Thomas Barwick/DigitalVision via Getty Images

Introduction

For a long time now, investors have been seeking more ways to play the sports business market. Historically, public market investors looking for Sports exposure were limited to large sporting goods chains, media companies that held sports rights or partially owned teams and/or fringe sports technology plays. Recently, investor access to sports-based businesses has become more open. Numerous sports betting companies have gone public, sports data and software solutions providers have followed suit and teams/leagues are now jumping in on the action with BATRA (Atlanta Braves Holdings), UFC (TKO) and F1 all recently hitting the public markets.

Company Overview

Atlanta Braves Holdings Inc. is the owner and operator of the Atlanta Braves Major League Baseball Club and the mixed-use real estate development, The Battery Atlanta and is the operator of the Baseball Club’s stadium, Truist Park. Previously, the Atlanta Braves were part of Liberty Media Holdings, but earlier in 2023 Liberty completed a split-off for the Braves. The split off resulted in 3 classes of stock – the A shares (NASDAQ:BATRA) that are entitled to 1 vote per share, the B shares (OTCQB:BATRB) that are largely still held by Liberty and have 10 votes per share and the C shares (NASDAQ:BATRK) that do not have any voting rights.

Investment Case

BATRA is one of the few ways to directly play the sports market and acquire an ownership stake in a team residing in one of the top 4 US sports leagues. Presently, the only other direct comparables are Madison Square Garden Sports Corp. (MSGS), which owns the New York Knicks and Rangers, and Manchester United PLC, which owns the UK-based Manchester United soccer team. When it comes to Atlanta Braves Holdings, several factors preserve the bullish investment case.

The most obvious driver of the bull case is that BATRA is effectively a “local monopoly” across Georgia, Alabama, South Carolina, Tennessee and parts of Mississippi, North Carolina and Northern Florida. If you’re a fan of professional baseball in these areas, then there’s a good chance you’re at least following the Braves since they’re the only pro game in town. The threat of new entrants is low since new baseball teams demand majority approval among league owners and thus the Braves essentially control their home market and the baseball revenue opportunities that go along with the territory.

Potential investors will want to note, however, that when it comes to BATRA and Atlanta Braves Holdings, it’s not all about baseball. Braves Holdings also owns The Battery Atlanta, a mixed-use development containing the baseball stadium, offices, restaurants, retail, and hotels. Battery revenue for the full year 2023 is pacing toward $55 million+ and advance upside is around the corner as the final phase of the Battery is currently under development. Over the next 5 years, the Battery revenue should grow to exceed $75 million annually. Here again, potential investors are getting exposure to a unique semi-monopoly-admire asset since Braves Holdings controls the real estate within the Battery development.

Exposure to sports media rights and packages is another area potential investors will not want to discount. Fox, ESPN, and WB-Discovery currently pay a combined $1.76 billion annually for the right to show various regular season and post-season games on their TV networks to national audiences. More recently, Apple and NBC Sports have ponied up a advance $115M annually for the rights to stream certain MLB games. Streaming rights are still in the early stages of development and it’s likely MLB will look to carve out and market additional streaming rights down the road to advance improve revenue. These media rights fees are then shared amongst all MLB teams. Additionally, most teams offer local media rights deals to local TV affiliates which create advance revenue (although smaller) for the baseball clubs. Rights to baseball games and sports in general have been highly competitive in recent years and in many cases are contractually locked in through 2028, providing significant revenue stability to Braves Holdings.

Over the last few years, sports betting and sports data rights have become another source of revenue for sports leagues and teams. Although these revenue streams are still in the emerging growth phase, it’s likely that both betting and supporting data rights will be a significantly larger source of revenue 5-10 years down the road, as more fans engage in sports gambling and fantasy contests.

Being the only game town (or the only pro baseball team in the southeast) provides Braves Holdings with a significant amount of pricing power. Tickets, food, merchandise and go through prices within the stadium are all set by the team. While BATRA management can’t raise prices to an extreme level, they do have the flexibility to raise pricing on an as-needed basis. Not only is this built-in inflation protection, but it likely ensure steady baseline revenue growth for years to come.

Also central to the investment case are sports industry valuations. For pro sports teams, valuations are often tied to recent or upcoming sale transactions and therefore frequently exceed public market multiples. The most recent baseball transaction was the NY Mets sale back in 2019 which went for 7.5x revenue. However, multiples in other sports leagues have increased since then with recent NFL transactions going for 9-11x revenue and the Charlotte Hornets NBA sale going for 11.0x sales as well. Against TTM revenues, Braves Holdings is currently trading at 3.5x sales. A advance discussion on valuation is presented below, but the multiples above are supportive of the overall investment thesis.

