alvarez

Introduction

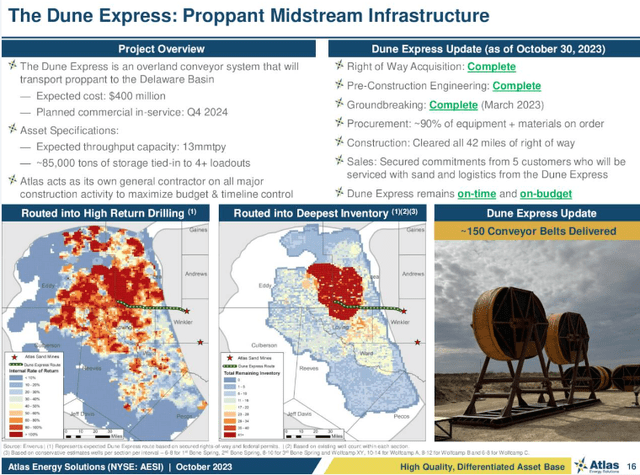

The case for Atlas Energy Solutions Inc. (NYSE:AESI) is not complex. The company is a locally sourced producer of high grade sand for fracking. It is introducing a step-change in last mile sand logistics later this year in the form of the now under construction conveyor belt called the Dune Express. (The link is for a nice video presentation that is well worth a look).

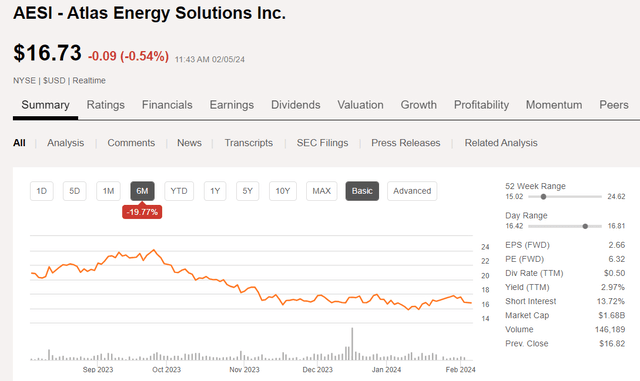

AESI Price Chart (Seeking Alpha)

Atlas has been dragged down over the last month from $18.00, to its long-term support line at $16.38 per share. It held that level and is now trading just below its support line at $17.18. For a company its size, Atlas is widely covered by the analyst community, and is ranked by all as a buy, and by three as a strong buy, according to the TipRanks site. As you can see below, the analysts all have a fairly bullish outlook for Atlas that offers about a 50% upside from present pricing.

Estimates for Q4 EPS are $0.57, slightly above Q3’s $0.56 per share. Estimates begin to rise in Q2 2024 to $0.64 and in Q3 2024 to $0.71, respectively. Atlas is expected to report earnings on February 27th.

In this article, we will define the central thesis for Atlas, and close with some strategy on taking a position.

The thesis for Atlas Energy Solutions

The title for this piece is taken from a SciFi story I read as a kid. When I get into the meat of thesis for Atlas, you will see the tie-in. In this 1940 Robert Heinlein classic, The Roads Must Roll, the author and futurist posits a scenario that when you want to go somewhere, you just hop on a rolling road. The story was more a vehicle for Heinlein to explore his views on the sociological implications of technology, than a hard SF story. The tie-in to Atlas should be obvious, as the company is turning sand delivery into the Delaware sub-basin of the Permian, on its head with the Dune Express.

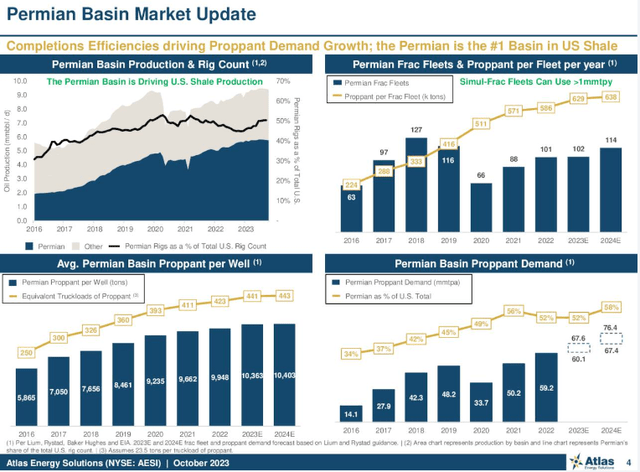

Estimates vary, but it is very likely the Permian basin has another 15-20 years of high oil and gas productivity. Perhaps more, estimating of this kind is a soft science that depends on a number of variables. The hydrocarbons are extracted from tightly compacted shale through the fracking process that creates deep fissures in the rock that are held open with the proppant-sand. This increase in permeability enables the hydrocarbons to flow into the well.

