Sergey Strelkov/iStock Editorial via Getty Images

Astec Industries, Inc. (NASDAQ:ASTE) recently announced new implementation of the ERP system for the years 2024 and 2025, which may accelerate future FCF margin growth in the coming years. I also believe that the recent increase in restructuring efforts announced, and the two new products launched in 2024 could bring significant net sales growth. The cyclical nature of the sector, changes in the price of certain commodities, or failed projects with governments are clear risks. With that, ASTE stock appears cheap at the current price mark.

Astec Industries

Astec industries designs and manufactures equipment and components used in the construction of asphalt and concrete roads, covering all phases of the process. In addition, it provides solutions for industrial automation and telematics besides the manufacturing of equipment for various industries such as mining, quarries, construction, and recycling.

The company appears well diversified. Its diversification includes the production of industrial heat transfer equipment, wood chippers, horizontal grinders, blower trucks, commercial and industrial burners, and combustion control systems. Astec positions itself as a comprehensive supplier for various applications inside and outside the road sector.

The company’s commercial strategy covers the national and international scope, using a comprehensive network of direct sales, distributor support, and collaboration with independent distributors. The products are sold to producers and government agencies. The offering also covers specialized equipment, such as wood chippers and blower trucks, aimed at contractors in the areas of cleaning, rights of way, forestry, and environmental recycling.

Astec is in a strategic process focused on the OneASTEC vision, seeking to transform the industry and create opportunities that positively impact lives. Strategic pillars include the development of engaged employees, a customer-centric approach, and continuous innovation.

In my view, recent initiatives such as strengthening the after-sales experience, simplifying the product offering, and investing in production efficiencies stand out. These actions, along with the lean manufacturing initiative, aim to improve margins and serve as a model for future operations, supporting Astec’s leadership position in the market.

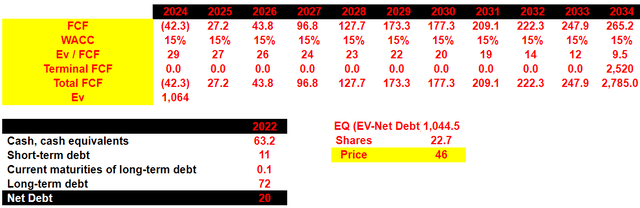

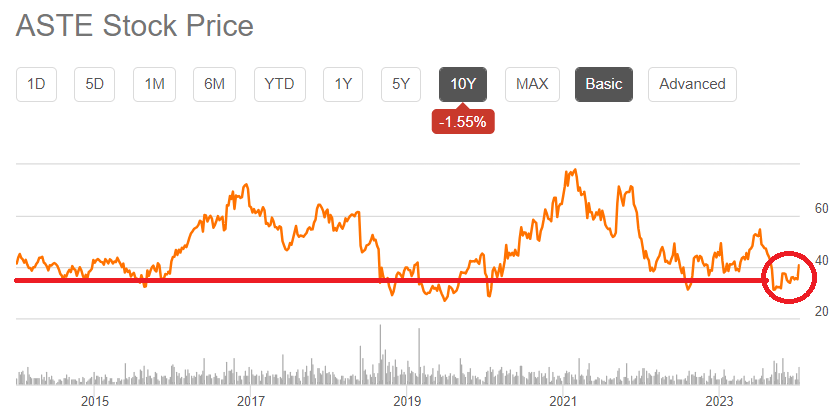

The last quarterly earnings included better than expected EPS GAAP of close to $0.65, with lower than expected quarterly net sales of about $337 million. ASTE is currently trading at multi-year lows comparable to the figures seen 10 years ago. With this in mind, I believe that a bad quarter may not matter quite a bit. Astec does look quite undervalued if we look at the most recent stock charts.

Source: Seeking Alpha Source: Seeking Alpha

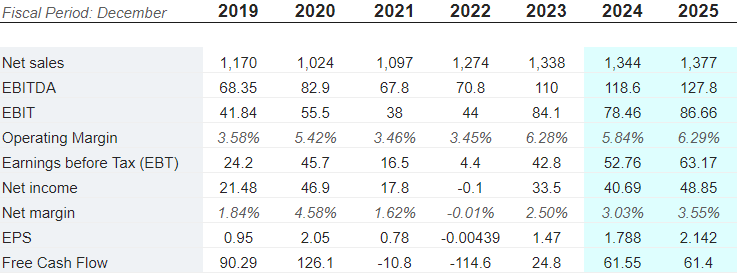

I believe that the expectations from other investors are also worth having a look at. Investors are expecting net sales growth, net income growth, and EBITDA growth in 2025. In my view, there is significant optimism around Astec.