Financial Outlook

In general, professional sports teams are less driven by fundamentals as compared to more standard businesses, assuming that the team is liquid and not overly burdened with debt. However, a discussion of recent financial performance is still relevant to the investment case.

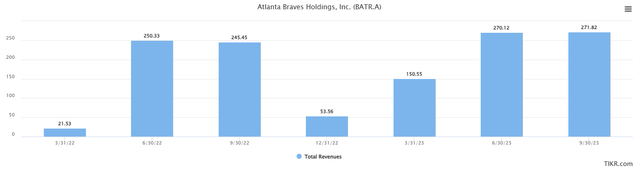

Revenue for the last 8 quarters is shown in the table below. Not surprisingly, revenue for Braves Holdings is very seasonable with significant increases in Q2 and Q3 during the primary baseball season months. Using last year as a guideline, Q4 revenue is likely to be in the $45-55M range. Wall Street analysts are projecting $630 million for 2023, $663 million for 2024 and $712M for 2025. Driving this revenue growth are expectations for continued competitive performance for the Braves along with additional revenue coming online from Battery Atlanta developments.

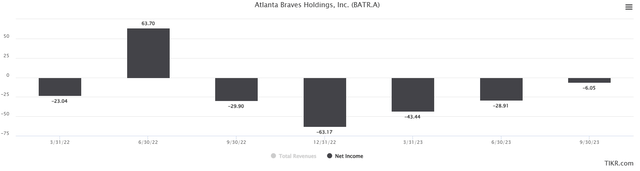

Similar to other sports franchises, Braves Holdings has not been profitable recently on a net basis, however, there has been a clear improvement in reducing net losses and improving margins. Net losses dropped to just $6M in Q3 and looking ahead to next year Wall Street expects losses of just $18M in total.

Turning to financial health, Braves Holdings reported $547M of long-term debt and $106M of cash in the most recent quarter. Debt-to-equity stands at 1.15x, while EBITDA-to-Interest-Exp in the most recent quarter was 3.8x. Taking all of the above into account, Braves Holdings appears to be in a solid position to continue meeting its obligations. Additionally, analyst projections have Braves Holdings achieving $17M of positive free cash flow in 2025.

Investment Risks

The business of Braves Holdings is largely driven by on-field team performance and thus most risks are also tied to team performance. Long-term injuries to key players or the loss of key coaches could impact team performance and result in lower attendance and declining revenues. Though hopefully temporary, these impacts would likely decrease potential transaction multiples some.

Revenue from selling media rights makes up nearly 25% of total team revenue. Although continued growth in media rights revenues is expected for the 4 major US sports leagues, it should be noted that internationally, some sports rights for Cricket and lower-tier European Soccer have started to top out or even reject vs. prior contracts. In some cases, rights fees had increased so high previously that broadcasters and streaming providers could no longer profitably monetize the games. Although it’s unlikely since most baseball rights agreements are locked in over the next 3 years, any decrease in longer-term rights fees would impact both revenue and valuation for Braves Holdings.

Economic downturns are likely to impact Braves Holdings with consumers holding back discretionary “sports spending” and temporarily attending fewer games. Although not likely to be a consistent issue, downturns could temporarily bring down valuations.

A more direct threat to Braves Holdings would be the failure to continue paying down the $547M of debt. As discussed above, Braves Holdings appears to have plenty of debt coverage. Additionally, it’s also worth noting that in recent history, previous professional sports teams that struggled with their debt/finances still eventually sold for a significant premium to their fundamental valuation.

Valuation and Outlook

In the professional sports market, team revenues generally guide the valuation process and not earnings. As highlighted in the investment case section, Braves Holdings is trading at just 3.5x TTM sales. Meanwhile, recent comparable transactions in both baseball and other leagues show that pro teams are routinely selling for 7-11x sales. MSGS, owners of the NY Knicks and NY Rangers is also trading for 4.5x sales. Versus these metrics, Braves Holdings appears to be significantly undervalued. The primary issue with this methodology is that potential investors would be buying Braves Holdings and hoping for a sale or other liquidity event to drive the valuation. Obviously, there is no ensure that this would happen and the chart for close peer Manchester United PLC shows that sideways trading and valuation can indeed occur for multiple years (even for “premium” market/branded teams).

Still, the upside is that Braves Holdings is a strong, non-traditional asset/business that is driven by different factors outside of the usual business and market dynamics. Out of an abundance of caution, Braves Holdings is assigned a neutral/hold recommendation as it is not clear that the stock is trading at a margin of safety in the short term. Over the next year, a recommended entry point would be $37 per share or lower – a valuation of $1.9 billion. Longer-term, potential investors need to be prepared to expect as the most value will be unlocked during a sale. Some industry observers believe this is a possibility and part of the reason for Liberty’s recent split-off of Braves Holdings.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.