The industry has taken several steps recently that will favorably impact the market for sand. First, the lateral sections are being lengthened to 10-12, and even 15-thousand feet, driving a need for a 50% increase in sand per well by itself. Second, the completion intensity is increasing. This means more sand and water per foot of interval. A 15K foot well at 2,500 ppf will require nearly 40 mm pounds of sand. (The figures in the Atlas slide below are representative of using 2,000 ppf on a 10K foot well.)

Permian basin outlook (Atlas Energy services)

Finally, as I have pointed out many times, there is no shale production without fracking, so the market for Atlas has a long way to go.

Why Atlas?

Dune Express

In bulk materials true “moats” are rare. Atlas has several that can drive business to them. Obviously, I’ve tipped my hand on the numero uno moat. The Dune Express is a game changer. If you have never traveled out to West Texas, let me tell you. Most of the roads are two-lane roads, and that means a big chunk of traffic are giant trucks trying to pass you, and dodging in front of you to avoid the giant truck coming the other way. It’s bedlam to average motorists-farmers, local traffic, tourists, etc., and dangerous. Highway 285 is known as the Highway of Death, to give you a flavor of the risk. Oil companies are always looking to de-risk their field operations, and taking truck loads- tens of thousands of truck loads, off the highway with the Dune Express conveyor belt, is an obvious lever to pull. From a safety and emissions standpoint, Dune Express is a no-brainer.

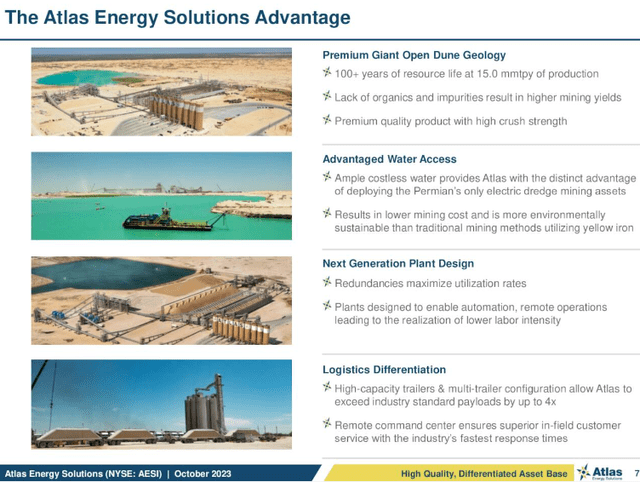

The Monahans Sand Hills

I know this area well. A lot of my early personal history involves Monahans and points south toward Alpine and, ultimately, Big Bend. Something I never knew was that the Pecos aquifer lies just below the surface of the dunes. Logistically, what this means is Atlas – alone of sand suppliers to my knowledge – can use dredging to mine sand. This is a huge logistics and cost advantage for the company. Trust me, I’ve pumped a lot of sand. Anytime you can move it with a suction hose as opposed to a Cat 6060, and ten thousand haulers, you have struck a blow for efficiency. I would argue that Atlas’ low cost of production is another moat for the company, which the company notes on slide #9 in this deck. The company notes that two more dredging barges will be deployed this year, moving Atlas to 100% dredge in Monahans.