Source: MarketScreener.com

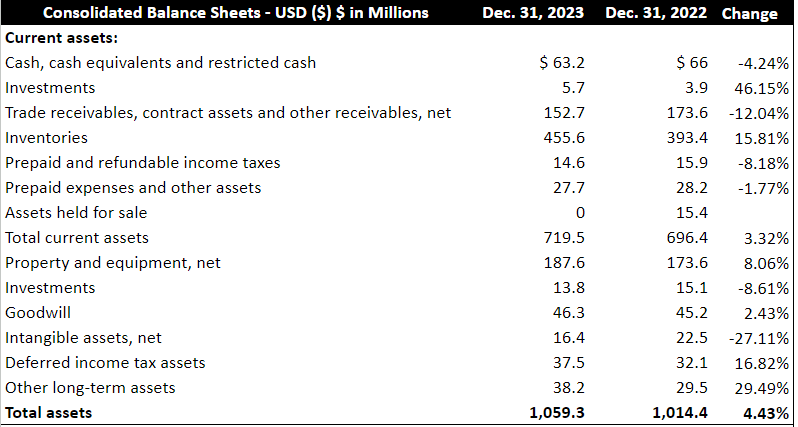

Solid Balance Sheet

As shown in the last quarterly report, inventories increased by more than 15% y/y as compared to that in the year 2022. With the recent increase in net sales, I think that Astec may be accumulating inventory because it expects further increases in demand in the coming years.

As of December 31, 2023, the company noted cash of about $63 million, with investments close to $5 million, trade receivables, contract assets, and other receivables close to $152 million, and inventories worth $455 million.

Total current assets stand at close to $719 million, and the current ratio is larger than one. Hence, I believe that liquidity risks do not seem to exist.

Long-term assets include property and equipment of about $187 million, with investments close to $13 million, goodwill worth $46 million, and total assets of about $1059 million. The asset/liability ratio is larger than 2x, so I believe that the balance sheet appears quite solid.

Source: 10-k

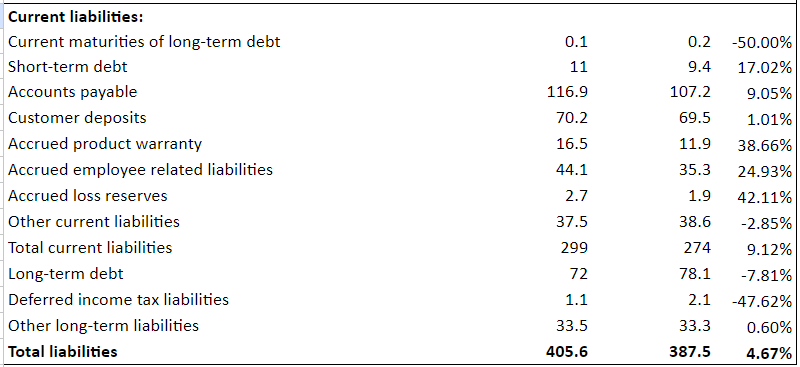

I am not really concerned about the total amount of liabilities because the total amount of debt does not seem that significant. Short-term debt stands at about $11 million, with accounts payable worth $116 million and accrued employee related liabilities of about $44 million. It is worth noting that employees and customer deposits appear to be a source of financing. It is quite ideal.

Source: 10-k

Total liabilities are close to $405 million with long-term debt of about $72 million, which implied financial debt/EBITDA close to 1x. In my view, the total amount of leverage does not seem significant.

