Papatsorn Khunsaard/E+ via Getty Images

Human life is but a series of footnotes to a vast obscure unfinished masterpiece. ― Vladimir Nabokov

Today, we put clinical-stage biotechnology company Arvinas, Inc. (NASDAQ:ARVN) in the spotlight. The stock has seen a huge jump in its price over the past four months. Part of this is due to rebound in the overall market over that time. A lot of the move has also been powered by favorable news flow around the company’s lead drug candidate in its pipeline. Can the rally continue? An analysis follows below.

Company Overview

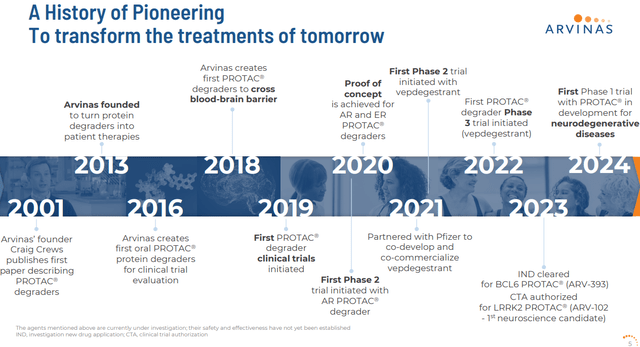

February 2024 Company Presentation

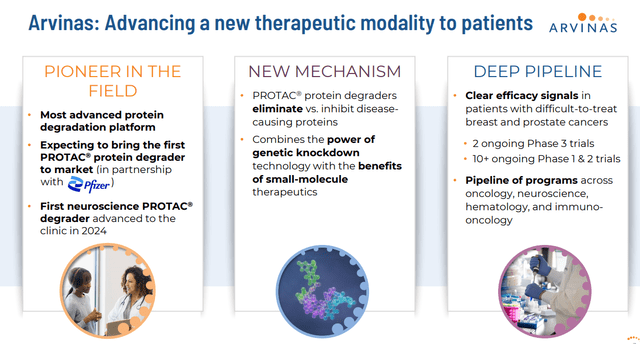

Arvinas, Inc. is headquartered in New Haven, CT. This small-cap concern is focused on the development and eventual commercialization of therapies to degrade disease-causing proteins. The stock currently trades for just over $47.00 a share and sports and a market capitalization just north of $3.2 billion.

February 2024 Company Presentation

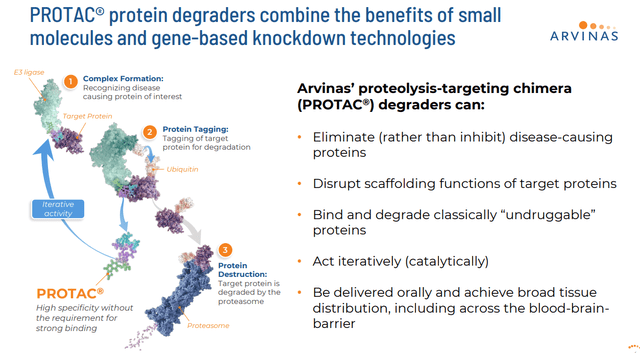

The company’s developmental approach consists of using its proprietary PROTAC® protein degraders to harness an individual’s own natural protein disposal system to degrade and remove disease-causing proteins.

February 2024 Company Presentation

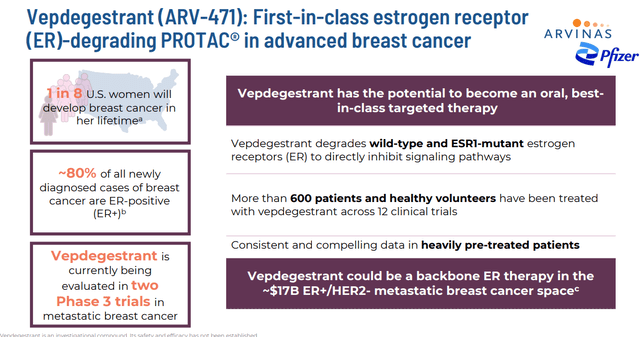

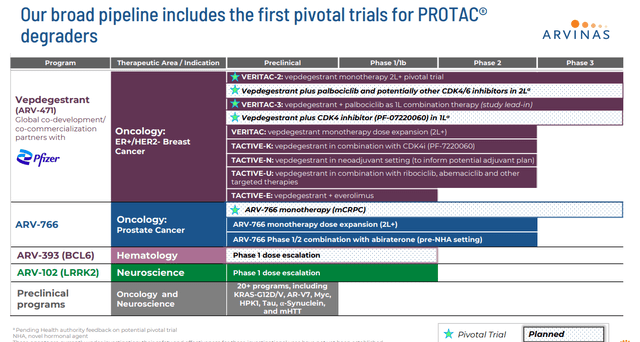

Using this method, Arvina has produced a pipeline with several candidates currently being developed. The company’s primary drug candidate is called vepdegestrant. This compound is an estrogen receptor [ER] targeting PROTAC® protein degrader. Vepdegestrant also is known as ARV-471.

February 2024 Company Presentation

It is currently being evaluated to treat individuals with locally advanced or metastatic ER positive / human epidermal growth factor receptor 2 (HER2) negative (ER+/HER2-) breast cancer.

