Charday Penn

AppLovin (NASDAQ:APP) is a high-growth, newly profitable technology company that makes a number of advertising and streaming technology products for app developers and CTV makers.

Assuming you saw the headline here and clicked, you may be wondering what the heck we are talking about, given that the firm doesn’t fit the typical profile of a company ready to return capital to shareholders – it only recently turned the corner on net income, and still has many avenues available to invest capital into the business to generate higher-than-average IRR over time.

So where is the yield opportunity?

As it just so happens, we think APP is a great company. The firm’s products provide tremendous value to customers, and revenues are growing hand over fist. Net income has also followed suit, finishing Q3 in the black by more than $100 million. However, it’s still a young company, and the stock has been rather volatile over the last year, ranging from highs of $116 per share to lows of ~$10 per share.

It’s a highly risky name that will likely continue to exhibit loads of volatility, even in the event that the company does execute and stabilize over the longer term.

Thus, our trade idea.

Sell put options on APP.

Selling puts gives us a chance to enter the stock at a much lower price than where it is currently, while also generating a LOT of cash in the meantime while the stock chops around.

At a relatively rich valuation, if the stock ends up flying higher, it’s ok – we can always wait to buy it later. However, in the event that the stock dips, for whatever reason, our high-yield income play gives us an opportunity to buy the stock at a better multiple and keep the income, which seems like the best of all worlds.

Today, we’re going to explore this trade idea in more detail and explain why you should consider a move like it for your portfolio.

Sound good? Great, let’s jump in.

Financial Results

As we mentioned, we like APP. The company has been producing advertising and streaming technology for years now, helping app developers monetize and market their apps.

In the company’s own words:

Since our founding in 2011, we have been focused on building a software-based platform for mobile app developers to improve the marketing and monetization of their apps.

Our founders, who are mobile app developers themselves, quickly realized the real impediment to success and growth in the mobile app ecosystem was a discovery and monetization problem—breaking through the congested app stores to efficiently find users and successfully grow their business.

Their first-hand experience with these developer challenges led to the development of our infrastructure and software—AppLovin Core Technologies and AppLovin Software Platform.

Since the company has been public, results have been mixed, but have trended overall in the right direction:

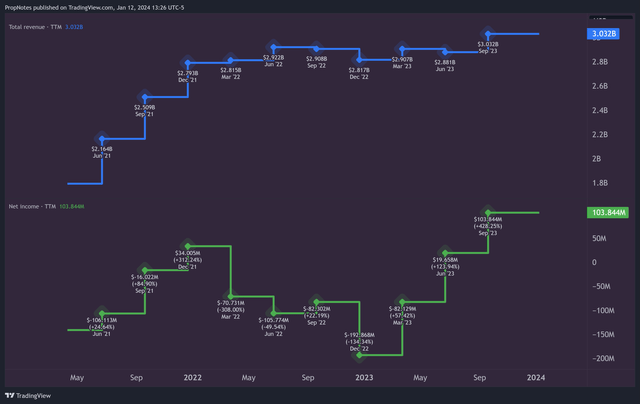

Revenue has grown in a systematic fashion, but TTM net income has proven a bit more elusive, briefly being positive at the start of 2022 before dipping back into the red. Only recently have results begun to look more positive.

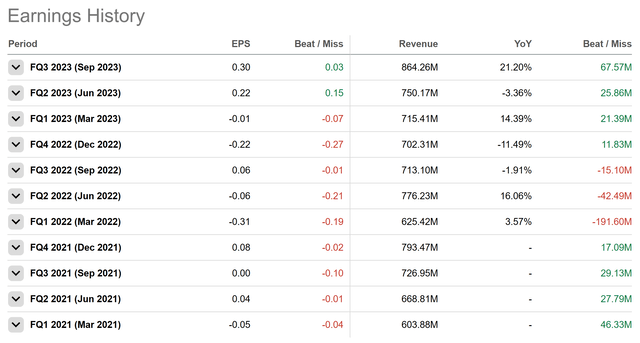

This experience also pours over into how analysts have perceived the company. Since going public in 2021, APP missed EPS estimates every single quarter, only finally beating for the first time recently, in Q2 2023:

Make no mistake, results have been volatile.

However, things appear to have turned a corner.

Aside from net income finally getting into the black for a few quarters consistently, management is showing more and more signs of bullishness following a rough period in 2022 which saw flat lining revenue and significantly negative earnings:

Our team has executed exceptionally well. This quarter’s record-breaking performance is a testament to the success of our new AI-based advertising technology, AXON 2, which has once again driven revenue and adjusted EBITDA above our expectations.

