andriano_cz

Aurora Innovation (NASDAQ:AUR), the self-driving trucking company, has seen a significant boost in its share price; it is up more than 100% in recent months. When TuSimple Holdings (TSP), the only other major player in this market, decided to withdraw from the US, it left AUR with an open field and a potential road to huge returns. Aurora is following its roadmap to commercial operations and has made excellent progress in 2023. However, I doubt its ability to complete the roadmap on time. The prospects for profits in the medium term are challenging to assess and likely do not exist. Couple this with an ongoing need for billions of dollars in funding, and this particular AI story becomes a tough sell.

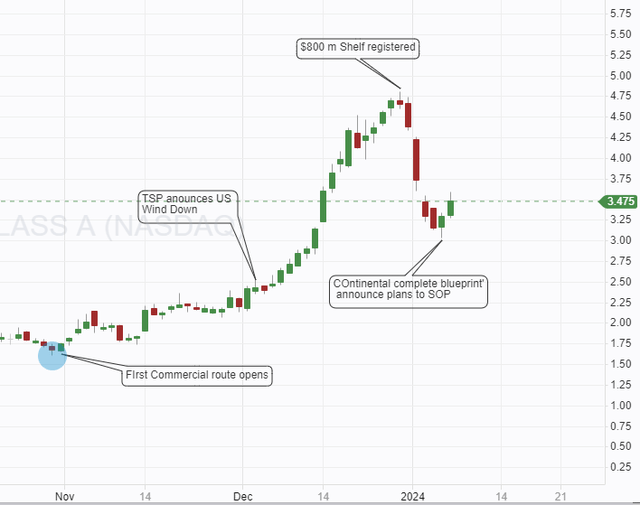

The Share Price

Recent volatility is high, and the changes in direction correlate with important news releases.

From the Nov 1st low, the stock price almost trebled on the news of the opening of the first commercial route and the withdrawal of TSP from the US market. A significant pullback began on the day of the announcement of another shelf for $800 million (AUR closed an $850 million capital raise in July 2023). A new wave higher might have just begun with the news earlier this month that Continental and Aurora have finalized the design for the Aurora Driver hardware that Continental has the exclusive rights to build and that a potential start of-production date has been set for 2027 with build and test happening during 2024 and 2025.

A rise of 300% in two months always attracts attention. Is it a fair reflection of growing value or just more SPAC hype?

Important News in 2023

Aurora has a roadmap (Slide 17 investor presentation) to get to commercial activities. Several key milestones have been met in 2023, but one important one was missed and pushed out to 2024.

Feature Complete

In March, Aurora announced that the feature set for Aurora Driver is complete. Aurora Driver is an autonomous driving hardware product. It is the key product of AUR, and completing the design and feature set is an important step forward.

The First Commercial Route

The share price growth began with this announcement; it is undoubtedly a step forward, but it had been guided in advance and should not have come as a surprise. Aurora has a lane running on the i45 between Houston and Texas; it has built hubs at both ends of the route, and its trucks drive between them. AUR is carrying cargo for its initial pilot customers (slide 14 Investor Presentation)

The trucks operate with drivers on board; however, AUR intends to go fully autonomous at the end of 2024 with its launch of commercial activities.

Continental

The joint venture with Continental was announced in March 2023. On January 5, 2024 a press release brought the news that the working team had completed the blueprint and design of the Aurora Driver and its fallback system. Continental will be the exclusive hardware manufacturer and intends to produce thousands of units for deployment in self-driving trucks.

The Safety Case

In 2022, Aurora gave guidance in this investor presentation (slide 31) that the safety case would be complete by the end of 2023. This has proven not to be the case, and the guidance has now been changed to the first quarter of 2024, CEO prepared remarks for Q3 2023:

We now anticipate completing the work to validate a small number of our Aurora Driver Safety Case claims will stretch beyond our end-of-year goal.

It is impossible to know how long this will take; the CEO stressed that he does not think it will take long in the Q and A section he said.

I wouldn’t think of this as kind of the dreaded, boy the edge cases are going to get you. It’s going to take forever to get the last bit.

He could be correct, but it may depend on the regulators; they will be the final arbitrators of what tests need to be run. In the Q and A section, the CEO explained that staff have been moved from this testing in the safety case and are now working on how to get the aurora driving system to work in more places. It does imply that every route and every place will need its own additions to the software or the safety case, which will inevitably add to the time taken.

Acceptance

The crucial issue. When and where will these autonomous trucks be accepted?

