peshkov/iStock via Getty Images

Appian (NASDAQ:APPN) is a leading player in the low-code space. Its low-code automation platform helps businesses to build and optimize applications swiftly. Their platform streamlines complex workflows, while its user-friendly tools cater to both professional and citizen developers.

Post-IPO journey has been bumpy. Went public at $17 per share in 2017, it currently sits at $37.13, delivering an over 118% total return. However, it’s far from smooth sailing. It peaked at $224 in 2021 and experienced significant volatility before settling at its current price. In recent times, though, performance has been lackluster. APPN’s 5-year return stands at merely 5%. Since my latest coverage in 2020, when I rated the stock neutral due to a concern about slowing revenue growth, APPN has also declined by -16% – further confirming my previous hesitation.

I maintain my neutral rating in this follow-up coverage. My modeled 1-year target price of $38.5 presents a projected 3% upside from today’s price of $37.25, suggesting a very minimal upside. At this level, APPN appears fully priced.

Financial Reviews

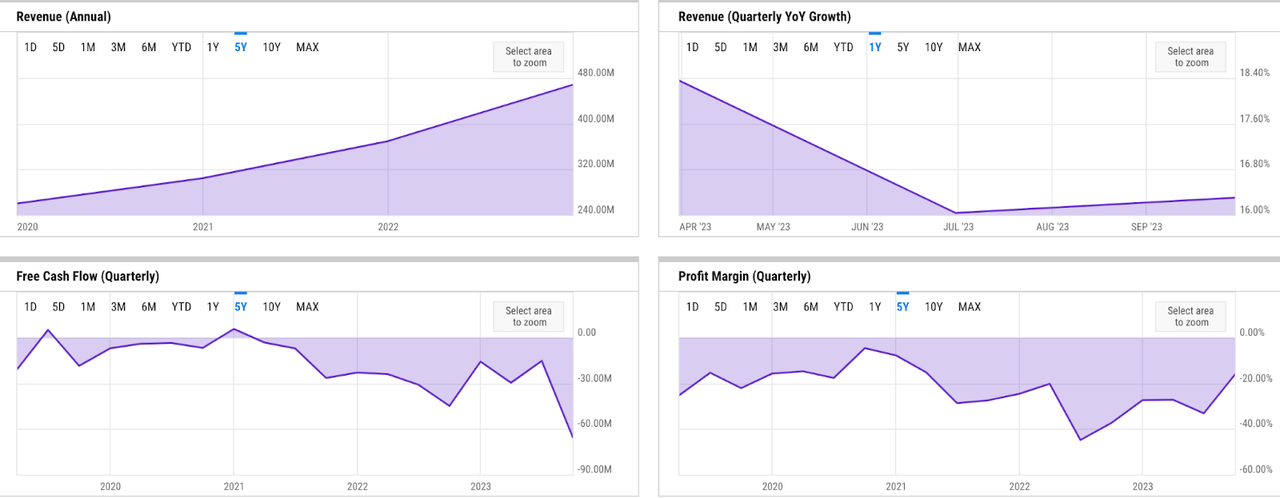

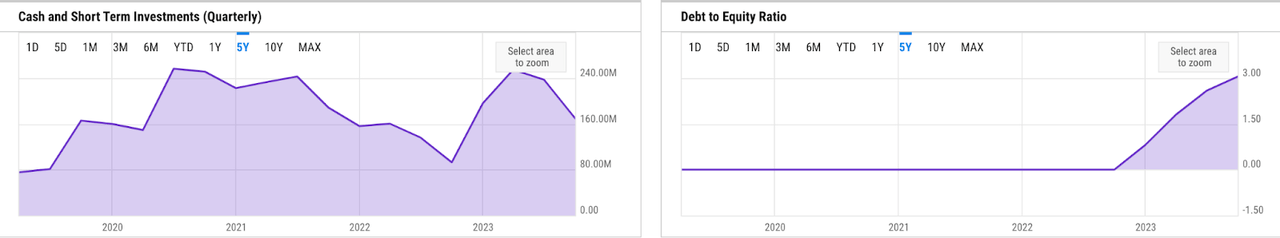

Overall, I would characterize APPN’s fundamentals as moderate at best. Over the past five years, revenue growth has been relatively steady, though net losses have gradually widened. Despite decent liquidity, part of it has also been funded by debt financing, which is less ideal, in my view.