I would like to take a moment to commend our outstanding team for their dedication and hard work. A year ago, we faced significant challenges, yet our teams resolve and enthusiasm never faltered. Our efforts this year have not only solidified our short-term growth trajectory but have also set the stage for sustained long-term expansion.

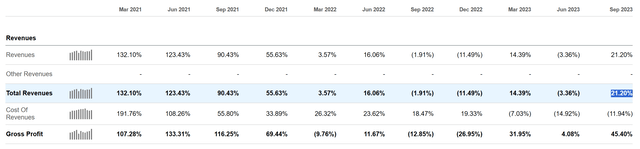

From a numbers perspective, things also appear to be re-accelerating:

We are excited to see our software platform and AI-driven technologies to help our advertising partners expand the reach, achieve better returns on their investments and increase their spending with us. The software platform reached record revenue of $504 million, a 65% increase over the prior year and a 24% increase quarter-over-quarter, which is the third consecutive quarter with double-digit quarter-over-quarter revenue growth.

Software Platform adjusted EBITDA grew 91% year-over-year and 33% quarter-over-quarter to $364 million, with a record 72% adjusted EBITDA margin.

The growth here in some segments appears in the consolidated financial statements, with revenue and gross profit growing significantly for the first time in a while:

While some of this is likely due to continued execution on the team’s part, in addition to APP’s new AXON 2 AI ad system which allows developers to understand their ROI better, there’s also some macro forces here to thank.

A less hectic rates environment has led to a more stable investment environment for app’s user acquisition. As the rate cycle appears to have peaked, it becomes easier for apps, which are typically high-growth, high spend, to forecast their burn rates, growth rates, and investor commitments.

A less hectic rates environment also leads to increased spend confidence among already profitable, established gaming apps, which comprise a large slice of APP’s revenue.

The increases in margin are also due in part to better datacenter cost efficiency, as discussed here:

Our business model on the software side, first of all, as you know, we report on a net revenue basis, so we start at that level in the P&L. And then in terms of the cost structure itself, that’s directly related to software.

A lot of it is the data center infrastructure that we talked about almost a year ago that we had a big new contract that we needed to get to initial amount of initial scale. And so we had to grow into that. I’d say now we’re very much on pace if not growing through some of that contract and so fully utilizing the capacity that we’ve had on board. And that’s why we’ve been able to really expand gross margin all the way through to EBITDA given a relatively fixed cost structure on the R&D front.

All in all, financials appear to be headed in the right direction, with an improved, consolidated offering among APP’s 4 products, and a new AI model which promises to drive even more spend and margin from clients.

The only real negative right now to mention is the large long-term debt on the company’s balance sheet, the result of multiple acquisitions over time, including MoPub and Wurl, which were ~$1B and $450 million in size, respectively.

Management has confirmed that revenue flow through is more than high enough to pay this down and buy back stock, which it has been doing, so it’s not a huge concern. That said, the heightened leverage profile may increase the volatility of the stock.

Valuation

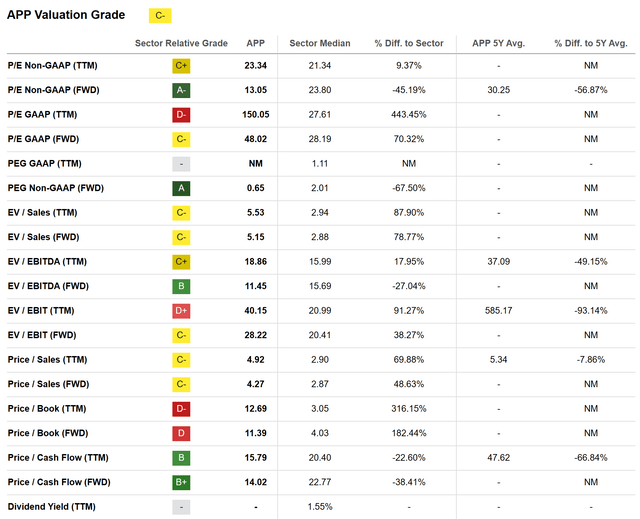

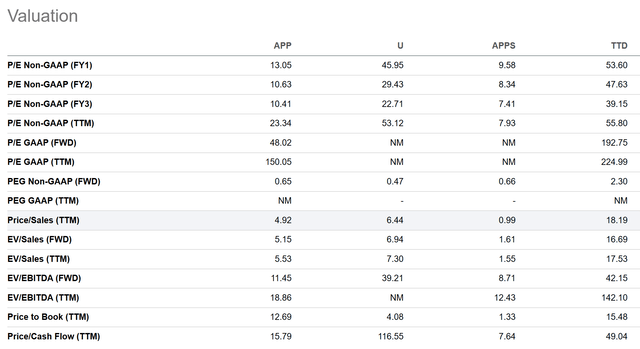

While APP is becoming more and more profitable over time & accelerating growth with new product launches, the valuation is a little bit richer than we’d like:

With a Seeking Alpha Quant Rating of a “C-” and a TTM price to sales of nearly 5x, APP looks a tad expensive, given its somewhat small size and lack of a true moat.

