years, but that 2024 and 2025 could be tough years for the industry I think is true. Seeing how AVT navigates this will be interesting, but with that said, I think the valuation makes sense and it looks like a value trap.

State Of The Company

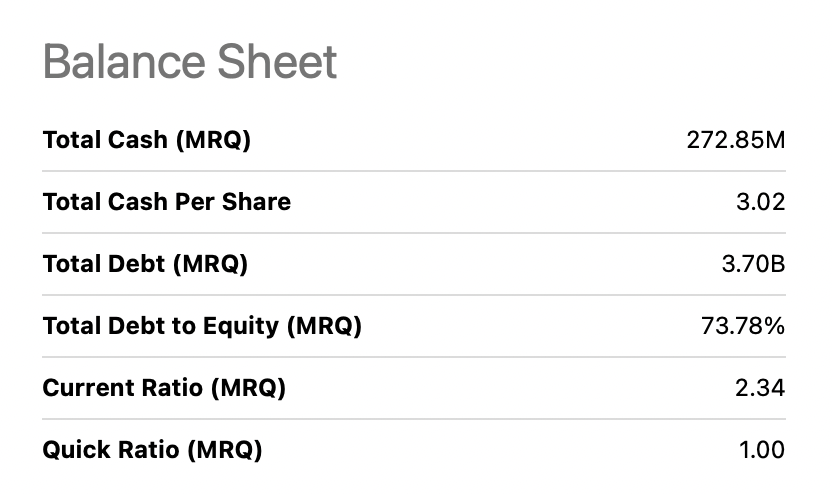

Balance Sheet (Seeking Alpha)

With a market cap of $4.1 billion, I hold the opinion that AVT doesn’t have that strong of a balance sheet right now. The cash position, which is the most liquid asset a company could hold is very low in comparison to the total debts, $272 million compared to $3.7 billion. Over the past years, AVT hasn’t prioritized necessarily to raise its liquid assets and being in a better position once these debts mature. Debt has nearly tripled since 2021 and leveraging like this was very unfortunate for the company as interest rates rose quickly after, meaning that AVT now pays $291 million in interest expenses. All in all, I find the state of the company to be needing a lot of improvements. Paying down debt over the next few years will be capital that otherwise could have been used to expand the business. With a small current asset AVT is also in a risky position should there be short-term earnings challenges and they have debts maturing.

Investment Conclusion

AVT has been in operation for a very long time, but the performance these past 10 years has been disappointing I have to say. The company should benefit from the demand for semiconductors but I don’t think AVT has been able to properly capture this. The market has consistently given the company a low valuation, which when dissecting the company makes a lot of sense. I think the downside is lower and some floors might have been established around the $43 – $45 range. But without anything concrete to buy into I will assess AVT as a hold rating.