Andrii Yalanskyi/iStock via Getty Images

Archer-Daniels-Midland (NYSE:ADM) bills itself as one of the world’s largest nutrition companies. It processes grains and crops that are used as key ingredients by many of the leading food companies. These ingredients are used to create foods for humans as well as animals. This business is headquartered in Chicago, IL but has operations all over the country as well. This company just announced some news that has clearly rattled some investors. On January 21, 2024, the company said that it was putting its CFO on administrative leave and that the company was investigating certain accounting practices in its nutrition segment and that it was cooperating with the SEC. The company operates in three segments which include ag services and oilseeds, carbohydrate solutions and nutrition. The nutrition segment of the business was the fastest growing part of the company, so it is important to the company overall. Based on this news, the stock plunged and has created a potential buying opportunity for investors with some patience. Let’s take a closer look:

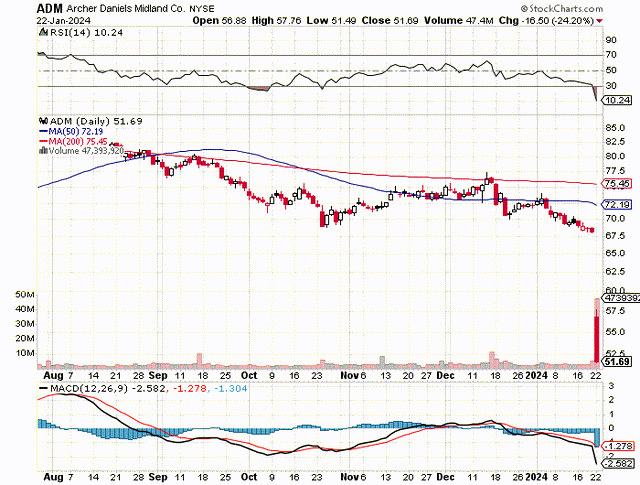

The Chart:

As the chart below shows, this stock has been decimated with the recent news. It was recently trading in the $70 per share range, and it lost roughly 25% of its value on Monday January 22, 2024, and hit a new 52-week low of $51.49 per share. As indicated on the chart, these shares now have a relative strength index or “RSI” of just 10. I don’t remember the last time I saw a stock with an RSI this low, so this could be a sign of massive capitulation. For reference, stocks are usually considered oversold when the RSI is around 30 or below, so an RSI of 10 shows we are seeing an extremely oversold stock.

What Comes Next:

With the stock at extremely oversold levels, it is possible we will see a significant rebound in the coming days. However, it makes sense to be prepared for more possible pain and bad news ahead. The bad news could come in the form of multiple analyst downgrades, some of which have already occurred. Bad news is also likely to keep coming in terms of class action securities lawsuits which have already been filed, with more likely in the coming days. Analyst downgrades and class action lawsuits are likely to be free flowing in the next week or two and this could keep some selling pressure on the stock. However, at some point soon, I expect the stock to stop reacting to downgrades and lawsuits and partially rebound, perhaps fueled by short covering when they see the stock has hit rock bottom. The stock will probably find some relief and then be stuck in a trading range until the company puts the accounting and SEC investigation past it, which could take a couple quarters or more. The company expects the accounting issue to delay 4th quarter and full-year earnings results, but it did provide some guidance that suggested nearly $7 per share in earnings for 2023, by stating:

“ADM now expects to deliver above $6.90 in adjusted earnings per share for the fiscal year ended December 31, 2023, subject to completion of annual close processes and related internal controls. The Company also expects to report fourth quarter and full year 2023 operating profit for its AS&O and Carbohydrate Solutions reporting segments in line with previous indications provided on the October 24, 2023 third quarter 2023 earnings call. Due to the ongoing investigation, ADM withdraws all of its forward-looking outlook for the Nutrition reporting segment.”

Archer-Daniels-Midland said it expects to complete the investigation into accounting practices by the end of February 2024. Seeking Alpha’s news editor Joshua Fineman detailed this news in a recent article which stated:

“The probe is looking at inter-segment transactions at Archer Daniels Midland (ADM), according to CNBC’s David Faber.

“The numbers may not change,” Faber said.”

This would be a relatively rapid potential conclusion to this accounting issue, and the possibility that “the numbers may not change” could be very good news for shareholders and make the nearly 25% selloff in the stock appear to be excessive.

