sutan abraham/iStock via Getty Images

This Analysis Gives Aris Mining Corporation a “Hold” Rating

This analysis lowers the rating from “Buy” to a “Hold” rating for shares of Aris Mining Corporation (NYSE:ARMN) (TSX:ARIS:CA).

In the previous analysis, a Buy rating was given as Aris Mining was viewed as an interesting vehicle to participate in the expected bull market in gold prices. This is because the company is improving its production profile a lot. In the past 21 months, Aris Mining has achieved important milestones: the expansion of its portfolio of gold activities to include gold operations at the Segovia gold mine and approval from the local watchdog to build the Marmato Lower Mine, both in Colombia.

Sprott’s Mining Risk Heat Map 2023 assigns Colombia a moderate risk, which summarizes various country risk factors, including social, economic, and geopolitical factors, as well as geophysical event risks.

A Growing Portfolio of Gold Activities

The Segovia mine is located approximately 130 km northeast of Medellin, Colombia. The Marmato Upper Zone mine and the Marmato Lower Mine expansion project are located approximately 85 km south of Medellin, Colombia.

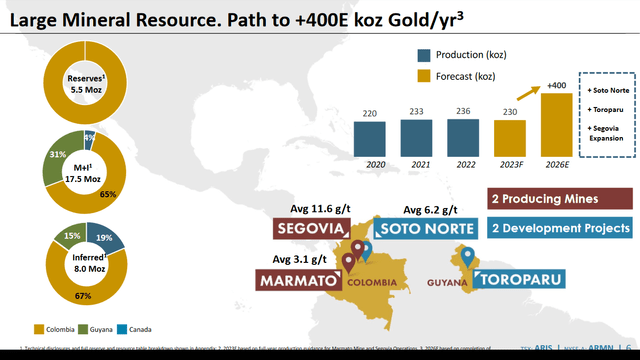

Source: Corporate Presentation

The stock is seen as having the potential to increase Colombia’s gold ounces by more than 70% from 2022 levels, with the mineral target on track to be achieved in three years. Furthermore, the previous article assumed that the key milestones would give Aris Mining a huge boost to financially sustain the Soto Norte project joint venture to develop gold, but also silver, and copper production. Soto Norte’s growth potential in Colombia is intact as of this writing.

The Soto Norte Project is located 7 km northeast of California, Colombia, and is a joint venture with Mubadala Investment Company. Aris Mining has a 20% interest in the Soto Norte project and is also the operator of the mineral project, while Mubadala Investment Company has an 80% interest. Mubadala Investment Company is a wholly owned investment vehicle of the Government of Abu Dhabi. Under the agreement, Aris Mining has the option to increase its ownership percentage in the joint venture to 50%. This joint venture mineral project follows Aris Mining’s merger with GCM Mining, a well-known mid-tier gold mining company in Latin America, in September 2022.

In addition, Aris Mining Corporation is the indirect owner of the Toroparu project with a total measured and indicated mineral resource of approx. 5.4 million ounces of gold, grading 1.45 grams of gold per tonne of mineral, located 213 km west of Georgetown, Guyana. Although these mineral resources must be upgraded to the upper category of reserves to be considered commercially viable resources, the Toroparu project already seems to bode well for Aris Mining’s plan to significantly improve its production profile over the next few years. The company is currently conducting studies aimed at updating and optimizing the development plan for Guyana’s mineral resources.

The company’s growth profile has strengthened and if gold prices continue to provide a robust environment, the combination could potentially lead to an uptrend in the share price over the long term but through cycles.

A Very Promising Outlook Is Shaping Up for Aris Mining

Not only will the growth of Aris Mining’s mineral portfolio have a positive impact going forward as the company moves towards its goal of larger quantities of precious metals to deliver at lower costs, but the price of gold is unlikely to erase its support. The increasingly uncertain global environment due to macroeconomic uncertainties, the negative consequences of the conflicts in Eastern Europe, the Middle East, and Africa as well as the geopolitical tensions between the USA and China and between North and South Korea are creating the conditions for robust demand for gold as a hedge against the resulting headwind for investor assets. Gold prices traded above $2,050 an ounce on Monday, rising for a third straight day, as demand for the metal remained steady as a safe haven amid escalating tensions in the Middle East: to prevent Yemen’s Houthis from launching further attacks on ships in the Red Sea, during a joint military operation, American and British forces attacked Houthi targets in Yemen, but the situation is dramatic as the Houthi militia now threatened a backlash against the American and British forces. Analysts at Trading Economics are forecasting a gold price of $2,090 per ounce by March 31, 2024, and a higher price of $2,160 in 12 months.