TTM GAAP P/E is obviously extended as a result of the company’s newly profitable status, but some measures, like EV/EBIT also look pricey, trading at a 91% premium to the sector.

From a different lens, it’s not outrageously expensive, comparing favorably to some larger peers like TTD:

Overall, we wish we could get shares at a better price in the company to increase our margin of safety, while gaining exposure to the improving business/financials story.

Thankfully, there might be a way to do just that.

The Trade

Selling put options on APP stock seems like the best way to play things at the current juncture.

By selling a put option, you’re agreeing to purchase a stock at a certain price (strike price), by a certain date, if the price of the stock finishes below the strike price.

In return for committing to be a buyer, the put option seller earns a large cash premium for taking on the risk of doing so.

In the case of APP, put sellers are earning a tremendous amount of money for agreeing to buy shares in the stock, even at much lower prices vs. where shares are trading, due to the company’s highly volatile shares.

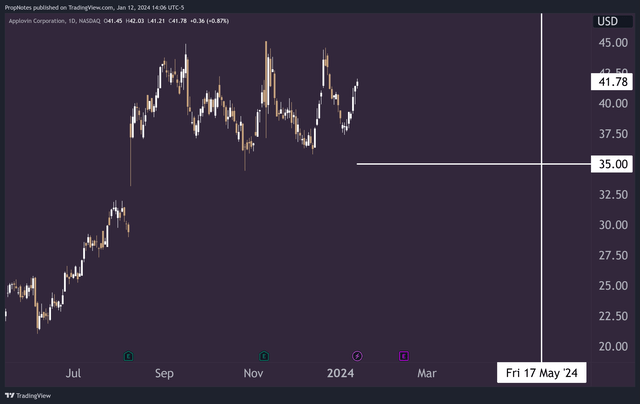

For the purposes of this article, we like the idea of selling May 17th, $35 strike put options for $2.70 a contract:

Functionally, this trade is quite simple. Selling the option will immediately net $270 in cash per contract to the seller, and your broker will reserve $3,500 in margin in the event that the option ends up exercised.

$270 on a cash commitment of $3,500 is more than 8%, which is an incredibly healthy cash-on-cash return over only 126 days. Annualized, that’s a yield of 24.2%(!).

No matter what happens with the stock, the put seller gets to keep this cash. If the stock goes up or sideways, the premium is kept as a profit. If the stock dips below the $35 dollar mark by May 17th, then the put seller keeps the cash and can use it to offset the cost of the new shares, effectively putting the trade’s breakeven at $32.30.

If APP stays above $32.30 by May 14th, then you make money. If it doesn’t, then instead of buying shares at today’s price (which stands around ~$42 as of writing), then you’ll ‘buy’ shares instead at a 22% discount to the current market.

This also means that you’ll get a better multiple on entry, as opposed to the 4.9x in sales you get right now.

With a probability of max profit at 76%, it’s a high-probability play.

Overall, whether you earn 8.3% in cash or end up purchasing the stock at a significantly better entry multiple, it seems like a win-win trade.

Risks

There are some risks associated with this idea.

First, if the stock drops to zero, you may still be obligated to purchase it at $35 as a result of being short the options. This is no different, functionally, to being long the stock, but it’s something to be aware of.

Secondly, there are two scheduled earnings reports between now and May 17th. Each of these will likely induce significant volatility in the stock, and could send it below $35 at expiry, which would require put sellers to purchase shares in the name.

Finally, APP is just a volatile name in general. Even if the company executes well, there’s a chance that the 2% daily ATR could impact this trade negatively, and shares could end up under $35 by expiry.

Summary

While there are some risks associated with our trade idea in APP, the company’s improving financial situation, new product momentum, and re-accelerating growth provide an excellent platform to sell put options on.

With the prospect of an 8.3% cash payout over the next 126 days, or a 22% discount on the underlying stock in that same time, this idea seems like a solid win-win for long-term investors.

Stay safe out there!