My Buying Strategy:

I was not long this stock before the accounting news broke, but I started buying some shares in the $51 range and I plan to add more in stages over the coming days. I may also sell put options in order to benefit from option premiums. Depending on how large my position gets, and if the stock gets a significant rebound, I may sell part of my position, but I definitely want to keep at least some of the shares I accumulate as a longer term investment. Food production is one of the most stable and important businesses we can invest in and I see the accounting issue at this company as a one-time and limited issue that will be forgotten in the not too distant future. The accounting issue only appears to potentially impact one segment (nutrition) of this huge food company’s business and that is why it is likely to have very limited impact and be resolved in the coming quarters.

Earnings Estimates and Balance Sheet:

Archer-Daniels-Midland produced strong results in the past couple of years and earnings were expected to soften in 2024 before resuming an uptrend. For example, the company has now guided for profits of $6.90+ per share for 2023, and analysts expect earnings of $6.08 per share for 2024, and $6.20 per share for 2025. As for the balance sheet, the company has about $1.5 billion in cash and $9.5 billion in debt. With well over $90 billion in annual revenues, and being in a relatively stable food business, the balance sheet appears very solid. Rebound potential for this stock in the future could be fueled by plans for nearly $5 billion in share buybacks, solid single digit revenue growth and a shareholder friendly dividend policy:

Archer-Daniels-Midland Investor Presentation

Archer-Daniels-Midland Is A Dividend Growth Stock:

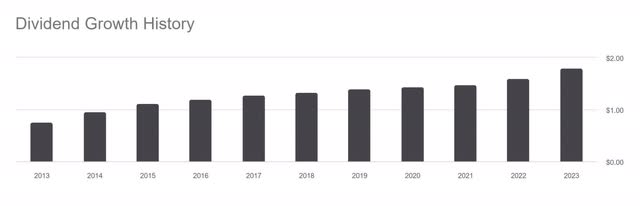

Archer-Daniels-Midland has been raising the dividend for many years and it is a dividend growth stock. For example, if we go back ten years to 2014, the quarterly dividend was just 24 cents per share, but the quarterly dividend is now 50 cents per share, which offers a yield of about 4%. The company’s investor presentation states it has paid dividends for 91 consecutive years and it has increased dividends for over 50 years.

Archer-Daniels-Midland has an impressive history when it comes to paying dividends. This company is in the S&P 500 Dividend Aristocrats Index (NOBL) because it is 1 of 67 members that has paid a dividend for 25 years or more, and it is also a “Dividend King” because it has raised the dividend for 50 years or more. Once again, Archer-Daniels-Midland just announced it would raise the dividend by 11% to 50 cents per quarter, which makes it the 51st year in a row that it has increased the payout to shareholders. It now yields nearly 4% and the next 50 cent per share quarterly dividend is payable on February 29th, to shareholders of record on February 8, 2024. With a dividend history like this and continued prospects for additional dividend growth in the future, this “Dividend King” makes sense for many income investors. The dividend now totals $2 per share annually and with earnings estimates of $6 per share or so, this implies a payout ratio of just around 30%, which means the dividend is easily supported by the earnings power this company offers.

Potential Downside Risks:

I believe the 25% recent plunge in the stock has priced in a lot of bad news, and probably overly so. Archer-Daniels-Midland has probably not lost a quarter of its business after the accounting issues are resolved, but it has already lost this much in market capitalization, so the pullback is probably overdone. However, sales and profits are expected to slow in 2024 and maybe the slowdown is going to be greater than expected. This accounting issue is likely to remain an overhang on the stock until it is fully resolved. Other potential risk factors are inflation, and geopolitics if for example, grains or other basic crops are impacted by the war in Ukraine or shipping lanes in the Red Sea.

In Summary:

I believe Archer-Daniels-Midland stock is a strong buy because the stock appears very undervalued at current levels. The company statements that suggest the accounting investigation will be completed by the end of February along with the recent dividend increase also seem to suggest that the accounting issue could just be a short-term speed bump and buying opportunity.

With the stock being so deeply oversold with an RSI of 10, and with it losing roughly 25% of its value, I feel like I had to start a small position in this stock. Food production will only increase over time as the population grows, and this is a fairly recession-resistant business with stable cash flows. It looks like 2024 could be a transition year for Archer-Daniels-Midland, whereby it will likely resolve this potential accounting issue and also position the company back for earnings growth in 2025. I do think this stock is soon due for a solid rebound, but the big gains will likely go to investors who patiently accumulate shares over the coming weeks and months and hold them into 2025, while collecting the dividend.

No guarantees or representations are made. Hawkinvest is not a registered investment advisor and does not provide specific investment advice. The information is for informational purposes only. You should always consult a financial advisor.