But Just “Hold” for Now and You’ll Keep Up with the Steady Growth

This analysis suggests simply to “Hold” shares of Aris Mining, as they are expected to remain neutral for some time under the mixed influence of the unclear situation about the Federal Reserve’s next interest rate move. A reduction in interest rates has a positive impact on the prices of gold and gold-backed assets. But if the Fed postpones the start of the interest rate-cutting policy, this decision does not bode well for gold as it would increase the opportunity cost of holding gold instead of US bonds. Pesky inflation that followed the release of consumer price data on Thursday is now making the central bank’s deliberations over the next few months somewhat more difficult, while as of the end of 2023, investors were fairly confident that rates would be cut in March. Moreover, longer-dated US Treasuries are showing resilience and are unwilling to send a clear signal of capitulation. In fact, home-buyers are feeling firsthand the renewed rise in mortgage rates, which is a measure of expectations for longer-term U.S. Treasury yields. The average interest rate on a 30-year fixed-rate mortgage rose for the second time last week after falling in December. This scenario supports the idea that the Fed will maintain its aggressive “higher for longer” interest rate policy and delay the first rate cut, while traders continue to expect a chance of 70% of an interest rate cut of 25 basis points at the meeting on 20 March.

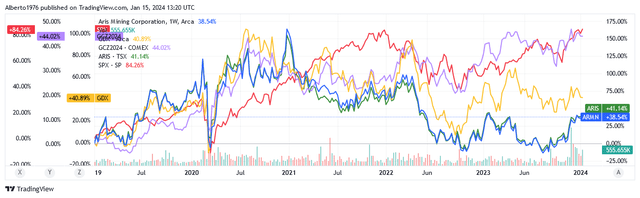

Holding a position in Aris Mining is essentially a medium to long-term strategy while offering a monthly dividend of CA$0.015/share (or approximately US$0.134/share on an annualized basis) as its stocks have a proven track record of long-term performance in line with stable growth in cyclical gold prices. Over the past five years, Aris Mining shares have risen between 38.54% and 41.14%, while the price of gold, represented by the gold futures benchmark (GCZ2024), has increased by 44.02%. As a benchmark for the gold mining industry, the VanEck Gold Miners ETF (GDX) rose 40.89%, but the US stock market far outperformed gold, gold mining stocks, and Aris Mining as its benchmark, the SPX, gained 84.26%.

Use Price Cycles to Strengthen your Strategy to Beat the Market

If retail investors were to combine a buy-and-hold strategy with one that targets gold price cycles, they would have a chance to better align with stock market returns by essentially taking advantage of the following: the strong positive correlation that exists between the share prices of Aris Mining and the price of gold.

The yellow area in the bottom section of the following two charts is a graphical representation of the positive correlation between the two assets, which implies the following relationship regardless of returns:

When the gold price is affected by bullish sentiment, that bullish sentiment is most likely to impact Aris Mining’s stock as well, while if there is bearish sentiment in the gold price cycle, the bearish sentiment is most likely to impact Aris stock as well.

The positive correlation between ARMN and gold prices on the NYSE stock market is historically strong, as the yellow area is almost always in the positive area of the chart.

The positive correlation between ARIS:CA and gold prices on the Toronto stock market is historically strong, as the yellow area is almost always in the positive area of the chart.

Growing Plans: Segovia’s Upside Potential Supports Marmato Expansion

The outlook for Aris Mining Corporation’s production profile is expected to strengthen in the future as the company reaches its gold production targets and the gold price in the market remains robust.

