IR_Stone

Applied Optoelectronics (NASDAQ:AAOI) reported improved financial performance for Q3-2023 and the company’s stock price has been on a year-long uptrend, gaining 900% over 12-months and 1000% YTD. Recent coverage on Seeking Alpha rates the stock as a hold because it is currently overvalued. The company is optimistic about its future outlook, i.e. growing profits and shrinking net loss, while market sentiment shows extreme optimism in its future potential. I have speculated what may be behind this market optimism. I think that the company offers an indirect AI play because of the increased demand in bandwidth for AI applications and computing.

I am taking the opposite position of recent analysts and rating the stock as a buy. I believe that the growing use of AI applications will require more and more internet bandwidth over the next few years. Applied Optoelectronics is already laying the foundations to meet this demand by supplying better laser optical equipment to datacenters. If the company’s stock price rallies further and returns to $24 per share, then gains between 14-15% may be realized. If the stock continues its extreme uptrend over 2024, then the gains will be more. I also encourage short-term call options strategies, if the momentum continues.

Q3-2023 Financial Results and 2024 Synergies

Applied Optoelectronics reported $62.5 million in revenue, representing a 10% increase YoY and a 50% increase QoQ. The company credits this increase to large growth in its 100G and 400G data center business, i.e. outfitting data centers with higher bandwidth capabilities. 78% of Q3-2023 revenues came from data center products, while 16% came from cable TV (CATV) products. The remaining 6% came from FCTH and Telecom products. CATV revenues are decreasing and the company is looking towards fitting out MSO’s (multi-system operators) with DOCSIS 4.0 (data over cable service interface specifications) networks throughout 2024.

Applied Optoelectronics manufactures and sells fiber optic networking products which are used by telecom, cable TV, and datacenters. The company’s products are in high demand. Synergies for 2024 include the company’s ongoing contract with Microsoft (MSFT) to supply equipment to update its data centers. Applied Optoelectronics expects around $300 million in revenues from its contract with Microsoft. Applied Optoelectronics has launched a new product called QuantumLink, which allows for remote management of cable and data centers. The company has also made a recent distribution partnership with Digicom to distribute some of its amplifier and line extenders.

The company reported improved financial performance for Q3-2023. Gross profits of $22.2 million represent an increase of 108% YoY and 155% QoQ. The company reported a gross margin of 32.5%, representing an increase from previous quarters. The company reported a net loss of $9 million, which has decreased YoY and QoQ. The decreased net loss was not due to lower operating costs, but to better profit margins. The company reported total debt at $46.6 million and did not generate free cash flow for the quarter. Even with these limitations, the company reported better financial performance and expects continued improvement into Q4-2023.

The market estimate for the company’s Q4-2023 earnings is $65 million. The company expects between $63 and $67 million in revenues with gross margins between 34.5% and 36%. The company predicts lower operating expenses for Q4-2023, between $21 and $23 million. Net loss should further decrease to around $1 million or less. If Q4-2023 results are better than Q3-2023, then the company’s stock should rally, assuming there are no issues with future forecasts or greater market volatility.

