May Lim

Introduction

I consider myself a conservative person by nature, so, therefore, I like to hold conservative companies in my portfolio. One that comes to mind is Ares Capital (NASDAQ:ARCC), one of the more conservative BDCs in the sector. Many investors prefer peers like Capital Southwest (CSWC) or Main Street Capital (MAIN) over ARCC, but it remains one of my favorites and a core holding. In this article, I discuss why Ares Capital, despite being more fiscally conservative, is the perfect company to hold for consistent income & stability. I also discuss what led me to downgrade the stock from a buy to a current hold since my last article.

Previous Thesis

As a reminder to readers, I usually cover stocks that I own, or would own here on Seeking Alpha. And if the company is one I hold, I usually write a follow-up article soon after quarterly earnings.

I last covered Ares Capital back in October after the BDC posted Q3 earnings. The company saw its share price decline briefly before bouncing back to nearly $20. One reason for the share price volatility could have been the miss on total investment income by roughly $4 million. Despite the miss, earnings remained strong during the quarter, allowing the BDC to beat by a penny on core EPS. I rated them a buy then due to their valuation at the time when they were trading less than their NAV price of $18.99.

For me, ARCC is one of my holdings I don’t worry too much about. Their share price may experience some volatility from time to time, or they may miss on earnings here and there. But they remain one of the most stable companies within the sector in my opinion and help income investors sleep well at night due to their consistency.

Core EPS ticked up from Q2 to $0.59 while net investment income fell from the prior quarter to $289 million. But they still managed to grow their total portfolio by $0.4 billion. I also touched on their strong balance sheet, and they managed to decrease their leverage quarter-over-quarter from 1.07x down to just 1.03x. Additionally, they managed to see their non-accruals decline over the same period, something that has plagued some BDCs and continues to be headwinds because of higher interest rates.

Latest & Greatest

ARCC recently reported Q4 earnings on February 7th and the BDC did what they always do, remain consistent and conservative; posting better-than-expected earnings as their net investment income grew impressively by more than 19% from $289 million to $345 million quarter-over-quarter.

And although this was a slight drop from the $349 million year-over-year, this was still impressive considering the economic backdrop. BDCs typically enjoy higher income due to their floating rate portfolios, but this also causes headwinds for their portfolio companies. And if companies face financial stress, this could cause their lender, in this case ARCC’s financials, to face downward pressure.

Core EPS also grew from $0.59 to $0.63 during the quarter, allowing them to post a record (core EPS) of $2.37. This was from strong credit performance & earnings from higher interest rates on NII.

They also impressively grew their portfolio to $22.9 billion from $21.9 billion in Q3, seeing total portfolio companies rise from 490 to 505. In 2023, ARCC reviewed more than $500 billion worth of transaction opportunities and in Q4 alone saw more transactions than they reported in the broadly syndicated loan & middle market combined.

Furthermore, they committed $2.4 billion to 74 different borrowers in the fourth quarter alone. So, the BDC ended the year very strongly, which is all you can ask for from your investments. Especially with high interest rates continuing to make it harder to find attractive investment opportunities for some businesses.

Most of their gross commitments were first-lien loans, which the company has been focusing on the past year with an average of 69%. Q4 was the highest at more than 87%, up from 61% in Q4 ’22. One reason some investors may prefer other peers in the sector is that ARCC’s first-lien loan percentage is significantly lower than peers like Capital Southwest, at just 44% total by asset class.

But this rose from 42% in Q2. This is in comparison to CSWC’s 87.5% and Blue Owl Capital’s 69% at fair value. So, ARCC’s concentration in first-lien loans is substantially lower.

Dividend Remains Very Safe

One metric I like about ARCC is they typically like to rollover spillover income into the next year. This puts them in a strong position financially if financials become suppressed, or they experience some unexpected headwinds. At year’s end, they had $635 million in spillover income, down from $643 million they carried over into 2023. But to put this into perspective, this is more than 2x the regular quarterly dividend paid.

This is important because the company can use this to pay specials or supplementals. Or they can fund the regular dividend if coverage becomes tight for a brief period. Additionally, they’ve elected to keep the dividend at $0.48 which is payable next month to shareholders.

As a shareholder, it would have been nice to receive an end-of-year special, but management could be preparing for a recession, which some say is still coming. Either way, I’m happy to receive income from a stable dividend payer like ARCC, and think their preferring to hold on to extra income is a smart business move. However, I do expect a raise sometime this year.

Strong Balance Sheet & NAV Growth

ARCC also managed to decrease leverage quarter-over-quarter, where they saw this decline from 1.03x to 1.02x. Furthermore, they increased their liquidity with the issuance of 5-year unsecured notes. Currently, they have $6.4 billion in total liquidity.

They also impressively grew their NAV from $18.99 to $19.24 quarter-over-quarter. This grew by 4.56% year-over-year from $18.40. For BDCs, continuously out-earning their dividend and retaining excess NII both play an integral part in NAV growth over time. The impact of fair value increases in the portfolio also has a hand in NAV growth.

