phive2015

Investment Thesis

Applied Industrial Technologies, Inc.’s (NYSE:AIT) revenue growth should benefit from easing year-over-year comparisons beginning in the second half of fiscal 2024. In addition, a potential rebound across the technology vertical and strength in the rest of the end markets supported by secular trends and associated government stimulus funds should drive revenue growth in the coming quarters. Further, the company’s continuous focus on enhancing cross-selling opportunities and expanding into high growth area like automation also bodes well for its future growth prospects. The company also has a healthy balance sheet, which enables it to continue supplementing organic growth with accretive M&As.

On the margin front, the company should be able to resume margin expansion with the help of lower Y/Y LIFO expenses as inflation moderates, and it benefits from initiatives such as the application of enhanced data analytics and operating leverage from sales growth. In addition to good growth prospects, the valuation is also reasonable, with the company trading at a discount versus its peer distributors. So, I rate AIT stock a buy.

Revenue Analysis and Outlook

Over the last few years, AIT has seen strong sales growth driven by good demand, price increases, and accretive M&A strategy. I started covering the stock with a buy rating in October last year and provided a follow-up coverage in December. The stock is up ~25% and ~10% since my initiating and follow-up coverage, respectively, validating my stance.

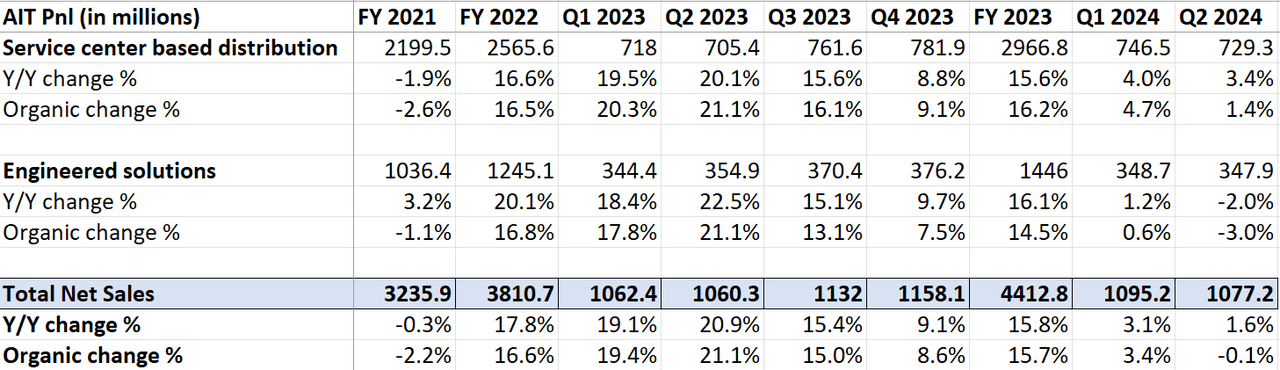

Since my last coverage, the company has reported its Q2 2024 results. In the quarter, accretive M&As and strength across food & beverage, mining, refining, pulp & paper, and transportation verticals continued to support sales growth. This helped the total company revenue increase by 1.6% Y/Y to $1.077 billion. Excluding a 1.4% benefit from acquisitions and a 0.3% increase from favorable FX translation, sales declined 0.1% Y/Y organically due to reduced activity across the technology vertical.

In the Service Center-Based Distribution segment, which operates primarily in Maintenance, Repair, and Operations (MRO) markets, sales grew 3.4% Y/Y on a reported basis and 1.4% Y/Y organically benefitting from sales process initiatives, solid growth across national accounts and strength in fluid power MRO in the U.S. Further, acquisition of Bearing Distributors (BDI) and Cangro Industries (Cangro) increased sales by 1.6%, and favorable foreign currency translation increased sales by 0.4%.

However, in the Engineered Solutions segment, sales declined 2% Y/Y. Excluding a 1% benefit from the acquisition of Advanced Motion Systems (AMS) and Automation, sales declined 3% Y/Y organically. This decline was attributed to weaker technology end-market demand and tough Y/Y automation comparison, which more than offset growth across core industrial and mobile fluid power and flow control markets.

AIT’s Historical Revenue Growth (Company Data, GS Analytics Research)

Looking forward, the comparisons are getting significantly easier moving forward. If we look at last fiscal year’s sales cadence, the organic sales growth was up 19.4% Y/Y in Q1, 21.1% Y/Y in Q2, 15% Y/Y in Q3, and 8.6% Y/Y in Q4. So, Y/Y organic growth comparisons are much easier in the back half of this year, especially in the fourth quarter.

