Rick Kern/Getty Images Entertainment

We’re nearly through the first quarter of 2024, and likely very few investors would have anticipated the sharp rise in the stock market since the start of the year. My appetite for risk-taking has taken off again, lifting everything from AI stocks to cryptocurrencies. But against this backdrop, investors should focus on deploying capital conservatively, and protect for potential downside instead of getting too greedy.

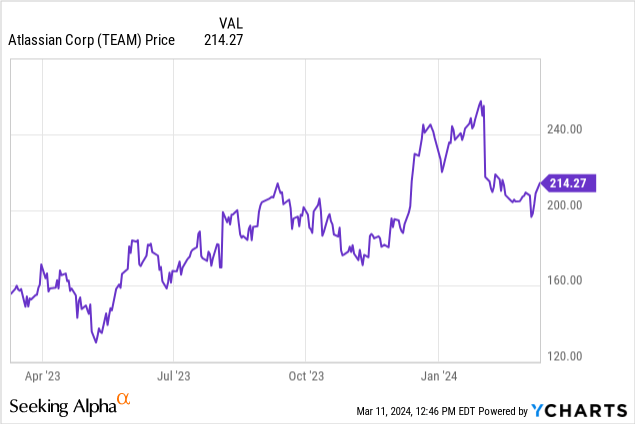

We’ve seen evidence of exhaustion for high multiples amid lackluster performance, especially in a stock like Atlassian (NASDAQ:TEAM). The workflow and project management software vendor has bucked the trend of its software peers this year and declined ~5% since the start of the year, with sharp losses picking up after the company’s fiscal Q2 (December quarter) earnings release.

I last wrote a neutral opinion on Atlassian in November, when the stock was trading closer to $175. At the time, I had argued that the present bull and bear case for the company was balanced and that investors would be wise to wait for a further drop before buying in. Now, with the stock modestly richer than back then (driven, in large part, by Atlassian rising in sympathy with other tech stocks rather than company-specific catalysts), plus the weaknesses exposed in Atlassian’s most recent earnings quarter, I’m dropping my rating on the stock back down to bearish.

Atlassian is in the midst of a big business transition. The company is killing off its server products and encouraging more customers to switch to its cloud offerings. This will be a long-term benefit to revenue as the company will bank on a more stable, recurring revenue stream, but there is a near-term impact on margins as cloud deployments have slightly higher embedded costs. At the same time, Atlassian is facing a continued macro headwind as companies rationalize their IT spending and take an axe to unnecessary costs. This has manifested in lower seat expansion, particularly in small and mid-sized businesses that are feeling a lot of the current macro pain.

Here are all of the long-term bear risks for this company:

- Once a growth superstar, Atlassian’s growth has moderated to the 20s. Due both to tougher macro conditions plus the burden of Atlassian’s own scale, Atlassian’s growth rates are finally starting to moderate into the 20s (versus a ~40% growth rate during the peak of the pandemic era). Arguably, Atlassian’s core products also face stiffer competition as similar software products like Asana (ASAN) continue to grow from a much smaller base. Continued deceleration calls into question Atlassian’s premium valuation multiple.

- Seat expansion at risk. Atlassian’s core business model involves converting freemium users to paid users, and then hoping that those paid users eventually expand usage and seats over time. In an era of budget rationalization, this expansion tailwind may lose some steam.

- Margins are also facing pressure, driven by cloud migration. Similarly, as Atlassian continues to see a revenue mix shift into the cloud (which carries a lower gross margin profile than its end-of-life server products), its low-80s gross margin is tapering off, which is hindering the company’s overall bottom-line expansion.

- Server end-of-life may cause higher-than-expected churn. Atlassian stopped supporting its server deployments in February 2024, which may alienate many longtime customers who refuse to migrate to either cloud or data center deployments, causing a revenue headwind.

We also need to consider the fact that, as Atlassian’s stock has bubbled up with the rest of the market, it continues to maintain an expensive valuation premium relative to its fundamental prospects. At current share prices near $215, Atlassian trades at a market cap of $55.55 billion. After we net off the $1.83 billion of cash and $987.2 million of debt on Atlassian’s most recent balance sheet, the company’s resulting enterprise value is $54.71 billion.

Meanwhile, for the next fiscal year FY25 (the year for Atlassian ending in June 2025), Wall Street analysts have a consensus revenue target of $5.10 billion for Atlassian (representing 20% y/y growth) and $3.13 in pro forma EPS. If we apply the company’s current YTD FCF margin of 22% against that revenue profile, we get a FCF of $1.12 billion.

This puts Atlassian’s valuation multiples at:

- 10.7x EV/FY25 revenue

- 48.8x EV/FY25 FCF

- 68.7x FY25 P/E

Considering the number of risks stacked against Atlassian which have partially materialized in recent results, I can’t justify paying a heady premium for this stock at this time. Steer clear here and invest elsewhere.

Q2 download

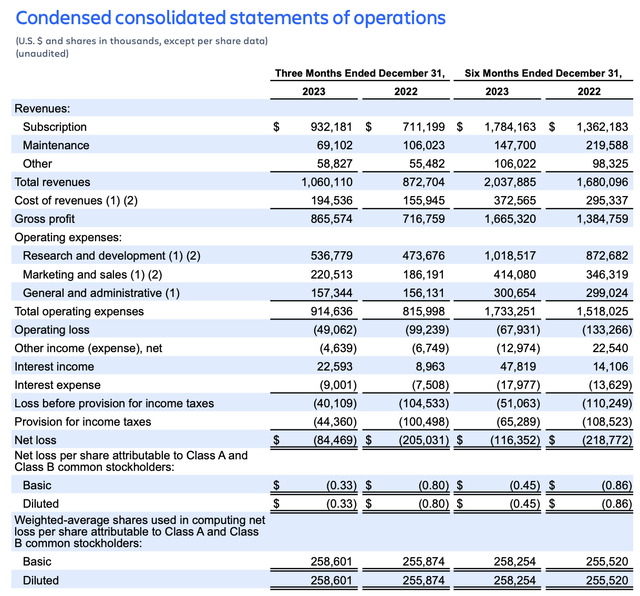

Let’s now go through Atlassian’s latest quarterly results in greater detail. The Q2 earnings summary is shown below:

Atlassian Q2 results (Atlassian Q2 shareholder letter)

Overall revenue grew 21% y/y to $1.06 billion, ahead of Wall Street’s expectations of $1.02 billion (+17% y/y) by a four-point margin. Revenue growth also kept pace with Q1’s 21% y/y growth pace.

