deepblue4you

Thesis

We all heard horror stories about investment managers providing poor advice, with people we know having long term portfolio results that amount to only 1% or 2% annualized returns long term. It happens, but it does not have to be that way. In the world of finance, simple structures work when held for long periods of time. The iShares Core Aggressive Allocation ETF (NYSEARCA:AOA) is such a structure.

Despite its bombastic name, the fund is a simple 80% equities/20% fixed income allocator, that does its own rebalancing. Rebalancing refers to keeping the 80/20 ratio as constant as possible throughout time. Absent rebalancing processes an investor would see his or her portfolio tilt towards the asset class which is performing the best, thus increasing concentration risk.

Going back to the fund’s name, an investor should interpret the ‘Aggressive’ nomenclature as a simple reference to the 80/20 build, versus the traditional 60/40 portfolio composition:

Stocks and bonds are the two mainstays of most investment portfolios. Stocks can support growth and help you keep up with inflation, while bonds provide stability. Since stocks carry more risk, having bonds in the mix can help offset losses. That’s where the 60/40 portfolio comes in. If you lose money on the stock side of your portfolio, steady returns on the bond side can keep you moving in the right direction.

Changing correlations

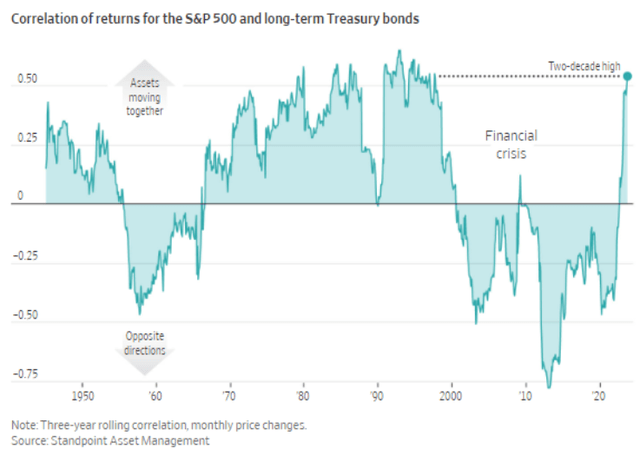

Throughout time, the 60/40 build has been the golden standard in portfolio construction. This however has changed since the advent of the bond bear market in 2022:

Correlations (Standpoint Asset Management)

Starting with 2022 we have seen the correlation between stocks and bonds go into positive territory. This translates into both equities and bonds having the same direction, thus negating the benefits of a 60/40 portfolio.

In the graph above, we can see how the blue line moves up sharply into positive correlation territory starting with 2022, thus indicating treasuries are no longer a hedge for equities, but an actual additive risk factors.

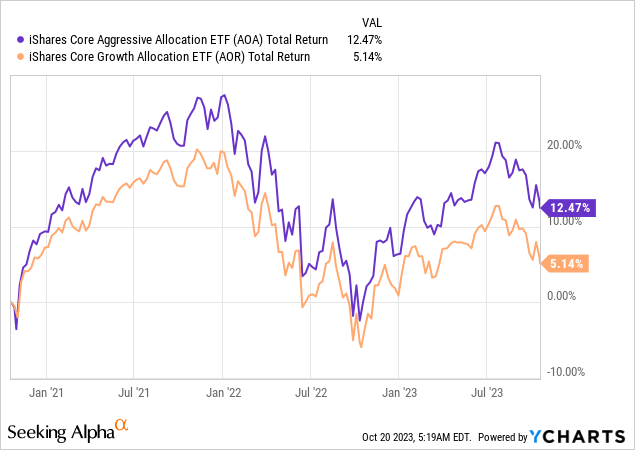

This is where AOA has benefited via its ‘Aggressive’ allocation, that actually just meant it had less treasuries in its portfolio:

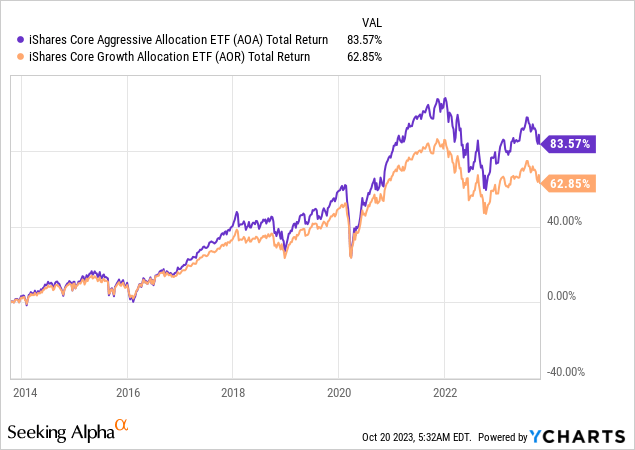

We can see from the above graph courtesy of YCharts how AOA has outperformed its sister fund iShares Core Growth Allocation ETF (AOR) in the past three years. AOR is a widely used 60/40 proxy, and has underperformed as its 40% treasury bucket has pulled its performance down during this bear market.

