Magdalena Wygralak

Recently, I had success investing in Carrols Restaurant Group, Inc. (NASDAQ:TAST), a leading franchisee of Burger King and Popeye’s restaurants. In my October article, I noted TAST was attractively valued at just $1.4 million per restaurant s. replacement cost of $1.8 million.

Not long after my article, Carrols announced it was being acquired by Restaurant Brands International (QSR), the parent company of Burger King. The transaction value was $1 billion in enterprise value, or $1.7 million / restaurant, a fair price in my opinion.

Fresh off my TAST-y success, I actively sought out other restaurant companies that might be similarly undervalued and came across Arcos Dorados Holdings Inc. (NYSE:ARCO).

Arcos Dorados is the largest franchisee in the McDonald’s system operating and sub-franchising over 2,300 restaurants. Its ability to sub-franchise restaurants to independent entrepreneurs have allowed the company to generate superior profit margins compared to Carrols.

However, valuing the company using a sum-of-the-parts analysis, I believe ARCO is properly valued by the market at $3.9 billion enterprise value. I rate ARCO a hold pending a drop in its valuation or an acceleration of its sub-franchising efforts.

Company Overview

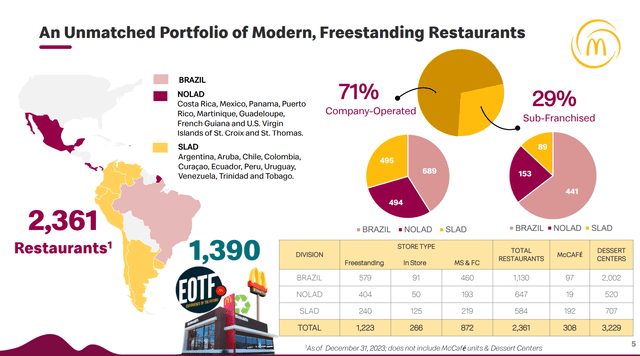

Arcos Dorados Holdings Inc. is the largest quick service restaurant (“QSR”) operator in Latin America and the Caribbean and is the largest independent franchisee in the McDonald’s restaurant system, generating over 4% of McDonald’s global sales. ARCO operates over 2,300 restaurants directly or through sub-franchise agreements in Brazil, Costa Rica, Mexico, and other South American countries (Figure 1).

Figure 1 – ARCO overview (ARCO investor presentation)

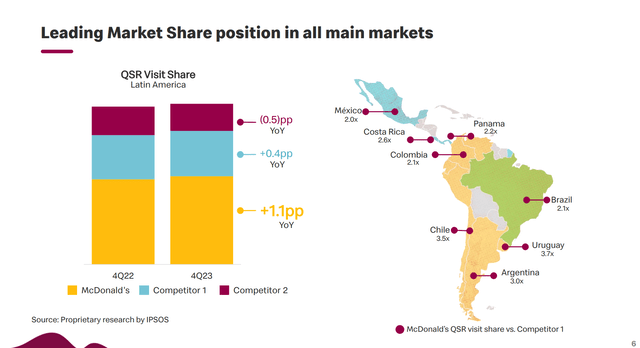

McDonald’s (MCD) is a leading global QSR restaurant brand and commands a leading market share position within all of ARCO’s main markets (Figure 2).

Figure 2 – McDonald’s is a leading QSR brand (ARCO investor presentation)

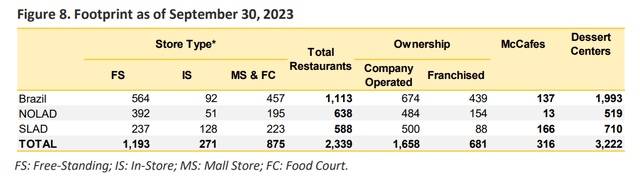

In total, ARCO’s operated 1,658 restaurants across Latin America and sub-franchised 681 restaurants as of September 30, 2023. It also derived revenues from 316 McCafes and over 3,000 dessert centers (Figure 3).

