sruilk/iStock via Getty Images

Investment Overview

Arcutis (NASDAQ:ARQT) IPO’d back in January 2020, raising ~$160m via the issuance of 9.375m shares priced at $17 per share. At the time, the company described itself as follows:

a late-stage biopharmaceutical company focused on developing and commercializing treatments for unmet needs in immune-mediated dermatological diseases and conditions, or immuno-dermatology.

Arcutis is currently developing three novel compounds (ARQ-151, ARQ-154 and ARQ-252) for multiple indications, including psoriasis, atopic dermatitis, seborrheic dermatitis and eczema.

In July 2022, the Westlake Village, California based biotech secured approval for ARQ-151 – now referred to as Zoryve (roflumilast) cream 0.3%, from the Food and Drug Agency (“FDA”) as a once-daily treatment in mild, moderate, and severe plaque psoriasis with no limitations on duration of use. According to the press release announcing the approval:

The first and only topical phosphodiesterase-4 (PDE4) inhibitor approved for the treatment of plaque psoriasis, ZORYVE provides rapid clearance of psoriasis plaques and reduces itch in all affected areas of the body.

ZORYVE — a once-daily, steroid-free cream in a safe and well tolerated, patient-friendly formulation — is uniquely formulated to simplify disease management for people living with plaque psoriasis.

In December last year, the company’s supplemental New Drug Application (“sNDA”) to expand Zoryve’s label to children aged 6 to 11 years with plaque psoriasis, was also approved by the FDA.

The second candidate, ARQ-154, is a foam formulation of roflumilast, described as follows in the company’s 2022 annual report / 10K submission:

Roflumilast foam contains the same highly potent and selective PDE4 inhibitor in roflumilast cream, and is nearly identical to roflumilast cream, with all ingredients in the foam being the same as those in the cream, other than reduced oil content and the addition of a propellant in the can to create the foam.

Also in December last year, the FDA approved ARQ-154, or ZORYVE (roflumilast) topical foam, 0.3%, for the treatment of seborrheic dermatitis in individuals 9 years of age and older, based on positive pivotal study data – “nearly 80% of individuals achieving the primary efficacy endpoint of IGA (Investigator’s Global Assessment -a five-point scale that provides a global clinical assessment of AD severity) Success, and just over 50% of individuals reaching complete clearance at Week 8”.

Finally, ARQ-252 – an alternative topical cream formulation of ivarmacitinib, a janus kinase inhibitor, has not met with the same success as ARQ-154 or ARQ-151 – as per Arcutis 2022 10K:

In May 2021, we announced that the Phase 1/2b study of ARQ-252 in chronic hand eczema did not meet its primary endpoint, with further analyses of the study pointing to inadequate local drug delivery to the skin.

Nevertheless, Arcutis has added to its clinical pipeline, with ARQ-255, another topical formulation of ivarmacitinib which leverages a “unique drug delivery technology” that the company refers to as Deep Dermal Drug Delivery (“4D” technology) specifically designed to treat alopecia areata in a Phase 1 clinical study, and ARQ-234, obtained via the company’s acquisition of Ducentis BioTherapeutics, a biologic that targets CD200R – an immune-regulatory receptor, which is in preclinical studies, and indicated for Atopic dermatitis.

In terms of finances, across the first three quarters of 2023, Arcutis made a net loss of $(196m), versus $(233m) in the prior year period, and reported a cash position of $107m, and $119m of marketable securities.

In summary, at current burn rate, Arcutis’s funding runway could be exhausted by the beginning of 2025. When handing Arcutis stock a ratings downgrade in November last year, Jones Research also noted concerns around Arcutis defaulting on a $225m conditional loan agreement with SLR Investment Corp. According to Arcutis Q3 2023 10Q submission / quarterly report:

The applicable rate is a per annum interest rate equal to 7.45% plus the greater of (A) 0.10% and (B) the per annum rate published by the Intercontinental Exchange Benchmark Administration Ltd. (or on any successor or substitute published rate) for a term of one month, subject to a replacement with an alternate benchmark rate and spread in certain circumstances. On September 30, 2023, the rate was 12.88%.

Explaining Arcurtis’ Poor Share Price Performance since IPO

On the face of it, a topical, prescription skincare cream seems like a product that could have wide-scale appeal as an alternative to injections, oral corticosteroids, and over the counter or lifestyle remedies for dermatological indications. Arcutis, for example, states in its annual report that:

Based on market research and our internal estimates, we estimate our primary addressable market opportunity, which focuses on U.S. patients treated in dermatology offices with topical therapies, at 7 million patients across psoriasis, atopic dermatitis, and seborrheic dermatitis.