ycharts

Though quarterly revenue growth appears to trend down over the past year, it has been relatively steady over the past five years. On an annual basis, APPN’s revenue growth has even been on an upward trend, gradually accelerating from 15% YoY in 2019 to 27% YoY in 2022, demonstrating resilience in the midst of challenging macro situations as of late. However, annual revenue growth slowed down in FY 2023, where APPN delivered $545 million of revenue, a 16% YoY revenue growth.

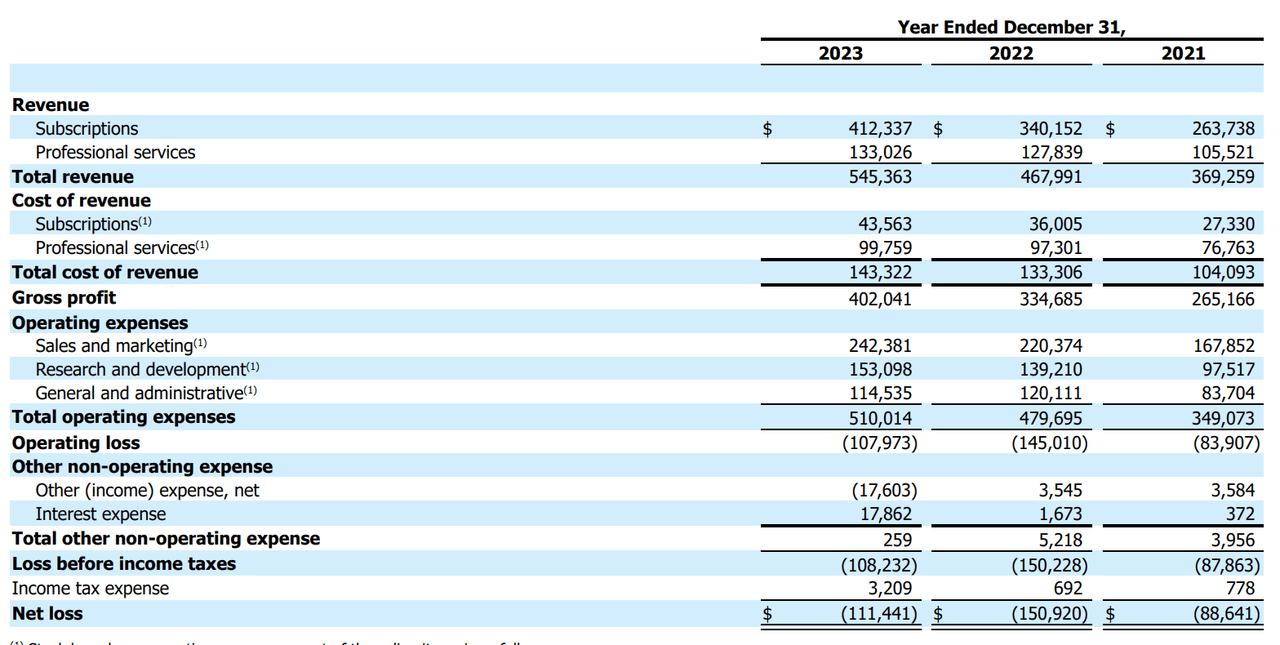

10K

Meanwhile, profitability and cash flow generation are relatively weak. GAAP net loss margin has widened since 2020, from under -20% to around -30% on average. This has not improved in FY 2023. APPN posted a net loss of -$111 million, which amounts to -20% net loss margin. The biggest drag on profitability has been the relatively elevated operating expenses, since APPN has been very focused on sales. Sales and marketing / S&M, for instance, has consistently been in the mid-forties range.