Regarding the first operational factor, the company is on track to meet its 2023 production guidance of 220,000 to 240,000 ounces. This represents a significant improvement over 2022 levels and benefits from recent momentum driven by a nearly 11% sequential increase in Q3 2023 (60,193 oz in Q3 2023 vs 54,227 oz in Q2 2023). Segovia accounted for almost 90% of total gold production, while Marmato accounted for the remaining 10%. In 2022, the company produced 215,373 ounces of gold, of which 34,933 ounces came from partnerships with artisanal and small-scale mining companies around the Segovia operations.

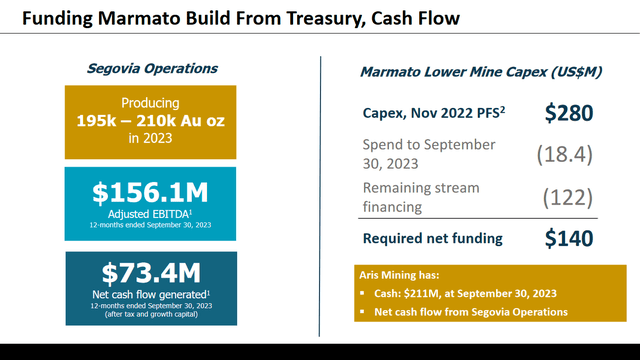

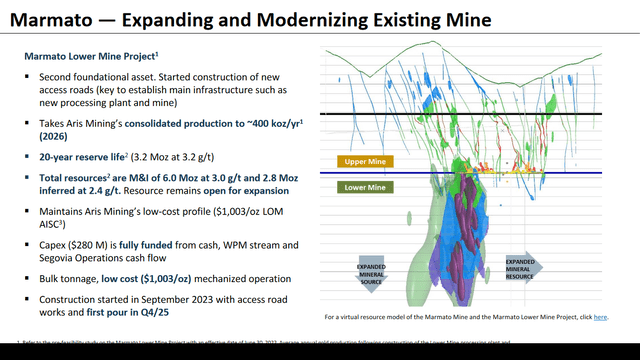

Continuous improvement in operations enabled nearly 100% funding of growth plans and expansion activities while maintaining a healthy cash balance of $211 million. These funds are now available to support the construction needs of the Marmato Lower Mine, which continues to ramp up following commissioning in September 2023.

Source: Corporate Presentation

The construction of the Marmato Lower Mine production is also covered by funds generated internally and through dedicated stream funding. To this end, Segovia provides tremendous support to the development of gold production from the lower Marmato mine: in the third quarter of 2023, the Segovia facility generated a trailing 12-month EBITDA of $156.1 million, resulting in a 12-month EBITDA margin of 36.6% of total revenue of $426.1 million. This compares favorably to Aris Mining’s most direct competitors McEwen Mining Inc. (MUX) -85.05%, DRDGOLD Limited (DRD) +29.34%, and Caledonia Mining Corporation Plc (CMCL) +24.77%.

The development of the lower Marmato mine is strategically very important to Aris Mining’s further growth prospects, as operational miners will have access to wider and larger porphyry mineralization that makes it possible to extract/process a larger amount of metal ore with a lower impact in terms of costs to pay.

Source: Corporate Presentation

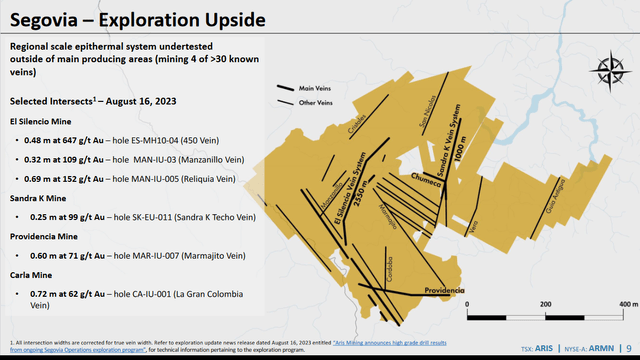

Aris Mining’s mineral profile is complemented by exploration activities targeting improved resource estimates at the Segovia Operations, located 132 km NE of Medellin, Colombia. By 2023, the exploration team succeeded in expanding the mineral reserves by 75% to 1.3 million ounces, extending the life of the mine, which is now 7 years, and targeting 300,000 ounces of gold per year.

