Megapixel8

Ares Commercial Real Estate (NYSE:ACRE) is a leader in the market for the origination of commercial real estate debt. Most recently, the stock’s dividend yield has crossed above 13%, indicating that dividend risks for the commercial mortgage lender have increased, largely due to deteriorating fundamentals in the commercial real estate market, especially in the office sector where Ares Commercial Real Estate has the most investments. I believe Ares Commercial Real Estate is headed for a dividend cut and I no longer suggest the REIT to dividend investors!

Previous rating

I worked on Ares Commercial Real Estate in April 2021 — This Stock Pays A 9.2% Yield And Has Upside — when I recommended the REIT for dividend investors due to the U.S. economy reopening after the COVID-19 pandemic. In FY 2022 and especially FY 2023 the winds in the commercial real estate market have changed, however, due to lower occupancy rates and a rising volume of office foreclosures. For those reasons, I down-grade Ares Commercial Real Estate to hold.

Office focus is set to become a bigger problem for Ares Commercial Real Estate

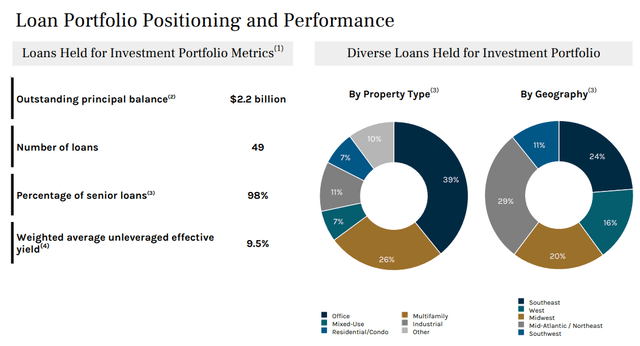

Ares Commercial Real Estate owns a large portfolio of commercial mortgage loans that produce recurring interest income for the REIT. At last count, in September, the firm owned $2.2B worth of loans in its portfolio (49 loans to be precise) that were largely made in the office category.

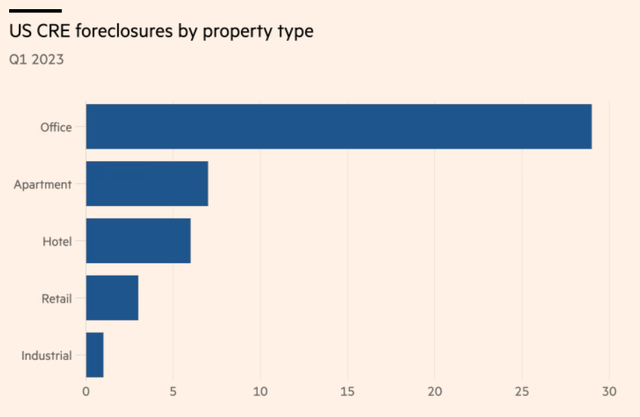

Offices have struggled mightily in the last year, in large part because remote work trends have led to rising vacancies in office properties and higher interest rates have made commercial real estate investments less profitable. The weak state of the office market hands negotiating power over to tenants which are set to push hard for lease concessions when renewals come up. U.S. office foreclosures have soared as well this year and many multinational companies have said that they want to reduce their office footprints.

And this is where I see a big problem for Ares Commercial Real Estate going forward because the firm is overly invested in the office market, meaning the highest risk asset category is overrepresented in the firm’s investment portfolio. In the September quarter, Ares Commercial Real Estate had 39% of its held-for-investment assets assigned to the office category.

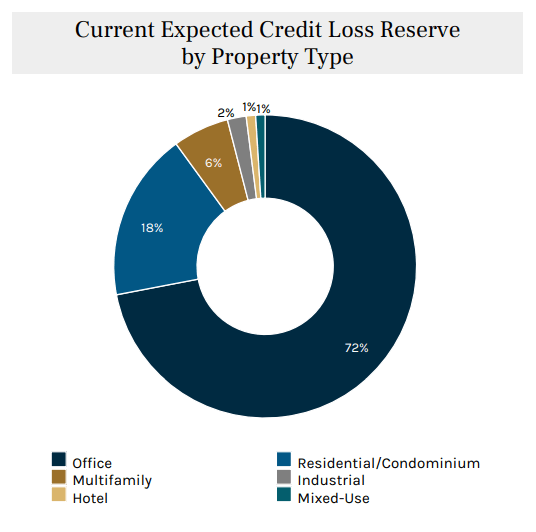

A breakdown of Ares Commercial Real Estate’s loss reserve shows that the majority of its projected losses are expected for the office category, as a total of 72% of the loss reserve relates to office loans. Ares Commercial Real Estate’s loss reserve was $115.7M in the September quarter, showing a 62% boost over the loan loss reserve balance at the end of FY 2022 and the loan loss reserve has been increased every single quarter in FY 2023.

Ares Commercial Real Estate

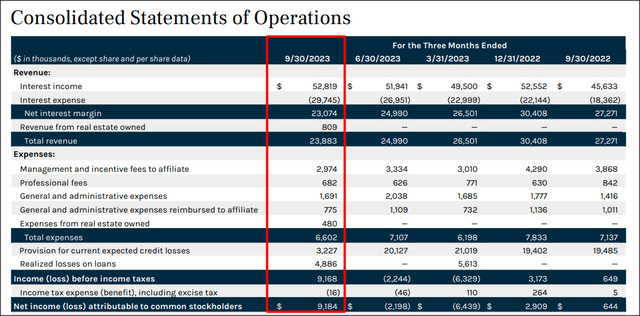

Ares Commercial Real Estate’s top line and net interest margin were pressured in Q3’23, as they were throughout FY 2023, largely due to higher interest expenses… and I don’t expect this trend to improve in the next several quarters. The REIT’s revenues declined 12% Y/Y in Q3’23 and the trend in credit provisions has not been a great one in the last year. In the last two quarters they were actually the reason behind Ares Commercial Real Estate posting negative net income.