Atlas Advantage (Atlas Energy)

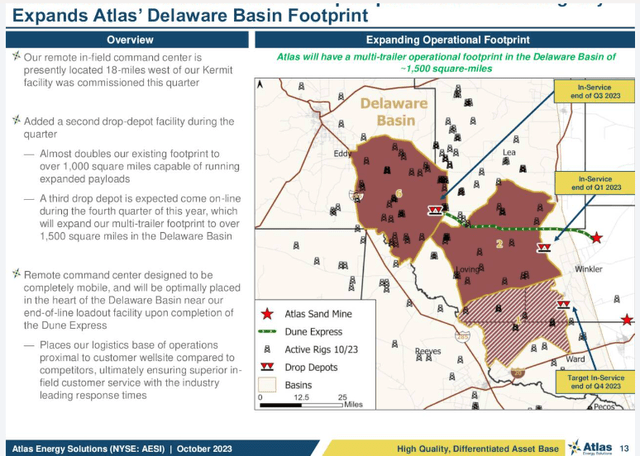

Last mile logistics are always a challenge in sand delivery. Some companies in this space have built a pneumatic based system of preloaded container boxes to facilitate last mile deliveries to the well site. Atlas has taken another approach with the triple-trailers shown in the bottom picture in the slide above. These can each haul 35 tons, and take two diesel burning trucks off the road. The slide below show the foot print for last mile logistics in the Permian using these triple-trailers. These travel only private lease roads and are not subject to Texas DOT weight limits. Another moat, in my book.

Atlas Delaware Footprint (Atlas Energy)

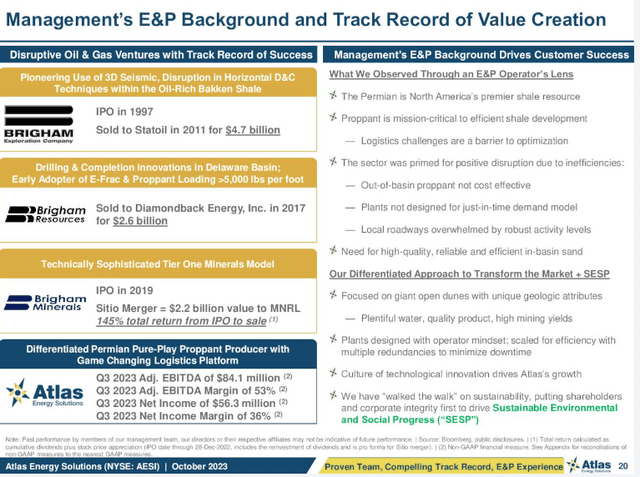

Proven history of value creation

Management matters. Atlas is led by a proven team with a strong record of value creation. In each prior case, the team led by the founder and owner, Bud Brigham, introduced new methodology to improve efficiencies. With an operator’s mindset the Atlas team has built out a sand delivery system that addresses key inefficiencies in traditional sand delivery packages.

Atlas Management (Atlas Energy)

Big capital spending to decline

Over the last couple of years, Atlas has been on a capital intensive growth curve with three key infrastructure developments, highlighted below. CEO Bud Brigham comments in the Q3 call on the culmination of this activity:

Our three major capital projects to grow our business the Dune Express conveyor system, the new Kermit facility addition and the build-out of our trucking fleet are progressing as planned on time and on budget.

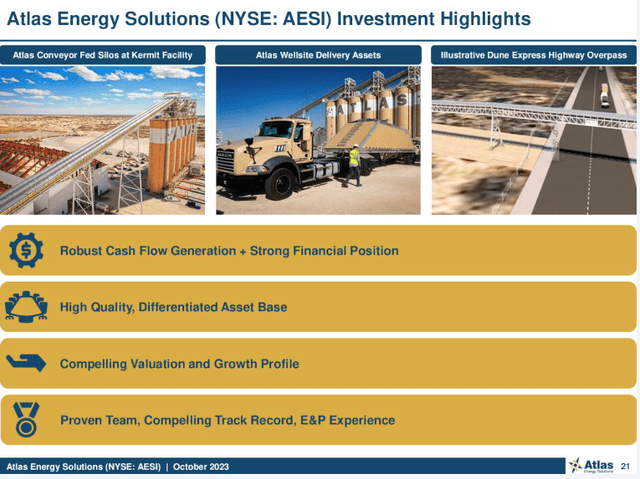

Atlas Energy Investment thesis (Atlas Energy)

