Gold has long been considered the ultimate safe haven asset. When things go horribly pear shaped in the world – be it a financial crisis or geopolitical confrontation (war, or the threat of it) – it is the asset that investors turn to and often reap rich rewards from.

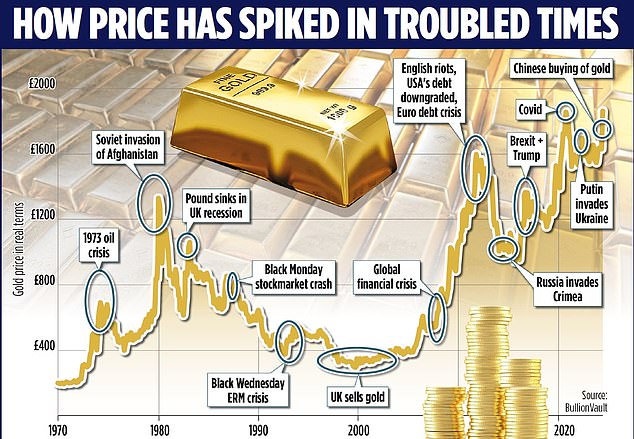

Look at a gold price chart spanning the last 54 years (adjusted for UK inflation) and you can clearly see the various spikes triggered by world crises: for example, the 1973 oil crisis, causing petrol prices in the UK to rocket skywards; the Soviet invasion of Afghanistan in late 1979; the banking crisis of 2008; and Russia’s invasion of Ukraine more than two years ago.

This year, the gold price has been rising again, both in dollar and pound terms. Its sterling price, expressed in pounds per troy ounce, now stands at around £1,889, compared to just above £1,624 at the start of the year. An increase of more than 16 per cent.

To put this figure into perspective, the FTSE100 Index, the barometer of the stock market performance of the biggest companies listed in the UK, has risen by around 9 per cent over the same period (and in the process has hit a series of new record highs).

Strangely, in City circles, most of the recent investment talk has all been about the booming UK stock market, not gold. The resurgence of gold has largely gone under the radar.

Maybe it’s because it is telling us something that we don’t necessarily want to hear – namely that the world is becoming increasingly dangerous and that the West may at some stage in the next few years be dragged into conflicts bigger than any it has faced since the ending of the Second World War in 1945.

As the head of the British Armed Forces, Admiral Sir Tony Radakin, said on Wednesday, ‘simmering tensions’ across the world ‘are coming to the boil’.

The buoyant gold price this year is not a reflection of a massive surge in UK investor interest – although the latest data from online bullion marketplace BullionVault indicates that last month there was strong demand in the UK from a mix of existing and first-time investors. Both Chinese and Indian households also continue to love their gold. No, it is more to do with the beasts in the east: China and Russia.

Take the People’s Republic of China. Since late 2022, it has been quietly filling its boots with gold (18 successive months of net purchases).

In other words, its thirst for gold has driven up demand – and according to the basic economic laws of supply and demand, that means ever higher prices. China’s official data shows it has amassed a gold stockpile worth more than $170 billion (£135 billion).

At the same time, it has been busy disposing of its official holdings in US Treasury Bonds – $400 billion worth since 2021. These moves have been interpreted by some experts as signs that China is building a war chest in the event of a massive fallout with the United States over Taiwan – an island that China views as its own territory and which the US has promised to protect if there is an invasion from its near neighbour across the Taiwan Strait.

Jonathan Eyal, associate director of the UK-based defence think-tank the Royal United Services Institute (RUSI), sits in this camp.

Last month, he described China’s relentless purchasing of gold as a ‘political project which is prioritised by the leadership in Beijing because of what they see is a looming confrontation with the United States’. Ominously, he added: ‘Of course, it’s connected also to plans for a military invasion of Taiwan’.

While some have accused RUSI of scaremongering (its backers, after all, are defence-orientated companies which do best when governments are spending money on boosting their military arsenals), the fact is geopolitical tensions in the world are higher than they have been for a while.

And for all the soothing words coming from President Xi Jinping in his recent meeting with President Emmanuel Macron in France, they are not going to go away.

In theory, that means that the gold price, not far off record highs, could go even higher. It’s a view that Adrian Ash, director of research at BullionVault, shares.

He says: ‘Anyone looking for a short-term spike in gold prices has probably missed it for now. But the fact remains that both China and Russia have been – and are – buying gold in the open market and very probably from their own domestic output too. They are also implicated in small scale gold mining camps across Africa and South America.

‘They are far from alone in growing their country’s gold reserves as a way of trying to sidestep – or prepare for – Western financial sanctions. This buying should support the gold price.’

And of course, the gold price thrives on adversity. So, as long as pariahs such as Putin and North Korea’s Kim Jong Un threaten the world order with their missiles, Xi Jinping craves Taiwan, and the West grapples with a mix of high interest and indebtedness, gold should continue to shine.

Building your own gold war chest

Most – but not all – investment experts say that gold should be bought as part of a diversified investment portfolio. Its main role, they say, is as a counterpoint: doing well when other assets are faltering and vice versa.