Market expectations

The foreclosure trends are not looking great, especially in office, and they could get worse in the short term. As long as interest rates remain as high as they are now, the fundamentals in the commercial real estate market are unlikely going to change, meaning Ares Commercial is likely to set to continue to have to boost its CECL reserve and see lower demand for loans from commercial property investors. The dividend coverage trend, discussed next, indicates that dividend risks have increased greatly and a continuation of current market trends will almost surely, in my opinion, result in a dividend cut for investors.

A dividend cut looms…

The rise in loan loss reserves is the surest sign that conditions in the commercial property market have seriously deteriorated in the last year, and the firm’s dividend coverage has already suffered quite significantly this year.

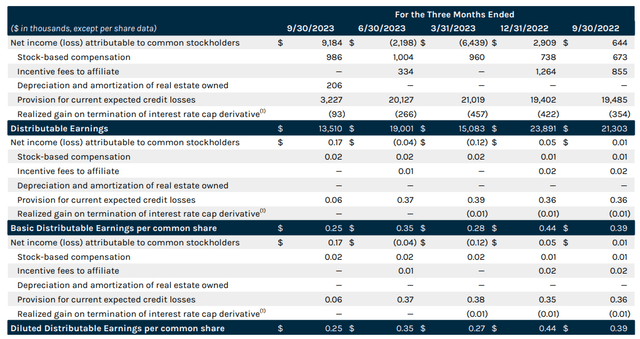

The following chart shows the reconciliation of Ares Commercial Real Estate’s net income to distributable earnings. In the first nine months of the year, the REIT’s investments generated $0.87 per-share in distributable income. During this period, Ares Commercial Real paid $1.03 per-share in dividends, which calculates to a dividend coverage ratio of 84%… which obviously is not great for a REIT whose core office investments face considerable market headwinds.

In the year-earlier period, Ares Commercial Real Estate generated $1.11 per-in distributable earnings and had a coverage ratio was 106%. The dividend coverage situation has therefore considerable worsened for the REIT and together with the boost in the loan loss reserves, I believe a sizable discount to book value is justified.

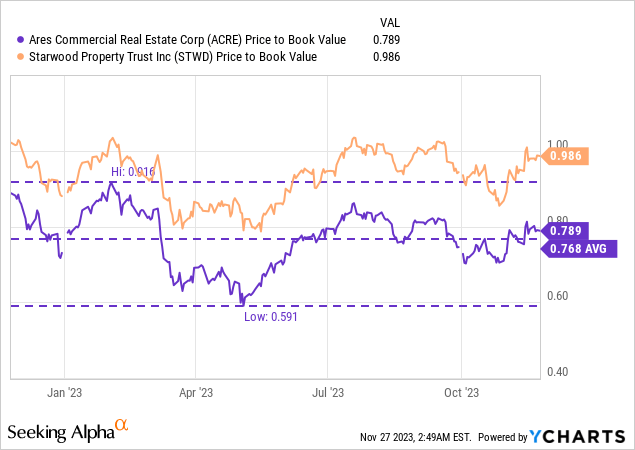

Ares Commercial Real Estate: fairly valued

The REIT is already trading at a significant book value discount which is something dividend investors should not grasp to mean that Ares Commercial Real Estate’s dividend is cheap, it isn’t. The 21% discount to book value reflects deep concerns over the state of the commercial property market and the firm’s exposure to office loans… which I believe is appropriate.

Ares Commercial Real Estate’s discount to book value is approximately on the same level right now as the average P/B discount last year (~23%). For context, Starwood Property Trust (STWD), which has less U.S. office exposure (10%) and other businesses besides loan origination, is selling for just a 1% discount to book value. I suggest Starwood Property due to the solidity of its 10% yield.

Given the high amount of office loans in Ares Commercial Real Estate’s portfolio, growing loan loss reserves and a weak coverage trend, I believe the stock is fairly valued right now, with the risk profile possibly slightly tilted to the downside.

Ares Commercial Real Estate’s risk profile

I believe the risks here are pretty clear: Ares Commercial Real Estate’s earlier bet on the office market is backfiring. In the worst case, Ares Commercial Real Estate may be forced to cut its dividend, should the market situation for commercial properties, especially offices, get worse and the current trend with regard to dividend coverage continue. The biggest risk for Ares Commercial Real Estate, as I see it, are new lease negotiations with tenants who in this market have all the bargaining power.

Final thoughts

Ares Commercial Real Estate has been well-run so far, but there are warning signs which I believe investors, especially those looking at the dividend, should not ignore. Ares Commercial Real Estate has consistently increased its loan loss reserve in the last three quarters and the market experiences obvious headwinds stemming from a combination of higher interest rates, lower occupancy rates and weaker lease negotiating positions for landlords. Ares Commercial Real Estate rightfully trades at a discount to book value, and I am therefore changing my 2-year-old recommendation from buy to hold!