When examined over lengthy periods, the stock market trounces all other asset classes. Over the past century, the average annual return for Wall Street’s major stock indexes — the Dow Jones Industrial Average (^DJI -0.37%), S&P 500 (^GSPC -0.48%), and Nasdaq Composite (^IXIC -0.82%) — has handily outpaced the annualized returns of oil, gold, certificates of deposit (CDs), and Treasury bonds over the same timeline.

But it’s a much different story if you narrow the lens. Since this decade began, the Dow Jones, S&P 500, and Nasdaq Composite have alternated bear and bull markets in successive years. Following record highs for the Dow and S&P 500, and a nearly 60% rally for the Nasdaq Composite from its 2022 bear market low, this pattern suggests Wall Street could be in for a rough 2024.

Image source: Getty Images.

Although predicting short-term directional movements in Wall Street’s major indexes can’t be done with 100% accuracy, it doesn’t stop investors from trying to gain an edge. In particular, one valuation tool, which has a perfect track record dating back more than 150 years, may offer an answer as to what’s next for stocks.

Are the Dow, S&P 500, and Nasdaq Composite about to plunge?

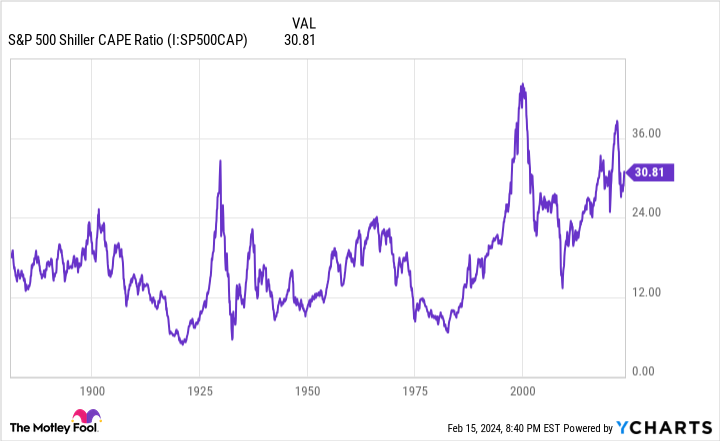

While “value” is a subjective term that’s entirely dependent on growth rate and the risk tolerance of individual investors, the valuation metric that’s historically had an uncanny ability to forecast directional moves in the stock market is the S&P 500’s Shiller price-to-earnings (P/E) ratio, which is also referred to as the cyclically adjusted price-to-earnings ratio, or CAPE ratio.

Most investors are familiar with the traditional P/E ratio, which examines a company’s share price in relation to its trailing 12-month earnings. The P/E ratio is the most popular and basic measure of value on Wall Street.

However, the traditional P/E ratio is subject to skewing due to unforeseen events. For instance, the COVID-19 pandemic ravaged corporate earnings in 2020, while fiscal stimulus artificially boosted profits in 2021.

What makes the Shiller P/E ratio different is that it’s based on average inflation-adjusted earnings from the prior 10 years. Using a decade’s worth of earnings history smooths out the spikes and plunges associated with unforeseen events and provides a more complete valuation picture for Wall Street’s benchmark index, the S&P 500.

Although the Shiller P/E ratio didn’t gain notoriety until the late 1990s, it’s been back-tested to 1871. Over this 150-plus-year period, the average reading for the S&P 500’s Shiller P/E ratio is 17.09. But as you’ll note in the chart below, it’s spent almost the entirety of the past 30 years above this mark.

S&P 500 Shiller CAPE Ratio data by YCharts.

Investors’ willingness to accept persistently higher valuations looks to be a function of the internet democratizing access to information, as well as interest rates declining. Lower interest rates encourage businesses to borrow, which can fuel hiring, acquisitions, and innovation.

