Phiromya Intawongpan

We were wrong about the ARK Innovation ETF (NYSEARCA:ARKK) when we covered the fund back in 2022 suggesting the high-growth and tech-heavy thematic strategy was poised to outperform. ARKK is down about 20% from that article publication date and we’ll admit it’s not one of our finer works.

While stocks did indeed rebound from what was then a period of historic volatility, ARKK remained a laggard through the past year and likely a disappointment to long-time investors.

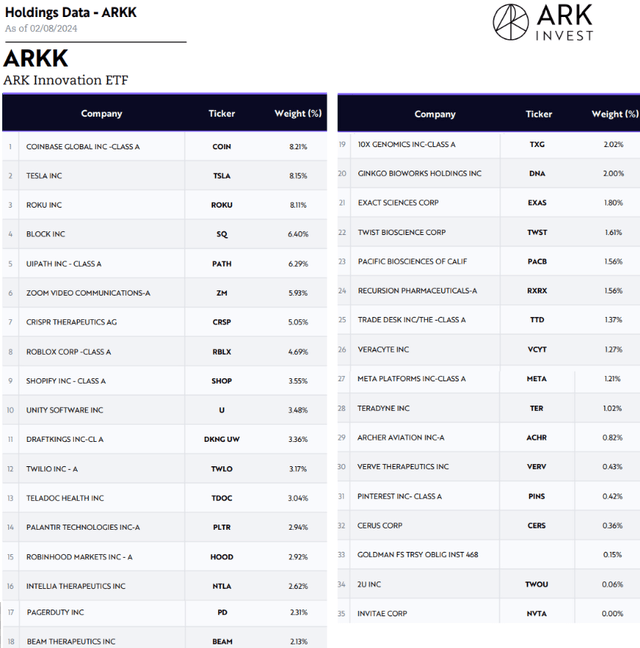

In many ways, we’ve witnessed something of a tarnished image for what was a reference point for actively managed funds, particularly in 2020 when it returned 154%. Fast forward, from several big ideas that have yet to materialize while missing out on other key developments, ARKK is approaching its 10th anniversary failing to deliver cumulative excess returns.

Ultimately, we’ve lost faith in ARKK’s portfolio positioning. While the strategy can still rally alongside the broader market and positive risk sentiment, we expect the fund to underperform benchmarks going forward.

What is the ARKK ETF?

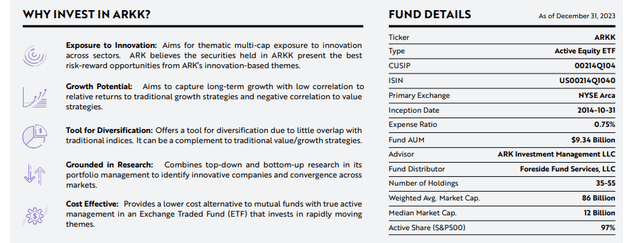

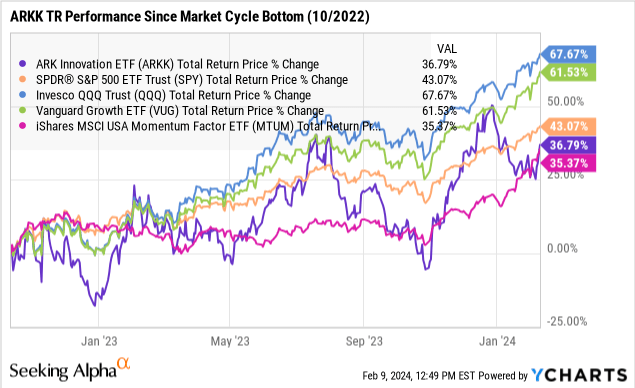

ARKK seeks to invest in companies the portfolio manager believes are leading through “disruptive innovation” with the potential to replace or enhance existing legacy solutions. Areas of focus include next-generation internet services, autonomous technology, synthetic biology, energy storage, fintech, and blockchain-related opportunities.

The plethora of buzzwords here is broad enough to encompass the universe of tech. There is flexibility in the security selection process to reflect the investment team’s outlook.

Going through the portfolio, there are familiar names between well-established large-cap as well as smaller emerging companies.

Top holdings include names like Tesla, Inc. (TSLA), Coinbase Global, Inc. (COIN), and Roku, Inc. (ROKU), each with an 8% weighting. Down the list, we find smaller allocations to other high-profile stocks including Zoom Video Communications, Inc. (ZM), DraftKings Inc. (DKNG), Palantir Technologies Inc. (PLTR), and even Meta Platforms, Inc. (META). Biotech is also well represented.

The idea here is that each of these names is expected to capture a long-term tailwind of growth as the technologies they are developing, or the particular markets they have exposure to remain in the early stages of secular expansion.

ARKK Disappointing Performance

One of our original attractions to the fund was the thought that this relatively unique selection of stocks, many of which are not current constituents of broad market indexes, represents a distinct investment vehicle compared to many other alternative ETFs. It’s fair to say that ARKK is different from most other exchange-traded funds.

The mistake we made in early 2022 was to assume that ARKK’s tech-tilt and high-beta growth profile would be enough to lead higher as a new bull market emerged.