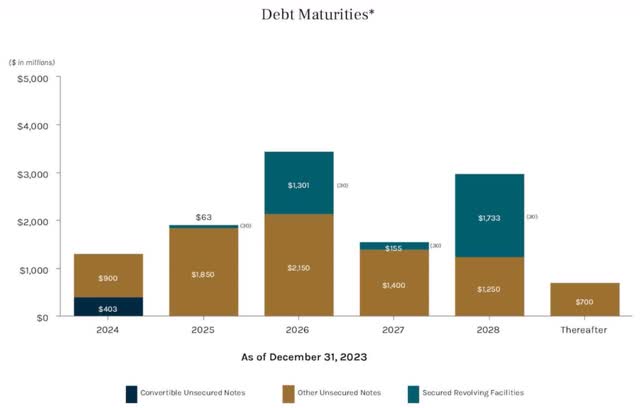

Their debt maturities are also manageable, with $11.8 billion total, a slight increase from $11.5 billion in Q3. Of this, $1.3 billion is due in the first half of the year, and they will likely have to refinance at a higher rate. This is also more than double MAIN’s $513.8 million (due this year). But as seen by their significant dry powder and investment grade credit rating, this is no problem for the BDC.

They have more maturing in 2025 that will likely have to be refinanced at higher rates, but this all depends on where interest rates are by then. These have a weighted average interest rate of 3.250% and 4.250% respectively, with the bulk of this due in the first quarter, March. But as previously mentioned, their liquidity profile remains strong, and I expect management to further strengthen this as time goes on.

Valuation

With their NAV growth in the quarter, ARCC only trades slightly above $20 at the time of writing, giving them a P/NAV ratio of 1.03x. Quant gives them a valuation grade of A- signaling the price is attractive currently and I agree. Especially, for a BDC of ARCC’s caliber, I would expect them to trade significantly above. Two reasons it doesn’t are their conservatism and the fact they are less defensively positioned than some peers, in my opinion.

This year, management has not paid out any specials or supplementals while many of their peers have elected to do so. Because of this, investors have chosen to invest in more shareholder-friendly peers like Capital Southwest and Sixth Street Specialty Lending (TSLX), driving their share prices higher.

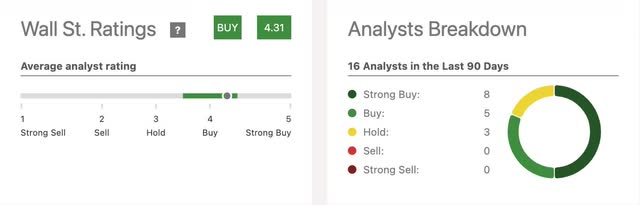

Both have consistently rewarded shareholders with specials as they’ve benefitted from high interest rates. Wall Street still rates them a buy, and they offer some upside to their price target of $21.63. Because of their higher quality and NAV growth of $0.25 since my last article, I do think it’s a decent share price to start a small position if you’re a long-term investor.

I prefer to buy or add below $18 for the margin of safety, but the stock has impressively grown its NAV and will likely continue going forward. Additionally, the current premium of 5.14% is slightly less than the 3-year average of 5.88% which means the stock is near fair value at the moment, whereas it was trading at a slight discount during my last article.

Risks

Could ARCC be preparing for a recession? Is that the reason they’ve not paid out any specials or supplementals despite benefitting from higher interest rates on net investment income? Who knows if these are the reasons, but I wouldn’t be surprised if they played a part.

ARCC’s management is very experienced and the BDC is well aware of how economic downturns affect the business. One thing I used to joke with my sailors about when I was on active duty: Stay ready so you don’t have to get ready!

And although the BDC has done a good job at managing this so far, a recession would likely cause a further rise in non-accruals, or a default on loan payments from borrowers.

Their non-accruals decreased quarter-over-quarter and stood at 1.3% and 0.6% fair value, down from 1.7% at the beginning of 2023. However, this did rise from 1.2% in Q3. This is in comparison to popular peer Main Street Capital’s 1.0% at fair value at the end of their Q3.

The higher-quality BDCs have done well managing non-performing loans during the macro environment. This is well below management’s 3% threshold and KBW BDC average of 3.9%. But a recession could increase chances of non-performing loans as portfolio companies face further financial stress.

Bottom Line

ARCC’s strong Q4 earnings showed why the BDC remains a strong performer amongst peers in the sector. Their size & scale advantage also play an important role in finding attractive investment opportunities in a challenging environment.

Additionally, the stock remains attractive, trading slightly above its NAV price, which has consistently grown over the past year. This was in part due to their portfolio growth and excess NII, which the BDC elected to roll over into 2024. This makes their dividend very safe if the economy experiences an unexpected downturn, or portfolio companies experience financial stress.

With rate cuts seemingly out for March and uncertainty surrounding when they will be cut, I think the price remains decent to dollar-cost into. The BDC will continue to enjoy extra income from higher interest rates, which they can continue to reinvest and grow their portfolio. Since my last article, the share price has increased from less than $19 to over $20, where it currently trades.

When rates are cut, I suspect ARCC’s share price will fall faster than peers in the sector because they’re more fiscally conservative. Because of this, I’ve decided to downgrade the stock to a hold, simply due to an expected sharp price decline sometime this year.