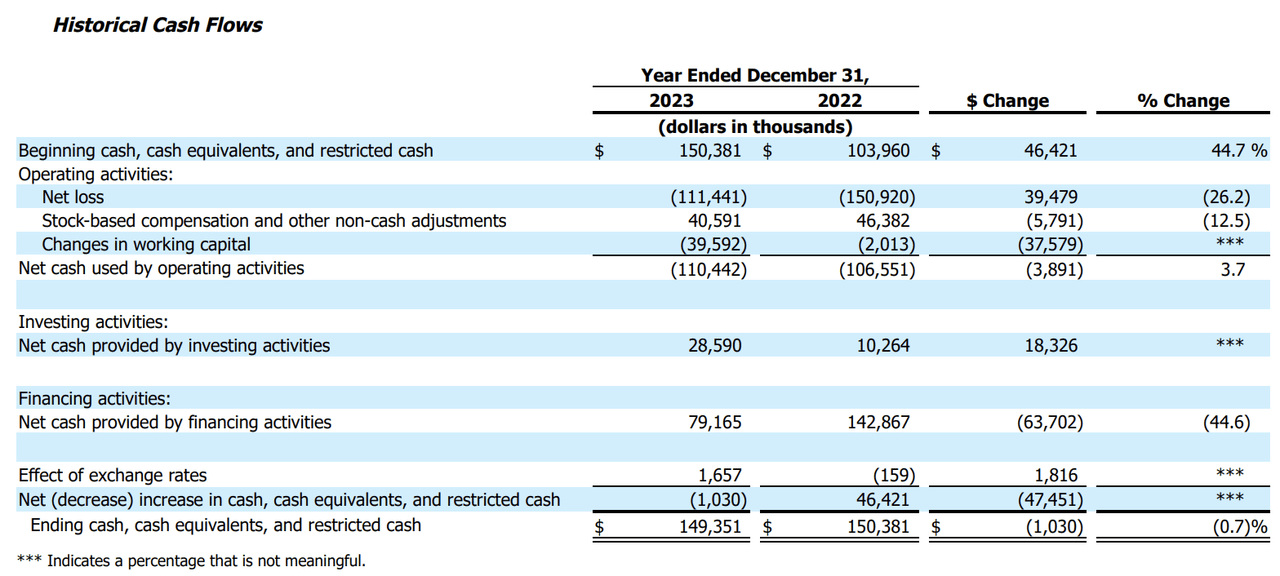

CF (10K)

Since only roughly 10% of APPN’s operating expenses are non-cash share-based compensation / SBC, cash flow outlook has also seen quite a bit of pressure. APPN’s operations have been burning through over $100 million in cash every FY on average as of late. Given the negative operating cash flows, APPN has primarily relied on cash flows from financing activities, such as debt issuance, to support its operations.

key metrics (ycharts)

As APPN was aiming to maintain its accelerated growth as of late, cash burn had intensified sometime in 2021 onwards, forcing APPN to raise debt financing in 2022 to bolster its liquidity balance. Before 2022, APPN had never needed to raise debt financing. Nonetheless, the debt-to-equity / DE ratio has increased to an undesirable level today, in my view. It is also less ideal to see a growing software company, let alone a cash-flow negative one, with a DE ratio above 3x.

Catalyst

There are some catalysts that should help APPN to achieve its 13% revenue growth, as per its guidance. Meanwhile, I believe that margin or cash flow expansion catalyst remains minimal to moderate at best, given the management’s primary focus on growth – For FY 2024, APPN will expect an adjusted EBITDA loss between -$20 million to -$25 million.

A key growth catalyst here would be the confluence of AI and low-code development trends, which should create a compelling growth narrative. Companies are increasingly looking to automate workflows, glean insights from data, and build applications faster.

