tadamichi

By Todd Jablonski, CFA, Chief Investment Officer & Global Head of Multi-Asset and Quantitative Investments

At the beginning of the year, we sat down with Todd Jablonski, Global Head of Multi-Asset and Quantitative Investments, to discuss his outlook for multi-asset markets in 2024, where he sees opportunities, and potential performance drivers.

Q: What factors will drive performance across markets in 2024?

The factors we are most concerned about in 2024 will move investors in a new direction. First, we are concerned about the pace of Federal Reserve (Fed) easing in 2024.

Many investors baked in expectations for easing, but it’s entirely possible the Fed could be a little late to deliver cuts. The second factor is valuations. While global equities, especially U.S. large caps, look expensive, there are plenty of valuation opportunities in mid- and small-caps and international equities.

And third is earnings delivery. In an environment where growth may still be accelerating, investors are looking for reliable fundamental performance.

If growth continues, and we avoid a recession, we believe sales growth, profitability, and earnings will point to winners in the stock market in 2024.

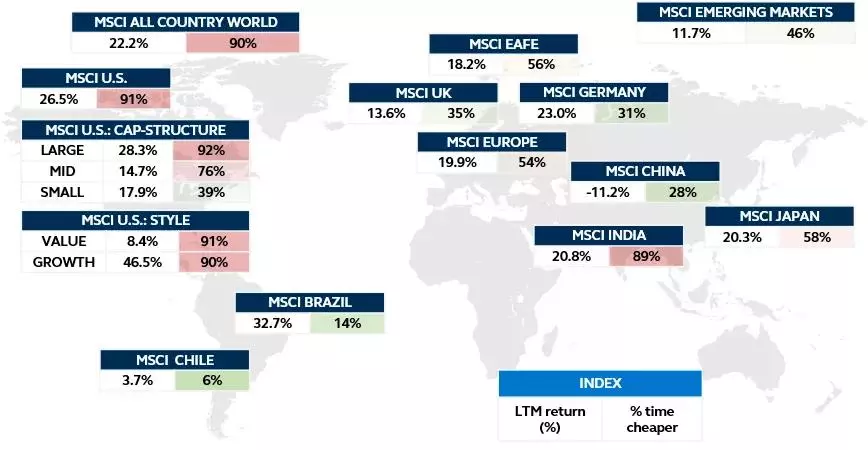

Global equity returns and valuations

Last twelve months returns and % times cheaper, MSCI indices

Source: FactSet, Bloomberg, MSCI, Principal Asset Allocation. LTM (last twelve months) returns are total return and in USD terms. % Time Cheaper is relative to PAA Equity Composite Valuation history. PAA Equity Composite Valuation is a calculated measure, comprised of 60% price-to-earnings, 20% price-to-book and 20% to dividend yield. Composite started in 2003. EAFE is Europe, Australasia, Far East. See disclosures for index descriptions. Data as of December 31, 2023.

Q: Where should investors add to their portfolios in 2024? Are there any specific asset classes or sub-asset classes that look particularly attractive?

Right off the bat, I’d recommend that investors rebalance their portfolios with a focus on freeing up capital to redeploy. One of the areas I’d send that newly freed-up capital to is equities.

There are good valuation opportunities in certain pockets of the equity asset class, especially around mid- and potentially small-cap acceleration. Additionally, I’d point toward credit, where investment grade is preferred.

We’ve seen some volatility around spreads in the more speculative space, so interest-rate-sensitive, higher-quality credit has the potential to add value and is an area we will be looking to add to in 2024.

Finally, I would recommend some lower volatility diversifiers in asset classes without a lot of risk, such as hedge funds and short-term credit.

Q: Many investors have recently moved away from the 60/40 portfolio, but you’re a proponent of it. Why are you a fan of the 60/40 portfolio for investors in 2024?

