Tie-up: Model Elle Macpherson for Boohoo brand Karen Millen

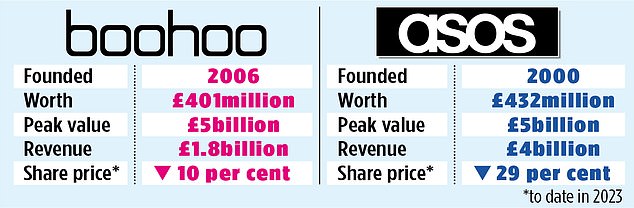

Hedge funds betting against Asos and Boohoo are quids in as shares in the beleaguered online retailers test new lows.

The two e-commerce groups, which pioneered the trend for fast fashion among younger customers, are currently the most ‘shorted’ shares on the stock market, meaning traders expect them to fall in value even further, new figures show.

More than 7 per cent of Asos shares – and over 6 per cent of Boohoo’s – are out on loan. Boohoo owns brands including Karen Millen.

It comes amid growing signs that sales at online-only companies may have peaked as customers return to the high street. Internet shopping boomed during the pandemic when lockdowns shut non-essential shops and working from home saw demand for new clothes, especially dresses and suits, fall off a cliff.

But the end of Covid curbs has seen a reversal of fortunes, with high street stalwarts such as Next and Marks & Spencer enjoying a significant revival.

These companies have been more successful at balancing online sales through apps and websites with having bricks-and-mortar stores.

Last week, Next increased its full-year profits guidance – its fourth such upgrade in six months – while Asos said it was mothballing a giant warehouse as sales slumped and losses spiral towards £300 million.

Experts say clothing retailers are having to adapt to the shifting behaviour of customers.

‘The way people shop has changed,’ said Tamara Sender, fashion and retail director at research group Mintel. ‘While there has been a shift back to visiting stores to buy clothes and footwear in the last year, heightened engagement with online has persisted.

‘People are using smartphones to check stock availability and compare prices whilst browsing in a physical store,’ she added. ‘Consequently, more retailers are moving towards a hybrid approach.’

Last month, online womenswear retailer Sosandar unveiled plans to open physical shops for the first time. The Aim-listed company noted that around 60 per cent of sales in the £55 billion clothing market are still in-store, with the rest online.

‘Our customers like shopping online and they like going to the shops so we’ve got to do both,’ said co-founder Ali Hall.

Investors remain unconvinced that its hybrid model will deliver returns.

Co-founder Julie Lavington said: ‘Our share price is the same as when we turned over £1 million – except now we’re turning over £40 million. It’s frustrating.’

Analysts say established retailers are well placed to benefit as shopping habits change. Next’s latest update noted that online sales had risen by 6.5 per cent in the three months to October compared to last year, while store sales dipped 0.6 per cent due to unseasonably warm weather.

Experts say it is too early to write off fast fashion. They point to the success of Shein, the controversial e-commerce retailer which last week snapped up fashion group Missguided from Mike Ashley’s Frasers Group.

Shein, which has been criticised for its treatment of workers in its Chinese factories, now enjoys UK sales of more than £1 billion. ‘It’s a phenomenon,’ added Lavington.