Figure 3 – ARCO restaurant count (ARCO financial reports)

ARCO Is More Profitable Than TAST

Historically, owning a franchise restaurant has been a well-trodden path to wealth for the middle-class. In the U.S., according to the Franchise Business Review, the average restaurant franchisee makes profits of $120,000 per year for businesses that have been open for more than 2 years.

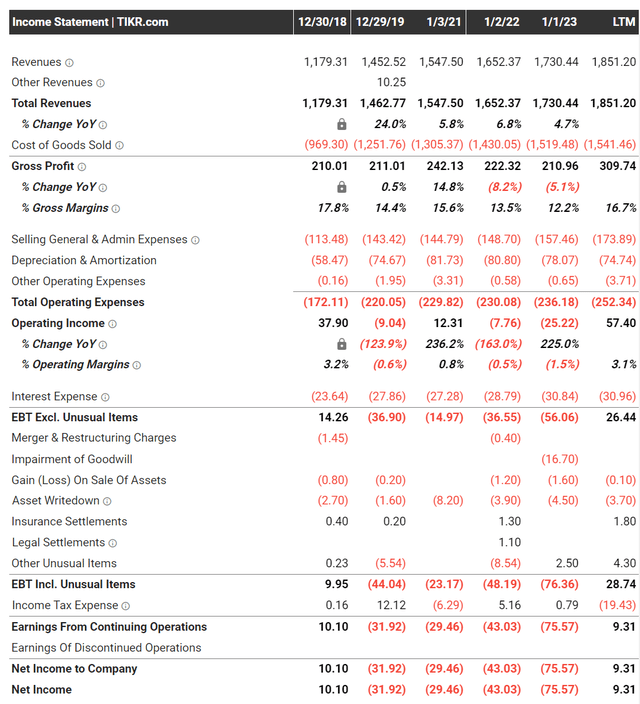

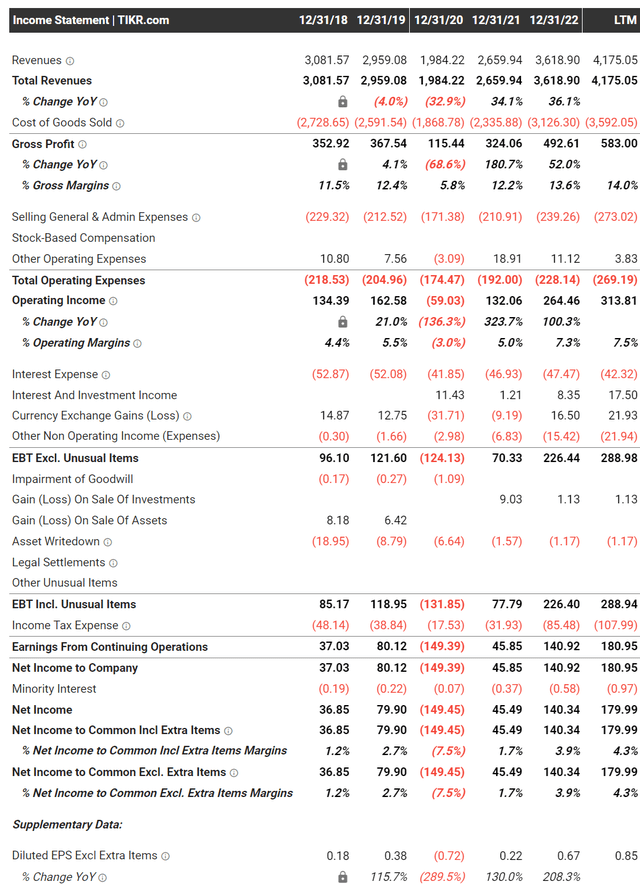

However, while individual franchisees can make very significant profits, results from publicly traded franchisees of QSR brands like Carrols Restaurant Group have often been disappointing, as there are significant dis-economies of scale. For example, TAST has reported years of low or negative earnings despite owning over 1,000 Burger King and Popeye’s restaurants (Figure 4).

