Bim

Investment Thesis

Aris Water Solutions, Inc. (NYSE:ARIS) is a water handling and recycling solutions provider headquartered in Houston, Texas. In this thesis, I will analyze its third-quarter results along with its future growth prospects. I will also be analyzing its valuation at the current price level and the upside potential in its stock price. It experienced a significant increase in revenues and an improvement in operating and net profit margins. The organic growth in the revenues and a favorable valuation compel me to assign a buy rating for ARIS.

Company Overview

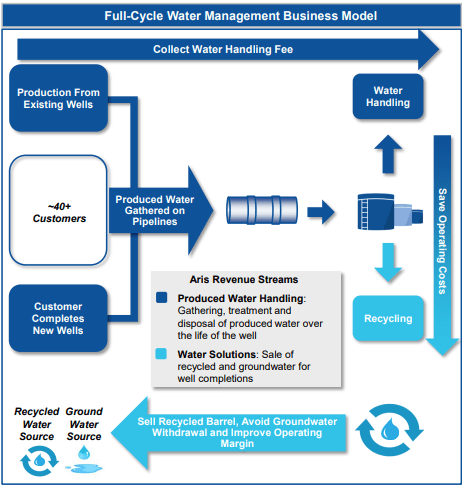

ARIS is an environmental infrastructure and solutions company playing a critical role in providing sustainable solutions for water management in the oil and natural gas industry. Its business can be segregated into two segments: Produced Water Handling Business and Water Solutions Business. The Produced Water Handling segment includes gathering and transporting produced water. This involves the collection and transportation of water that is produced as a byproduct of oil and natural gas extraction. It is also involved in the handling of produced water. This may include various processes and technologies to manage and treat the water before further use or disposal. Under its Water Solutions segment, it operates recycling facilities designed to treat, store, and recycle produced water. These facilities likely employ advanced technologies to purify and reuse the water, contributing to sustainable water management practices.

Investor Relations ARIS

Q3 FY2023 Result

ARIS reported solid third-quarter results, beating the market revenue and EPS expectations by 3.80% and 19.86%, respectively. The Produced Water Handling segment proved to be the outperformer, with a significant 17.2% growth in revenues. As per my analysis, the growth in the oil industry due to the high demand for energy globally has resulted in increased water requirements by companies including ConocoPhillips, Chevron, and ExxonMobil, which are the top clients of ARIS. The higher demand for water solutions is reflected in the increased volume processed by the company. The total volume of water processed by ARIS in Q3 was reported at 1.5 million barrels/day, up 7% compared to the same quarter last year.

It reported total revenue of $99.8 million, an increase of 10% compared to $90.7 million in the same quarter last year. As I mentioned earlier, the primary revenue driver was the water handling segment, with an increase of 17.2% in revenues at $75.6 million, compared to $64.4 million in the corresponding quarter last year. The water solutions segment, on the other hand, experienced a decline of 10% in revenues. The primary reason behind this is the focus on technological advancement that impacted the revenues in the short run, but now the company has begun pilot projects with most of its top clients, including ConocoPhillips, Chevron, and ExxonMobil. These updated technologies could help companies solve long-term water management challenges, and I believe it could be a revenue booster for ARIS in the future. One important point I would like to highlight is that while growing its infrastructure and revenue, the company didn’t compromise on profitability and actively focused on improving operational efficiency. This resulted in reduced operating expenses, bringing its operating margins to 22.3%, compared to 9.9% in Q3 FY22. The net profit for the quarter stood at $12.2 million, up 526% compared to $1.96 million, bringing the diluted EPS for the quarter to $0.17.

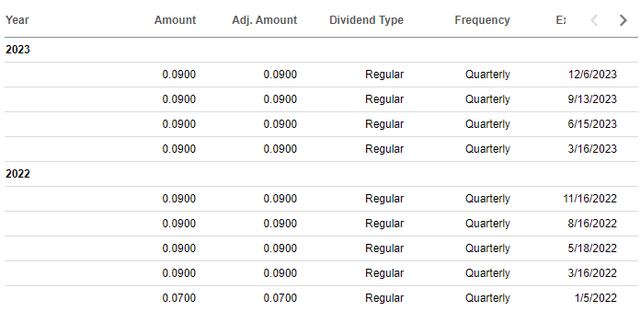

Since its IPO in October 2021, the company has been consistently paying dividends. The current quarterly dividend stands at $0.09, bringing the annual dividend yield to 4.32%. The current quarterly EPS to dividend payout ratio stands at 53%, and I believe there is a potential for a rise in the dividend, which we could witness in the upcoming quarters.

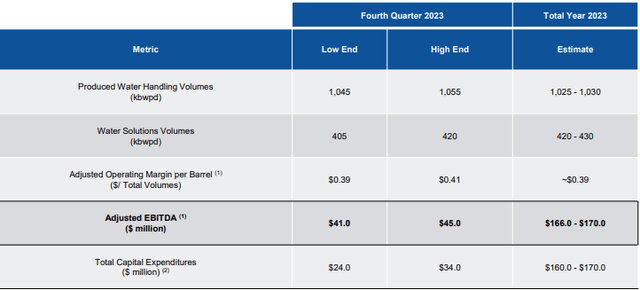

Overall, the company managed to outperform on multiple parameters, including organic revenue growth and expanding profit margins. I believe the company will continue to perform given the strong global energy demand and technological advancement incorporated by ARIS, which makes significant revenue visibility. The strong future performance is reflected in the management’s FY23 guidance. It estimates the FY23 adjusted EBITDA to be in the range of $166-$170 million, reflecting an increase of 14% compared to the FY22 adjusted EBITDA of $149 million. The company is also spending money on developing its infrastructure and is in line to meet its Capex target of $160-$170 million. Capital expenditure to date has helped the company expand its capacity and efficiency and will continue to do so in the coming years. I think the company should be able to achieve all the targets and maintain its revenue growth rate while improving its profit margins.

Key Risk Factor

High debt obligation: As of September 30, 2023, it reported cash and cash equivalent of $24.2 million against long-term debt of $429.3 million. The company has significant debt, and this is putting stress on its balance sheet. It is a high capital expenditure company and needs constant funds to expand its operations, but the existing debt will make it really difficult to raise funds in the future without putting itself at risk of being overleveraged. The high debt is also resulting in increased interest expenses, putting a dent in its profit margins. To put this in perspective, it reported Q3 FY23 interest expenses of $7.95 million, up from $6.7 million in the same quarter last year. The company has managed this risk till now by performing exceptionally well both in terms of revenues and profits, but I recommend investors consider this risk before investing in the company.

Valuation

ARIS is currently trading at a share price of $8.34, a decline of 41% in the past year. It has a market cap of $489 million. It is trading at a forward GAAP P/E multiple of 11.9x, compared to the industry standard of 21.4x. When we compare its valuation to its peers like CESO, BV, and PESI, who are trading at a forward GAAP P/E multiple of 43.1x, 27.38x, and 99.5x, respectively, we realize that ARIS is trading at a discount. It doesn’t have the price momentum in its favor, but I think the current price level provides a favorable risk-reward profile. I believe it should trade closer to the industry standard, and with a forward P/E multiple of 18x, the fair value of the company comes out to be $12.6, up 51% from current price levels.

Conclusion

The company is on the right growth track, experiencing a rise in the water-handling business. The water services segment also has significant growth potential, given the growing demand for renewable and recycled resources. The company faces the risk of being overleveraged, but the current valuation provides a favorable risk-reward profile. Considering all these factors, I assign a Buy rating for ARIS.