peepo

Overview

My recommendation for Archer Aviation (NYSE:ACHR) is a buy rating, as the business continues to progress well in terms of certification and go-to-market strategy. In addition, an ACHR balance sheet with net cash of >$400 million enables it to easily tide through the next couple of years without any liquidity risk. Switching from a relative valuation model to a long-term DCF, my target price for ACHR continues to show attractive upside. Note that I previously gave a buy rating for ACHR as everything was progressing well in terms of R&D and that any outstanding issues regarding the lawsuit had been settled. Importantly, there is no structural change to the long-term secular tailwind.

Recent results & updates

ACHR continues to make successful strides in its execution plans, particularly in getting the necessary certification and expanding its go-to-market [GTM] strategy. In regards to the former, ACHR is still on schedule to complete assembly of its conforming aircraft in the coming months and start piloted flight testing next year, so execution is definitely going well. Regarding the latter, I think management has been keeping their foot firmly on the gas behind the scenes since they recently announced a pathway forward in India and the UAE, with the latter agreement slated to fund the acquisition of up to 200 Midnight aircraft for operations in India. While some might question management’s intention of expanding abroad rather than being focused on the domestic (US) market, I think this is the right strategic move. By moving the chess pieces ahead abroad today, ACHR achieves two things:

- ACHR can show the US government that their product works and is safe for deployment on US grounds. As this happens, I believe there is an opportunity for the ACHR contract with the DOD to expand significantly beyond the current $142 million, especially as the department validates the technology and use cases. This would certainly help with ACHR cash flow at this stage.

- ACHR diversifies its base of customers, making its revenue and cash flow more resilient.

The other important update is regarding the ACHR balance sheet and whether it has sufficient cash to tide through the coming years of cash burn. I believe ACHR has no liquidity issues due to a couple of reasons. To start, ACHR will be able to reduce its cash burn rate going forward by making better use of its current aerospace supply chain. Giving some background, ACHR pays vendors the standard non-recurring engineering [NRE] fees for the research and development [R&D] and tooling needed to incorporate the systems into ACHR-specific designs. Recent quarters have seen NRE payments accounting for around $10-$15 million of ACHR’s quarterly expenses; however, this should taper off eventually. Assuming these expenses go away by end of 2024, using the management 4Q23 operating expense guide of $75 million to $85 million, this means the new cash burn rate would be ~$55 million to $70 million. Using the management 4Q23 operating expense guide of $75 million to $85 million, this means the new cash burn rate would be ~$55 million to $70 million. ACHR currently has around $443 million in net cash, and at a $62.5 million burn rate (midpoint), ACHR can last for another 7 years. Secondly, the ACHR asset-light strategy helps reduce the burden on its balance sheet. Specifically, ACHR is choosing to partner on vertiports and charging infrastructure instead of owning them. Thirdly, management is also setting up aviation financing mechanisms to limit the need to hold aircraft on its own balance sheet. All of these should improve the balance sheet position, allowing ACHR to have enough cash to get through the entirety of certification.

Our aim remains to begin with New York City service with United Airlines, our partner who has placed an up to $1 billion order for up to 200 aircrafts. from: 3Q2023 earnings call

Regarding the point of owning infrastructure, over the long run, I do believe it makes sense for ACHR to own a few strategic assets. Specifically, I think ACHR should eventually invest in vertiports if it allows it to be an exclusive operator in a key region. Doing so would basically allow ACHR to monopolize the region and widen the gap between itself and its peers. More importantly, it would not be under the mercy of the infrastructure asset owner when it comes to fee negotiations.

Valuation and risk

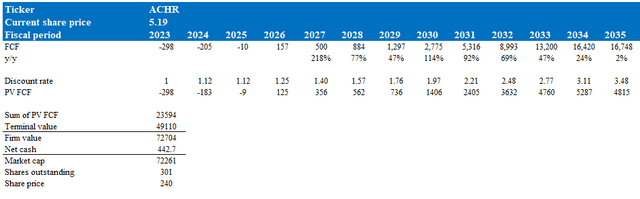

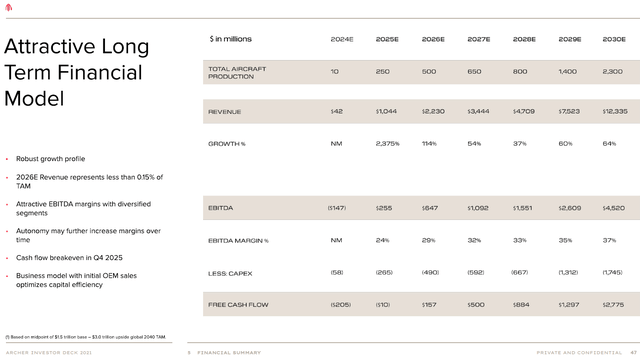

After using the relative EBITDA valuation method to model ACHR for the past few updates, I changed the method to a long-term DCF to see whether I was being biased with my EBITDA multiple assumption. In my DCF model, I used consensus FY23 FCF (since 3Q of FY23 is already in, the consensus estimate should be accurate), followed by management long-term FCF guidance through FY30. I term this period the growth year, as ACHR’s FCF sees very high growth. Post-FY30, I made the assumption that the business should start to mature; as such, growth is expected to taper to a long-term inflation rate of 2%. The assumption behind the 2% is that ACHR should be able to at least raise prices to match inflation every year. As the model assumes FCF is far out in the future, the uncertainty and risk profile are high; as such, I used a high discount rate of 12% to reflect this uncertainty. Using all these assumptions, I derived a share price of $240, which represents a significant upside from the current share price (in line with my previous estimates).

The major prevailing risk is that ACHR messes up getting the necessary certificates. This will not only impact its ability to commercialize the products; it will also impact the reputation of the firm, which is likely to affect prospective clients’ decision-making processes.

Summary

In summary, I maintain a buy rating for ACHR as execution remains sound and it has a robust balance sheet with over $400 million in net cash. Notably, the balance sheet strength is bolstered by an asset-light strategy and tapering of NRE payments. Using a discounted cash flow model, my target price for ACHR is $240, indicating substantial upside potential. While risks associated with certification delays persist, the overall outlook remains optimistic.