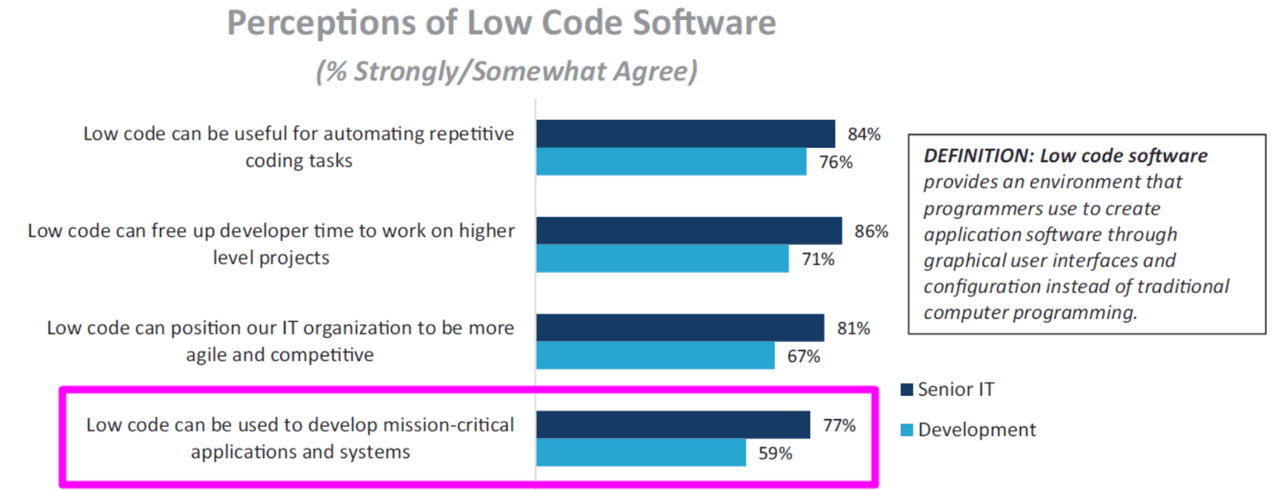

To a great extent, these new trends have changed my view on APPN. I first covered APPN in May 2020, on which revenue grew by almost 31%. Yet, I decided to stay on the sidelines then, as I questioned the long-term growth prospect of the low-code industry.

survey (the newstack / appian)

However, having developed a better understanding about the potentially key role of low-code in scaling up digital transformation within various divisions across organizations of many sizes globally, I stand corrected.

products (APPN website)

Amplified by the growing trend in generative AI, I conclude that AI-driven low-code platforms could yield powerful results for organizations. Therefore, I expect APPN to continue seeing growing demand for its AI-driven offering. From the product standpoint, I rate APPN’s offering to be comprehensive, further positioning it well to capture the opportunity.

Another potential catalyst for growth would be the increasing focus on large deals in 2024. In my opinion, larger deals will not only drive revenue growth but also cash flow generation, primarily through potentially higher billings growth (recorded in deferred revenue). Nonetheless, due to the variation in billing cycles, the magnitude of its impact on FY 2024’s cash flows could also still be minimal to moderate at best, in my opinion.

Progress on large-deal acquisitions has been promising, in my view. APPN’s recent entry into Gartner Magic Quadrant 2023 would also boost its reputation further, enabling it to continue attracting larger deals in FY 2024 to maintain its solid progress in Q4 2023:

Appian landed some of our largest 7-figure deals this quarter. The total contract value of our top 10 net new software deals increased by 70% in Q4 2023 compared to the same period last year.

Source: Q4 earnings call.

Risk

I believe there are a few moderate-to-high risk factors to monitor for investors interested in APPN. Overall, the management’s comments on the Q4 earnings call suggest that APPN will continue to pay less attention to the bottom line improvement, which would increase the risk of holding APPN:

Sure. Yes. No, we really didn’t do anything out of the ordinary to get to a positive adjusted EBITDA in Q4. That was an artifact of our strong revenue performance. We had a really good level of linearity in — on the top line. And we’re just on our plan here on the expense side that we’ve discussed in the past and we’re steady as she goes on that in terms of operational discipline. But the name of the game is still growth for us.

Source: Q4 earnings call.

In my view, given the increasing lack of appetite for companies prioritizing growth over profitability, the sticky net losses and negative operating cash flows may result in lower demand for the stock and pressure on share performance.