I see two parts to acceptance; one is regulatory. Will authorities allow driverless trucks on our roads? The other is acceptance by the general public and stakeholders. One stakeholder I guarantee will not easily accept autonomous trucks on US roads is the Teamsters Union. They are not the powerhouse they once were, but they are committed to fighting for autonomous vehicle regulation at a national level. Autonomous trucks will inevitably lead to loss of work for truck drivers, and the unions are likely to resist that robustly. The teamsters have a representative on the Department of Transport Advisory Committee, and he recently said:

The formation of TTAC comes at a pivotal moment for Teamster members in the transportation industry. The emergence of new technologies carries the potential for increased safety at work and the creation of new jobs, but also presents dangerous risks to existing workers’ jobs and conditions if not subject to thoughtful and rigorous federal oversight,

This acceptance will inevitably become political and difficult to navigate.

Regulatory approval

It was clear from the CEO’s comments in the Q3 earnings call that AUR is spending time working with regulators on future approval. Part of this is the Aurora Driver Safety case, the document, and data to prove the product is safe to be on the roads with other drivers. Currently, most states allow the deployment of autonomous vehicles (investor slide show slide 15), but there is no federal agreement.

The Business Model

Aurora plans to begin commercial operations in late 2024. They will be using their small fleet and running driverless trucks between their hubs in Dallas and Houston. They are already running 75 loads a week for initial partners and hope to extend this to 100 loads shortly. The trucks currently run with both a driver and a technician onboard. Continental plans to begin system production in 2027, leading to Aurora beginning full operations.

There is a contradiction in the current business model, which does not align with the long-term one. Currently, the two hubs in Dallas and Houston receive freight from the trial customers. This freight is packed onto Aurora trucks and driven by Aurora to the terminal at the other end of the highway, at this point, it is unloaded and picked up by the trial customers.

Aurora uses terminals to house, maintain, prepare, inspect, and deploy autonomous trucks between destinations.

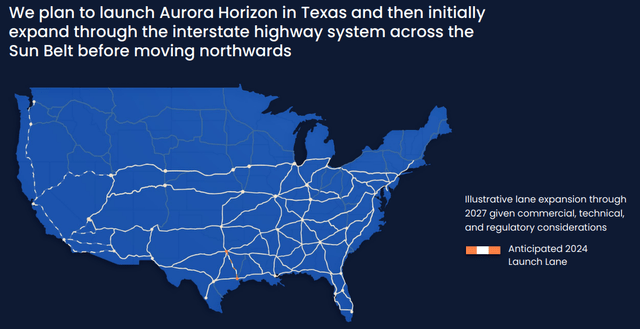

AUR is planning to open lanes on major US highways connecting its cities. Implicit to this is the establishment of large distribution centers or terminals at the end of each motorway; unless regulators give the green light for these trucks to drive through cities, drivers must do the last leg of the journey, so AUR would be doing the middle mile.

I understand how this idea would work, and the planned expansion across the US is clear.

AUR expansion plan (Investor slide show slide 13)

However, what is not clear is how this alters into the long-term business plan. Page 13 of the Q3 10-Q explains Aurora’s view of future business.

We expect that the Aurora Driver will ultimately be commercialized in a Driver as a Service (“DaaS”) business model, in which customers or third parties will purchase, manage, and maintain fleets directly, while subscribing to the Aurora Driver and a suite of related services. We do not intend to own nor operate a large number of vehicles ourselves. Throughout commercialization, we expect to earn revenue on a fee per mile basis. We intend to partner with OEMs, fleet operators, and other third parties to commercialize and support Aurora Driver-powered vehicles.

Aurora Horizon is the name of the software control product that will operate as a Driver As A Service. Aurora says it will be asset-light as they will not own trucks or facilities. What happens to the hubs?

During the start of commercialization, though, we expect to briefly operate our own logistics and mobility services…

After the first 12 – 24 months of operation, AUR envisages operating as a HAAS (Hardware As A Service) company. They intend to own and operate a small fleet as a proof of concept for the first two years, but after that, the trucks will be owned by the fleet operator.

Aurora will buy (or lease) the systems from Continental and be responsible for maintenance, insurance, remote assistance, and continued system development.

The Aurora Drive system will be installed into trucks, and Aurora will receive a fee per mile for operation. From a fleet operator’s point of view, it will likely be viewed as the cost of a driver for the truck.

This business model is not the one being trialed.

Can it be profitable?

If fully operational, the Aurora Driver and Aurora Horizon products offer advantages. Trucks can operate 24 hours a day, allowing for greater utilization. They only need to stop for refueling and repairs (flat tires etc.).

The software can be speed-limited and drive more efficiently than humans, saving as much as 5-10% of fuel (yet to be proven). It may reduce insurance costs for operators significantly if these trucks prove they can reduce the number of accidents. Over 5,000 deaths a year are caused by large truck accidents in the US, and it is expected that this figure will be cut dramatically.

