Monty Rakusen

Investment Thesis

As its ticker indicates, Avid Bioservices (NASDAQ:CDMO) is a biologic CDMO. The company produces drugs for pharmaceutical and biotech companies and also helps them in the development, quality control, and compliance of the drug. Avid has been performing really well since becoming a pure-play CDMO in 2018, growing revenue at a 22.7% CAGR and adjusted EBITDA at a 21.5% CAGR in 5 years (although normalized EBITDA is much higher than what they did in F23). However, over the last two years Avid has been investing heavily in building a new facility and upgrading the current one, which has caused lower margins, high levels of capex and negative free cash flow.

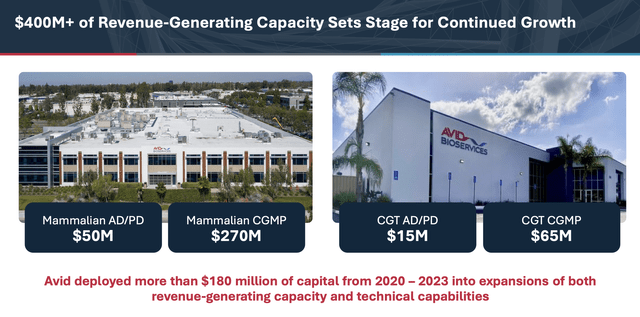

In 2020, the company announced an expansion of its mammalian cell facility and, in late 2021, the construction of a specialized cell gene therapy (CGT) development and manufacturing facility. Combined, the company spent near ~$180 million in capex and increased its revenue capacity by more than $250 million. Both projects have been recently completed, leaving Avid with a total annual revenue-generating capacity that could reach $400 million, with adjusted EBITDA margins in the low to mid 30s and low maintenance capex levels (3%-4% of revenue).

For context, the company reported $149.3 million in revenue and only $10.9 million in adjusted EBITDA in F23, and the management has provided guidance for revenue ranging from $137 million to $147 million in F24. However, one might wonder why the guidance seems to imply almost no growth despite all the investments. There are three main reasons for this:

-

Investments during last year shifted from early-phase to late-phase drug development projects. While these late-phase projects have the potential to generate significantly more revenue, they also take considerably longer to execute and materialize compared to early-phase projects.

-

The increase in interest rates led to a decline in investments for biotech companies. As a result, a lot of small biotech firms had to cut off expenses and postpone projects due to a lack of financing.

-

Although the new CGT facility is completed, it is not fully operational yet. Therefore, it represents more of a revenue stream expected in 2024.

All of this caused the stock to drop ~85% from its 2021 highs. At the current price of $6.1 per share, the market capitalization is $370 million. As of Q2 F24, the company had $31.4 million in cash and $141 million in total debt, totaling a $480 million enterprise value. Assuming a scenario where they do $350 million in revenue by F26 with a 25% EBITDA margin, minus $15 million in maintenance capex, the company could generate $55 million in free cash flow per year (they have $700 in NOLs, so it will be a long time before they pay meaningful taxes). This translates into a 15% normalized FCF yield at current prices. Assuming it trades at just 12x P/FCF, the stock could compound at a 21% CAGR over the next three years. Another way to look at it is through EBITDA. There is a long history of transactions where CDMO’s were taken private between 17x to 20x EBITDA. Check the list in my Lifecore (LFCR) investment thesis. If we assume a 15x EV/EBITDA ratio, the CAGR jumps to 48% in three years. Either way the stock looks cheap, and although the FCF ratio scenario is conservative, the EBITDA ratio assumption could totally materialize in a bull market.

In addition, consider the following:

Growing market

-

Avid manufactures biologic drugs. Examples of biologic drugs include vaccines, antibodies, gene and cellular therapies, and fusion proteins. Biologics drugs represent only around ~10% of global sales today, while the other 90% are small-molecule drugs (think pills like Advil and Tylenol). However, on average, a daily dose of biologic costs 22 times more than that of a small molecule, and it is growing more rapidly than small-molecule, representing a much bigger opportunity.

-

The biologic CDMO market is expected to grow at a 12.9% CAGR from $19.7 billion in 2023 to $45.9 billion in 2030, according to Coherent Market Insights. Furthermore, Mordor Intelligence estimates that it will compound at an 11.5% CAGR until 2028, reaching $33.9 billion from the current $15.6 billion.

High barriers to enter and switching costs

-

Establishing a CDMO requires a significant amount of capital, but that’s not the primary barrier to entry. The real challenge lies in the fact that constructing and properly validating facilities can take years. Furthermore, establishing a successful FDA track record can take even longer. Hence, pharmaceutical companies typically prefer to work with CDMOs that run smoothly and can guarantee a high level of regulatory compliance, thereby reducing execution risk.

-

When a pharmaceutical company partners with a CDMO, the CDMO becomes part of the FDA approval process for the drug, which is typically long and expensive. If the pharmaceutical company decides to switch to a different manufacturing partner, the drug manufactured at the new facility must go through FDA approval again. No company would do this just because, resulting in high switching costs.

-

Avid has a strong regulatory track record, consisting of a 20-year inspection history. Since 2005 they have successfully completed eight pre-approval inspections, including six FDA inspections since 2013, none of which resulted in any Form 483 observations by the FDA.

Risks

-

Customer concentration is a major risk. Halozyme Therapeutics (HALO) and Gilead Sciences (GILD) represent 51% and 16% of Avid’s total revenue, respectively.

-

Avid operates in a complicated industry. CDMO’s face extensive regulations, including compliance with local and international bodies. Noncompliance, for example, may lead to approval delays, significant costs, and legal consequences. New regulations could require additional approvals and changes in manufacturing standards. Failure to comply may result in penalties, fines, and disruptions in production and supply. And so on.

- Although they are in a solid financial position, they are currently losing money, which could lead to dilution or more debt. As we mentioned before, the company has $140 million of total debt, which consists entirely of convertible notes that bear a 1.25% interest rate. During the Q1 earnings call, the management assured investors that they have all the capital they need to finish the facilities and operate normally. However, things change rapidly, so this possibility shouldn’t be discarded.

Takeaway

In synthesis, the past two years haven’t been great in terms of profitability for Avid and this fiscal year guidance disappointed the market who was expecting more growth. But do not miss the bigger picture: Avid’s substantial investments in cutting-edge facilities are primed to generate tons of cash in the not so distant future, and the market is not pricing it.