da-kuk

Intro

We wrote about AudioCodes Ltd. (NASDAQ:AUDC) in November of last year after the company’s Q3 earnings numbers when we were contemplating an investment in the company on the long side. GAAP earnings of $0.14 per share in Q3 beat the consensus estimate by $0.05 per share as the company’s conversational AI offerings & higher margin software solutions remained to the fore. Furthermore, the stock’s technicals were demonstrating a bullish bias in both the long-term & near-term charts. Although we did not pull the trigger on the long side (as we needed more bullish confirmation), we were not surprised to see the stock has rallied over 13% over the past 2.5 months. All eyes now are on AudioCodes’ upcoming Q4 numbers which have the potential to aggressively bring buyers in on the long side here.

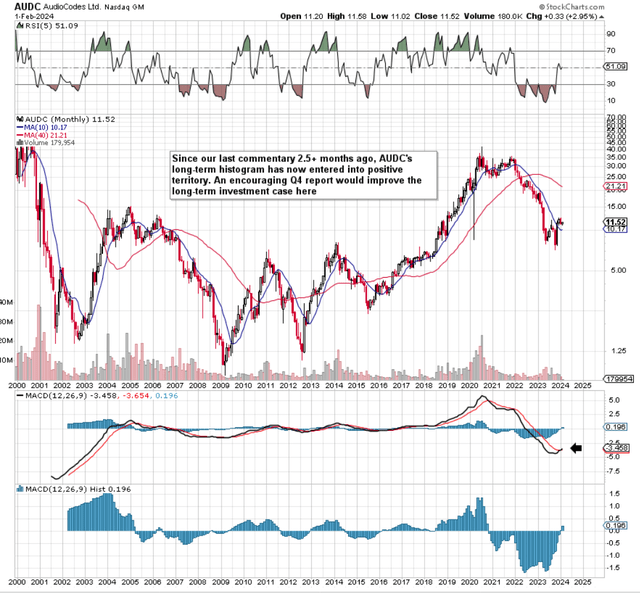

If we go to AudioCodes’ long-term chart, for example, strength in recent months has resulted in a marginal crossover of AudioCodes’ MACD indicator. This indicator is especially noteworthy on long-term charts due to the dual role of the indicator (momentum & trend) and the amount of information that goes into the readouts. Furthermore, the best buy signals are when the crossovers take place well below the zero line (what we potentially have at present). Therefore with GAAP earnings of $0.14 also expected for the fourth quarter, a convincing earnings beat as well as bullish forward-looking trends regarding guidance would go a long way in making the long-term MACD crossover even more convincing. Therefore, let’s go through what we will be looking out for in the earnings report which is due on the 6th of February next.

AudioCodes Long-Term Chart (StockCharts.com)

Live Subscription Growth

Although growth rates of subscription sales (in terms of core numbers) may not look all that impressive on the front end (due to the spanning out of sales over an expanded period), they really make their mark when it comes to growing bottom-line profitability & margin growth. AudioCodes’ live subscription business grew by over 7% in Q2 and by over 50% compared to the same period of 12 months prior. Therefore it will be interesting to see the growth rate of ‘Live Subscription’ in Q4 & whether it can hit its $48+ million annual recurring revenue estimate in due course.

If we get anything higher, it will be a big bonus for the following reason. The faster we see overall sales in AudioCodes comprised of software & services products, the more gross margin appreciation we will witness on the income statement. Non-GAAP gross margin increased from 67.3% in Q3 from a comparable 64.5% in the previous quarter. A big reason for this move is ‘Live Subscription’ growth so eyes will be peeled on the readout here as well as its level of revenue visibility in this segment going forward.

Conversation AI

In the Customer Experience business, we witnessed growth of over 50% in ‘Conversational AI’ bookings compared to the same period of 12 months prior. Here, we see how AudioCodes continues to reap the benefits of aggressive R&D it has undergone in recent times. The success of the Voca CIC offering (launched in mid-2023) on the CCaaS platform has led to a significant increase in customer engagement which in turn has opened up a plethora of income-generating opportunities in associated areas.

Investors will be sizing up forward-looking ‘scaling’ opportunities in the Q4 report such as the auto contract win discussed by the CEO on the Q3 earnings call. This seven-figure contract (the largest of its kind thus far) demonstrated the magnitude of how Coca-CIC can be scaled going forward irrespective of whether conversation AI or IVR systems are provided to the customer over time.

The success of Voca CIC in many ways provided AudioCodes a ‘leg-up’ in the fast-growing voice AI space & emerging meeting space. In fact, through platforms such as WebRTC & Click-To-Call, the company looks primed for accelerated growth. The CEO pointed to this on the recent Q3 earnings conference call.

The success of our CCaaS offering is having a pull-through effect on the rest of our conversational AI portfolio, in particular, in our generative AI-powered recording services. We are stepping up our efforts in the cognitive services space with key investments in speech-to-text and generative AI and LLM technologies. In that regard, we believe that we own a unique advantage in maintaining a very comprehensive knowledge of several key vital technologies, which are vital to create efficient systems. We own technologies such as telephony, VoIP networking, and a variety of cognitive services technologies.

Forward-Looking Earnings Revisions

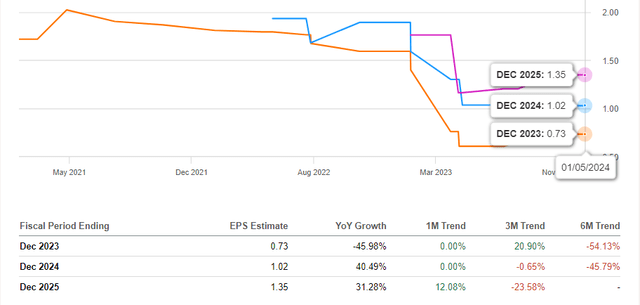

Given the bullish trends alluded to above, where AudioCodes seems to have a long runway for growth incorporating growing recurring revenue, the consensus is expected strong bottom-line growth for the stock. Consensus’ encouraging bottom-line expectations as well as revisions explains why one cannot go merely on top-line growth rates when valuing this stock. Suffice it to say, with bottom-line growth of 40%+ expected in fiscal 2024 followed by 30%+ in fiscal 2025, AudioCodes’ valuation ( trailing-GAAP multiple of 28.76) does not look overly expensive. The question will be whether EPS revisions can continue to improve over time. If they can and these expected growth rates come to pass, we see shares trading well north of their current price point over time.

AudioCodes Consensus EPS Revision Trend (Seeking Alpha)

Conclusion

To sum up, AudioCodes’ upcoming Q4 numbers and associated guidance could confirm that the software & services company has indeed begun a long-term bull market. The live subscription business & Conversation AI-associated forward-looking bookings remain key as investors will look at these trends to gauge the stock’s upside. We look forward to continued overage.