January 2024 Company Presentation

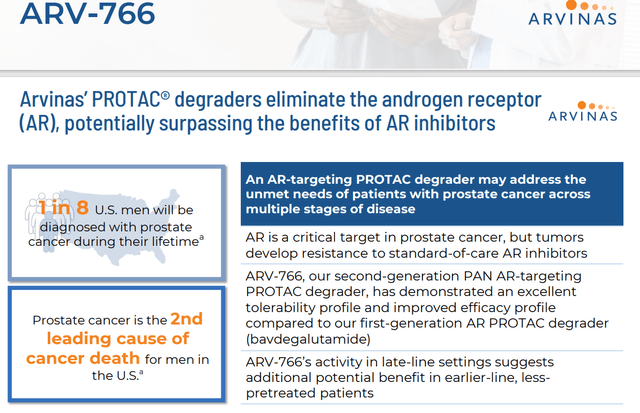

Also, in development within Arvinas’ pipeline are Bavdegalutamide or ARV-110 and ARV-766. These are androgen receptors targeting PROTAC® protein degraders. They are being evaluated to treat metastatic castration-resistant prostate cancer or mCRPC. The company is currently prioritizing the initiation of a Phase 3 trial with ARV-766 evaluating it to treat mCRPC. Management plans to meet with the FDA around the design of a Phase 3 study sometime in the second quarter. Enrollment in a Phase 2 dose expansion study is ongoing, and Arvina expects to have PFS data around the middle of this year. As can be seen above, the company has some earlier stage candidates in development that will not be germane to this analysis.

February 2024 Company Presentation

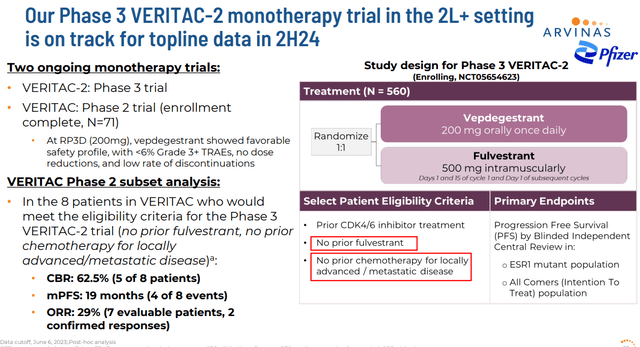

Recent Developments

Currently, Arvinas has two ongoing Phase 3 trials, VERITAC-2 (second-line setting) and VERITAC-3 (first-line setting). These studies are evaluating ARV-471 as both a monotherapy and in combination with CDK inhibitor IBRANCE from Pfizer (PFE) which is the development partner for ARV-471. As part of this partnership deal, Pfizer made a $350 million equity investment in ARVN. Arvinas also received $650 million in a one-time upfront payment. The company was also eligible to pocket a potential $1.4 billion in milestone payments. Profits and costs are to be shared 50/50 globally between the two companies as well.

This combination received Fast Track status from the FDA early in February of this year. Two months earlier, the stock of ARVN jumped as interim data from a Phase 1b trial evaluating this combination therapy were disclosed. The therapy recorded a PFS (progression-free survival) rate of 11.1 months with a 42% ORR (overall response rate).

February 2024 Company Presentation

Enrollment for VERITAC-2 should be completed sometime in the second half of this year. Initial data from the monotherapy portion of this study should be out before the end of this year. Enrollment for VERITAC-3 is ongoing. Management did not put a timeline around completion of enrollment in this study during its last quarterly conference call. Management also noted during its fourth quarter press release that:

Pending further data and discussions with regulatory authorities, the expanded development plan for vepdegestrant will include a new Phase 3 trial in combination with CDK4/6 inhibitors in the second-line setting and a new Phase 3 trial of vepdegestrant plus Pfizer’s novel CDK4 inhibitor in the first-line setting.

Analyst Commentary & Balance Sheet

Since Arvinas posted its Q4 numbers on February 27th, seven analyst firms including Barclays, Wedbush and Piper Sandler have reiterated/assigned Buy/Outperform ratings on the stock. Three of these have upward price target revisions. Price targets proffered range from $59 to $90 a share. Goldman Sachs initiated the shares as a new Buy on February 1st with a $70 price target. Goldman’s analyst stated one of the reasons for this new initiation was that ‘Arvinas could be a potential M&A target for companies looking for late-stage cancer drugs, the clinical profile of vepdegestrant, and the company’s PROTAC protein degrader platform‘.

Just over 15% of the outstanding float in the shares is currently held short. Four insiders sold nearly $500,000 worth of equity in recent days. It was the first insider activity in the stock since August of last year. That said, existing shareholders did sell over 16 million shares via a private placement late in 2023. Arvinas ended the fiscal 2023 year with north of $1.25 billion in cash and marketable securities on its balance sheet. Management has stated this is sufficient to fund all planned activities into 2027.

Verdict

Arvinas is well-funded, is well-thought in the analyst community and has a solid strategic partnership with drug giant Pfizer. There is a lot to like about this story. However, the stock has more than tripled since late October. In addition, potential commercialization is some ways down the road. Sign off on the design of the Phase 3 trial for ARV-766 to treat mCRPC, Phase 3 enrollment completions for ARV-471 and initial data for the monotherapy arm of VERITAC-2 are the remaining significant milestones for 2024.

Given all of the above, I would probably wait for the stock to pull back below $40 before I would initiate a small ‘watch item’ position via covered call orders pending further developments. Outside a buyout from Pfizer, it is hard to see major news that could move the shares significantly higher in the coming months and the shares and the overall market seem ripe for some profit-taking.

You cannot change what you are, only what you do. ― Philip Pullman