On top of this, it appears from very rich and promising intercepts that the Segovia mineral prospect has enormous upside potential, so through further exploration and infill drilling, these mineral achievements of total resources, mine life, and annual production targets can still be extended.

Source: Corporate Presentation

Through 68 operating agreements with artisanal, small-scale miners, Segovia is expected to achieve its 2023 targets of 195,000 – 210,000 ounces of gold at an AISC of $1,125/oz to $1,175/oz, (approximately 90% of Aris Mine’s total gold production, with the remainder coming from Marmato Upper Mine).

Historically, Segovia is a strong gold producer. Just note the following trends: More than 6 million ounces of gold have been mined in the last 100 years, and 1.5 million ounces of gold have been produced in the last 11 years, with an average grade of 13.6 grams of gold per ton of mineral.

Stock Price Expected Performance

Aris Mining Corporation on the NYSE American stock market:

Shares of ARMN were trading at $3.33 per unit, giving it a market capitalization of $456.45 million as of this writing. Shares traded above the 50-day simple moving average of $2.99 and the 200-day SMA of $2.64. Shares also traded above the midpoint of $2.86 in the 52-week range of $2.05 to $3.67.

The 14-day relative strength indicator is at 58.47x, suggesting that shares have plenty of room to decline if the economic cycle experiences a recession. Gold stocks, including Aris Mining, are also being used to hedge against headwinds. However, the headwind will initially also hit gold stocks, which will be treated like all other stocks listed in North America.

Gold and gold securities, including Aris Mining shares, are considered a safe haven to protect against headwinds arising from the risks and uncertainties triggered by the looming recession. The inverted curve of the US Treasury yield spread (at time of writing: 3-month rate at 5.371% vs. 10-year rate at 3.939%) predicts a recession, as higher interest rates on shorter-term loans mean the short-term outlook is seen as riskier and more uncertain for market participants. Under normal circumstances, the shorter the term, the lower the risk of the borrower becoming insolvent, and the return can therefore only be lower than on loans with a longer term.

Duke professor and Canadian economist Campbell Harvey‘s inverted yield curve for the spread between 10-year and 3-month US Treasuries is a strong indicator of an economic recession, having correctly predicted each of the eight economic recessions of the past six decades.

The negative cycle in the US economy will be the result of the Fed’s extremely restrictive interest rate policy against runaway inflation, as the combination of increased financial costs and elevated inflation weighs on consumption and business investment.

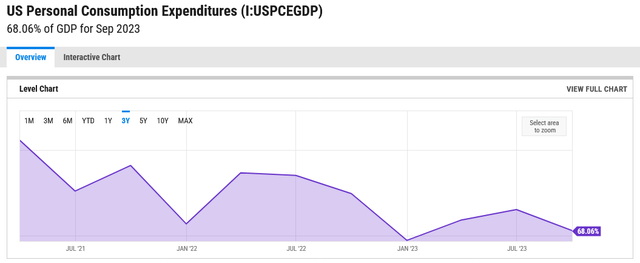

The core component of the US economy, consumption (nearly 70% of US GDP), is showing signs of “softening consumer trends” (consistent with the views of Lakos-Bujas Dubravko, JPMorgan Chase & Co. (JPM) strategist, and Torsten Slok Apollo Global Management, Inc. (APO), chief economist). Like any other macroeconomic measure, U.S. personal consumption expenditures have trended upward over the years, albeit with fluctuations. So, the sharp decline over the last three years is another clear sign of a sharp slowdown in consumption.

This negative trend roughly coincides with the depletion of excess savings that US households have built up during the Covid-19 crisis, as their finances are strained by expensive credit cards, the end of forbearance on student debt repayments, and slow wage growth compared to rising living costs.

The deteriorating outlook for consumer spending is dampening companies’ growth investment plans, with the number and value of IPOs well below 2021 levels. This is a strong signal of a decline in activity in raising money through borrowing, as taking out additional loans or refinancing loans now comes with high interest costs.