There are millions of additional U.S. patients suffering from chronic hand eczema, vitiligo, and alopecia areata, as well as millions of patients treated by physicians other than dermatologists for their psoriasis, atopic dermatitis, and seborrheic dermatitis.

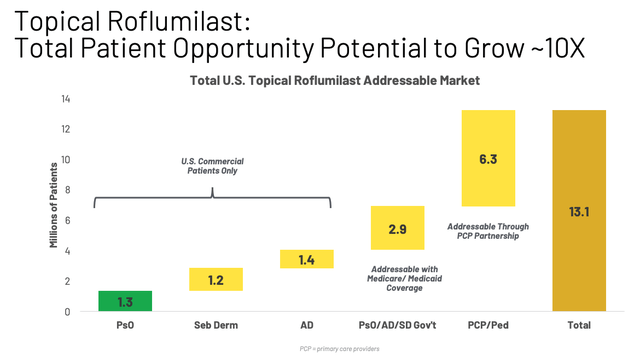

Based on a list price of ~$900 for 60g supply of Zoryve (and assuming this supply lasts for one year, although management has suggested that patients may require up to 4 tubes per year), we can estimate a ballpark market opportunity of >$6bn per annum for Zoryve cream, although across all indications, Arcutis management calculates it to be twice as large, as shown below:

Roflumilast market opportunity (presentation)

Across the first three quarters of 2023, however, net revenues from Zoryve amounted to $2.8m, $4.8m, and $8.1m, while Arcutis’ net losses amounted to $(80.1m), $(71m), and $(44.8m). Accumulated deficit as of Q3 2023 amounted to $(916m).

Shortly after Zoryve was first approved, in August 2022, Arcutis stock traded at a value of >$25 per share, perhaps reflecting the market’s high expectations for the new product’s commercial potential – some analysts have set peak revenue targets of $1.8bn – $3.8bn – but for the following 15 months, as the company has struggled to meet revenue and earnings targets, the share price has slowly sunk in value, reaching a low of <$2 at the beginning of December last year.

In October 2023, analysts at Mizuho revised their share price target to $4, from $57, citing underwhelming Zoryve sales, and a potential debt covenant breach, discussed above.

The reality is that dermatology markets are crowded and competitive, and if revenues do not pick up, Zoryve would not be the first topical therapy to have failed to grow market share in the atopic dermatitis field.

Pharma giant Pfizer (PFE) secured approval for Eucrisa cream – a drug product it acquired via the $5.2bn buyout of Anacor Pharmaceuticals, with a similar mechanism of action (“MoA”) to Zoryve, being a PDE-4 inhibitor, back in 2016, but it was a commercial failure, driving only ~$140m of revenues in 2019, despite prior expectations for >$2bn per annum in peak sales.

More recently, in 2021 Incyte Corporation (INCY) secured approval for a topical therapy to treat atopic dermatitis (“AD”), Opzelura, which earned revenues of $229m across the first nine months of 2023, while Dermavant, part of the Roivant Sciences (ROIV) family of companies, has secured approval for its VTAMA cream in plaque psoriasis, and is likely to enter the AD market soon, after Phase 3 study results saw >50% of 728 patients achieve complete disease clearance. Like Zoryve, VTAMA has been a slow-seller, although with $18.4m of revenues earned in Q3, it is already outselling Zoryve, and an additional approval in AD will triple its addressable market.

When we consider the facts that, although lucrative, dermatology markets are highly competitive and patients have a range of options to consider, some of which are marketed and sold by companies with multi-billion dollar marketing budgets, that there are three rival creams on the market besides Zoryve, and that creams have attracted criticism for lacking efficacy, poor patient adherence, and limits on duration of therapy, perhaps it’s not surprising that the market has lost faith in Arcutis’ core business and product.

With that said, recent growth in the share price, triggered by the seborrheic dermatitis approval, and an upgrade from analysts at Mizuho, increasing its price target to $8 based on recent adoption trends, suggests that the market still has an appetite for Arcutis, stock, and perhaps, a good set of Q4 earnings, and a bullish outlook for 2024, if shared when management updates the market on 14th February, will result in shares recapturing more of their lost value.

Looking Ahead – A Make Or Break Year For Arcutis, Or Is Patience A Virtue?