Historical Performance and Current Valuation

|

Amounts in US$ Millions |

Q3-2023 |

Q2-2023 |

Q1-2023 |

Q4-2022 |

Q3-2022 |

|

|

Revenues |

62.5 |

41.6 |

53.0 |

61.6 |

56.7 |

|

|

Cost of Revenues |

42.4 |

33.7 |

43.8 |

55.4 |

46.9 |

|

|

Gross Profit |

20.2 |

7.9 |

9.2 |

6.2 |

9.7 |

|

|

Total Operating Expenses |

26.9 |

23.9 |

23.4 |

24.6 |

23.2 |

|

|

Operating Income |

(6.7) |

(16.0) |

(14.2) |

(18.4) |

(13.5) |

|

|

Net Income |

(9.0) |

(16.9) |

(16.3) |

(20.3) |

(15.6) |

|

|

Cash & ST Investments |

21.9 |

21.6 |

16.1 |

24.7 |

26.3 |

|

|

Accounts Receivable |

60.8 |

42.6 |

56.8 |

61.2 |

52.8 |

|

|

Total Current Assets |

164.4 |

144.5 |

161.5 |

183.2 |

187.8 |

|

|

Total Long-Term Assets |

373.8 |

356.9 |

383.6 |

408.3 |

414.3 |

|

|

Accounts Payable |

34.9 |

35.1 |

38.4 |

47.8 |

52.3 |

|

|

Total Current Liabilities |

188.2 |

187.5 |

205.6 |

138.6 |

130.9 |

|

|

Total Long-Term Liabilities |

195.4 |

193.6 |

210.9 |

223.6 |

215.8 |

|

|

Unlevered Free Cash Flow |

(18.0) |

25.5 |

(2.4) |

1.8 |

(2.3) |

|

|

Current |

Q3-2023 |

Q2-2023 |

Q1-2023 |

Q4-2022 |

Q3-2022 |

|

|

Price |

20.90 |

10.97 |

5.96 |

2.21 |

1.89 |

2.72 |

|

Total Enterprise Value (MM) |

862.23 |

476.27 |

314.13 |

195.05 |

178.69 |

192.40 |

|

Market Cap (MM) |

752.46 |

365.77 |

174.01 |

64.21 |

53.91 |

75.84 |

|

NTM Total EV / Revenues |

2.75x |

1.75x |

1.55x |

0.80x |

0.71x |

0.79x |

|

Book Value / Share |

5.20 |

5.14 |

5.94 |

6.45 |

7.08 |

|

Financial Data from Seeking Alpha and Valuations from TIKR

Over the last five quarters, revenues and gross profit have increased. While operating expenses have stayed about the same, net loss has decreased. If gross profit continues to increase and net loss decrease, then we will see more rallies in 2024 with the company’s stock price. The company’s cash positions have decreased somewhat and there have been ATM offerings of senior notes to raise cash. The company has reported free cash flow a few times over the last five quarters. Investors will want to see consistent free cash flow from quarter to quarter. Q4-2023 earnings report should tell us whether the improvement continues.

The company’s stock price is overvalued according to the metrics. It is trading at 4x its book value and its NTM Total EV / Revenues multiplier is increasing. The higher this ratio goes, the more overvalued the price. This overvaluation in the market may be caused by optimistic investor sentiment around the company’s business strategy. I believe it relates to the increased demand in bandwidth for AI application and the need for new data infrastructure. Overvaluation is a reason for concern, but does not negate an investment strategy.

Stock Price Uptrend and Increased Momentum

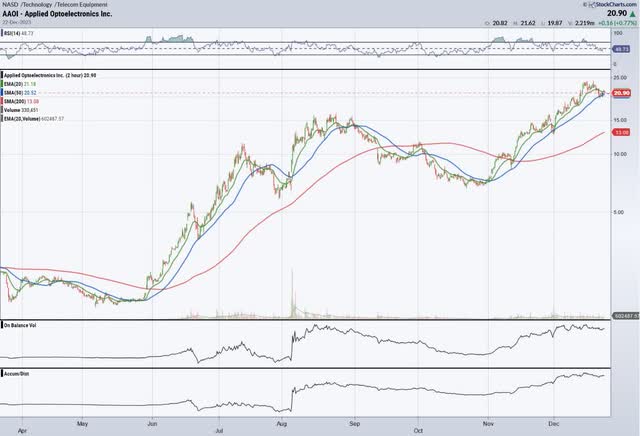

The company’s stock price has been on a severe uptrend. Over the year, the stock price has ranged from $1.60 to $24.08. It has gained 945% over the last 12-months and 1005% YTD. Its 6-mo performance is 454%, 3-mo performance is 118%, and 1-mo performance is 58%. The stock is currently trading above its 20/50/200 moving-day averages. There has been a noticeable increase in On Balance Volume and Accumulation/Distribution lines. This trend indicates an increase in momentum and optimistic investor sentiment. The company’s stock has high institutional ownership at 46.82% and is currently undergoing short-squeeze conditions (92% shares float). The setting is ripe for volatility and future earnings releases may push the price higher.

Investment Strategy and Risk

The company is at low risk of liquidity and has an abundance of resources for achieving its current business strategy. Because the company’s stock price is overvalued, an investment strategy in the company’s stock comes at a high to moderate risk. Market volatility or poor financial outlook from the company may cause the stock price to downtrend well below the 10% stop loss mark. One should exit at or around $18, if the volatility brings the price downward.

A long-term hold strategy comes at a moderate risk. The stock price may go down over the year back to a normal valuation or it may continue its current trend. If the price continues an uptrend and stabilizes at $24 per share, then gains of 14-15% may be released. If January confirms a greater bull run in the market, then this long-hold strategy becomes a lower in risk.

One might consider a high risk, short-term, out-of-the-money, call options strategy. The $24 strike price call option (across multiple strike dates) has seen increased volume. If the stock price moves in the sort-term from $20 per share to $24 per share, then the option price premium will gain 300% (for instance 01/05 strike date at $24; from $50 to $200 in premium, if it makes). Although risky, this strategy may bring big gains. It must be executed quickly and watched per day for volatility.

Conclusion

Applied Optoelectronics has reported better financial performance and expects the improvement to continue into Q4-2023 and PY2024. The company’s stock price has seen an intense rally and uptrend over the last nine months. The current overvaluation of the stock price has caused analysts to rate the company as a sell. I am taking the opposite approach and rating the stock as a buy. Although the company has not said so much, I believe the demand for better infrastructure due to AI computing will cause continued heightened demand for the company’s products and services.