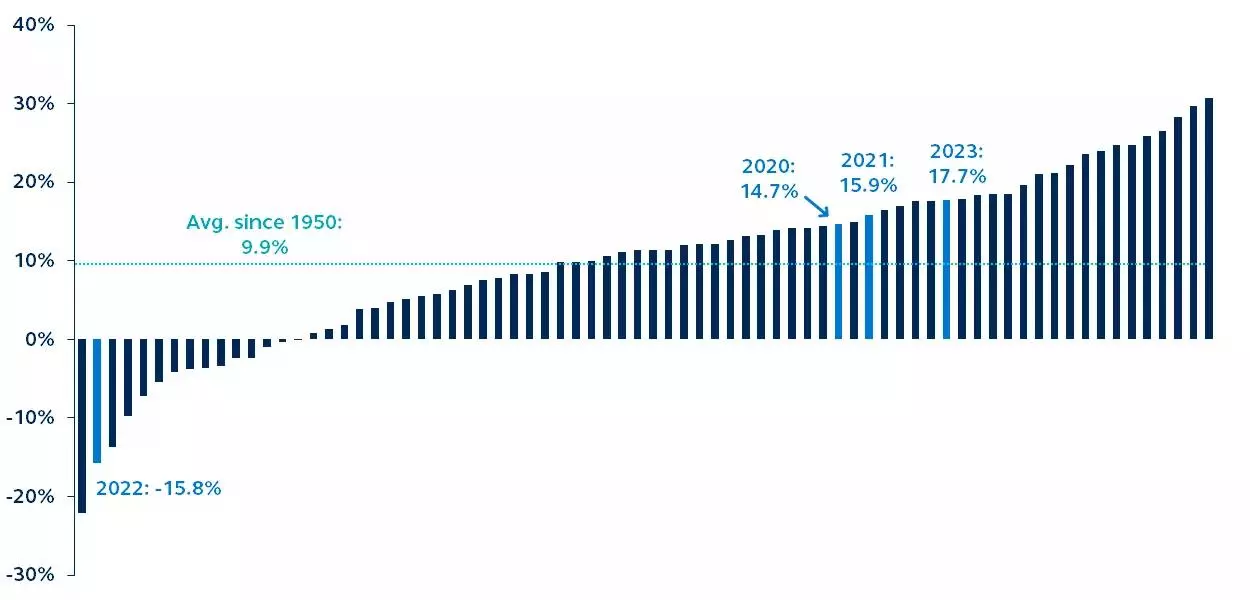

The 60/40 portfolio is an easy target for investors to pick on and claim weakness in the construct. However, the durable nature of the 60/40 simply keeps on working.

Going back a couple of years, the correlation between stocks and bonds began to rise, and many investors were worried it was the death of the 60/40 by not getting the correlation benefit.

However, that correlation has come back down. For the 60% equities, investors can find good valuations and strong fundamentals in a supportive economic environment.

On the 40% fixed income side, with or without a positive correlation, there is some stability in interest rate risk and owning some of the returns from spread risk.

Putting those two forces together, investors should be able to achieve a certain level of diversification, so as multi-asset strategies come, the 60/40 has the potential to be efficacious in 2024.

60/40 annual returns

1950–present

Source: Morningstar Direct, Principal Asset Allocation. Data as of December 31, 2023. From 1/31/1950 to 1/31/1980 the 60/40 portfolio was comprised of 60% S&P 500 TR USD/40% IA SBBI US IT Govt TR USD. From 1/31/1980 to 12/31/2023, once the Bloomberg U.S. Agg Bond TR USD return series was available, it was used in place of the IA SBBI US IT Govt TR USD for the fixed income index, thus the 60/40 portfolio was comprised of 60% S&P 500 TR USD/40% Bloomberg US Agg Bond TR USD.

Q: Some investors are looking to add another sleeve to the 60/40 approach, an alternative sleeve for example, to help add some diversification. Is that a good option heading into 2024?

I’ve seen investors take anywhere from 5%, 10%, and even up to 20% of a 60/40 portfolio and use it to achieve some sort of different implementation or diversification.

In certain environments, I think that makes sense, and I can see the reasons to look at real assets, income assets, and stability assets as a complement to a 60/40 portfolio at some point in 2024.

However, those alternative betas often lack the kind of return potential that you find in stocks and bonds, so I’d recommend investors consider a traditional 60/40 to start in 2024 and perhaps look at more modifiers and other diversification elements later in the investment horizon.

Q: Any final thoughts on how investors should prepare portfolios in 2024?

In 2024, discretion might be the better part of valor, meaning there’s a false choice for investors right now. The idea is that investors either need to prepare for an expansion by risking up their portfolios toward equities, high yield, and more volatile asset classes or prepare for contraction by looking to Treasurys and less volatile asset classes.

Our view is that you shouldn’t fall for that binary trap. Investors can prepare their portfolios for an outcome that allows for the room to participate in the upside of positive economic events, while also lowering standard deviation and protecting against risk during an uncertain investment environment.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.