Figure 4 – TAST financial summary (tikr.com)

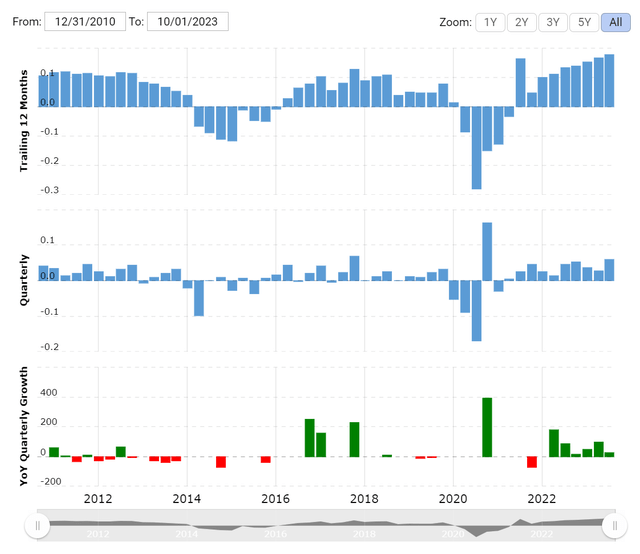

Fortunately, ARCO is no TAST, as the company has been generating strong profits annually, except for 2020, when the COVID pandemic negatively impacted results (Figure 5).

Figure 5 – ARCO financial summary (tikr.com)

In fact, ARCO has been consistently profitable and the company’s LTM net profits of $180 million is the highest in its history (Figure 6).

Figure 6 – ARCO generated $180 million in LTM net profits (macrotrends.net)

Sub-Franchising Is the Key Differentiator

What is the key differentiator allowing Arcos Dorados to generate $180 million in trailing 12 month net profits compared to almost nothing for Carrols?

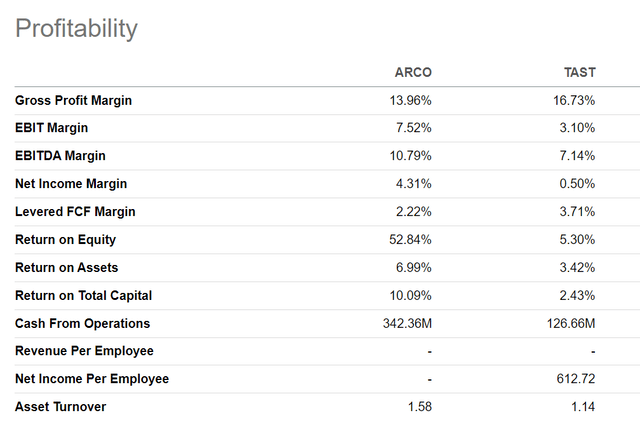

Comparing ARCO and TAST’s profitability, we can see that ARCO actually has a lower gross margin of 14.0% compared to 16.7% for TAST (Figure 7). So ARCO’s operating environment is actually tougher than TAST’s.

Figure 7 – ARCO vs. TAST profitability (Seeking Alpha)

However, when we move down to the EBIT and EBITDA margin line, we see that ARCO’s results are substantially better than TAST.

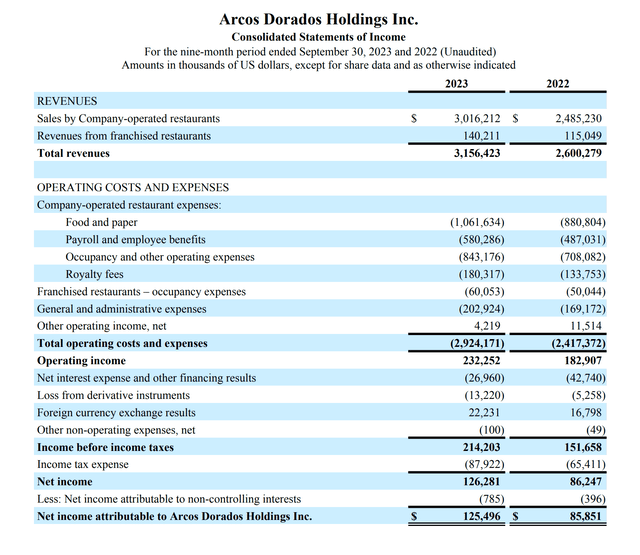

In my opinion, the key difference between ARCO and TAST is ARCO’s ability to sub-franchise stores to independent entrepreneurs. For example, looking at ARCO’s financial statements for the 9 months to September 30, 2023, we can see that ARCO generated $140.2 million in franchised revenues while paying $60.1 million in franchised restaurant rent expenses (Figure 8). This translates into $80.1 million in net franchise revenues or 34% of the company’s operating income.