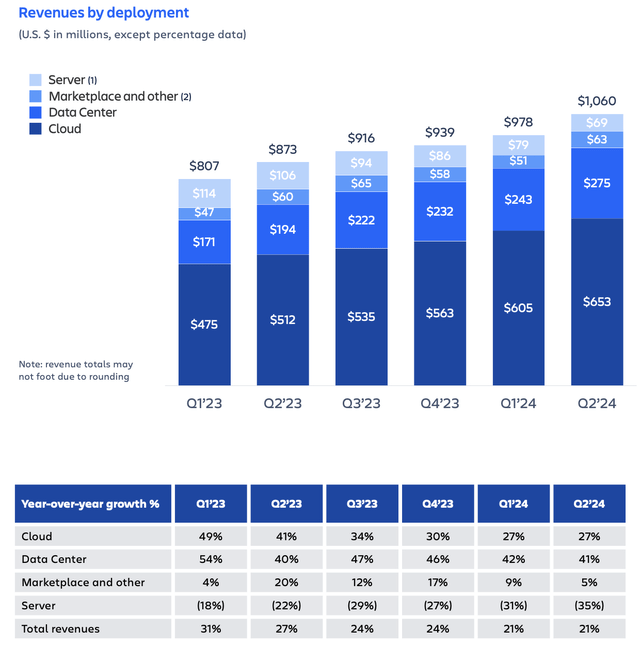

The chart below shows Atlassian’s revenue broken out by category:

Atlassian revenue trends (Atlassian Q2 shareholder letter)

As can be seen above, the main trends over the past few quarters have continued: cloud continues to lead the way in growth, while revenue is mixing in from the end-of-life of the company’s server deployments. What is disappointing, however, is the deceleration in marketplace revenue. While a small contributor (~6%) of overall revenue, this is an important validation of Atlassian’s ecosystem and a way to monetize apps made by other developers. Management is noting that it expects high single-digit growth for marketplace revenue for the remainder of the year, hopefully indicating that Q2 was a minor unfavorable blip.

What investors mostly panned in Q2 was a weaker performance in the SMB segment, as fewer smaller customers chose to upgrade and expand their seat counts. Here’s helpful anecdotal commentary from CFO Joe Binz’s remarks on the Q2 earnings call:

There were a few cross currents in that performance, so let me walk through them in terms of consumer — customer segment and growth driver trends to try and help, and then I’ll transition into your question on the confidence around H2. From a customer segment perspective, we had very strong sales execution in the quarter, which drove healthy performance in our enterprise customer segment. This resulted in better-than-expected billings on an annual and large multi-year deals, a significant portion of which landed on the balance sheet and unearned revenue. This also drove healthy upsell to premium versions of our products. Results conversely in SMB were slightly lower than we expected and that was driven by paid seat expansion and a mix shift from monthly to annual subscriptions, which, as you know, signal stronger customer’s commitment, but also carrier’s lower pricing. And as you know, dynamics in the SMB business, good or bad, are largely realized in the quarter given the linearity in that part of the business. In terms of the trends on our key growth drivers in the quarter, migrations from server and data center exceeded our expectations, and that’s driven by the significant investment and execution focus we put there. In terms of paid seat expansion, while the overall rate of paid seat expansion remained lower than the prior year, the pace of deceleration or slope of that trend continued to moderate from Q1, and within that trend, as mentioned earlier, enterprise was better-than-expected and SMB was slightly worse.”

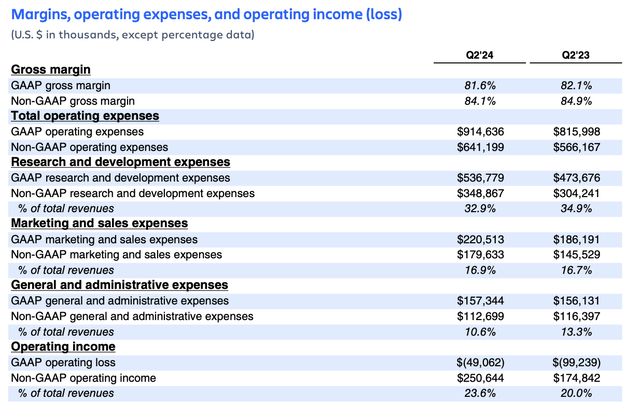

From a profitability standpoint: pro forma gross margins declined 80bps to 84.1%, driven by a greater mix shift into cloud revenue.

Atlassian margins (Atlassian Q2 shareholder letter)

However, as shown above, total pro forma operating margins did jump to 23.6%, a 360bps y/y improvement: driven by Atlassian gaining operating leverage on G&A and R&D expenses.

Key Takeaways

Amid expansion pressures in the SMB space, potential lumpiness from the end-of-life of Atlassian’s server deployments, and a rich valuation, there is more risk than reward in investing in Atlassian at current share prices. I’d prefer to steer clear here and invest elsewhere.