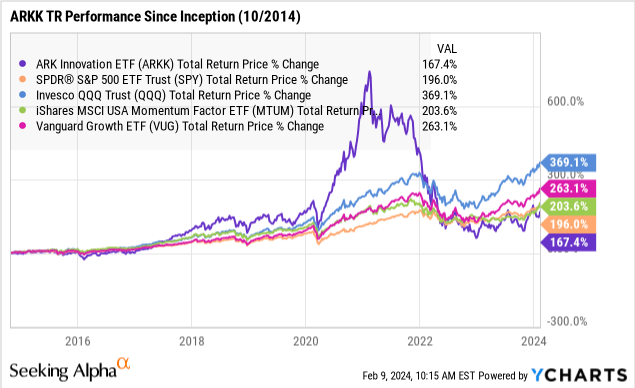

While the S&P 500 (SPY) is up 43% from its October 2022 cycle low, ARKK has lagged with a 37% return over the period. For investors seeking the “growth” factor, we can point out that a low-cost fund like the Vanguard Growth Index Fund ETF Shares (VUG) performed well over the timeframe, returning 61%.

As we see it, there’s no big secret to the current ARKK holdings. The majority of these stocks have been publicly traded for more than 3 years and don’t necessarily stand out as some undiscovered gem or under-the-radar opportunity.

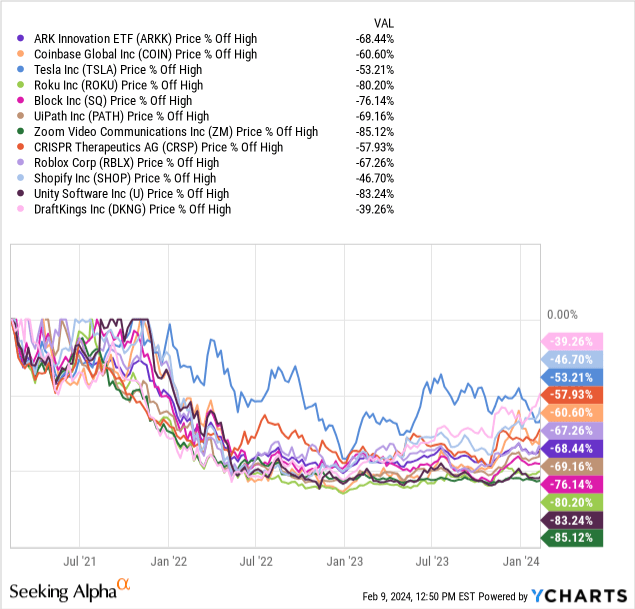

In many ways, the portfolio today looks like it was built at the height of the pandemic-era meme bubble, and never went through a rebalancing. While there have been changes, it’s mostly the same stocks carried over from the last cycle, with nearly all of the top 10 holdings down by more than -50% from their 2021 highs.

The performance of an active equity manager should be measured not only in the ability to find winners, but also in the prudence to manage volatility effectively, hedge, or exit positions in a shifting market landscape.

It’s fair to claim that beyond any daily or even yearly volatility, it’s still very possible the overall portfolio will recover with the understanding ARK considers these stocks as future leaders in decade-long trends. There are some stocks here where we are bullish from the current level, but it’s becoming harder to have confidence in the fund’s overall strategy given the record.

ARKK Missed Out on AI and GLP-1

One of the most disappointing developments when looking at ARKK is in consideration of its missed opportunity to think back at one of the biggest themes of tech in recent decades that started playing out in early 2023. We’re talking about the emergence of artificial intelligence as a major growth driver for chip stocks and many key software names that apparently didn’t make the cut as innovative enough.

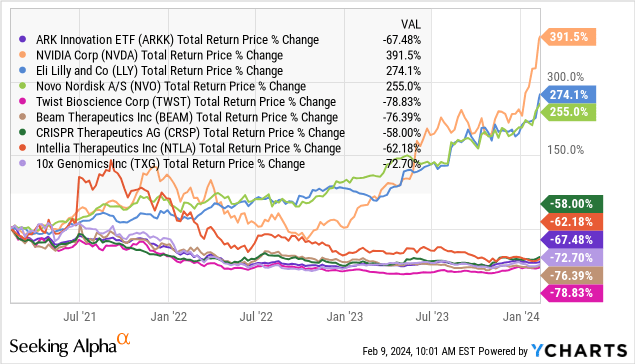

Notably, NVIDIA Corporation (NVDA) was a holding of ARKK in late 2022 while records show the position was mostly exited by Q2 last year ahead of NVDA’s historic 230% surge through 2023. Respectfully, being on the wrong side of one of the most historic tech rallies in history is almost inexcusable for a specialist in this field.

By that same line of thinking, it is also curious that ARKK did not get involved with the spectacular rise of “GLP-1 agonists” drugs, which have been seen as revolutionary in the treatment of diabetes and weight loss.

We would have liked to see names like Eli Lilly and Company (LLY) along with Novo Nordisk ADR (NVO) or related stocks in the portfolio. We believe there is a strong case that these two players, among the best-performing large-caps in recent years, are more interesting compared to the current biotech selection in the ARKK portfolio.

Final Thoughts

The stock market has kicked off 2024 with solid gains as a continuation of the 2023 rally. An environment of resilient economic conditions, declining inflation, and loom Fed rate cuts should provide a tailwind for risk assets as a general market consensus. From there, we believe the ARKK portfolio should benefit from that momentum.

At the same time, our base case is to expect ARKK will continue to underperform benchmarks like the NASDAQ-100 (QQQ) on a long-term time horizon.

We simply haven’t seen enough to believe the strategy is capable of beating the market long-term, or that it makes a compelling alternative compared to more vanilla indexed-growth and tech ETFs.

In hindsight, maybe the biggest weakness of ARKK is that it attempts to do too much, which ends up missing the mark in terms of a unified core strength. On this point, the other funds of the same ARK family such as the ARK Fintech Innovation ETF (ARKF), ARK Autonomous Technology & Robotics ETF (ARKQ), or ARK Genomic Revolution ETF (ARKG) may be a better option to complement a diversified portfolio for a more targeted thematic exposure.