It’s a traditional asset allocation view which Dzmitry Lipski, head of fund research at investment platform Interactive Investor, expounds. He says that between 5 and 10 per cent of an investor’s wealth in gold ‘is a good rule of thumb’. Wealth is defined as investable wealth – so excludes the family home and any company pension.

Spread the risk: Most investment experts say that gold should be bought as part of a diversified investment portfolio

Lipski also says that investors should take a long-term view – and hold gold for at least three or five years. Trying to time the market, he says, can result in investors missing out, because price surges can be sudden – as can price falls.

Lipski is right up to a point. More than any other asset, it is sentiment that drives the gold price higher or lower. Financial anxiety and geopolitical stress push it higher while the opposite drive it lower. Sentiment can change rapidly, catching out investors.

Yet the performance numbers don’t overwhelmingly back the long-term investment approach that Mr Lipski and plenty of other authoritative financial experts espouse.

Annual return figures crunched by BullionVault indicate that holding gold long-term adds little sparkle to the overall returns generated by a diversified portfolio.

For example, over the past 50 years, a portfolio invested 60 per cent in equities (split equally between UK and global stocks) and 40 per cent in bonds (half UK gilts, half corporate bonds) would have generated an annual return of 5.6 per cent net of inflation.

If 10 per cent of this portfolio had been invested in gold, (so 10 per cent gold, 54 per cent equities and 36 per cent bonds), the annual return would have been the same. If gold had represented 20 per cent, the annual return would have been marginally lower at 5.5 per cent.

Admittedly, gold improves overall annual returns over both 10 and 25 years. So over 10 years, the respective annual returns are 3.5 (no gold), 3.7 (10 per cent gold) and 3.9 per cent (20 per cent gold). Yet the added value is marginal. Over 25 years, the numbers are 3.6, 4.1 and 4.5 per cent.

Some investors would be perfectly happy with these marginal extra gains generated from holding gold. Indeed, BullionVault’s Ash says many of his company’s clients first opened their accounts either during the financial crisis of 2008 or in the 2020 pandemic.

But an alternative approach is for investors to manage gold holdings more aggressively. That means absorbing research from analysts on where the gold price is heading, keeping a keen eye on the news – and increasing or decreasing holdings accordingly. It requires an investment in time and decisiveness.

What are the experts saying about gold?

On the up: Most analysts are bullish about the prospects for the gold price

Most analysts are bullish about the prospects for the gold price in the coming months. Their forecasts are made in dollars, not pounds.

Last month, Goldman Sachs upped its price target for gold by the end of the year from $2,300 to $2,700 per ounce – the current price is around $2,315. So, an anticipated increase of more than 16 per cent.

Among the factors it says that support a higher price is the buying of gold by central banks, uncertainty caused by the impending US elections and the ‘fear’ of possible financial and monetary chaos in the United States.

Bank of America is even more optimistic. Michael Widmer, the bank’s commodity strategist, says the price could hit $3,000 by next year, especially if interest rates start coming down in the United States, making non-interest paying gold more appealing to US buyers against interest paying assets such as cash. If correct, this would imply a 30 per cent gain.

The boldest prediction is from Swiss Bank, which says the gold price could nearly double to $4,000 in the next two to three years.

The most cautious is Swiss bullion refiner MKS Pamp which recently increased its 2024 price forecast from $2,050 to $2,200, with a possible price range from $2,000 to $2,475.

Robert Crayfourd, a commodities and metals fund manager at CQS (part of Manulife), is in no doubt that investors should be increasing their exposure to gold. He says that with demand for gold from central banks remaining ‘strong and sticky,’ any increase in buying from US investors could ‘add a few hundred dollars to the gold price’.

The best strategy… and the danger signs

Ensuring your investment tracks the gold price is essential if you want to take advantage of the kinds of gains forecast by leading analysts (this rules out gold investment funds).

This can be done in two ways – through a gold exchange traded fund, listed on the UK stock market, or buying gold through an online marketplace such as BullionVault that then holds it on your behalf.

The leading gold exchange traded fund is iShares Physical Gold (market ticker SGLN) which has total annual charges of 0.12 per cent. It can be bought through all leading investment platforms – the likes of Hargreaves Lansdown and Interactive Investor.

BullionVault levies a buying and selling charge of 0.5 per cent. There is also a monthly storage charge. For an investment of £7,500, it would charge £37.50 initially and then an annual charge of £39.

The warning bells that scream: ‘sell!’

Signals suggesting it may be time to bank any gains made include: an easing of geopolitical tensions (for example a peace deal struck between Ukraine and Russia); signs that the United States is prepared to tackle its budget deficit and ballooning debt; and a correction in the US equity market, making equities look more attractive against other assets such as gold.

How much should I commit to gold?

This is a decision for you – and you alone. As guidance, BullionVault customers have on average 15 per cent of their wealth in gold (the average holding is £8,500) – while the central banks of the United States, Germany and Italy hold around 65 per cent of their assets in gold.

This suggests the traditional asset allocation model (between 5 and 10 per cent) is underselling gold’s shine.

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.