A robust long-term performance without headaches

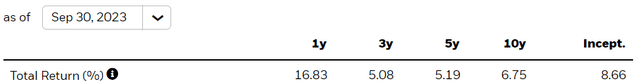

The fund has a very large 8% annualized total return since its inception:

Annualized Returns (Morningstar)

If you want a solid one-stop investment security for your retirement account, AOA fits the bill. Long term it delivers robust results and it does its own rebalancing. All you need to do as an investor is add more funds throughout time to increase the retirement pot.

The fund was down less than the S&P 500 in 2022, and is up this year:

We can see that in the past decade, the worst annual total return was obtained in 2022, when the equity/bond correlation turned positive. This vehicle has good risk/reward metrics as well:

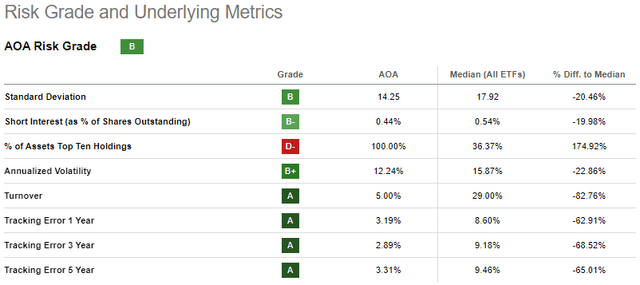

Fund Risk Grades (Seeking Alpha)

The fund has a low 12% annualized volatility, and a standard deviation of only 14.25%. The fund outperforms long term a simple 60/40 composition:

On a 10-year lookback AOA handily outperforms AOR, mainly due to the bond bear market experienced in the past two years. However, do expect AOA to post better results long term, since equities deliver outsized total returns versus bonds if held for long periods of time.

This fund is going to correctly encapsulate equity and bond market returns going forward, with a realized volatility that will be smaller than an outright equity portfolio.

Fund composition

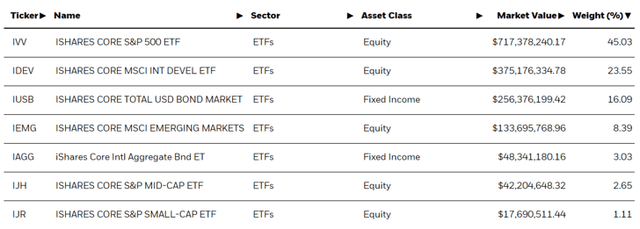

The ETF utilizes simple building blocks to achieve its 80/20 build:

Let us have a closer look at each building block and relate them to market indices:

- The largest exposure here is to the iShares Core S&P 500 ETF (IVV), which is basically an ETF replicating the S&P 500 index. The weighting for this fund is 45%

- The iShares Core MSCI Int Devel ETF (IDEV) invests in public equity markets outside of the U.S. The fund represents a diversified take of global growth and value stocks, and has a 23.5% weighting here. The fund mostly represents very large capitalization multinationals.

- The smaller equity allocations to the iShares Core MSCI Emerging Markets ETF (IEMG) represents a small sectoral allocation to EM equities specifically, and has a 8.4% weighting. The three equity funds covered so far account for roughly 75% of the fund.

- The remaining 5% of the equity bucket is represented by U.S small and mid cap stocks.

- On the bond side, the largest allocation is to the iShares Core Total USD Bond Market ETF (IUSB). IUSB is the iShares product that represents a cross sectional take on the investment grade bond market. The best known fund in this space is AGG, which IUSB is a carbon copy of. The fund has a 16% allocation here.

- Lastly, we have the iShares Core Intl Aggregate Bond ETF (IAGG) with a 3% weighting. This fund provides an international bond exposure in the portfolio.

In summary, the fund utilizes simple building blocks from iShares in order to give the portfolio both a US and global exposure, in both equities and fixed income.

Is AOA the right choice for a 401(k) plan?

We think the answer to this question is yes. When an individual cannot actively manage an account, but still wants a safe, robust portfolio with long term growth, AOA delivers.

Instead of making risky individual stock choices and panicking at market bottoms, retail investors are best served to purchase a security like AOA in their 401(k) account, and just watch the investment grow and rebalance on its own. The fund has narrower drawdowns than an exclusive equities portfolio, and has handily outperformed the traditional 60/40 allocation.

Via its building blocks, the fund aggregates exposures to both the U.S. and global markets, and it will benefit once bond/equity correlations move to negative territory again.

Conclusion

AOA is an exchange traded fund. The vehicle falls in the asset allocators fund category, offering a 80/20 equities/fixed income exposure. The fund’s name is slightly misleading, the ‘Aggressive’ nomenclature simply referencing the fact that the fund has more equity exposure than a traditional 60/40 portfolio.

The fund utilizes other iShares building blocks to provide investors with exposure to the S&P 500, global stocks and U.S. and global investment grade bonds. The fund has very robust long term results, with an 8% annual total return since inception. The fund has posted superior results to a 60/40 portfolio as reflected by AOR, and represents a very good choice for a retirement portfolio.

Passive investors who do not wish to have the stress of trying to time the market are very well served by a fund like AOA which delivers. In today’s uncertain environment a higher than normal cash balance is warranted, with the other proportion of the portfolio allocated to AOA. We like the fund’s build, its analytics and its outlook long term, and we favor dollar cost averaging into this name for a passive retirement portfolio.