Bloomberg/Bloomberg via Getty Images

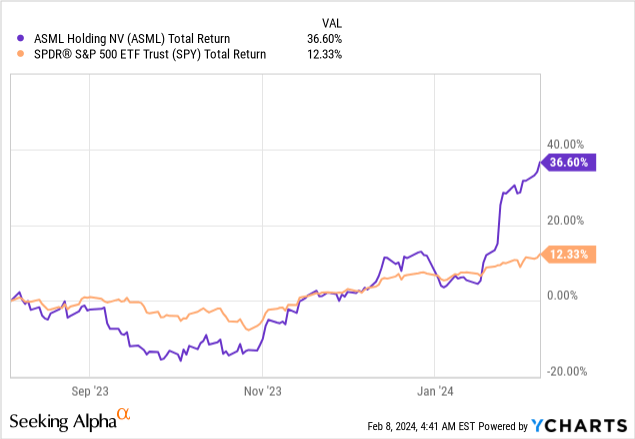

ASML Holding N.V. (NASDAQ:ASML) ended its fiscal year in remarkable fashion, beating the S&P after ASML did not deliver an outstanding return throughout its entire fiscal year. ASML has impressively beaten Wall Street expectations, and this is the guidance.

In August, I published an article titled “ASML’s Mixed Outlook: Near-Term Headwinds, Long-Term Promise.” In that article, I argued that ASML is a monopoly company with a strong long-term investment thesis, despite mixed results for the second quarter of 2023.

In my last article, ASML: Near-Term Headwinds Weigh On Q3 Results. I explained the Q3 highlights, and the headwinds that affected Q3.

Let’s dive into the company’s fourth-quarter results, see how my projection fared compared to the consensus, and find out if the investment thesis remains.

Investment thesis

I believe that ASML is a great investment for the long term. The company has a strong track record of growth, and it is well-positioned to benefit from the growth of the semiconductor market. However, I believe that the company’s valuation is currently somewhat stretched, and I would recommend a Hold rating until the company’s near-term challenges are resolved.

Background

In August, I began to see a recovery in ASML’s performance. However, up until the fourth quarter results were released, ASML’s returns were quite similar to those of the (SPY) and did not outperform it.

Now that it’s been observed that ASML outperformed the S&P 500 in the fourth quarter, it’s crucial to examine the factors that led to this achievement and whether they are sustainable. Additionally, it’s important to investigate the reasons behind the 10% rise in ASML’s stock price following the release of their financial results.

Q4-23 Highlights

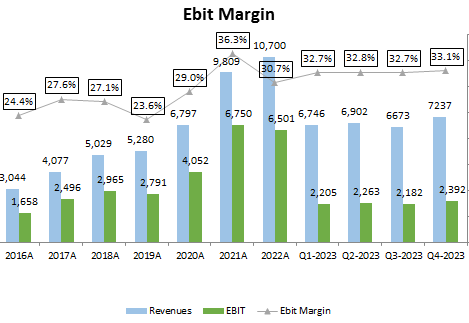

In Q4-23, ASML’s consolidated revenue stood at €7.2 billion, indicating a 12.6% YoY growth. For the entire 2023, it reported a revenue of €27.5 billion, up 30.2% YoY. Interestingly, the EUV system sales witnessed a remarkable growth of 30%, which can be attributed to the high demand for Lithography machines from the previous year.

ASML’s monopoly in the market is due to its edge in producing EUV lithography, which is a significant advantage as there are no other companies that currently offer this technology. If we analyze the details, we can understand how this advantage contributes to their leading position in the industry.

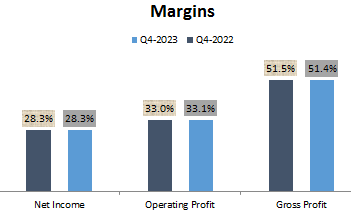

Margins (This analysis is based on data sourced from official Asml financial documents)

Our customers across different market segments are currently more cautious due to continued macroeconomic uncertainties, and therefore expect a later recovery of their markets. Also, the shape of the recovery slope is still unclear.

Peter Wennink, CEO, Q2-2023 Press Release

The company anticipates a small decline in demand soon. This is due to macroeconomic uncertainty and a recovery that is slower than expected. But, in my view, as a monopoly company with a high pricing power and strong demand, I want that the company to manage its costs and raise the prices for its products, which did not happen.

In my previous publication regarding ASML, I informed you that the company’s management has acknowledged the imminent decline in demand. Despite this, we can observe that the company has a strong competitive advantage through its wide moat. One of the ways this is evident is by looking at the company’s consistent margins, which have been maintained at a range of 32% to 33%, as demonstrated in the graph below.

Ebit Margin (This analysis is based on data sourced from official Asml financial documents)

Despite the current unsettled macroeconomic conditions and a gradual recovery rate, ASML has managed to maintain its margins without any significant decline. This is a testament to the robustness of their moat and speaks volumes about the company’s ability to weather tough times.

Outlook

Based on different market scenarios1 as presented during our Investor Day in November 2022, we modeled an opportunity to reach annual revenue in 2025 between approximately €30 billion and €40 billion, with a gross margin between approximately 54% and 56% and in 2030 an annual revenue between approximately €44 billion and €60 billion, with a gross margin between approximately 56% and 60%

As per the latest update from ASML’s management, the company is expected to maintain its positive guidance in the foreseeable future, primarily due to the robust demand for its lithography machines. ASML remains at the forefront of the semiconductor industry as the leading supplier of advanced lithography systems, which are essential for the production of high-performance computer chips.

Valuation

I conducted a valuation of ASML using a DCF methodology. In my assessment, I projected a CAGR of 11% for the company’s revenue from 2024 to 2031, taking into account its monopoly position and high pricing power. Furthermore, I estimated a 2.4% FCF yield for the 2025 exit.

ASML’s Fwd PEG ratio currently stands at 2.22x, which is a tad high, indicating the presence of high near-term concern. Although ASML witnessed a 10% upside jump after earnings, I still believe it to be a worthwhile long-term investment. Although ASML is going to face some demand problems, it is still expected to perform well in the long run. However, in the near term, it may not perform better than SPX.

Risks

It’s crucial to acknowledge potential risks that could impact my thesis:

Macroeconomic headwinds: The ongoing global economic uncertainty, inflation, and potential recession could dampen demand for semiconductors, impacting ASML’s sales and profitability.

Technological advancements: Although ASML holds the current edge in EUV technology, competitors may develop alternative lithography solutions or catch up in EUV development, eroding ASML’s monopoly power.

Geopolitical risks: Trade tensions and disruptions in key markets, particularly China, could pose challenges for ASML’s supply chain and customer base.

Execution risk: Failure to meet production targets, delays in technological advancements, or mismanagement could negatively impact ASML’s performance.

Conclusion

ASML navigated a challenging year to emerge as a winner in the fourth quarter, outperforming the S&P 500 and exceeding expectations. Its monopoly in EUV lithography remains a strong moat, reflected in consistent margins despite macroeconomic headwinds. While a near-term demand slowdown is anticipated, the company’s long-term outlook remains bright, with potential for significant revenue and margin growth.