The labor market is no longer as stubborn as it was a year ago and is therefore gradually failing to support the soft-landing thesis: a) job creation fell significantly from 4.8 million in 2022 to 2.7 million positions in 2023; b) the number of job cuts announced by companies increased by 98 percent in 2023 compared to the previous year, to 721,677 jobs to be cut in 2023. To protect their profit margins, which are at risk from lower sales volumes and a slowdown in retail price inflation, it is no secret that companies are cutting labor costs, which has a dramatic impact on the company’s overall costs after the tidal wave of jobs that arose during the recovery from the COVID-19 crisis.

Andrew Challenger, a labor expert and senior vice president of Challenger, Gray & Christmas, Inc., said in early December last year that layoffs would continue to occur in 2024. The layoff falls on some of the “Magnificent 7” in the S&P500 index: Amazon.com, Inc. (AMZN) announced it would send hundreds of termination letters to media employees, and Alphabet Inc. (GOOG) (GOOGL) announced its plan to lay off employees in voice assistance and hardware and engineering departments. Amazon, Alphabet, Meta Platforms, Inc. (META) (META:CA) and Microsoft Corporation (MSFT) (MSFT:CA), among the world’s largest technology companies, have announced plans to cut more than 75,000 jobs since the third quarter of 2022. Outside of the components of the S&P 500, relevant last week was the news that video game developer Unity Software (U) will lay off approximately 1,800 employees, or 25% of its workforce.

As a hedge against the headwinds of an economic recession, shares of Canadian gold explorer and mining company Aris Mining will be in high demand, potentially leading to a rise in the share price.

However, according to the 24-month market beta of 1.33 (on this Seeking Alpha webpage, scroll down to the “Risk” section), Aris Mining shares will initially decline somewhat, as will be the case with every other stock in the US stock market.

But before lower stock prices occur, which retail investors may want to use to gain exposure to potentially higher gold prices via Aris Mining Corporation, shares are likely to trade sideways for a while amid uncertainty over whether or not the Federal Reserve will begin cutting interest rates on the 20 March. The first cut, scheduled for March 20, may be delayed until the next Fed meeting.

The same considerations apply to shares of Aris Mining Corporation traded on the Toronto Stock Exchange.

Aris Mining Corporation on the Toronto Stock Exchange:

Shares of ARIS:CA were trading at CA$4.40 per unit, giving it a market capitalization of CA$611.98 million as of this writing. Shares traded above the 50-day simple moving average of CA$4.02 and the 200-day SMA of CA$2.85. Shares also traded above the midpoint of CA$3.71 in the 52-week range of CA$2.77 to CA$4.65. The 14-day relative strength indicator is at 56.11x, suggesting that shares have plenty of room to decline if the recession appears as the next cycle of the US economy.

Additionally, Aris Mining Corporation stock has a low trading volume in both markets. So, if there are too many shares in the portfolio, it may be difficult to change the position quickly enough to reflect relevant changes in the gold price scenario.

The average volume (3 months) was 91,347 shares on the US exchange and 203,236 shares on the Canadian Stock Exchange. The stock has 137.22 million shares outstanding. The float consists of 117.92 million shares. About 37.41% of the float is held by institutions.

Conclusion

In this analysis, Aris Mining Corporation stock is considered an interesting means of participating in the gold price cycle, although a medium-term position is not ruled out, as this stock has grown in line with gold prices.

By combining a strategy designed to take advantage of gold price cycles, the retail investor can also increase returns to bring them closer to market price long-term trends.

A long-term horizon is supported by a company that significantly expands its production profile, primarily through internally generated cash flow. It is crucial to Aris Mining’s growth profile that the price of gold remains robust: as the global environment becomes increasingly uncertain and challenging, the strong demand for gold as a safe haven creates the conditions for a supportive price over the long term.

The economic recession could cause the price of gold to increase enormously in 2024 and also boost Aris Mining. Initially, the headwinds from the panicky market will not differentiate between gold stocks and other US-listed stocks, providing an opportunity to strengthen Aris Mining’s position by capitalizing a more convenient entry point. A chance to also be better positioned against the rising price of gold as a hedge against recessionary headwinds. Before a recession enters the US cycle, the effects on Aris Mining shares are expected to be mixed due to uncertainty about the Fed’s next interest rate move. Therefore, retail investors would be better off staying with the “Hold” rating for the time being.