Figure 8 – ARCO financial statements, YTD September 2023 (ARCO financial reports)

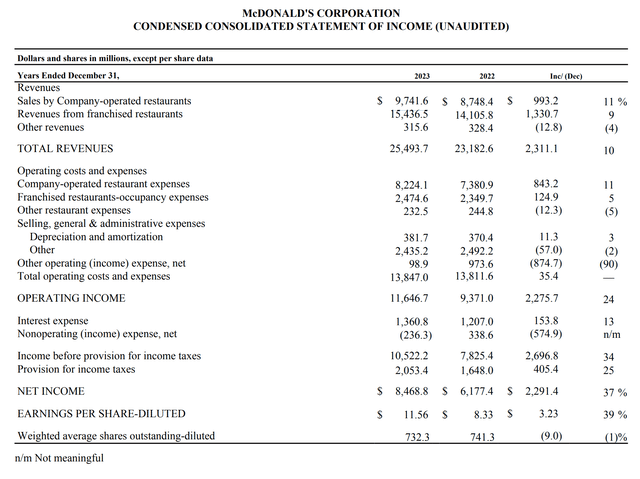

This is taking a page out of McDonald’s playbook, as the vast majority of McDonald’s operating profits are also generated from net franchise revenues (Figure 9). “According to industry analysts, McDonald’s keeps about 82% of the profit generated by franchisees, compared with only about 16% from its company-operated locations, further trimmed by the costs incurred in operating these units”.

Figure 9 – MCD financial statements, 2023 (MCD financial reports)

Valuing ARCO As Sum-Of-The-Parts

So one way to think about ARCO is as a mini-McDonald’s. McDonald’s generated $13.0 billion in net franchise revenues in 2023, or $340k per franchisee (McDonald’s has over 40,000 restaurants in its network at the end of 2022 and 95% are franchised).

In comparison, ARCO has 681 franchised restaurants generating $108 million in LTM net franchise revenues to September 30, 2023 or ~$160k per sub-franchisee.

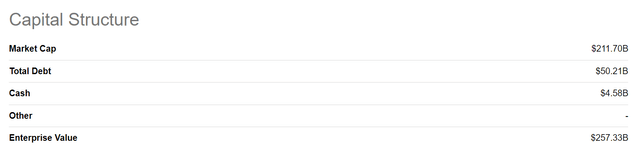

If we accept the premise that much of MCD’s enterprise value is derived from the company’s franchising model and not operating restaurants, MCD has $257 billion in enterprise value for ~38,000 franchised restaurants or approximately $6.7 million per franchised restaurant (Figure 10). This is roughly a 20x multiple on the net franchise fee of $340k per restaurant.

Figure 10 – MCD enterprise value (Seeking Alpha)

Using a similar metric, we can value ARCO’s sub-franchise value as 20x its net franchise fees or $2.2 billion ($160k per restaurant x 20 x 681 restaurants).

ARCO’s operated restaurants are also highly profitable and deserve value. In the trailing twelve months, ARCO’s operated restaurants generated $205 million in operating profits or $121 million after tax (ARCO has an effective tax rate of ~41%). Since operating restaurants is more volatile and lower margin, this cash flow stream should be valued at a lower multiple compared to franchise fees.