Further, abating technology vertical headwinds also bodes well for sales growth in the coming quarters. Over the last year, the company’s Y/Y sales growth has been impacted by slower activity across the technology vertical. However, on its Q2 FY24 earnings call, management noted that sales tied to this key end market have stabilized and related orders were up over 10% sequentially, which indicates a positive trend for future sales performance. I believe this improving order trend along with secular tailwinds from growth verticals like cloud computing and artificial intelligence which is increasing data center demand bodes well for the growth in this end-market moving forward.

The company’s sales growth should also benefit from continued strength in its other end markets, which are benefiting from increased spending on U.S. industrial infrastructure, energy transition, and reshoring of manufacturing fueled by federal stimulus like the Science and CHIPS Act and the Inflation Reduction Act. I believe these trends should continue to support the company’s revenue growth for the next few years. Further, the potential reversal in the interest rate cycle as the Federal Reserve starts cutting interest rates sometime this year should also contribute to increased end-market demand for the company.

In addition, the company also has good exposure to secular growth markets like industrial automation and is expanding its automation footprint and capacity to support its long-term growth. This includes ongoing progress with greenfield initiatives and a facility expansion in the Pacific Northwest in the last quarter. The company is also focused on improving the end-to-end customer experience by investing in its e-commerce and digital capabilities. The company is further developing cross-selling opportunities across its core customer base to drive revenue growth and increase market share.

In addition to good organic growth, the company plans to further penetrate higher growth areas such as automation by leveraging its technical expertise and new capabilities from M&As. The company has a healthy balance sheet with net leverage of 0.3x at the end of the last quarter, which enables it to continue supplementing organic efforts with selective M&A opportunities.

Overall, I remain optimistic about the company’s revenue growth prospects ahead. While the organic growth was slightly down last quarter, I expect a meaningful acceleration in the coming quarters helped by easing comps, recovery in technology sales, government stimulus, exposure to growth verticals like automation, good execution in terms of initiatives like cross-selling, and a reversal in the interest rate cycle. In addition, continued M&As helped by a solid balance sheet should complement organic growth.