But what’s particularly noteworthy about the Shiller P/E ratio is what’s happened throughout history any time it’s crossed above 30 during a bull market rally. Looking back more than 150 years, there have only been six instances where it’s demonstrably surpassed and sustained this level — and it’s portended a big move lower in the broader market in all prior events:

- Aug. 1929-Sept. 1929: The Shiller P/E topped 30 as the Great Depression took shape, ultimately pushing the Dow Jones Industrial Average lower by a peak of 89%.

- June 1997-Aug. 2001: The Shiller P/E peaked at its all-time high of 44.19 during the dot-com bubble. The benchmark S&P 500 lost around half of its value at its trough.

- Sept. 2017-Nov. 2018: After once again surpassing a reading of 30, a fourth-quarter sell-off in 2018 cost the S&P 500 20% of its value.

- Dec. 2019-Feb. 2020: Just prior to the COVID-19 crash, the Shiller P/E leaped over 30. In less than five weeks, the S&P 500 tumbled 34%.

- Aug. 2020-May 2022: After briefly touching a reading of 40, the 2022 bear market lopped as much as 28% off the S&P 500 at its peak.

- Nov. 2023-current: As of the closing bell on Feb. 15, 2024, the Shiller P/E sat at 33.85.

In other words, the S&P 500’s Shiller P/E has an immaculate track record of forecasting at least a 20% downturn in the broad-based index if it surpasses 30.

The drawback to the Shiller P/E ratio is that it’s not a timing tool. Just because the Dow Jones, S&P 500, and Nasdaq Composite are historically pricey doesn’t mean these indexes can’t stay pricey for months or years. You’ll note that prior to the dot-com bubble bursting, the Shiller P/E was north of 30 for more than four years.

Nevertheless, the writing does appear to be on the wall that a sizable downturn in stocks awaits at some point in the future.

Image source: Getty Images.

Stock market corrections and bear markets can be blessings in disguise

To be fair, the Shiller P/E represents just one of around a half-dozen predictive indicators and data points I’ve examined recently that point to either a U.S. recession or a stock market correction/bear market for equities. While this may not be the news investors want to hear, corrections and bear markets are known for being blessings in disguise.

As much as we might dislike recessions, they’re a normal part of the economic cycle. The thing about recessions is that they’re short-lived. Nine of the 12 U.S. recessions since the end of World War II resolved in less than a year. In comparison, two periods of expansion have hit the 10-year mark over this same time span.

This disparity observed between the length of recessions and periods of economic growth can be seen on Wall Street, too.

To be upfront, we’re never going to know with any preciseness when stock market corrections or bear markets will begin, how long they’re going to last, or how much the major stock indexes will ultimately fall. But history does tell us that every double-digit percentage decline in the Dow Jones, S&P 500, and Nasdaq Composite has eventually been cleared away by a bull market. In other words, patience and perspective are incredibly powerful tools for investors.

History also shows that bull markets tend to handily outlast bear markets.

It’s official. A new bull market is confirmed.

The S&P 500 is now up 20% from its 10/12/22 closing low. The prior bear market saw the index fall 25.4% over 282 days.

Read more at https://t.co/H4p1RcpfIn. pic.twitter.com/tnRz1wdonp

— Bespoke (@bespokeinvest) June 8, 2023

Last June, researchers at Bespoke Investment Group released a data set that compared the length of every bear market in the S&P 500 since the start of the Great Depression in September 1929 to every S&P 500 bull market over the same stretch. Whereas the average bear market lasted only 286 calendar days, the typical bull market endured for 1,011 calendar days.

What’s more, 13 of the 27 S&P 500 bull markets over the past 94 years have lasted longer than the lengthiest bear market has. From a mathematical standpoint, betting on the future success of American businesses has always been a moneymaking strategy.

Even if the Shiller P/E ratio continues its more than 150-year immaculate streak of forecasting at least a 20% downturn in the S&P 500, long-term investors can have confidence that equities will eventually rebound. That makes any notable downturn in the stock market a blessing in disguise for patient investors with cash to put to work.