Demand For New Products May Bring Net Sales, And Backlog Appears Healthy

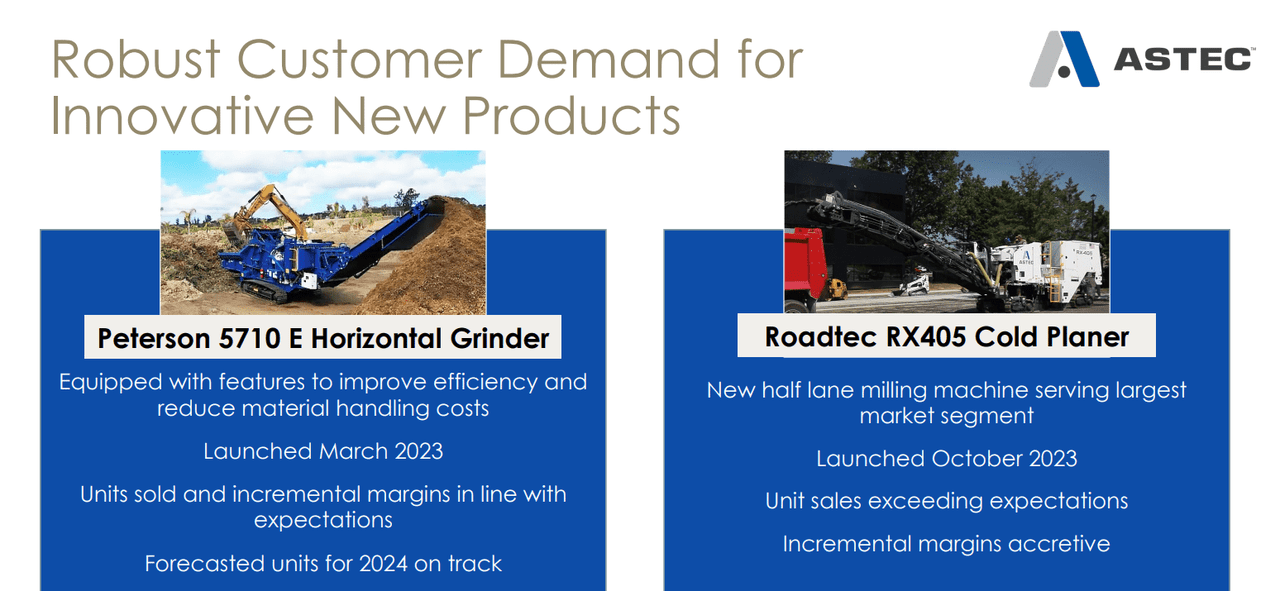

Astec reported a new Horizontal Grinder and the new RX405 Cold Planer, which were launched in 2023. In both cases, with units sold in 2023, Astec is expecting incremental margins and future sales in 2024. In my view, if the company is correct about the forecasts made, Astec may report higher net sales growth thanks to demand for these products.