With its finances stretched close to breaking point, you can certainly make the argument that 2024 is a “make or break” year for Arcutis. This will be Zoryve cream’s second year on the market, while the launch of Zoryve foam into a market with “pent-up” need for this type of solution (Arcutis management believes), must begin well to prevent the market falling out of love with the company and its products.

One advantage Arcutis has is that, unlike steroidal creams, there is no limit on usage of Zoryve – the product is derived from a drug used to treat Chronic Obstructive Pulmonary Disease (“COPD”) – although the same can be said of VTAMA, an aryl hydrocarbon receptor agonist, and Opzelura, although the latter is a member of the janus kinase (“JAK”) inhibitor class, which typically carry boxed warnings related to serious side-effects such as adverse cardiovascular events and cancer.

Broadly speaking, from a safety and efficacy perspective, there seems to be little to separate Zoryve, VTAMA, and Opzelura, a situation that arguably benefits Arcutis the least, given its stretched finances make it difficult to drive awareness of its product. In its Q3 earnings presentation, management claims to have secured 80% commercial coverage in the US, with >90% of lives covered without prior authorisation, and notes that there have been 9k unique prescription writers since launch of Zoryve cream, and that refills grew ~50% in Q3, versus Q2.

The signs point towards continuing growth, but of the incremental, rather than the exponential kind, which means that management’s outlook for 2024, likely to be revealed when Q4 earnings are announced 14th February, seems unlikely to wow the market. Looking ahead to later in the year, however, management is promising the opening up of new markets, as CEO Frank Watanabe told analysts on the Q3 earnings call:

We’re also very excited about 2024, as we are on the cusp of a very significant expansion of the opportunity for topical roflumilast in the coming year, which will translate into a substantial acceleration in our revenue trajectory.

In the next 12 months, roughly, we will expand the total addressable market for ZORYVE, potentially about ten-fold, expanding our patient opportunity in the U.S. from roughly 1.3 million commercial psoriasis patients today to over 13 million patients as we add about 1.2 million patients — commercial patients with seborrheic dermatitis and about 1.4 million commercial patients with atopic dermatitis treated by dermatologist, following the anticipated approval for those indications

Approval for Zoryve cream in Atopic Dermatitis, to add to the seb derm opportunity, could make a significant difference to Arcutis fortunes, in my view, not least because a potential approval in Q3 2024 would likely allow the company to complete a fresh round of funding, at a higher share price (I am assuming there would be a post-approval demand for Arcutis shares), and solve some of its financial issues.

As such, I believe there are two different conclusions about an investment into Arcutis. The first is that the company is running out of steam, as the market has not embraced its Zoryve product, owing to competition, a lack of public awareness, and a preference amongst patients for different therapeutic options – injections, or pills, for example. Each of these three problems strikes me as tricky for a smaller biotech with limited funding to resolve.

On the other hand, we could put Arcutis underperformance with regard to Zoryve revenues down to inexperience in the market place, slow uptake among physicians, and a smaller addressable market in the plaque psoriasis market. Each of these problems could be solved in 2024, as management gains more insight into market dynamics – pricing has already emerged as a key differentiator between products – existing physicians continue to prescribe and persuade colleagues to prescribe – and the market opportunity converts into a multi-billion one thanks to additional approvals, in AD primarily.

Arcutis’ recent share price gains suggest to me that the market still harbours belief that the latter scenario is the more likely, and as such, would respond to positive developments by pushing the biotech’s valuation up substantially – what needs to happen for that to be the case in 2024, and beyond?

Personally, I would like to see management forecast for revenues of >$50m in 2024, and if that is achievable, I would expect >$100m revenues in 2025 to be achievable also. A 1% share of its total addressable market would allow Arcutis to realise revenues in the region of $350m, and if losses can be narrowed – a possibility, as expensive clinical trials complete and approvals are secured – and revenues grown – as funding ought to be diverted from R&D to SG&A – that would be an attractive revenue figure for a company with a market cap of ~$600m.

To conclude my analysis of Arcutis, I don’t expect great things form the company in the first half of 2024, as the company focuses on driving incremental growth in a smaller indication, taking on rivals and attempting to grow awareness and favour among physicians.

That hard work may well pay off towards the end of the year, if, as seems likely, Zoryve wins an approval in AD, and gives management the chance to raise some funding and buy some breathing space.

As such, although I would classify Arcutis as a highly risky investment opportunity, for the many reasons I have alluded to throughout this post, I wonder if the market gave up on this company a little too soon, and whether Arcutis can ultimately deliver the sales figures and approvals in 2024 that will go a long way towards helping it recapture a >$1bn market cap valuation.