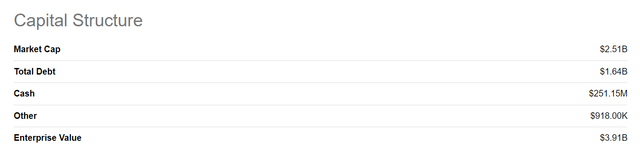

If we assign a 15x multiple to this earnings stream, ARCO’s operated restaurants are worth $1.8 billion. So the entire company is worth $4.0 billion using a sum-of-the-parts valuation. This compares to ARCO’s current enterprise value of $3.9 billion (Figure 11).

Figure 11 – ARCO enterprise value (Seeking Alpha)

Based on this sum-of-the parts analysis, ARCO looks fairly valued at the moment.

Risks To ARCO

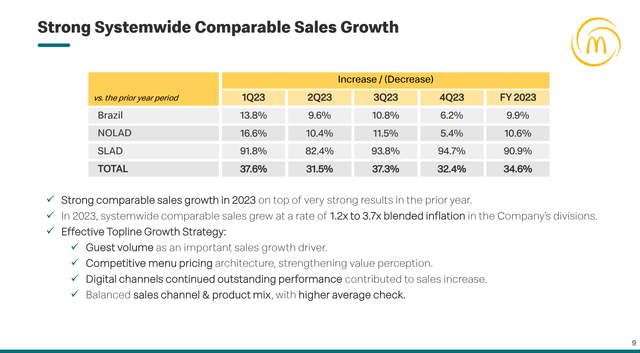

On the upside, ARCO has seen exceptional comparable sales growth, especially in its South Latin American Division (“SLAD”) where comp sales were up 93.8% YoY in Q3/23 (Figure 12). This exceptional performance was due to strong digital sales growth in addition to restaurant openings and price increases.

Figure 12 – SLAD has been star performer for ARCO (ARCO investor presentation)

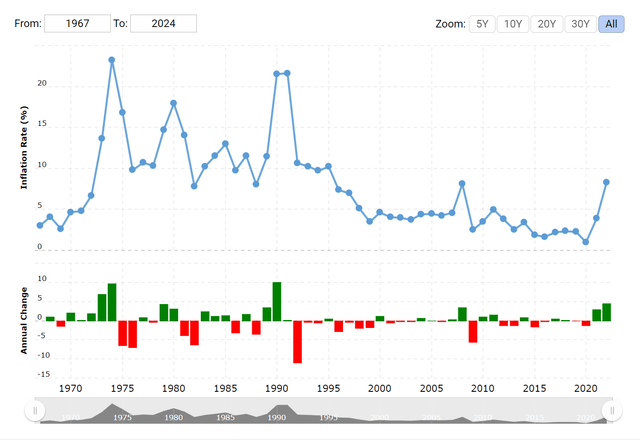

In general, Latin American countries have historically faced higher inflation rates (Figure 13), so consumers there may not be as sensitive as American consumers, who have been revolting against price increases at McDonald’s.

Figure 13 – Latin American inflation has historically been high (macrotrends.net)

So while sales growth may slow down for North American restaurant chains as they cannot take as much price increases, Latin American restaurants like ARCO may continue to benefit from price increases.

On the flipside, consumers are generally poorer in Latin American countries, so if Arcos Dorados keep increasing its menu prices, the company may risk alienating customers and negatively impacting sales. Furthermore, many parts of the world have been slipping into recession. If recession strike Latin American countries, Arcos Dorados could see its sales suffer. So far, comp sales have been strong, but investors should closely monitor quarterly results to sure this does not become an issue (Figure 14).

Figure 14 – ARCO comp sales have been strong (ARCO investor presentation)

Conclusion

Arcos Dorados is a leading Latin American franchisee of McDonald’s restaurants. It operates and sub-franchises over 2,300 restaurants, contributing over 4% to McDonald’s worldwide sales.

Looking at ARCO’s financial performance, I believe the key differentiator between ARCO and other franchisee companies like Carrols is ARCO’s ability to sub-franchise restaurants in its geographical regions. This has allowed ARCO to earn attractive net-franchise fees, just like McDonald’s.

Valuing ARCO’s business using a sum-of-the-parts analysis between franchised and operated restaurants, I believe ARCO’s share are currently fairly valued. I rate the company a hold for now.