Source: Quarterly Presentation

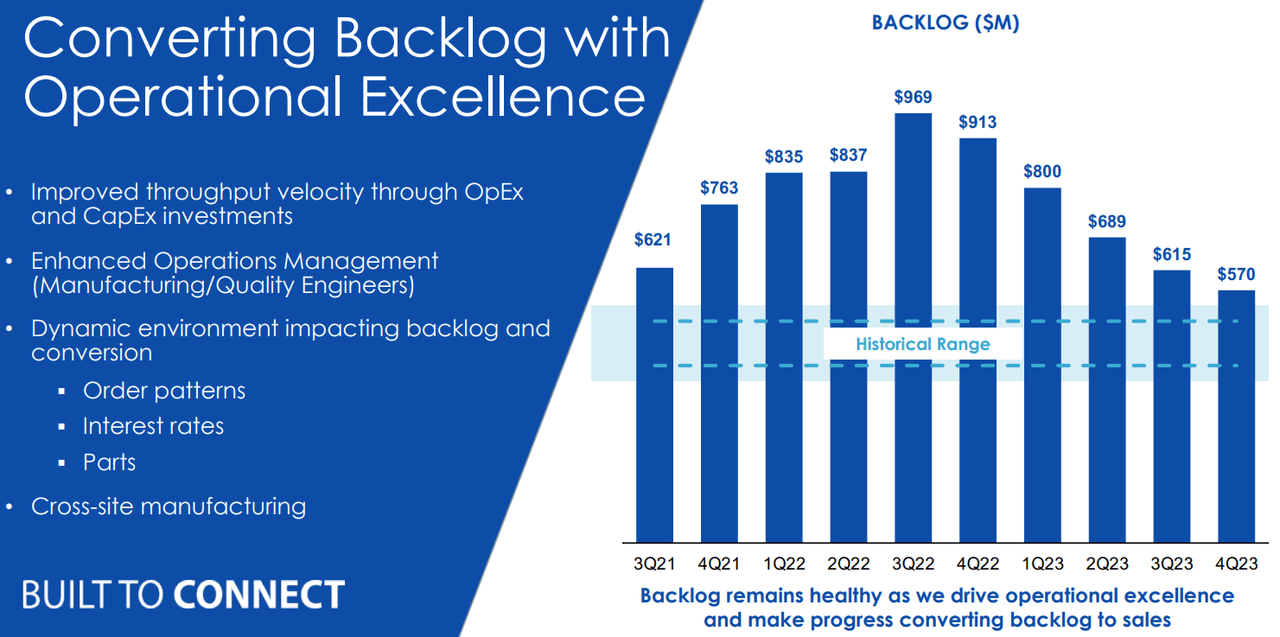

Astec also appears to be reporting beneficial order patterns, cross-site manufacturing efforts, and enhanced operations management. These efforts appear to be enhancing the backlog, which remains well above the historical range seen from 2021 to 2023.

Source: Quarterly Presentation

Restructuring Could Bring Financial Flexibility And FCF Margin Growth

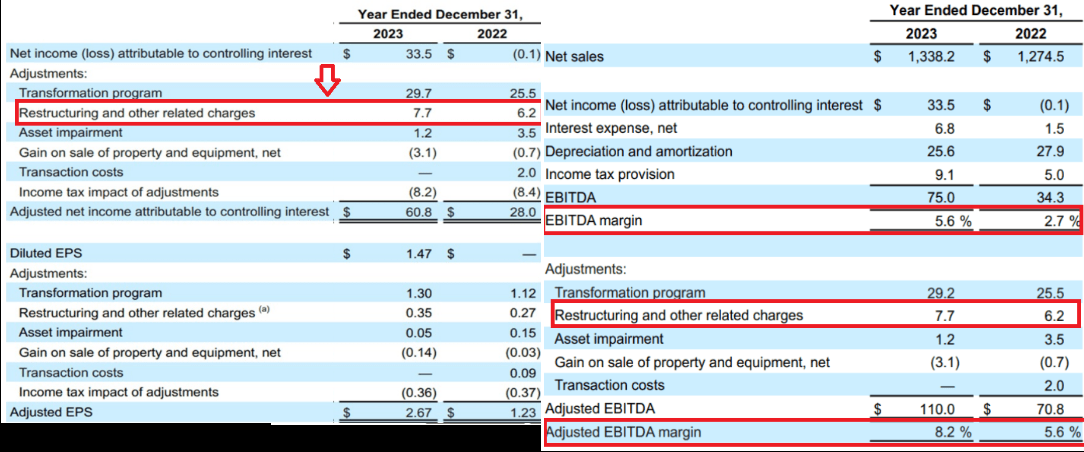

I believe that restructuring efforts could have a beneficial effect on future financial flexibility, FCF margin growth, and EBITDA growth. In this regard, it is worth noting that the EBITDA margin and the adjusted EBITDA margin increased significantly in 2023. The adjusted EBITDA margin increased from about 5.6% in 2022 to 8.2% in 2023.

Source: 10-k

The New ERP And Cloud-based Platforms Could Bring Financial Flexibility

Astec is launching a new ERP system that could bring significant transformation, leverage automation, and process efficiency in the coming years. As a result, I think that we could expect significant FCF margin expansion in the coming years.

This new ERP system will also provide for standardized processes and integrated technology solutions that enable us to better leverage automation and process efficiency, transforming how we connect people, products and processes to operate as OneASTEC. Source: 10-k