Shareholder rewards

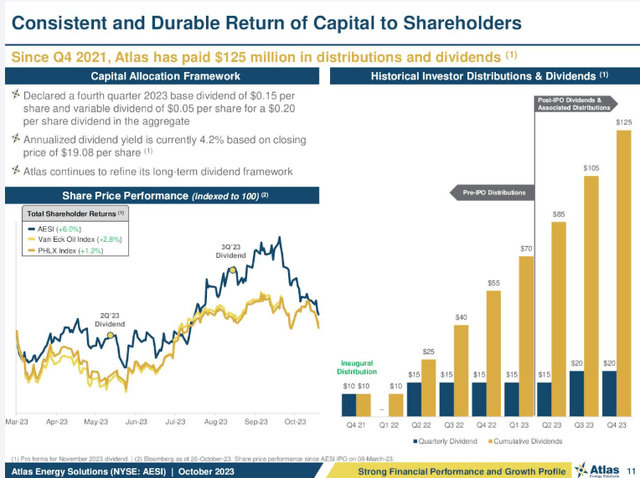

For a company its size to be knocking down a ~4% dividend is pretty impressive. Dividends get paid out of free cash, and since Q2 2022, Atlas has steadily returned capital to shareholders. It’s important to note that this has been a time of rapidly increasing capex to build out infrastructure. As previously noted, growth capex should be taking a pause as the three key projects we have discussed go live. They note in the slide below that the future framework of the dividend is still being worked through. That’s a bit nebulous, but management has shown their underlying disposition toward shareholders, and there is reason for optimism going forward.

Atlas Energy Capital Return plans (Atlas Energy)

Risks to the thesis

The key risk lies in the company’s pure-play Permian status. Atlas is leveraged to future activity in the basin, with no options for diversification that fit their model. If/when operator activity declines, it will impact Atlas revenues.

I view this risk as remote – at least for the next few years, as the Permian’s multi-bench, layered reservoirs provide thousands of remaining targets in the Tier I Wolfcamp A, and Upper Bone Spring in the Delaware sub-basin. The B and C Wolfcamp secondary targets are upgradable to Tier I in certain areas and with newly evolved technology. The Midland sub-basin’s principal targets include the Wolfcamp and Bone Spring, but at somewhat shallower depths, leading to a typically higher oil cut.

There is no question that the Permian is a maturing basin that will enter a decline. Increasing gas and water cuts may make production uneconomic in the future. The current frenzy of M&A activity in the basin is under-pinned by a desire to build out Tier I portfolios, and is symptomatic of “peaking resource” behavior. The good news for investors in Atlas is the downslope will be relatively flat with years of multi-million BOEPD output ahead of it, as previously noted.

It should also be noted that short interest on the stock is fairly high at 13%. I don’t really understand shorting Atlas from these levels, but facts are facts.

Q3 2023 Financials

On total sales of $158 million, adjusted EBITDA for the period was $84 million representing a sequential decrease of 9.4%. Adjusted EBITDA margin was 53% for the period. Adjusted free cash flow, was $69 million representing a sequential decrease of 21% and an adjusted free cash flow margin of 43%. Atlas generated net income of $56 million for the quarter representing a strong net income margin of 36% and earnings per share of $0.51 per share.

As of September 30, 2023, total liquidity was $439 million. This was comprised of $265 million in cash and equivalents; $74 million of availability under the ABL facility-with no outstanding balance; and $100 million of availability under their delayed draw term loan facility.

Atlas streamlined their capital structure during the period, with a new $180 million term loan that refinanced their previous term loan in finance leases. Atlas ended the quarter with a debt to LTM adjusted EBITDA ratio of 0.5. In Q3, Atlas converted just over 81% of adjusted EBITDA to adjusted free cash flow.

Your takeaway

Atlas has an upside shipping capacity of 15 mm tons in 2024 and currently has 6.2 mm tons contracted for the year, or 40% of nameplate. Discussions are underway with customers to scale up contracted volumes to 80% of nameplate or 12 mm tons, so there is quite bit of growth to come.

On a run rate basis, Atlas generated $320 mm of EBITDA in Q-3, that puts their TTM multiple at 4.8X, not especially cheap for a company Atlas’ size. While I am pretty enthused about the company’s long term prospects-as you can probably tell, I don’t want to rush in. Q-4 estimates are for flat EPS of $0.57, and a decline in revenues to $145 mm, that could soften pricing post-earnings release.

I think we put Atlas Energy Solutions Inc. on the sticky-note bulletin board to monitor trading post earnings for a slightly better entry point. Right now, it’s a hold.