andresr

After a strong year performance in 2023, AppLovin (NASDAQ:APP) looks poised to have another strong showing in 2024 powered by its new AI advertising technology engine.

Company Profile

APP offers software solutions that help mobile app developers optimize the marketing and monetization of their apps. The company offers several solutions. Its AppDiscovery platform is a marketing software solution that helps customers grow their apps profitability with performance based mobile and Connected TV (“CTV”) campaigns. Its Max solution, meanwhile, is a monetization solution that helps customers drive in-app ad revenue. Its Wurl platform is used to distribute streaming video to content companies to help better monetize CTV ad inventory. The company also offers and end-to-end app management suite call Array.

The company also has a portfolio of its own apps. It has over 350 free to play apps that are run both by its own studio as well as partner studios.

Opportunities & Risks

APP dove into AI in 2023 when it introduced its AXON 2 AI-based advertising technology, and so far the early results have been positive. The company has been using a staged rollout of the new underlying tech. The company’s original AXON machine learning engine was rolled out about 4 years ago, while the improved AXON 2 with AI technology has been in development for about a year before being rolled out in Q2 of 2023.

On its Q1 call in May introducing the new AI engine, CEO Adam Foroughi said:

“Now let’s talk a little bit more in detail about AXON improvements. We have been discussing the development of AXON 2 for a year now, and have always communicated that our strongest growth would come from advancements in our own technology. It’s been challenging to explain what this means, but with the exploding popularity of consumer-facing AI tools, we can draw a simple analogy. Upgrading from AXON 1 to 2 is no different than OpenAI moving from ChatGPT 3 to 4. Our models can always be improved, and our entire business is powered by the evolution of our technology. The enhancements to our machine learning and AI are not a onetime thing, but a series of upgrades over time. As we make these, there is the potential for significant lifts to both revenue and cash flow. We are currently in the midst of a staged rollout of AXON 2, and we are very excited about the long-term potential of this new technology for our partners and our business. We are extremely pleased with our execution so far this year. We believe that our technology and innovation will continue to be the driving force behind our success, and we are committed to continuously improving our business.”

Among the benefits of the new technology is that it is allowing APP to work with a wider breadth of advertisers, as the technology is more predictive. As such, it is starting to let it move into more verticals. Traditionally, APP’s core vertical has been gaming apps.

The early payoff from its upgraded AXON engine has been huge so far. In Q3, the company saw software platform revenue soar 65% to $504 million, while software EBITDA jumped 92% to $364 million. That was a huge acceleration from the 28% growth it saw in Q2 when it initially launched AXON 2.

Early on, AXON was primarily being used in the company’s AppDiscovery Platform. However, it is also in the midst of rolling out the AI-based advertising technology to its Wurl connected TV platform and Array business as well.

Array and CTV are two other potential growth drivers for APP. Array is focused more on the OEM carrier side with Android devices. The company expects that with Array being powered with AXON 2 that it will be able to offer multiple new ad offerings to this segment.

Meanwhile, by adding AXON 2 to its WURL platform, it will look to sell performance media on connected television. CTV is still in the early stages for APP, but this could be a nice opportunity for the company down the road.

Another opportunity for APP is to stabilize its app portfolio business. Q3 marked the first time the company did not see a sequential decline in revenue in the business since Q4 2021. In that time, Apps revenue has gone from $547 million to $344 million in Q2 of 2023, before seeing a lift to $360 million in Q3. The company invested in some new games and user acquisition to help stem this tide, which had been a big drag on overall revenue growth.

When looking at risks, the macro environment is a big one. The largest part of the company’s business is still performance marketing for game advertisers. When advertisers become more cautious, it can impact APP’s business.

The company’s app portfolio of games, as noted above, has also seen a lot of pressure over the past two years. The company has worked on optimizing its portfolio and saw the business finally trough this year. However, the segment’s results over the past two years shows how difficult and competitive this part of its business is. Unity Software (U), which provides the development kits many of its studios use to build its apps, also announced a change to its pricing in September, although walked back a more dramatic price increase announced earlier.

APP also carries a fair amount of debt. At the end of Q3, it had $3.13 billion in debt and $332.5 million in cash on its balance sheet. However, the company is generating solid free cash flow (nearly $700 million through the first nine months of the year) and its year-end leverage should be just under 2x.

This debt comes from the company spending $4.0 billion on 29 acquisitions between 2018-2022. This acquisition strategy comes with risks, as it needs to integrate the assets and technology it has acquired, and some of this emerging businesses may not live up to expectations. One of its biggest deals was buying MoHub from Twitter in early 2022 for $1.05 billion. It was generating around $190 million in revenue at the time, and has since been folded into its Max product.

Valuation

APP stock currently trades around 8.8x the 2024 consensus EBITDA of $1.8 billion and about 8.0x the 2025 consensus of $1.99 billion.

It trades at a forward PE of nearly 10x the 2024 consensus of $3.90 and just over 9.8x the 2025 consensus of $3.98.

Revenue growth is expected to be nearly 16.3% in 2024, and then grow around 9% in 2025.

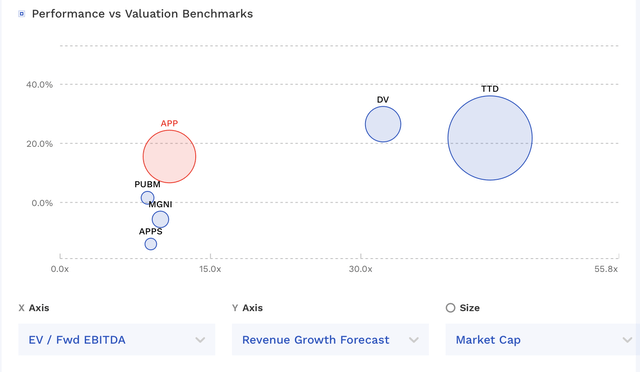

The company trades at a similar multiple to many of its adtech peers, but is showing much higher growth.

APP Valuation Vs Peers (FinBox)

Given its growth, I’d value APP between 10-12x 2025 EBITDA, which would place a fair value of between $51-63.

Conclusion

APP’s new AI engine is powering growth for the company’s software business, while its app business has seen signs of stabilization. The accelerated growth the company saw in its software business in Q3 was quite impressive, and should just be the start of the benefits of AXON 2 for its business. If AXON 2 is able to help the company expand beyond its core gaming customers, there should be plenty of upside ahead.

APP’s stock had a strong performance in 2023, and I think the stock could perform well this year driven by revenue growth outperformance powered by AXON 2 as well as some multiple expansion in the name. As such, I’m going to start APP with a “Buy” rating and $51 price target.