Like the rest of the world, the US currently has a shortage of truck drivers, perhaps 60,000. The figure is forecasted to grow but has been falling in recent years.

This is a compelling proposition: safer, lower cost, and less emissions.

The Investment case

On first reading, it looks like a slam dunk, a clear winner. Aurora is now the only US player, with some key OEMs invested (OEMs Paccar, Toyota, and Volvo slide 8 investor presentation). A major deal is in place with Continental to manufacture the hardware, and the first lane is running as proof of concept.

It looks challenging to have US nationwide regulation in place quickly; politics are always an issue, and the federal nature of the country can make this kind of change very difficult. At the very least, we can expect it to move forward piecemeal with some setbacks along the way, some states and senators campaigning against the changes and various interest groups getting involved. It will likely be several years before this is fully resolved and I believe this acceptance issue has caused Wall Street to be relatively bearish towards this stock.

Wall Street is not buying the story

TuSimple has withdrawn from the US market, and the general perception was that they were forced out because they could not find a new OEM to work with. That may not be the whole story. TuSimple is focusing on China and Japan, where the regulatory regime is much easier to work with. China is moving towards greater automation and has a large market for new trucks. In Japan, where opposition to new technology is less, they have a far more pressing driver shortage, and the authorities are preparing the ground for fully autonomous delivery trucks.

Wall Street does not seem to believe Aurora can profit in the foreseeable future.

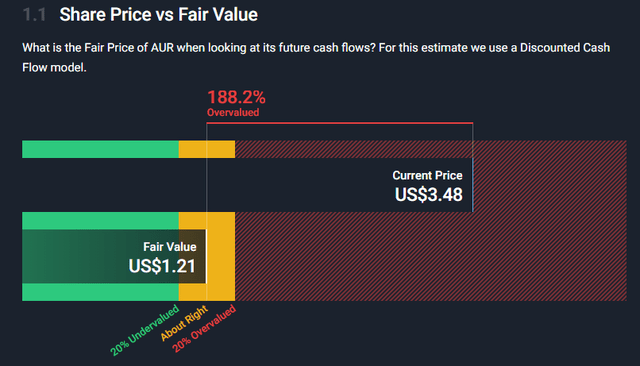

Simplywall.st has Aurora being significantly overvalued. They calculate the fair value using Wall Street analysts’ revenue and earnings forecasts in a two-stage DCF. Going through their calculations (data provided on the website), only one analyst has forecast a positive free cash flow before 2030. The average is a net cash outflow of $1.97 billion by 2028.

As of September 23rd, Aurora had $1.5 billion of cash on its balance sheet and was burning a little over $600 million per year, giving it two and a half years cash runway, clearly not enough to make it past 2028.

Aurora has zero debt and has been raising cash by selling shares over $800 million in 2023, and a similar-sized shelf registration was filed this month. Shareholders suffered more than 30% dilution in the last 12 months, which looks set to continue.

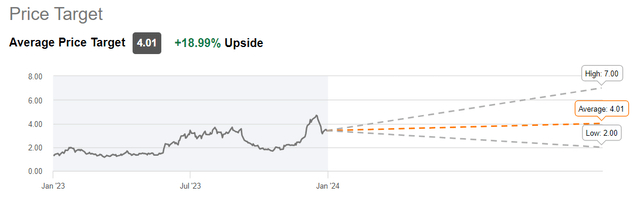

Wall Street has a 12-month price target that is only 19% above the current market price, and one analyst rates the company a sell with a price target of $2.

Wall Street Targets (Seeking Alpha ratings page)

Share Ownership

Aurora is almost a controlled company; its top five shareholders own 50% of the company, giving them effective control, and the top 25 shareholders own 85% of the company. The general public owns less than 10%, which usually adds stability, but that has not been seen in Aurora shares of late.

Conclusion

After the recent rise in share price value, the company appears to be close to its 1-year forecast value, and a DCF model suggests it is above fair value relative to the next ten years of forecast cash flow.

The US market for autonomous trucks looks quite challenging, with many stakeholders likely to get involved with regulating and permitting these operations. The leading competitor, TSP, has withdrawn from the US market to focus on Asia, which may leave the market open for Aurora but may also reflect the difficulty ahead relative to other jurisdictions.

It is unclear how the business model will develop or its ability to generate cash. We understand the concept of customers paying a service fee per mile but have little to no understanding of what that service charge will be or what the costs of Aurora will be when it is operational.

The CEO has already raised the prospect of selling the company once, and with the significant amounts of cash the company will need to generate going forward, that still seems like a valid possibility. It may be a good out for shareholders and present a profit opportunity.

There is too much risk and not enough upside, so I will stay on the sidelines and see how things develop.