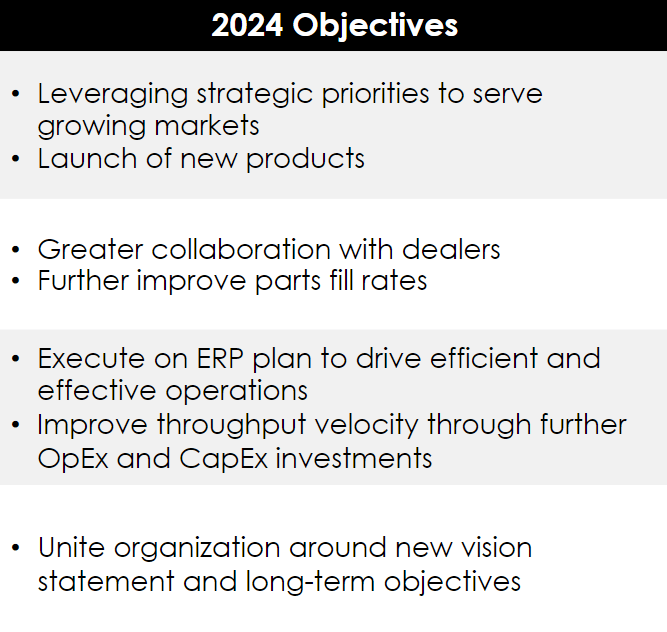

In addition, Astec launched a human capital resources’ module, converted the operations of one manufacturing site, and expects the implementation at additional sites in 2024 and 2025. In this regard, I would be expecting news in the coming years, which may bring acceleration in the FCF expectations from 2024. In a recent quarterly presentation, Astec noted that with new products expected for the year 2024, it expects execution on ERP plans in 2024.

Source: Quarterly Presentation

Best-Case Scenario

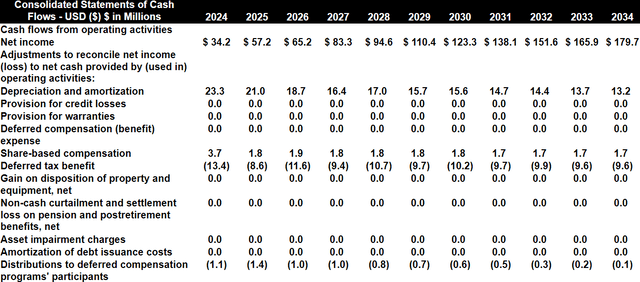

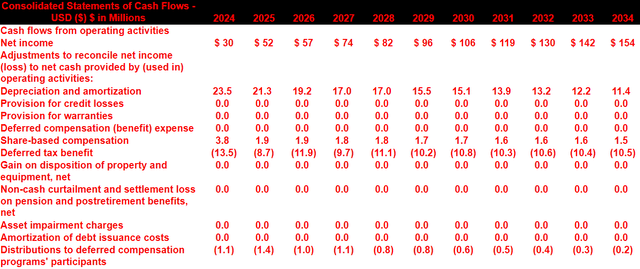

My assumptions include 2034 net income of about $179 million, with the following adjustments to reconcile net income to net cash provided by operating activities. First, I assumed 2034 depreciation and amortization of about $13 million and 2034 deferred tax benefit of -$10 million.

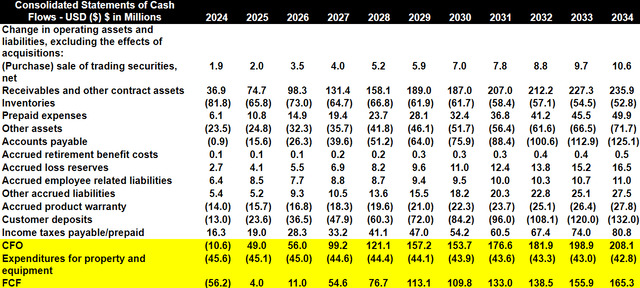

In addition, I included the following changes in operating assets and liabilities. 2034 changes in receivables and other contract assets are expected to be close to $235 million, with changes in inventories of about -$53 million, 2034 prepaid expenses worth $49 million, and changes in accounts payable of about -$126 million.

Besides, with accrued loss reserves worth $16 million, changes in accrued employee related liabilities of about $11 million, and 2034 customer deposits of -$133 million, 2034 CFO would be $208 million. Finally, with 2034 expenditures for property and equipment of about -$43 million, 2034 FCF would be $165 million.