Margin Analysis and Outlook

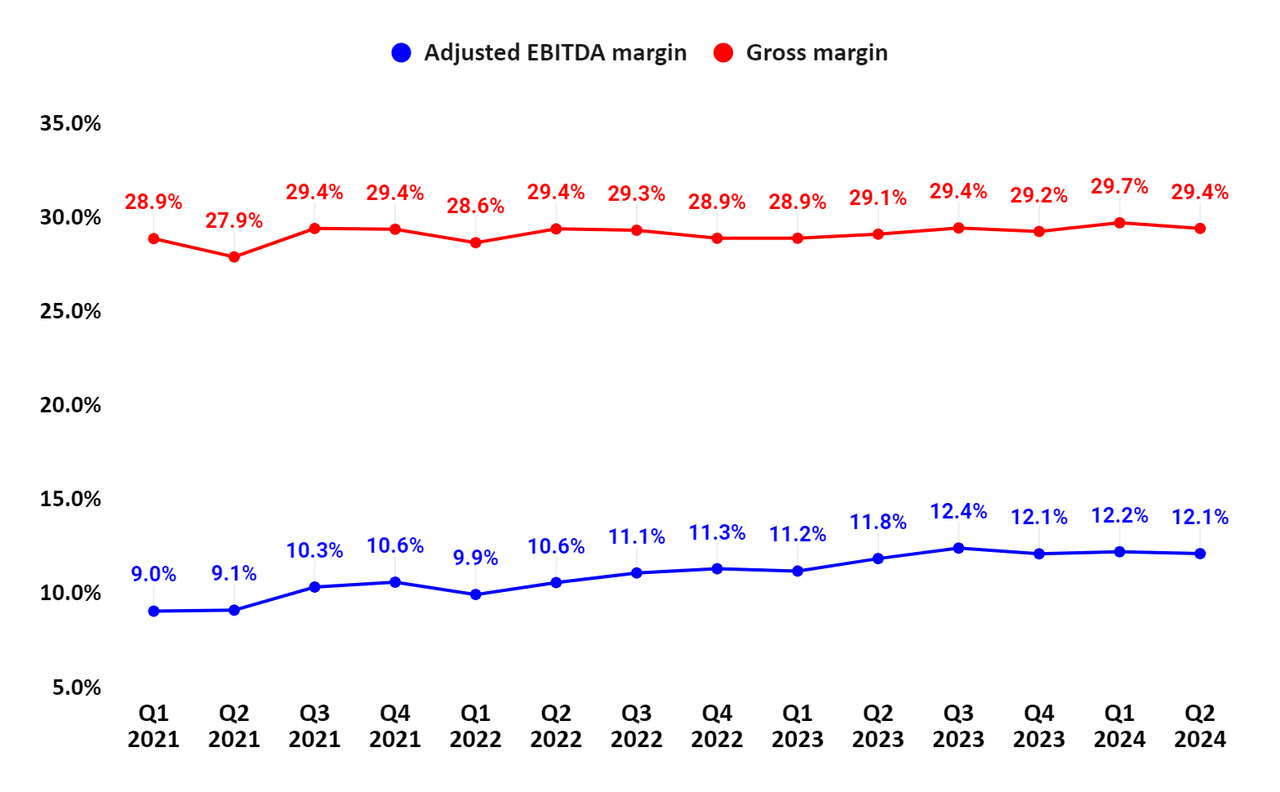

In Q2 2024, the company’s margins saw a favorable 51 bps Y/Y impact due to lower LIFO expenses. This positive effectively offset a 20-30 bps Y/Y mix headwind from reduced Engineered Solutions segment sales, national account growth, and a lower mix of automation engineered solutions compared to the prior year. As a result, the gross margin expanded by 34 bps Y/Y to 29.4%, and the adjusted EBITDA margin expanded by 31 bps Y/Y to 12.1%.

AIT’s Adjusted EBITDA margin and Gross margin (Company Data, GS Analytics Research)

Looking forward, I am optimistic about the company’s margin growth prospects.

Over the last few years, the company’s margins have been impacted by higher LIFO expenses due to higher inflationary input costs. However, with inflation moderating, the company recognized a lower Y/Y LIFO expense of $3.4 million in Q2 2024 compared to $8.9 million in the prior fiscal year’s second quarter. As inflation continues to moderate, I believe the company should see lower Y/Y LIFO expenses in the coming quarters, which should continue to help margins.

Further, the company is implementing various initiatives to improve gross margins, like the application of enhanced analytics, freight expense management, and strong channel execution, which also bodes well for margin growth. Moreover, with an acceleration in organic revenues in the second half of this fiscal year, the margins should also benefit from operating leverage.

Valuation and Conclusion

AIT is currently trading at a 19.78x FY24 consensus EPS estimate of $9.55 and an 18.74x FY25 consensus EPS estimate of $10.08. Over the last 5 years, the stock has traded at an average forward P/E of 17.05x. While the valuation is higher than AIT’s historical average, I believe the stock deserves a premium versus its historical valuation given growth tailwinds with the reversal in the interest rate cycle, government stimulus, secular tailwinds in technology and automation end market, and improved execution in terms of cross-selling initiatives and margin improvement.

The stock is also trading at a discount to its peer distributors like W.W. Grainger, Inc. (GWW), which is trading at a 24.72x FY24 P/E, and Fastenal (FAST), which is trading at a 33.96x FY24 P/E. As the company continues to execute well, I believe there is a good chance for its valuation multiple to re-rate further and close the gap with high-quality distributor peers.

I believe Applied Industrial Technologies, Inc. has good growth prospects ahead as it should benefit from easier Y/Y comps, recovery in the technology vertical, good demand in end markets outside of the tech vertical supported by secular trends and associated government stimulus funds, continuous focus on cross-selling initiatives and new growth markets and potential M&As. The margins should also continue to expand in the coming quarters with the help of declining LIFO expenses as inflation moderates, operating leverage on higher sales, and margin improvement initiatives like enhanced data analytics. These good growth prospects coupled with its relatively lower valuation compared to its distribution peers make AIT a good buy.

Risks

I am expecting a cyclical recovery ahead as the company benefits from interest rate cycle reversal, recovery in the technology vertical, and government stimulus. If my expectations prove optimistic or the macroeconomic environment worsens for some reason, AIT’s growth may not accelerate as anticipated.

I am also anticipating margin benefiting from lower Y/Y LIFO expenses as inflation normalizes. If the inflation doesn’t subside or the inflationary environment worsens for some reason, it may negatively impact Applied Industrial Technologies, Inc. margins.