Moreover, while there is strong demand for APPN’s offerings, the relatively aggressive strategy may also yield a rather undesirable scenario, especially with the uncertain macro outlook. APPN’s increasing global presence could exacerbate the situation further, in my opinion. Today, international revenue already makes up 36% of the business, up from the low thirties just two years ago.

It is possible that a deteriorating global outlook lengthens sales cycles for larger deals, threatening revenue forecasts. This could trigger a significant stock price correction, in my opinion, considering APPN’s valuation is primarily driven by top-line growth due to its lack of current profitability.

APPN’s costly growth strategy also risks straining its liquidity and amplifying its dependence on financing cash flows. While further leveraging seems unlikely given the elevated DE ratio, equity financing also poses challenges. Potential dilution at this valuation could be significant, and raising capital under the current market outlook might also not be straightforward, especially with track record of operating losses.

Valuation / Pricing

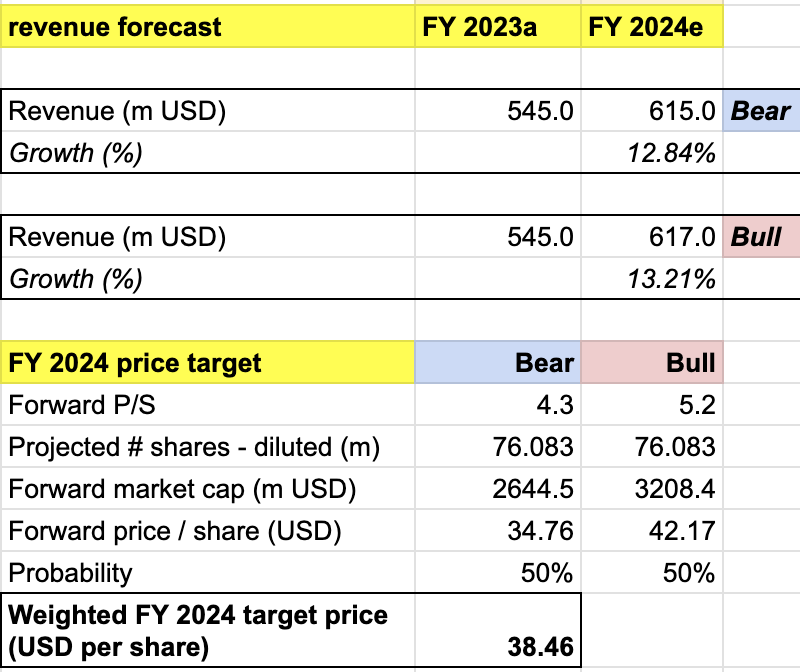

My target price for APPN is driven by the following assumptions for the bull vs bear scenarios of the FY 2024 projection:

-

Bull scenario (50% probability) assumptions – APPN to achieve FY 2024 revenue of $617 million, a 13% growth, at the high end of APPN’s guidance. Despite achieving its target growth rate, I would expect P/S to remain at 5.2x, where it is trading today. At 13% YoY growth, APPN will actually see slower revenue growth compared to previous FY. Moreover, without highly significant bottom line improvement, I conclude that 5.2x is a fair P/S.

-

Bear scenario (50% probability) assumptions – APPN to deliver FY 2024 revenue of $615 million, a 12.8% growth, at the low end of APPN’s estimate. I assign APPN 4.3x P/S, a slight contraction from the current level.

price target (own analysis)

Consolidating all the information above into my model, I arrived at an FY 2024 weighted target price of $38.5 per share, suggesting a 3% upside from the current price level. At this level, I conclude that APPN appears fully priced. Consequently, I rate the stock neutral.

Conclusion

APPN’s low-code platform is promising, but risk remains high. While exceeding its IPO price, volatility and recent stagnation raise concerns. Its 5-year return is a mere 5%, and my previous neutral rating in 2020, driven by slowing revenue growth, seems validated by a 15% decline since then. My revised target price again offers minimal upside, not favoring the stock until more compelling developments emerge.