zbruch

Overview

My recommendation for Arrow Electronics (NYSE:ARW) is a buy rating, as I believe ARW is in the early innings of recovery. Particularly, the inventory on ARW’s balance sheet has shown a significant decline sequentially, with unit volume declining both sequentially and annually. The growth outlook is also much better today than in 2023, as inflation has tapered, rates may be cut, and ARW benefits from its demand creation initiatives [DCI]. Management also remains laser-focused on returning capital to shareholders, which should serve as some form of valuation support.

Business

ARW sells a wide range of electronic products and parts to 85 countries across the globe. The business reports two key segments, namely: Global Components [GC], which distributes electronics components; and Global Enterprise Computing Solutions [GECS], which provides information technology solutions. 77% of the business comes from the GC business. ARW has six main targeted end markets: industrial/automation; healthcare/medical; consumer electronics; aerospace/defense; auto/transportation; and data centers.

Recent results & updates

ARW share price has faced severe pressure over the past year, falling from $147 to $109 today, which is mainly due to weak growth and margin expectations given the weak economy outlook and bloated inventory on the balance sheet. However, I believe ARW 4Q23 performance could be a potential signal that the worst is over. Revenue y/y growth has tapered down to -2%, the best it has ever been over the past 5 quarters, resulting in total revenue of $7.85 billion, which was in line with consensus. Gross margin also showed improvement over the past 2 quarters, coming in at 12.6%, which was a 40bps sequential improvement. ARW also did better than expected at the operating EPS line, coming in at $3.98, which was 7% above consensus.

At the topline, I expect ARW performance to improve in FY24 as it laps the weaker macro economy in FY23 and benefits from positive progress in its DCI. Although I cannot pinpoint the timing of macro recovery, on a year-over-year basis, 2024 is a much stronger year than 2023 given that inflation has come down a lot (though still sticky) and the interest rate outlook is a lot healthier (a rate cut is still possible this year vs. 2023). In terms of DCI, the initiative has been well-executed by management. In FY23, with the addition of engineering resources, demand creation revenue surpassed the broader portfolio. A larger benefit should be seen in FY24 as well, as management mentioned a growing pipeline made possible by customers’ ongoing product development.

As for the gross margin pressure situation, I believe it will eventually recover over the next 2 years, as the 4Q23 inventory figures suggest that ARW is in the first innings of inventory normalization. Specifically, while inventory remains elevated relative to pre-pandemic levels (FY19) at ~$5.2 billion, 4Q23 inventory declined significantly on a sequential basis, down 11% from ~$5.8 billion to ~$5.2 billion, which is the largest sequential decrease over the past 10 years. Inventory conversion data (book to bill) is also improving slightly, suggesting that ARW is able to wind down the backlog at a faster pace, which is positive for the progress in inventory normalization. I think an important distinction to make here is that the elevated inventory figure is on a dollar basis and not volume. Remember that COVID resulted in major supply chain challenges across the globe, leading to huge price increases. If we were to adjust for the pricing impact, ARW actually saw its inventories decline both sequentially and annually. The positive implication on gross margin is huge here because the inventory moving through from the balance sheet to P&L is going to come at a lower cost (first-in, first-out). This, coupled with the elevated pricing, should lead to gross margin expansion.

The other thing to point out about inventories is that our units were down in the quarter both sequentially and year-over-year. So part of the excess you’re still seeing is really a function of price versus a lot of inbound volumes. from: 4Q2023 earnings call

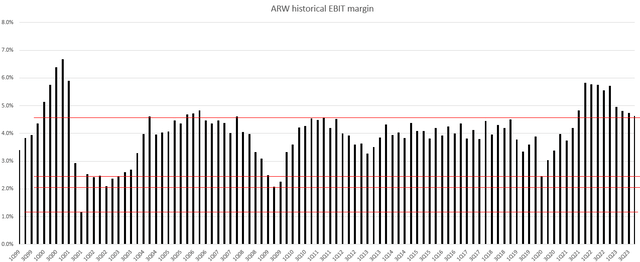

The improvement in gross margin/profits should flow down to the bottom line, as ARW has done an excellent job managing costs over the years, resulting in a structurally higher margin at every cycle. If we look at ARW historical EBIT margin, the lows of each cycle’s EBIT margin are higher than the previous one, and the same applies to this cycle.

The other thing I like about ARW is that management focuses on returning capital to shareholders. Despite the challenging macro environment, management maintained their capital allocation posture of actively returning value to shareholders. As of 4Q23, ARW has approximately $580 million remaining on their current share repurchase authorization, which translates to ~10% of the current market cap.

Valuation and risk

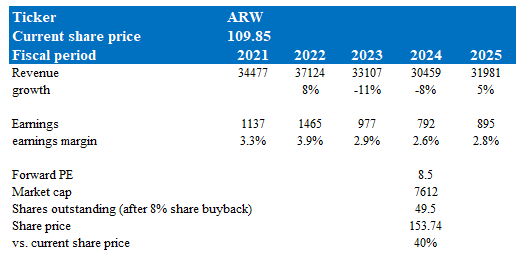

Author’s valuation model

According to my model, ARW is valued at $153, near where it was back in July 2023. This target price is based on my growth forecast of -8% in FY24, 5% growth in FY25, a net margin of 2.8% in FY25, and a forward PE valuation of 8.5x.

As I stated earlier, FY24 should benefit from a better economy, further progress in DCI, and an easier comp relative to FY23. However, I do not expect an immediate recovery back to positive growth yet, as management’s 1Q24 revenue guide ($6.7 billion to $7.3 billion) suggests 1H24 is going to remain weak. I expect ARW to return to positive growth in FY25, as ARW has never gone through more than 2 years of negative growth. I modeled mid-single digits (5%) growth as that has been the average growth rate between FY13 and FY18 (before the decline in FY19). Margin wise, I expect the inventory normalization to accelerate in FY24, which should drive all the elevated-pricing inventories through the P&L, thereby pressuring near-term margins. As the inventory situation normalizes and revenue recovers in FY25, margins should recover accordingly. As FY25 is the first year of recovery after this cycle, I am being conservative by assuming earnings margins will recover to just slightly below FY23 levels.

ARW is currently trading at 8.5x PE, which is near the average, and I believe this is a fair multiple as the ARW inventory situation has shown signs of easing, and the growth outlook is much better today vs. last year (where it traded at near the low end of its valuation range). Also, some discount is warranted relative to the average until ARW shows in its results that growth and margins are back to positive expansion levels.

The downside risk here is that it is hard to predict the exact timing and shape of the next upturn. It could take longer than I expected, which means growth and margin recovery may not happen in the near term. Prolonged weakness could cause the valuation to fall as the market resets expectations. In addition, if, for whatever reason, the inventory supply situation worsens, it could drive a reversion in industry pricing (negative impact), which will impact ARW performance.

Summary

I recommend a buy rating for ARW. Despite challenges in the macroeconomic environment, ARW has managed to reduce the elevated inventory sitting on its balance sheet, notably with unit volumes declining both sequentially and annually. The demand outlook also looks better this year, given progress in DCI and a better macro situation. While FY24 may still face headwinds, I anticipate a return to positive growth in FY25, as ARW has historically never gone through more than 2 years of negative growth. Risks include the uncertainty of the timing and shape of the next upturn, prolonged weakness, and potential disruptions in the inventory supply chain.