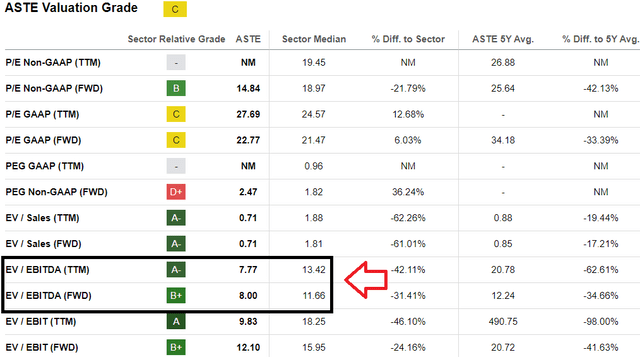

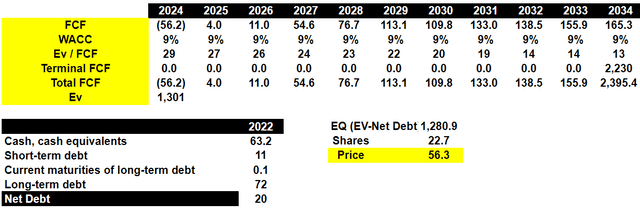

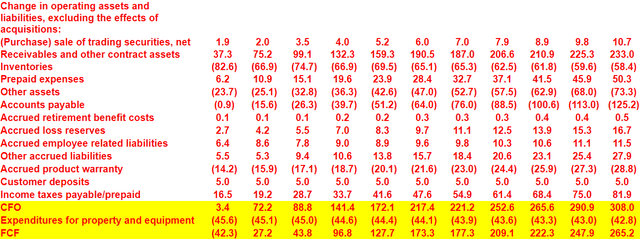

With a WACC of 9% and terminal EV/FCF of 13x, the implied EV would be close to $1.3 billion. I believe that my Ev/FCF multiple appears conservative. It is in line with the multiples reported by other competitors.

Besides, if we subtract net debt of $20 million, the implied equity valuation would be $1.2 billion, and the fair price would be $56.3 per share.

Bearish Case Scenario

Under this case scenario, I included the following assumptions. With 2034 net income of $153 million, I assumed 2034 depreciation and amortization of about $11 million and 2034 distributions to deferred compensation programs’ participants of close to -$1 million.

In addition, the changes in operating assets and liabilities, excluding the effects of acquisitions include 2034 sale of trading securities of about $10 million, receivables and other contract assets close to $233 million, inventories of -$59 million, and 2034 prepaid expenses of about $50 million.

Besides, with changes in accounts payable of close to -$126 million, 2034 accrued loss reserves worth $16 million, and accrued employee related liabilities of $11 million, I also included changes in other accrued liabilities of $27 million. Finally, with customer deposits of about $5 million, I obtained 2034 CFO of $308 million and 2034 FCF of $265 million.

Under this case scenario, I tried to use very conservative assumptions. First, I used a cost of capital of 15% and a terminal EV/FCF of 9.5x. The implied results include an enterprise value of $1 billion. Subtracting net debt and dividing by the share count, the implied fair price would be about $46 per share.

Risks

The company faces significant risks due to the cyclical nature of demand in the road construction and utilities sector. The variability in the volume and frequency of projects directly impacts the demand for durable equipment that the company markets.

Besides, the recent rise in global interest rates could discourage economic activity and affect the financial ability of customers to purchase new equipment. The company is also exposed to the risk of delays, cancellations, or reductions in purchases due to the inability of customers to obtain financing on attractive terms.

Competitors

National markets are highly competitive in price, service, and quality. Different segments face constant challenges. Although international competition is limited in the United States, except in track-mounted milling machines and crushers, in global sales, the company competes with foreign manufacturers.

Besides, according to the last 10-k, in asphalt and concrete road options, asphalt dominates resurfacing. Offering asphalt and concrete coating options, the company’s portfolio sets it apart from other companies. In terms of infrastructure solutions, it competes with leaders such as Asphalt Equipment Company, Ammann group, and ERIE Strayer Company, highlighting the diversity and quality of the products.

My Opinion

Considering the implementation of an ERP system in 2024 and 2025, significant restructuring efforts, and two new products in 2023, Astec could enjoy significant FCF margin growth in the coming years. Astec Industries stands out in the industry by offering a comprehensive range of equipment and solutions for road construction and various industrial applications. I believe that product diversification could bring lower net sales volatility than that reported by smaller competitors. The company faces risks due to the cyclical nature of the sector and the recent rise in interest rates. However, I believe that the company is a buy at its current price mark.